Cyprus may or may not prove to be a ‘watershed’ for the European crisis but what we can say for now (tempting fate outrageously as we do) is that, for all the dire warnings that this ‘confiscation’ will provoke a Continent-wide bank run, the initial reaction of the wider populace has been to treat the matter as something of ‘a quarrel in a far away country between people of whom we know nothing’.

That said, there is a wider issue at stake, beyond the inequity or otherwise of penalising small depositors, or the opportunism of imposing a haircut on those stock music hall villains, the Russian oligarchs, whose holding companies populate the corporate register of this otherwise economically–insignificant little island.

This is, namely, that however much we might express our contempt for a European elite which has so far exhibited a mix of pusillanimity and shameless political calculation in trying to avoid having their constituents face up to the cost of either their caprice or credulousness during the boom, the Cypriot ‘tax’—in reality a haircut—must serve as a necessary, if horribly belated, reminder to all of what it is exactly that modern-day banking entails.

It is high time that the Man on the Clapham Omnibus realised that his banker is nothing more than his, the depositor’s, debtor—and not a very reliable one, at that. Nor will it do our Everyman any harm to be shown once more that, for all the marbled halls and pseudo-classical gravitas of the banker’s typical premises, his profession is nothing more than a highly-leveraged, actuarial gamble, largely reliant not so much on the shrewdness of the banker himself as upon his cynical awareness that he can stretch to almost no enormity of bad judgement or abused trust such that it will pierce the carapace of privilege and protection with which he is furnished by a venal political class itself hopelessly in hock to the lenders of the counterfeit monies with which it buys the votes necessary to keep its members in the enjoyment of the many perks of office. A further lesson might be drawn from this last assertion which is that, far from being the soundest of borrowers, sovereign entities throughout history have been the worst, zero risk-weighting and mandatory ‘liquidity’ holdings notwithstanding.

Though there has been much expression of outrage at this ‘assault upon private property’, the sorry truth is that this is only the most recent—if also the most blatant—of the many transfers of wealth from the populace at large to the balance sheets of their bankers. Should you need any convincing of this, I am sure the poor, put-upon Irish could quote you chapter and verse about the miseries of the debt slavery imposed upon them by their overlords in Frankfurt, while it is beyond human wit to reckon the number of the prudent and thrifty now being denied a due return on their hard-won savings by the arrogance of the central bankers to whose crass, ’reflationary’ redistributionism they are now subject.

It should also be emphasised that it is no more than just that the owners and creditors of a failed institution share proportionately in its ruin, or conversely contribute in due measure to its rescue—though, naturally, the choice between these alternatives should lie with them as individuals. That the institution in question is a purveyor of banking services, rather than of beauty products or bed linen is totally beside the point. As the latest of several heavyweight commentators (such as members of the Chapter 14 group or Richard Fisher of the Dallas Fed in the US), Willem Buiter endorses this view in his latest piece where, he says, it is high time we ‘resolved’ our commercial banks à outrance, relying on the near limitless power of the central bank to maintain the basic stock of money and to staunch any systemic haemorrhage as and where needed. After all, if we are to be saddled with the institutional evil of a central bank, we may as well enlist its baleful power in a good cause for once.

That the powers-that-be, having driven the masses through the drip-drip torment of ‘Fauxterity’ in the attempt to save their own banks, have only now dared to try to implement such a process of ‘bail-in’ in a small , politically-impotent country such as Cyprus certainly reeks of hypocrisy and double standards. Nor is it exactly a matter of justice that the admittedly nugatory exposures of the banks’ stock and bond holders have again gone unscathed, or that even depositors of healthy banks (assuming there are any) are being compelled to pay for the sins of their less sanitary peers. Nevertheless, as we have said several times before, the lesson that must be taught when dealing with bankers, as with any other recipient of one’s funds, is Caveat commodator! Let the lender beware

Slowly, slowly, amid all this chaos, the commentariat is coming around to espouse several key tenets of our Austrian creed. Five years too late for many of the downtrodden victims of the crash, alas, and with nary a nod of recognition to the fact that their beloved Keynes is an idol with feet of clay, but at least they themselves are beginning to inch tentatively along the road to Damascus-am-Donau.

