At the annual meeting of the American Economic Association in San-Diego on January 4-6 2013 Harvard professor of economics Benjamin Friedman said,

The standard models we teach… simply have no room in them for what most of the world’s central banks have done in response to the crisis.

Friedman also advises sweeping aside the importance of the role of monetary aggregates. On this he said,

If the model you are teaching has an “M” in it, it is a waste of students’ time. Delete. it.

According to most economic experts the Fed has re-written the central banking play book, cutting interest rates to near zero and tripling its balance sheet by buying bonds. The federal funds rate target is currently at 0.25%. The Fed’s balance sheet jumped from $0.86 trillion in January 2007 to $2.9 trillion in January 2013.

Professors who say they agree with the Fed’s approach to the 2008-9 economic crisis are nonetheless challenged by how to explain this new world of central banking to their students. Dramatic action by central banks to counter a global financial crisis cannot be explained by traditional models of how monetary policy works, it is argued.

So what seems to be the problem here?

Now according to the traditional way of thinking, a lowering of interest rates activates the overall demand for goods and services and this in turn, via the famous Keynesian multiplier, activates general economic activity. Furthermore, according to the traditional way of thinking massive monetary pumping should also lead to a higher rate of inflation.

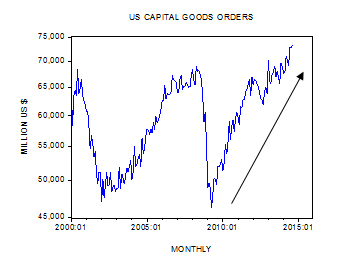

Yet despite the massive monetary pumping, both economic activity and the rate of inflation remain subdued. After closing at 8.1% in June 2010 the yearly rate of growth of industrial production fell to 2.2% in December 2012. The yearly rate of growth of the consumer price index (CPI) fell to 1.7% in December 2012 from 3.9% in September 2009. Additionally the unemployment rate stood at the lofty level of 7.8% in December 2012 with 12.2 million people out of work.

So why has the massive monetary pumping by the Fed and the near zero federal funds rate failed to strongly revive economic activity and exert visible upward pressure on the prices of goods and services?

Is the comment by Benjamin Friedman that money is not relevant now valid? We would suggest that the fact that massive pumping by the Fed has failed to produce results along the line of mainstream models doesn’t indicate that money supply is not important any longer in understanding what is going on.

The fact that economic activity is currently not responding to massive monetary pumping as in the past is indicative that prolonged reckless monetary policies have severely damaged the economy’s ability to generate real wealth. Contrary to Friedman, we maintain that money very much matters. Contrary to mainstream thinking, an increase in money supply doesn’t grow but rather destroys the economy.

The ongoing monetary pumping coupled with an ongoing falsification of the interest rate structure has caused a severe misallocation of scarce real capital. On account of reckless monetary policies, a non-wealth generating structure of production was created – obviously then, on account of the diminishing ability to generate real wealth, it is not possible to support (i.e. fund) strong economic activity.

Remember that monetary pumping is always bad news for the economy since it diverts real funding from wealth generating activities to wealth consuming activities. It sets in motion an exchange of nothing for something.

As long as the economy’s ability to generate wealth is still there the reckless monetary policies of the central bank can be absorbed. Loose monetary policies can create the false impression that they are the key drivers of economic growth.

However, once wealth generating activities as a percentage of total activities falls below the 50 percent line the reality takes over and general economic activity has to fall.

In response to the weakening in the wealth generating process various non-wealth generating activities that were supported by wealth generators are coming under pressure. To stave off bankruptcy they are forced to lower the prices of goods and services that they produce (the goods they produce are very low on consumers’ preference scales). According to Mises,

As soon as the afflux of additional fiduciary media comes to an end, the airy castle of the boom collapses. The entrepreneurs must restrict their activities because they lack the funds for their continuation on the exaggerated scale. Prices drop suddenly because these distressed firms try to obtain cash by throwing inventories on the market dirt cheap.[1]

It is not clear whether we have already reached this stage in the US. But the fact that despite massive pumping by the Fed economic activity remains subdued raises the likelihood that the US economy is not far from sinking into a black hole.

