There has been considerable throughput of gold in western capital markets, with substantial buying from all round the world following the April price crash. The supply can only have come from two sources: the general public, or one or more governments. It really is that simple. Two months later the gold price has only partially recovered, so physical supplies have continued to be made available. Physical demand cannot have been entirely satisfied by ETF liquidations, confirming governments are involved. This article looks at the dynamics of the gold market around this event and the implications.

While the investing public in the western nations has been generally stunned following the April price smash, demand from Asia is running at record levels, illustrated in the chart below, which is of physical gold deliveries on the Shanghai Gold Exchange. (Thanks due to @KoosJansen for pointing me to the data on the SGE’s Chinese website).

The increase in deliveries for April and May was spectacular, totalling 460.5 tonnes, with the week ending 26 April alone seeing phenomenal deliveries of 117 tonnes. In addition, according to the Economic Times,India imported 142.5 tonnes in April and 162 tonnes in May, compared with an average monthly rate of 86 tonnes in Q1 2013. Therefore these two countries imported 765 tonnes of gold in two months, before considering any unofficial imports or their government purchases in foreign markets. The rest of Asia, from Turkey to Indonesia would certainly have stepped up their demand for gold as well, as did the western world itself for physical metal as opposed to paper entitlements.

The table below puts this into context.

A prefatory note about the statistics in this table: there is no single defined source of statistics on gold movements, and there are considerable variations in the same numbers reported by different organisations. The figures in the table above can only illustrate bullion flows. I have sourced the statistics from official sources where possible. The cash-for-gold business has had the easy pickings by now, so an assumption that this is about 600 tonnes per annum is I believe cautiously over-generous. It is based on a speech made by Jeffrey Rhodes of INTL Commodities DMCC to the LBMA in 2010, when he identified scrap supply as 583 tonnes in North America and Europe, whose central banks are in the gold suppression business. At that time, 1,091 tonnes were recycled in the East, including Turkey. Since the Chinese, Russian and other gold-producing governments of Central Asia retain most if not all of their domestically mined gold amounting to over 700 tonnes, there is less than 2,000 tonnes of free mine supply annually available for global markets, based on US Geological Survey figures.

Looking at the bottom line for 2012, there were only 87 tonnes of gold supply for the rest-of-the-world, after Asian and Russian central bank and global ETF purchases. In other words, there must have been a severe deficit overall, which can only have been covered by central bank sales.

About 150 tonnes of ETF gold were liquidated in Q1, providing temporary relief until the Cypriot crisis, when concerns over the security of large deposits in eurozone banks prompted a flight into physical gold, but interestingly, not into ETFs. This was because there were escalating systemic concerns over having physical gold and currency deposits with European banks, while at the same time portfolio investors were worried that the 12-year bull market might have ended.

From the point of view of the western central banks, as well as the bullion banks with short positions on Comex, in March the alarm bells must have been ringing loudly. Chinese demand was accelerating and there was an increasing likelihood that ETF liquidation would cease if the gold price stabilised. If that happened, as the table above clearly shows, an epic bear-squeeze would likely develop, fuelling a rush into gold and potentially bankrupting many of the bullion banks short in the futures markets and/or offering unallocated accounts on a fractional reserve basis.

Therefore, investors had to be dissuaded from buying gold, otherwise the ensuing crisis would not only cause a market failure that could spread to other derivatives (particularly silver), but it would come at the worst possible time, given the coincidental programme of monetary expansion currently being undertaken by all the major central banks.

The reasons for governments to intervene on the side of the bullion banks were therefore compelling. As one would expect, the intervention was well-timed: on Friday 12 April two large sell orders of 100 and 300 tonnes were placed on Comex, clearly designed to do maximum damage to the price, and setting it up for all remaining stops to be taken out the following Monday. Furthermore, central banks were prepared to supply physical gold to keep the price from recovering. We know this because lower prices generated a surge in private demand, not only in China and India, but from everywhere. The only possible supply, other than inadequate ETF liquidation, is from governments.

India and China have absorbed enough gold in the last two months of April and May to leave the rest of the world in a supply deficit, requiring matching sales of western government gold to continue to suppress the price.

The future

We now know for certain that government-controlled gold has been used to defuse a developing crisis in gold markets that had the potential to destabilise bullion banks, other derivative markets and ultimately the whole fiat currency system. We have seen the surge in demand for physical gold, which is the consequence of sharply lower prices. Realistically, the priority has been to ensure such a crisis is avoided, rather than for the price of gold to be continually suppressed.

The difficulty for the casual observer is compounded by the available information being one-sided. We are all painfully aware of both the losses inflicted on investors and their loss of faith in gold at a time when other investment media, such as stocks and bonds, have been doing well. Concealed from us is the real financial condition of the banks and governments themselves, which is the fundamental reason for owning gold. We are acutely aware of the sellers’ pain and only dimly aware of the buyers’ motivation.

Nervous western investors in a market of 160,000 tonnes are in truth a small part of the whole, particularly since gold has been migrating from the west to the east where it has been more valued ever since the 1970s oil crisis. More fundamentally we know that the stock of gold grows at about 1½% annually in line with global population growth. We also know that central banks everywhere are expanding their balance sheets at an accelerating rate. The disparity between the rate of growth for gold and paper currencies will certainly lead to increased tensions between precious metals and currencies generally, and it is this that will drive future demand for gold, not whether western investors think it is in a bull or bear market.