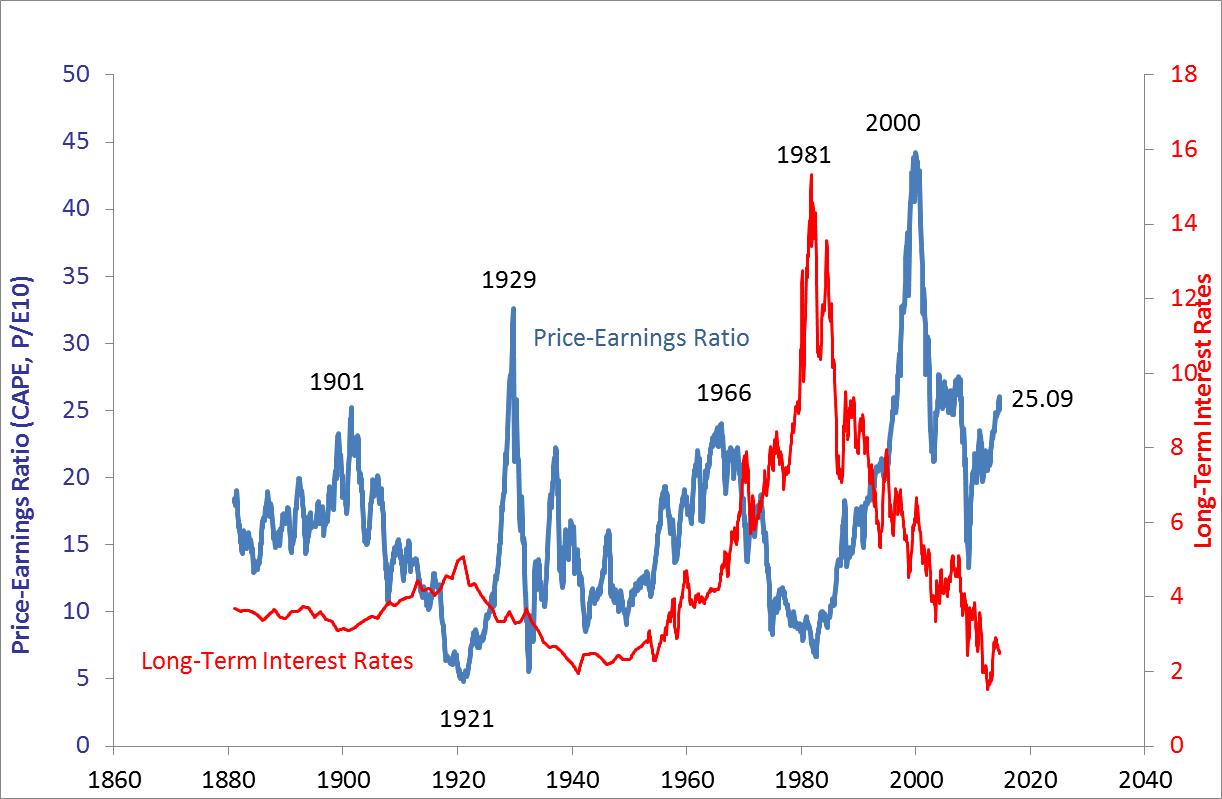

The first of these contentions is that the crisis itself is always the result of an inflation of money and credit—whether this is unleashed as a deliberate act of commission before, or supinely accommodated by the monetary authority after, the fact. The danger here is not so much that consumer goods prices rise as the money and its substitutes swell in availability, but is rather that the inflation distorts, if not entirely suppresses, the critical signals sent about relative scarcities and the subjective human preferences which set these. Especially problematic are those least directly observable signals which act across time and which are therefore transmitted by interest rates in particular and by asset pricing in general. In scrambling these, inflation progressively fixes too much precious capital into the wrong, ultimately barren foundations and leads too many people to exert their limited human energies in pursuing foredoomed endeavours.

