In a previous life as a London-based ‘global strategist’ (I was never sure what that was) I was known as someone who was worried by QE and more generally, about the willingness of our central bankers to play games with something which I didn’t think they fully understand: money. This may be a strange, even presumptuous thing to say. Surely of all people, one thing central bankers understand is money?

They certainly should understand money. They print it, lend it, borrow it, conjure it. They control the price of it… But so what? What should be true is not necessarily what is true, and in the topsy-turvy world of finance and economics, it rarely is. So file the following under “strange but true”: our best and brightest economists have very little understanding of economics. Take the current malaise as prima facie evidence.

Let me illustrate. Of the many elemental flaws in macroeconomic practice is the true observation that the economic variables in which we might be most interested happen to be those which lend themselves least to measurement. Thus, the statistics which we take for granted and band around freely with each other measuring such ostensibly simple concepts as inflation, wealth, capital and debt, in fact involve all sorts of hidden assumptions, short-cuts and qualifications. So many, indeed, as to render reliance on them without respect for their limitations a very dangerous thing to do. As an example, consider the damage caused by banks to themselves and others by mistaking price volatility (measurable) with risk (unmeasurable). Yet faith in false precision seems to us to be one of the many imperfections our species is cursed with.

One such ‘unmeasurable’ increasingly occupying us here at Edelweiss is that upon which all economic activity is based: trust. Trust between individuals, between strangers, between organisations… trust in what people read, and even people’s trust in themselves. Let’s spend a few moments elaborating on this.

First, we must understand the profound importance of exchange. To do this, simply look around you. You might see a computer monitor, a coffee mug, a telephone, a radio, an iPad, a magazine, whatever it is. Now ask yourself how much of that stuff you’d be able to make for yourself. The answer is almost certainly none. So where did it all come from? Strangers, basically. You don’t know them and they don’t know you. In fact virtually none of us know each other. Nevertheless, strangers somehow pooled their skills, their experience and their expertise so as to conceive, design, manufacture and distribute whatever you are looking at right now so that it could be right there right now. And what makes it possible for you to have it? Exchange. To be able to consume the skills of these strangers, you must sell yours. Everyone enters into the same bargain on some level and in fact, the whole economy is nothing more than an anonymous labor exchange. Beholding the rich tapestry this exchange weaves and its bounty of accumulated capital, prosperity and civilization is a marvelous thing.

But we must also understand that exchange is only possible to the extent that people trust each other: when eating in a restaurant we trust the chef not to put things in our food; when hiring a builder we trust him to build a wall which won’t fall down; when we book a flight we entrust our lives and the lives of our families to complete strangers. Trust is social bonding and societies without it are stalked by social unrest, upheaval or even war. Distrust is a brake on prosperity, because distrust is a brake on exchange.

But now let’s get back to thinking about money, and let’s note also that distrust isn’t the only possible brake on exchange. Money is required for exchange too. Without money we’d be restricted to barter one way or another. So money and trust are intimately connected. Indeed, the English word credit derives from the Latin word credere, which means to trust. Since money facilitates exchange, it facilitates trust and cooperation. So when central banks play the games with money of which they are so fond, we wonder if they realize that they are also playing games with social bonding. Do they realize that by devaluing money they are devaluing society?

To see the how, first understand how monetary policy works. Think about what happens in the very simple example of a central bank’s expanding the monetary base by printing money to buy government bonds.

That by this transaction the government has raised revenue for the government is obvious. The government now has a greater command over the nation’s resources. But it is equally obvious that no one can raise revenue without someone else bearing the cost. To deny it would imply revenues could be raised for free, which would imply that wealth could be created by printing more money. True, some economists, it seems, would have the world believe there to be some validity to such thinking. But for those of us more concerned with correct logical practice, it begs a serious question. Who pays? We know that this monetary policy has redistributed money into the government’s coffers. But from whom has the redistribution been?

The simple answer is that we don’t and can’t know, at least not on an amount per person basis. This is unfortunate and unsatisfactory, but it also happens to be true. Had the extra money come from taxation, everyone would at least know where the burden had fallen and who had decreed it to fall there. True, the upper-rate tax payers might not like having a portion of their wealth redirected towards poorer members of society and they might not agree with it. Some might even feel robbed. But at least they know who the robber is.

