To begin to understand how central banks intend to reignite economic growth we have to understand that central bankers believe that changes in the quantity of money affect the price level, and for a short time, the level of economic activity, ie output.

By examining a classic monetary equation which became the foundation of Milton Friedman’s monetarism and central bank monetary policy we can see why there is potential for much more money printing.

MV = PT

M= money supply

V = velocity of money/ circulation

P = prices of goods and services/ price level

T = quantity of goods and services/ transactions or output

Irving Fisher termed this the quantity theory of money, and is often credited with this economic identity, but it was in fact the mathematician and astronomer Simon Newcomb who introduced this simple relationship; the equation of exchange, when he ventured into a new field of expertise with his book Principles of Political Economy (1885). Fisher’s belief is upheld by central bankers today:

we find nothing to interfere with the truth of the quantity theory that variations in money (M) produce normally proportional changes in prices

MV=PT simply put means the amount of money spent (MV) is always equal to the price of all things bought (PT) in an economy over any given period of time. If MV is the quantity of money (M) multiplied by the number of times that money is used during any given period (V); and if PT represents the price (P) of each product multiplied by the quantity purchased or volume traded (T) then this must equal the value of everything produced and sold in an economy during a given period of time.

If we look again at the definition of nominal GDP – the sum of all the goods and services produced, counted in their quantity (the ‘real GDP’), and then multiplied by their prices (the ‘price index’ or ‘deflator’). Clearly this is the same as PT. Therefore MV = PT = Nominal GDP.

Market Monetarism Misdiagnosis (M3)

A new strain of monetarism called market monetarism argues that because velocity is unpredictable, the Fed should manipulate the money supply so as to offset fluctuations in velocity and maintain a fixed rate of growth in the level of aggregate demand. Successfully doing so, they maintain, would considerably mitigate demand-side macroeconomic fluctuations.

The two decades prior to the financial crisis of 2008 was known by economists as ‘the Great Moderation’, an acknowledgement of a period of low inflation and relatively stable growth, with only two relatively mild recessions.

Furthermore, this stable period was attributed to the success of the Federal Reserve Bank (and many of the other world’s central banks) adopting an inflation target. They decided on a preferred inflation rate and steered the economy towards it, adjusting interest rates lower when inflation fell below target and higher when inflation exceeded the target.

Then in 2008 the severest recession since the Great Depression undermined economists’ faith in the ability of central banks to respond to crises as they were seemingly unable to prevent this major crisis. The search for alternative ways to conduct monetary policy began.

Inflation targeting was supposed to make the demand-side fiscal policy less relevant or even obsolete, as after all, both monetary and fiscal policy affect the same variable, total nominal spending (aggregate demand).

However the slump in nominal spending has had demonstrative effects as both public and private sector debt burdens have risen. Since both households and governments ability to service their debt depends upon their nominal incomes and revenues, a new monetary solution is being advocated that in encompasses the impact of fiscal policy. The solution that has risen to prominence is Nominal GDP level Targeting (NGDPLT).

NGDPLT was the hottest idea in monetary blogs over the last few years but has now migrated from the academic cloudscape to implementation. Central bank monetary policy setting across the G7 is adopting de facto or actual NGDPLT.

It was the Danish economist Lars Christensen of Danske Bank who coined the phrase ‘Market Monetarist’ in his working paper Market Monetarism – The Second Monetarist Counter-revolution. In it he refers to this economic school as the first to be born out of the blogosphere and in the abstract he defines the school as such:

Market Monetarism shares many of the views of traditional monetarism but unlike traditional monetarism Market Monetarism is sceptical about the usefulness of monetary aggregates as policy instruments and as an indicator for the monetary policy stance. Instead, Market Monetarists recommend using market pricing to evaluate the stance of monetary policy and as a policy instrument. Contrary to traditional monetarists — who recommend a rule for money supply growth – Market Monetarists recommend targeting the Nominal GDP (NGDP) level. The view of the leading Market Monetarists is that the Great Recession was not caused by a banking crisis but rather by excessively tight monetary policy. This is the so-called Monetary Disorder view of the Great Recession.

Proponents of NGDPLT believe it is better than inflation targeting, which to date has been used explicitly or implicitly by most central banks as a means of stabilising inflation and growth. Critics of inflation targeting centres on the belief that such a target provides too little flexibility to stabilise growth and/or employment in the event of an external economic shock.

The lead protagonist is arguably Scott Sumner, Professor of economics at Bentley University who adopted the motif of Market Monetarism having written extensively in his blog The Money Illusion to promote NGDPLT.

Sumner outlines nominal income or NGDPLT for the US in an article Re-targeting the Fed in National Affairs, Issue Fall 2011, and applies it to the UK in The Case for NGDP Targeting – Lessons from the Great Recession in a publication by the Adam Smith Institute in 2011.