The second Austrian lemma is that when the boom turns to bust, the wisest course, that is to say the one which will involve the least long-run hardship and impose the lowest threat of a widespread descent into lingering hopelessness, is not one that will involve the exercise of either misplaced compassion (if we are charitable) or of naked, political short-termism (if we are not). The answer, when the bust threatens to push the economy beyond its self-regulating ‘corridors’ is to widen them as much as possible by pursuing an Auflockerung—a lifting of the man-made impediments to swift adjustment—and to eschew all attempts at propping up as much of the Boom’s inherently unsound and demonstrably unremunerative superstructure as is possible by a crude and usually fruitless macro-manoeuvring.

The dispelling of the boom-time enchantment typically leaves many saddled with ill-advised levels of obligation which they cannot now honour in the easy manner formerly envisaged. It reveals that many of those in command of economic assets have woefully misapplied and mismanaged them, even where this has not been deliberately fraudulent. It shows that large numbers of people have imagined themselves more prosperous than they really were and have therefore spent and borrowed according to a perniciously false scale of values.

Once this mass deception becomes known, it would be folly to assume that the ‘undeserving’ can be spared any and all suffering in the ensuing bust. It is also clear that there will be far greater numbers of the plaintive than the pleased when the Wheel of Fortune starts on its inevitable downward course. But nothing in this implies that any purpose is served by indulging in a denial of the gravity of the circumstance. It is a further grave misstep to trust that a ‘socialization’ of the problem will somehow help, or to expect genuine benefits to accrue from a wilful attempt to further confuse the accounts—which is essentially what the unholy concert of the fiscal and monetary authorities usually seek to do. To the contrary, to act to deaden the pain through a policy of obfuscation, procrastination, and the dispersion of responsibility is not only to prolong the suffering in the here and now but to make a future recurrence much more likely.

All of the misconceptions fostered in the easy money boom require for their remedy a forthright and fearless recognition of what can hardly fail to be unpalatable facts. Like a patient confronted with the news that his ailment is at once more serious and more advanced than he had been given to suspect, or like the general who discovers to his horror that his previously quiescent foe is even now marching in strength upon his flanks, this is no time for palliatives, or for futile ’If Only’s’. It is time for corrective action: for harsh treatment if necessary; for a rapid re-arrangement of one’s dispositions and for an immediate abandonment of one’s earlier illusions.

The more rapidly that a misguided lender and his now discomfited borrower can renegotiate their arrangement, the more resolutely they can each own up to their disappointments, and the more determinedly they can avoid the sunk cost fallacies of regret, the quicker each can disencumber himself of his past errors of judgement and so the earlier each may begin to re-establish what he has lost by acting henceforth in a manner more suited to the changed situation in which he and most of his fellows now find they must go about their business.

It is far preferable to undergo a timely, strategic withdrawal, the better to prepare both the recovery of lost ground and hopefully the advance beyond it, than to become trapped in a personal Stalingrad where a combination of an unwillingness to recognise the scale of the reverse suffered and a naïve hope in a rescue miraculously being effected from above condemns one both to an unavailing struggle and to a final reckoning of loss far more shattering than what was initially required.

One of the most insidious ways to postpone this catharsis is for the central bank to slash interest rates and to flood the world with liquidity, goading the populace into repeating that very falsification of price of assets and of the discount between today and tomorrow which led its members to their present state of ruin.