When the government raises revenue by selling bonds to the central bank, which has financed its purchases with printed money, no one knows who ultimately pays. In the abstract, we know that current holders of money pay since their cash holdings have been diluted. But the effects are more subtle. To see just how subtle, consider Cantillon’s 18th century analysis of the effects of a sudden increase in gold production:

If the increase of actual money comes from mines of gold or silver… the owner of these mines, the adventurers, the smelters, refiners, and all the other workers will increase their expenditures in proportion to their gains. … All this increase of expenditures in meat, wine, wool, etc. diminishes of necessity the share of the other inhabitants of the state who do not participate at first in the wealth of the mines in question. The altercations of the market, or the demand for meat, wine, wool, etc. being more intense than usual, will not fail to raise their prices. … Those then who will suffer from this dearness… will be first of all the landowners, during the term of their leases, then their domestic servants and all the workmen or fixed wage-earners … All these must diminish their expenditure in proportion to the new consumption.

In Cantillon’s example, the gold mine owners, mine employees, manufacturers of the stuff miners buy and the merchants who trade in it all benefit handsomely. They are closest to the new money and they get to see their real purchasing powers rise.

But as they go out and spend, they bid up the prices of the stuff they purchase to a level which is higher than it would otherwise have been, making that stuff more expensive. For anyone not connected to the mining business (and especially those on fixed incomes: “the landowners, during the term of their leases”), real incomes haven’t risen to keep up with the higher prices. So the increase in the gold supply redistributes money towards those closest to the new money, and away from those furthest away.

Another way to think about this might be to think about Milton Friedman’s idea of dropping new money from a helicopter. He used this example to demonstrate how easy it would theoretically be for a government to create inflation. What he didn’t say was that such a drop would redistribute income in the same way more gold from Cantillon’s mines did, towards those standing underneath the helicopter and away from everyone else.

So now we know we have a slightly better understanding of who pays: whoever is furthest away from the newly created money. And we have a better understanding of how they pay: through a reduction in their own spending power. The problem is that while they will be acutely aware of the reduction in their own spending power, they will be less aware of why their spending power has declined. So if they find groceries becoming more expensive they blame the retailers for raising prices; if they find petrol unaffordable, they blame the oil companies; if they find rents too expensive they blame landlords, and so on. So now we see the mechanism by which debasing money debases trust. The unaware victims of this accidental redistribution don’t know who the enemy is, so they create an enemy.

Keynes was well aware of this insidious dynamic and articulated it beautifully in a 1919 essay:

By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. … Those to whom the system brings windfalls… become “profiteers” who are the object of the hatred…. the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

Deliberately impoverishing one group in society is a bad thing to do. But impoverishing a group in such an opaque, clandestine and underhanded way is worse. It is not only unjust but dangerous and potentially destructive. A clear and transparent fiscal policy which openly redistributes from the rich to the poor can at least be argued on some level to be consistent with ‘social justice.’ Governments can at least claim to be playing Robin Hood. There is no such defense for a monetary driven redistribution towards recipients of the new money and away from everyone else because if the well-off are closest to the money, well, it will have the perverse effect of benefitting them at the expense of the poor.

Take the past few decades. Prior to the 2008 crash, central banks set interest rates according to what their crystal ball told them the future would be like. They were supposed to raise them when they thought the economy was growing too fast and cut them when they thought it was growing too slow. They were supposed to be clever enough to banish the boom-bust cycle, and this was a nice idea. The problem was that it didn’t work. One reason was because central bankers weren’t as clever as they thought. Another was because they had a bias to lower rates during the bad times but not raise them adequately during the good times. On average therefore, credit tended to be too cheap and so the demand for debt was artificially high. Since that new debt was used to buy assets, the prices of assets rose in a series of asset bubbles around the world. And this unprecedented, secular and largely global credit inflation created an illusion of prosperity which was fun for most people while it lasted.