NGDP and NGDPLT explained

Nominal GDP (NGDP) is the sum of all the goods and services produced, counted in their quantity (the ‘real GDP’), and then multiplied by their prices (the ‘price index’ or ‘deflator’). So NGDP combines a ‘real’ variable – one that measures something being actually produced and a ‘nominal’ variable, one which considers prices and not actual production.

Simply put NGDP is the sum or value of all spending in the economy, measured in US dollars, in the case of the US or Sterling, in the case of the UK etc; as you and I use them. It is the GDP figure that has not been adjusted for inflation. For example if nominal GDP is 8% and inflation has been 4%, the real GDP has increased 4% (NGDP minus inflation).

NGDP Level targeting is where a central bank determines a path along which NGDP would grow, and uses its monetary policy tools to affect that end; either conventional or unconventional if at the zero bound.

In practice the central bank, say the Fed, would adopt an annual rate of nominal income growth of 4 to 5%, and commit to return to that trend line when spending falls short or overshoots. So if the target is 5% and NGDP comes in at only 4% one year, they would aim for 6% the next year.

In most developed countries inflation has been preferred at 2% and long term growth potential at 2 to 3% and monetary policy would react, as it does now, easing when NGDP growth was expected to be too slow and tighten when it was too fast. So if NGDP fell below the target growth rate in any one year then the central bank would seek to make up for that in subsequent years.

What one will see is that in any one year the components of NGDP will vary. If trend target growth is a 5% NGDP, in years where real GDP is 1% then the central bank will alter monetary policy to achieve 4% inflation or such inflation that is required over a number years to regain this trend path of 5%. This as we discuss later is one the main criticisms of NGDPLT – that excessive growth in money supply could lead to higher inflation than is stable for long term sustainable output (employment).

Advocates of NGDPLT believe its overriding virtue is that it can address the dual concerns of macroeconomic policy by combining both employment and inflation into a single metric. It provides a way to address both inflation and output (employment) stability, without placing the central bank in the confusing situation of having to aim at two separate targets which require opposite action to achieve them.

A Flaw in Nominal GDP Level Targeting

In our latest HindeSight Investor Letter – “The Central Bank Revolution I – Well ‘Nominally’ So” we explored the arguments for and against NGDPLT in some depth. We wanted to highlight one flaw here, which is the potential implementation of NGDPLT.

The single biggest problem for a NGDPLT is what is the start date from which to project a trend path for NGDP. If one recalls NGDP Level targeting is where a central bank determines a path along which NGDP would grow, and using its monetary policy tools to affect that end; either conventional or unconventional if at the zero bound.

Christina Romer, professor at the University of California, Berkeley in a NY Times article making the case for NGDPLT explained how it would work:

The Fed would start from some normal year — like 2007 — and say that nominal G.D.P. should have grown at 4 1/2 percent annually since then, and should keep growing at that pace. Because of the recession and the unusually low inflation in 2009 and 2010, nominal G.D.P. today is about 10 percent below that path. Adopting nominal G.D.P. targeting commits the Fed to eliminating this gap. HOW would this help to heal the economy? Like the Volcker money target, it would be a powerful communication tool. By pledging to do whatever it takes to return nominal G.D.P. to its pre-crisis trajectory, the Fed could improve confidence and expectations of future growth.

The key phrase here is – “is some normal year – like 2007”.

We nearly choked on our morning Weetabix when reading this comment. This encapsulates to us how market monetarists have totally misunderstood that we have witnessed a super credit cycle that culminated in a blow-off bubble in 2007. Now this is hardly a year that we would term ‘normal.’

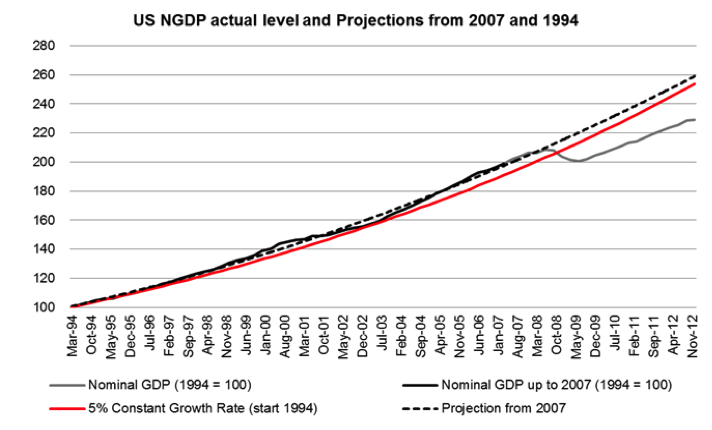

Normal is brushing your teeth before you go to bed, normal is filling your car with petrol because that is what provides the essential ingredient to propel it; normal is not gunning your car at 200 mph down the motorway so you won’t be late for a speeding offence, which would be somewhat analogous to starting the economy again at some excessive price rate of the likes we witnessed in 2007. This graph below illustrates beautifully how far we are away from Romer’s concept of norm:

Our next graph illustrates that if we started with 1994 when the FOMC signalled base rate changes then one could argue that late 90s and early 2000s were over-trending and 4.5% is the correct growth rate. This fits with our understanding of credit induced NGDP. We would emphasise that this suggests the Fed should do nothing more as it is at the target level, finally.