If we recognise that our savings have been wasted, that our investments have gone sour, that our wealth has been reduced, then the price of what must be a more scarce endowment of productive capital should reflect this. Rates should be higher, not lower. Moreover, with yesterday’s attempts at providing for our present needs having been led so far astray, we will all have to put more emphasis on securing current rather than future provision. Again, rates should be higher, not lower. With the sorry lesson fresh in our minds that any chancer can start a business when credit replaces capital and when its rent is set artificially low, we should all be more choosy about whom we are to entrust with our savings. A third time, rates should be higher, not lower

To clarify this last point, it should be obvious that we should never be overly willing to see funds placed, willy-nilly, at the disposal of men who, however praiseworthy their initiative, are sufficiently foolhardy as to want to undertake projects of such a marginal nature that they will fold at the first whiff of adversity—at the merest uptick of interest rates, the first drop in sales or hike in costs, at the smallest fluctuation of exchange rates. Instead we should look for men whose product is really likely to satisfy consumer demand, men whose entrepreneurial antennae have unearthed a reasonably durable arbitrage between input and output prices, and men whose confidence in the schedule of prospective returns to their efforts does not require a vanishingly small rate of interest for its maintenance. If this is true of start-up companies in the upswing, it is doubly true of those stranded on the beach when the flood tide of the boom recedes.

But what do we get instead? We get the present, abominable, inverted Bagehotism of lending on no very good security at all, to all and sundry, and at a highly subsidised rate of interest. By this perverse means we attempt to perpetuate people in the errors of the boom, to succour the weak at the expense of the strong, and to practice Aufhalterung—a gumming up of the system—in place of Auflockerung.

Miracle of miracles, there are those who are beginning to recognise this, whether from the ranks of Britain’s recovery professionals at R3, or in the shape of well-known UK investor John Moulton, who severally risk much ill-informed opprobrium by daring to bemoan the policy of allowing zombie companies to hoard resources, manpower, and space on overburdened bank balance sheets. On another tack, Ronald McKinnon and his Stanford University colleague John Taylor (he of ‘Rule’ fame) argue correctly that ZIRP discourages much lending — whether direct or disintermediated — since risk palpably outweighs a return which is deliberately ’repressed’ to or even, in real terms, below zero.

In Axel Leijonhufvud’s pithy characterisation, when depressions occur, we are made captives of the past while inflations act to preclude us from mapping out our course into the future. He also suggests that, in the former case, monetary policy may be less effective than might be thought because once it has percolated, as it inevitably will, from the wallets of the income-poor to the pockets of the income-sufficient, the latter may have little incentive to re-employ it—whether they seek to hold it as a backstop amid economic uncertainty, or from a Ricardian-equivalence foreboding about higher taxes, or again because an elevated appraisal of risk seems vastly to outweigh a purposefully scanty reward. If prices, moreover, are not allowed to fall out of an irrational fear of ‘deflation’, the real value of their reserve will not increase and so gently encourage them to transmute a portion of it back into a medium of exchange: the Pigou effect will not come into play and so another means of self-equilibration will be denied us.

Can we really say that such is not the fate to which Ben Bernanke will consign us, strive though he will to dissolve our contractual ties in the acid of inflation instead?

NB: The mischievous thought arises that since what Blackhawk Ben and his acolytes really seek is for us all to lose faith in our money as a store of value, so that we go out and spend it as fast as we can, they should be cheering the Cyprus experiment to the rafters!

I’m underwhelmed by the allegedly devastating effects of artificially low interest rates.

First, interest is just one of the many costs involved in running an investment: there is also associated labour costs, energy costs, etc. Thus if interest rates are say 3% too low, that’s certainly undesirable, but its hardly catastrophic.

Second, it is EXTREMELY DIFFICULT to judge the optimum amount of investment in any project: the amount invested is often 30% too much or 30% too little. Thus interest rates that are say 3% too low are near irrelevant.

Third, the TOTAL PROFIT that firms make on investments varies by a HUGE AMOUNT. A 100% return on capital (or 100% loss on capital) is not uncommon. E.g. the profit that Jaguar Landrover made for Tata last year (about a billion) was equal to what Tata paid for JL. That’s a 100% return on capital. In that scenario, and assuming the takeover of JL by Tata was funded entirely by borrowing, the above 3% is irrelevant.