But beneath the surface, the redistributive mechanism upon which monetary policy relies was at work. Like Cantillon’s gold miners, those closest to the new credit (financial institutions and anyone working in finance industry) were the prime beneficiaries. In 2012 the top 50 names on the Forbes list of richest Americans included the fortunes of eleven investors, financiers or hedge fund managers. In 1982 the list had none.

Besides this redistribution of wealth towards the financial sector was a redistribution to those who were already asset-rich. Asset prices were inflated by cheap credit and the assets themselves could be used as collateral for it. The following chart suggests the size of this transfer from poor to rich might have been quite meaningful, with the top 1% of earners taking the biggest a share of the pie since the last great credit inflation, that of the 1920s.

Who paid? Those with no access to credit, those with no assets, or those who bought assets late in the asset inflations and which now nurse the problem balance sheets. They all paid. Worse still, future generations were victims too, since one way or another they’re on the hook for it.

So with their crackpot monetary ideas, central banks have been robbing Peter to pay Paul without knowing which one was which. And a problem here is this thing behavioural psychologists call self-attribution bias. It describes how when good things happen to people they think it’s because of something they did, but when bad things happen to them they think it’s because of something someone else did. So although Peter doesn’t know why he’s suddenly poor, he knows it must be someone else’s fault. He also sees that Paul seems to be doing OK. So being human, he makes the obvious connection: it’s all Paul and people like Paul’s fault.

But Paul has a different way of looking at it. Also being human, he assumes he’s doing OK because he’s doing something right. He doesn’t know what the problem is other than Peter’s bad attitude. Needless to say, he resents Peter for his bad attitude. So now Peter and Paul don’t trust each other. And this what happens when you play games with society’s bonding.

When we look around we can’t help feeling something similar is happening. The 99% blame the 1%; the 1% blame the 47%. In the aftermath of the Eurozone’s own credit bubbles, the Germans blame the Greeks. The Greeks round on the foreigners. The Catalans blame the Castilians. And as 25% of the Italian electorate vote for a professional comedian whose party slogan “vaffa” means roughly “f**k off” (to everything it seems, including the common currency), the Germans are repatriating their gold from New York and Paris. Meanwhile in China, that centrally planned mother of all credit inflations, popular anger is being directed at Japan, and this is before its own credit bubble chapter has fully played out. (The rising risk of war is something we are increasingly worried about…). Of course, everyone blames the bankers (“those to whom the system brings windfalls… become ‘profiteers’ who are the object of the hatred”).

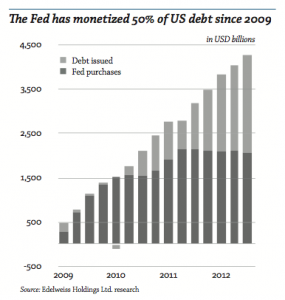

But what does it mean for the owner of capital? If our thinking is correct, the solution would be less monetary experimentation. Yet we are likely to see more. Bernanke has monetized about a half of the federally guaranteed debt issued since 2009 (see chart below). The incoming Bank of England governor thinks the UK’s problem hasn’t been too much monetary experimentation but too little, and likes the idea of actively targeting nominal GDP. The PM in Tokyo thinks his country’s every ill is a lack of inflation, and his new guy at the Bank of Japan is revving up its printing presses to buy government bonds, corporate bonds and ETFs. China’s shadow banking credit bubble meanwhile continues to inflate…

For all we know there might be another round of illusory prosperity before our worst fears are realised. With any luck, our worst fears never will be. But if the overdose of monetary medicine made us ill, we don’t understand how more of the same medicine will make us better.

We do know that the financial market analogue to trust is yield. The less trustful lenders are of borrowers, the higher the yield they demand to compensate. But interest rates, or what’s left of them, are at historic lows. In other words, there is a glaring disconnect between the distrust central banks are fostering in the real world and the unprecedented trust lenders are signaling to borrowers in the financial world.