Aggressive policies by the Fed have highlighted the destructive nature of loose monetary policies. Contrary to popular theories, the actions of the Fed have shown that monetary pumping cannot grow an economy, it can only set in motion a process of destruction.

Mainstream economic thinkers are of the view that one can make the Fed’s policies more effective by making the central bank’s policies more transparent and consistent. According to Michael Woodford, a professor at Columbia University and one of the most influential current thinkers about monetary policy, “the recent events…have given us a lot of reason to change what we teach when we talk about monetary policy”. In future, Woodford said he would incorporate a lot more discussion about the importance of stability in the financial sector on the macro economy, and tell students why future expectations for central bank interest rates can be vital.

“Explain why expectations are important for aggregate demand,” he told the panel. “Make it credible that the central bank will actually follow through with the policy it is indicating,” Woodford said, referring to the importance of convincing businesses and households to invest and spend.

The belief that if Fed’s policies were to become more transparent and consistent will lead to stable economic growth is fallacious. We have seen that it is the Fed’s actual policies that are the key factor behind the destruction of the wealth generating process. Hence the damage inflicted by these policies cannot be avoided even if the Fed is consistent and transparent.

Also, observe that the key problem with the mainstream perspective is the emphasis that all that is needed for economic growth is boosting the demand for goods and services, i.e. demand creates supply.

It is for this reason that mainstream thinkers used to hold the view that increases in the money supply and the subsequent increase in the overall demand for goods and services is a catalyst for economic growth.

We have seen that once money is pumped, it sets in motion an exchange of nothing for something, i.e. the diversion of real wealth from wealth generators to non-wealth generators, and subsequent economic impoverishment.

Summary and conclusion

At the annual meeting of the American Economic Association in San-Diego on January 4-6 2013 academic economists said that the latest monetary policies of the Fed made it difficult to employ accepted theories regarding the effect of central bank policies on the economy. Experts are of the view that in the “new world” because of Fed’s policies there is little room left for money supply to explain the latest events, such as why economic activity and the rate of inflation are subdued despite the Fed’s aggressive policies since 2008. Contrary to mainstream thinking the aggressive policies of the Fed have highlighted the destructive nature of loose monetary policy – hence money supply matters more than ever.

[1] Ludwig von Mises Human Action 4th revised edition p 562.

The American Economics Association was set up by the (German Historical School educated) Richard Ely (the mentor of both T Roosevelt and Woodrow Wilson) to UNDERMINE the understanding of economics in the United States.

Before the AEA political economy in the United States was dominated by followers of Bastiat (and the rest of the French Liberal School) such as A.L. Perry. The AEA tried to make move economics away from the free market (i.e. freedom) and back towards government interventionism.

Sadly real economics such as Frank Fetter never really grasped that people like Richard Ely were not economists with another point of view, people like Richard Ely (like the Pragmatists in philosophy at the same time) were not really supporters of the basic concepts of OBJECTIVE TRUTH in ECONOMIC LAW at all. Indeed Frank Fetter even joined in Richard Ely’s “academic freedom” – not seeing that Ely’s real objective was to make academic economics a “closed shop” (dominated by a guild – committed to thinking up pretend “scientific” justifications for state interventionism) with the only position in universities upon to real economists…. cleaning the toilets.

The antics of the AEA now (denying the importance of money and so on) are in the tradition of its founder Richard Ely.

As for explaining the deeds of the Federal Reserve – that is not difficult.

The Federal Reserve is (like other major Central Banks) engaged in the direct and indirect funding of government spending by creating money (from NOTHING), and also engaged in the “cheap money” subsidy of banks and other favoured enterprises (Corporate Welfare) by the same process of creating money – from nothing.

Their (the Central Bankers) argument is – that if they did not increase the “monetary base”, “broad money” (the credit money bubble of the banking and general financial services sector) would collapse.

The capital structure is now so distorted that the question no longer is “will this economy collapse?”, only “when will this economy collapse?”

Uhm. This looks to me like a few bold assertions and some window dressing, not much in the way of explanation or argumentation on the key points, but maybe I need to work through a couple years of economics teaching to understand what the author is on about. Or maybe he could try and explain a bit more, perhaps try to construct instead of handwave?

Read The Case Against the Fed by Murray Rothbard. That will help get you started.