I’m underwhelmed by the allegedly devastating effects of artificially low interest rates.

That comment reminds me of Tyler Cowen’s questioning of ABCT when he wondered [aloud, of course] why people were continually fooled into malinvestment. The correct question would have been, why does the Central Bank continue to pump if people are so smart?

The “bottom line” with Cyprus is that anyone with a business who banks with these two main banks, had just been bankrupted.

They might have just about survived losing ten percent of their money – but 40% or more? Not a chance.

This means that the people who work for these (not de facto bankrupt) enterprises, will soon be out of a job.

Interest rates…….

As Frank Fetter tried (again and again) to explain to Irving Fisher.

Interest rates should be a matter of pure time preference – between savers and borrowers.

People give up their resources (they save rather than consume) for a period of time (and risk losing the savings totally) so that other people can have the money NOW.

The saver prefers the possiblity of having more money later, the borrower wants the money NOW and is prepared to pay interest for having the money now.

Efforts to reduce interest rates (either by banking credit bubbles, or by the government printing press) are terrible – utterly terrible.

Someone who really can not grasp the horror of a “low interest rate” “cheap money” policy, should be kept away from economics.

In much the same way that a baby should be kept away from razor blades.

Full reserve banking solves your 40% point. Under full reserve, depositors have the choice between, 1, having their money lodged in a 100% safe manner, or 2, letting their bank lend on their money, in which case the depositor carries the risk.

Regardless of what the regime is (full reserve, fractional reserve or a centrally planned communist economy for that matter) no business should put itself in a position where it might run out of cash – and as we all know, failing to watch the cash flow is a common mistake in business.

So under full reserve, any well run business would keep enough in it’s safe account to keep it going even if a major banking crisis erupted next week.

Dear RM,

Thank you so much for the lesson in how businesses work. But perhaps you can explain why it is, since interest rates are such a trivial issue, that everyone always clamours for them to be reduced as much as possible, not least once the boom has turned to bust.

And given that there tends to be a two-way causation (and certainly a close correlation) between low interest rates and a plenitude of money, do you not think it possible that so much of that awful variation in prices of which you speak – of labour, raw materials, and equipment, as well as of realised selling prices – may have something to do with whether money and credit is being made more or less available and to whom and therefore, by extension, what the level of interest rates might be?

Finally, the fact that it is as hard as you say to judge capital requirements or to estimate the return on capital invested ex ante is (a) a non sequitur regarding the appropriate level of interest rates per se and (b) a very good reason not to further complicate the calculation process by falsifying the price of credit and, at one remove, that of capital itself.

I honestly believe that Ralph Musgrave is trolling for responses.

Nothing else would seem to explain his deliberate disregard for the only reliable means of determining the constantly changing and critically important value of currency – in the free market.

Interest rates are absolutely crucial when it comes to pricing money, or for that matter currency. And if you can’t price money, or for that matter currency accurately, then you have absolutely no way of engaging in efficient buying and selling.

This has the effect of forcing one to return to different forms of barter.

I think the article is extremely well written and decisively cogent.

Also Paul Marks, I agree with everything you said.

Leonardo DelVecci

Great article, as always, but there’s something I can’t understand. In your sentence: “It is high time that the Man on the Clapham Omnibus realised that his banker is nothing more than his, the depositor’s, creditor—and not a very reliable one, at that.”

My understanding would lead me to believe that ‘debtor’ is the correct word here, not ‘creditor’. Am I going mad?! Someone please help me out here!

Thanks Phil. Now fixed.

Leonardo – you may be right, but I am not sure.

I have a lot of experience with trolls and they are normally write in a different way to the way Ralph Musgrave does.

I do not agree with what he says – but I do not think (although I could be quite wrong)that he is writing with the intention to provoke (which is the definition of a troll).

Phil,

You are, of course, absolutely correct. Sorry for the confusion.