Of course, there is no such thing as “risk-free” in the real world. Holders of UK cash have seen a cumulative real loss of around 10% since the crash of 2008. Holders of US cash haven’t done much better. If we were to hope to find safety by lending to what many consider to be an excellent credit, Microsoft, by buying its bonds, we’d have to lend to them until 2021 to earn a gross return roughly the same as the current rate of US inflation. But then we’d have to pay taxes on the coupons. And we’d have to worry about whether or not the rate of inflation was going to rise meaningfully from here, because the 2021 maturity date is eight years away and eight years is a long time. And then we’d have to worry about where our bonds were held, and whether or not they were being lent out by our custodian. And of course, this would all be before we’d worried about whether Microsoft’s business was likely to remain safe over an eight year horizon.

We are happy to watch others play that game. There are some outstanding businesses and individuals with whom we are happy to invest. In an ideal world we would have neither Peters nor Pauls. In the imperfect one in which we live, we have to settle for trying hard to avoid the Pauls, who we fear mistake entrepreneurial competence for proximity to the money well. But when we find the real thing, the timeless ingenuity of the honest entrepreneurs, the modest craftsmen and craftswomen who humbly seek to improve the lot of their customers through their own enterprise, we find inspiration too, for as investors we try to model our own practice on theirs. It is no secret that our quest is to find scarcity. But the scarce substance we prize above all else is trustworthiness. Aware that we worry too much in a world growing more wary and distrustful, it is here we place an increasing premium, here that we seek refuge from financial folly and here that we expect the next bull market.

This article was previously published in Edelweiss Journal, Issue 12 (11 March 2013)

Imagine the transition to a rational economy if the monetary base were simply frozen, would we see the financial sector crumbling away, London becoming a ghost town as the lack of economic activity took its toll, and far away from London, in towns small and large, as the distortions of decades of fiat money wore off, would people start to look smart and prosperous again as economic activity blossomed?

It would be a fascinating and at times grim experience.

London becoming a ghost town as the lack of economic activity took its toll, and far away from London, in towns small and large, as the distortions of decades of fiat money wore off, would people start to look smart and prosperous again as economic activity blossomed?

Yes. That’s a very good prognostication.

For years, we’ve all been fed the idiotic assumption [on the part of ignorant economists and journalists] that the development of a huge financial sector and the withering-away of manufacturing are just natural occurrences as an economy becomes developed.

Of course, there is no such natural law.

Yes Mr Ed.

But can the present system carry on even with Central Bank support – I think we would agree that it can NOT.

So then the queation becomes – “when does the cracking start to become obvious”.

I am going to stick my neck out and do what no rational person should ever do (but then I am a wild man – so I am not supposed to be level headed), I am going to make a specific prediction.

I think the cracking (in the currency markets and the stock markets and so on) will start to become obvious in May – this May.

I know perfectly well that (for example) the Germans will do anything to delay the cracking till after their election in September, and that some of the worst things Barack Obama has pushed through do not go into effect till January 2014. But I still think that May (this year) is when the cracking will start to become obvious.

If I am wrong – give me a firm slap on the wrist with a wet lettuce leaf.

An outstanding article.

“Yet faith in false precision seems to us to be one of the many imperfections our species is cursed with.”

Even though he died in his nineties, its too bad Dr Edward Deming, the father of quality assurance in Japan first, and then the US had not lived long enough to become a guru to the financial industry and especially central banks. One of his famous eye-opener experiments/demonstrations was to drop a marble from a funnel supported by a rigid frame onto a target laying on a table. He always had corporate executive participants in his seminars conduct the experiment in several groups. Some groups would be instructed to adjust the funnel each drop to compensate for error. If the marble missed the bulls-eye by say 3 inches to the right and high, then the funnel apparatus would be moved 3 inches to the left and low for the next drop. The other group would make no adjustments. After many drops, the distribution of the marble hits were measured. The group whose rule was to adjust every time always had a larger distribution radius than the group whose rule was to do nothing. He then showed mathematically that over time, using the rule to adjust every time would result in a distribution circle that was the square root of 2 greater than doing nothing.

He was at first ridiculed by American industry. That is until the Japanese quality of products went from being a synonym for cheap, poor quality products in the 1950s to being a synonym for quality in the 1980s. Then, he became one of the most sought after advisor to corporate America.

What if the central banks actually do know who Peter and Paul are ?

If they don’t it presupposes an ignorant aberration, if they do it presupposes a crime.