If central banking were a stock, you’d go short.

Blue-chip mystique still clings to it but you can feel the reputational parabola slowly gathering momentum on the downside. Its projects are too large and diffuse, the resources to achieve them too crude and there are mounting signs of unhappiness and confusion at the top.

Given their long-standing rock star status, pity the central banker; the fall from grace may be vertiginous.

♦ ♦ ♦

The Governor of the Old Lady seems more attuned to this unfolding trend than most. On my reading, he metaphorically ran up the white flag in a recent speech. It was the oddest mixture of explanations, implicit apologies and rationalisations imaginable from such an august perch. Do have a look; it’s not long.

King finished with an amusing touch: “As for the MPC [Monetary Policy Committee], you can be sure we shall be looking for as much guidance as we can find, divine or otherwise. What better inspiration than the memory of those children on Rhossili beach singing Cwm Rhondda.”

Perhaps the South Wales Chamber of Commerce seemed a forgiving place to lay out some of central banking’s many puzzles.

Put simply, his message was: I know what we’re doing seems a bit crazy, and I know all the fundamental problems are still out there waiting to be solved, but what else can we do?

What’s even scarier is that I understand what he means. After all, most of the really important stuff, like correcting the monstrous accumulated imbalances of recent decades and setting a more sensible course for the future, isn’t within the Bank of England’s remit. And yet, because the magic wand is in their hands, everyone looks to them to do something. Anything.

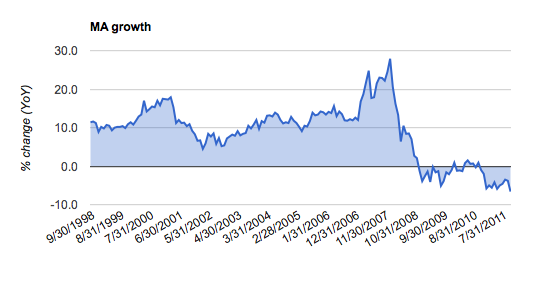

Which, as we know, they did. Cumulative QE (so far) of £375 billion, or 25% of GDP, enough for top spot amongst its Western institutional colleagues. As King suggested, the market is well and truly sated:

During the crisis central banks have provided liquidity to banks on a truly extraordinary scale, so much so that there were no takers for additional liquidity in our latest auction. It is still useful to keep their auction facility as an insurance policy. But banks are now overflowing with liquid assets.

Insurance policy indeed. Any more QE would seem in danger of plunging the whole business into farce.

♦ ♦ ♦

King, as he often does, got to the nub of the matter early on in his speech:

In the long run, we will need to rebalance our economy away from domestic spending and towards exports, to reduce the trade deficit, to repay our debts, and to raise the rate of national saving and investment. So you are probably puzzled by the fact that we seem to be doing exactly the opposite of that today. Almost 4 years ago now, I called this the “paradox of policy” – policy measures that are desirable in the short term appear diametrically opposite to those needed in the long term. Although we cannot avoid long-term adjustment to our economy, we can try to slow the pace of the adjustment in order to limit the immediate damage to output and employment.

He’d be only too aware, I’m sure, that our current intolerable mess is the result of giving in to a long succession of apparently desirable short-term policy measures. In each of the would-be and actual recessions of recent decades, politicians and central bankers strove to “limit the immediate damage to output and employment.” And, for the most part, succeeded. Trouble is, of course, in doing so earlier excesses were never allowed to sort themselves out; instead, they were carried forward with compound interest and then added to afresh.

How does one ever decide that now, finally, is the moment to pay the piper?

Thing is, even if King thought the time was now (or, quite possibly, a few years ago), it’s out of his hands. He can advise, plead, cajole, threaten to resign, but he can’t decide. So too with his compatriots elsewhere, many of whom have also been delicately (and sometimes not so delicately) pointing out the limits of of monetary policy and pleading for deeper structural reform.

As King said immediately after his comment about banks now overflowing with liquid assets:

Their problem remains insufficient capital. Just as in 2008, there is a deep reluctance to admit the extent of the undercapitalisation of the banking system in many parts of the industrialised world. The verdict of the market is clear – without central banks support banks still find it expensive to borrow.

What’s true of the banking system is no less true for the economy more generally. There’s way too much debt and not enough equity. Until that imbalance is dealt with (together with all the real world distortions it fostered) there’s no chance of organic growth, just the hyped up, artificial variant produced by great bouts of fiscal and monetary stimulus.

Central bankers are burdened with a kind of original sin. After all, without their unfailing support and encouragement (together with the very nature of the fiat fractional reserve banking systems over which they preside), the credit excesses of recent decades would have been quite impossible. Can any of them coolly and dispassionately disentangle and measure the system in which they’re so deeply embedded?

I don’t know, but it’s not hard to imagine King lying awake in the early hours of the morning.