The same thought process can be applied to analysis of UK NGDP. The next graph shows a NGDP growth level of 5% by which the BoE could signal its intentions. It is clear that prior to 2008 the UK NGDP was running ahead of this pathway. One can see the gap that now exists – this is the output gap that policymakers like to refer to, and why market monetarists advocate that NGDP should rise by more than 5% to get back to its original trend path.

Anthony J. Evans of Kaleidic Economics illustrates that using a 4.5% NGDP target level extrapolated from 1997 shows the boom up to 2007 was significantly above trend. So depending on what target level one uses determines if you are back at trend levels, or undershooting. And if you want to get back to a 2007 projection M will have to rise considerably, and no doubt P will do too. So what is the correct growth rate required to get back to trend levels?

Again, one can see it all depends on a start point that is totally arbitrary.

UK 4.5% Target Level – Are we at the trend growth rate already?

Evans has a keen sense of humour when his observation on an extrapolated 2007 trajectory for NGDPL targets:

But by this logic we should believe that since Usain Bolt can run the 100 metres in under 10 seconds, he could run 600 metres in under a minute.

Market Monetarists have overlooked credit, in the same way the US Federal reserve did away with collating data on M3 credit supply. This oversight and misdiagnosis renders NGDPLT as a non-starter.

The great Monetarist Milton Friedman who persistently argued that the main reason still to have an independent central bank was that over the medium and longer term monetary forces influence only monetary variables. Other real, ie supply-side, factors determine long-term growth. So are Market Monetarists really now telling us that faster and higher inflation will generate sustainable long-term growth rates and faster to boot? Really…

In our latest HindeSight Investor Letter – The Central Bank Revolution I (Well ‘Nominally’ So) – we explore and counter this new wave of economics called Market Monetarism, which advocates NGDPLT and which appears to be revolutionising central bank monetary policy.

This article was previously published at HindeCapital.com.

Whilst “inflation” is defined as “an increase in the price level” not the MONETARY EXPANSION ITSELF, monetary economics will be crippled.

Frank Fetter refuted Irving Fisher in theory. And the busts of 1921 and 1929 refuted Fisher in practice.

The “mainstream” can not understand that even if prices are not rising the shops, inflation (the monetary expansion) may well be twisting the capital structure of the economy – and that this “boom” will lead to bust.

Benjamin Strong’s credit money boom in the 1920s led the bust (yet the “mainstream” just blast the Federal Reserve for not, somehow, maintaining the bubble economy even after 1929).

Alan Greenspan created the present mess (yet is treated as a respected figure – and manages to blame the results of HIS OWN POLICY OF MONETARY EXPANSION on “the market” and him having too much faith in the market).

And Helecopter Ben just continues the madness.

It is difficult not to despair.

The “mainstream” can not understand that even if prices are not rising the shops

Stop right there. The mainstream cannot even wrap its little pin heads around the fact that even if prices are not rising in the shops, there is still inflation. Without the increase in money, prices would likely be [better sit down for this one] dropping!

Oh, God, that would be awwwwwwful.

Ben

I don´t think MM´s misdiagnose it. This post argues against your “credit view” of the crisis.

http://thefaintofheart.wordpress.com/2012/09/21/it%C2%B4s-all-in-the-timing-it-was-not-the-financial-crisis-but-the-drop-in-ngdp-that%C2%B4s-responsible-for-deleveraging/

Ben Davis and MMT/Positive Money , get misled by equations.

MV=PT – Does not mean that V and P have to be UNIFORMLY distributed in the economy, which implies that measuring them is very, very trickey , if not impossible(a residual of the Economic Calculation debate). eg. If ALL the EFFECTS of inflation (oversupply of money) is in the prices of govt bonds, then if you don’t measure V and P in gov tbonds(they don’t) , you will get the wrong answers for implied inflation. (Implied because you are measuring the effects inflation to gauge the inflation itself). These effects will eventually seep out into the general economy(they may already be), but not before the bond market bubble collapses. That could be years, although I suspect not.

I cannot see how Ben Davis cannot see this. It has been pointed out to him for at least 2 years, but he apparently still cannot see it.