♦ ♦ ♦

So what’s the endgame?

With overall debt levels rising (still), rates pinned to the floor and vast amounts of excess liquidity sloshing about (thank you Mervyn, Ben, Mario et al), a private sector busily trying to repair its collective balance sheet and economies everywhere in the doldrums because of massive imbalances, anyone who says they know the answer is dreaming.

What we can say is that policy is distinctly, perhaps even irretrievably, assymmetrical. Central bankers are conditioned to leap into action at the merest hint of renewed weakness, much less deflation. As with both fiscal and monetary stimulus in recent decades, the political incentives all run one way. In the absence of sustained, reassuring economic growth, it’s hard to see what might change this bias.

Right now, all the resulting excess liquidity is mostly languishing in reserves at various central banks, collecting a paltry return and seemingly doing no harm. There’s a bit of fresh lending going on here and there, but demand is low and the banks, generally, remain relatively cautious. Fact is, central bankers are tearing their hair out because of the financial system’s lack of responsiveness.

Careful what you wish for, perhaps? According to Ashwin Parameswaran, the market’s current willingness to hold unusually large quantities of money because of the crisis induced desire for safety and liquidity may not hold if “real rates turn significantly negative”:

Once real rates become sufficiently negative, credit growth explodes and the positive feedback loop of ever higher inflation fuelled not just by currency repudiation but by active exploitation of the banking and central bank discount window to access essentially free loans is set in motion. In other words, hyperinflation in modern capitalist economies is characterised not just by a collapse in the demand for deposits but an explosion in demand for loans at the free lunch level of nominal interest rates enforced by the central bank.

Whether these huge reserves might one day wreak unexpected havoc is something I’ve long wondered about too. What I hadn’t realised until I read Ashwin’s links was how critically important explosive private credit growth has often been in earlier hyperinflations.

It makes perfect sense, of course. Once the incentives are strong enough (and what could be stronger than seriously negative real rates?) the whole machinery of credit and money creation is unleashed. One shudders to think how silly things could get.

Could it really happen today, in the US, the UK, or Japan? Could central bankers miscalculate or lose control so badly as to set this particular doomsday machine in motion?

Cassandra though I often am in these matters, I struggle to see it. After all, there’s no shortage of historical horror stories at hand. Still, like armies, central bankers are inclined to fight the last war, and after the 1930s they’re understandably paranoid about letting debt deflation get the upper hand. As Bernanke said at a conference honouring Milton Friedman on his 90th birthday: “Regarding the great depression. You’re right, we [the Fed] did it. We’re very sorry. But thanks to you, we won’t do it again.”

So it’s not inconceivable. It just needs inflation to get away enough to generate juicy negative real rates. With so much dry tinder already around and central banks all leaning one way, that’s not inconceivable either. Remember too that while individual banks can get rid of reserves through making loans or purchasing investments, overall, banks can’t. What one loses, another gains. One can therefore imagine an accelerating rush by individual banks to deploy reserves, all of it, at a systemic level, entirely fruitless and on the other side newly hungry demand intent on exploiting negative real rates. While the notion of hyperinflation still seems . . . well, a bit hyper, it doesn’t strike me as an easy beast to rein in if it bolts.

To bring it under control, central banks would either have to vaporise sufficient reserves through sales from their portfolio to give banks pause, or, raise the rate they pay on reserves high enough to discourage the process. Neither seems attractive. Brave indeed would be the central banker who embarked on the former in these bone china delicate times. As for the latter, with reserves so high (and still growing) it sure wouldn’t be cheap.

Tricky business, central banking.

How much gold is there in seawater?

I don’t know, let’s audit the New York Fed.

Most of the gold was leased to the bullion banks long ago, and has entered the market in order to suppress the real price of gold, thus artificially bolstering the value of Fiat currencies. James Turk has stated that up to 15,000 tonnes of Central Bank gold is not there. I will be interested to see how the Central Banks explain this one to its citizens…

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2012/10/29_Turk_-_15,000_Tons_Of_Western_Central_Bank_Gold_Is_Gone.html

B.B. (if only that stood for “Bilbo Baggins”) draws exactly the wrong conclusion from the boom-bust of the 1920s.

To him the problem is not the credit-money bubble – to him (as to the late Milton Friedman) the problem is the “collapse of the money supply” i.e. the bursting of the credit money bubble.

Such thinking is so profoundly wrong headed that it is hard to know where to start.

Bilbo liked his gold, it was precious to him, Ben likes his paper, but it isn’t precious any more.

The claim that Captain Skin makes can be easily checked.

All the Federal Reserve has to do is to allow the members of the relevant Congressianal committees (Congressman Ron Paul and the others) to do an inspection.

If Captain Skin and the others are “conspiracy theorists” the Federal Reserve (and the other Central Banks) will be only too happy to open up to inspection.

If they are not…..