A second point about the market being 160,000 tonnes and not just the sum of mine and scrap supply is that the market is far bigger than western governments’ gold reserves. Gold held by them is officially about 19,000 tonnes, but it may well be only half that, or 5% of the aboveground stock, when unrecorded leasing and selling over the last 25 years are taken into account. The ability of central banks to contain a global surge in gold demand such as that which followed the April price-crash and continuing to this day is therefore limited.

But this is only a part of the story. There are the factors concealed from us, such as the buying opportunity given to gold-friendly governments and sovereign wealth funds, both with surplus dollars, as well as the appetite for gold from the growing ranks of the Russian and Asian mega-rich. There are factors known to the financially savvy, such as the growing instability of the Indian rupee and other emerging market currencies, the increasing systemic risks in eurozone banks with the threat posed to deposits, and the revenue shortfalls that force governments to raise money by printing their currencies at an increasing pace: all will impact the gold market in coming months.

These and other systemic problems are deteriorating. A potentially destabilising crisis in the gold market from runaway prices has been defused by allowing the bullion banks the space to square their books. There can be no other realistic objective in supplying government-owned gold into the market. As to the embarrassment of the gold price rising at a time of accelerating money printing – that will have to be accepted, presumably emphasising the official line, that the gold price is irrelevant to a modern economy.

This article was previously published at GoldMoney.com.

The major Western governments (via the Central Banks and so on) are indeed trying to break the gold market.

If the “international community” and “world governance” (not “World Government” that would be “paranoid” – “world governance” is quite different from “World Government”…..) are to win, then independent money must be destroyed.

And for most people in the world physical gold and silver (not Bitcoin) are that independent alternative to government fiat money.

What is happening now is no less than a calculated and determined effort to destroy the financial possiblity of liberty.

But do the Western governments actually have enough physical gold to succeed in their objective of destroying even the possibility of liberty?

I believe they do NOT.

And with every ounce of physical gold that Western government hand over (to support their front people in the gold markets) their position gets WEAKER.

Buy PHYSICAL gold and store it (without anouncing you have it) far from the normal places.

The establishment elite will lose.

Their system will fall.

They tried this before , Paul. With the London Gold Pool, and we know how that ended in calamity. It destroyed Bretton Woods.

In those days the economic adviser to De Gaulle, Jacques Rueff, saw what was happening long before and he advised that France send a gunboat to NY and retrieve France’s gold. Rueff was a gold sage. He also knew, and was vindicated by Triffin, that a country with a fiat currency that was also the reserve currency could never escape from an eventual inflationary currency demise because they have to run a trade deficit to produce dollars to satisfy international demand for dollar reserves and at the same time lose the inflation battle at home. Eventually this system must fail.

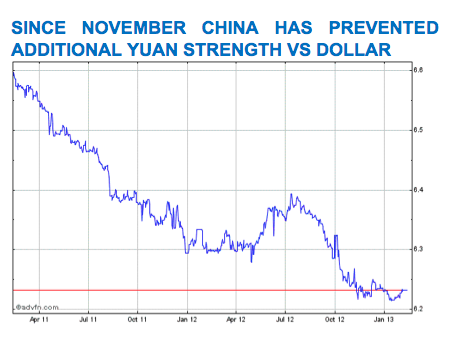

The USA gained a reprieve from inflation with the emergence of China and the Yuan/Dollar peg, which had the effect of exporting the US inflation to China. This created a false sense that QE was benign. When, not if , that peg breaks(they always break), I suggest that the USA will witness the Triffin dilemma at close quarters and it won’t be pretty. They will lose the gold suppression war, if not then, then long before that.

Of course , markets can be irrational(read manipulated) longer than one can remain solvent, but we must be closer o the end than the beginning. These irredeemable fiat currencies have a statistical lifespan of about 40 years, max.

Have you had a look at FOFOA’s blog Gary?

If you haven’t, you would enjoy it

Well said, Paul.

Quite so Gary.

Yes I have, captain.

The freegold idea. The idea of having one currency for day to day transactions and gold as a unit of account and store of value. I think this will arise spontaneously for expediency. The currency may inflate and the market may accept that cost as long as it can be cleared for gold timeously. Fekete says that absent legal tender laws, self liquidating real bills will be chosen by the market as the transacting currency.

I think some crypto currency would work as the transacting currency, they are practically cost free to move and are borderless.

You should also have a look at two short planks’ blog…

A very clear thinker, which has the same thought process as I have had, over the last couple of years.

When you actually think long and hard about it, the revaluation of gold is going to be mind blowing for those that do not adequately understand gold, or its role in the history of humanity…

http://twoshortplanksunplugged.blogspot.co.uk/

I see no reason why gold can not be used as money – DIRECTLY.

Many years ago L. Neil Smith pointed out that a speck of gold could be put in a clear plastic coin. “He is just a science fiction writer” – that does not mean the idea is wrong. And, of course, in an age of electronic transfers of ownership the gold (if people want) could sit in vaults whilst they used their cards (transferring ownership of the gold from themselves to those they bought goods and services from).

Although, the latter system depends on honest people being in charge of those gold vaults and the backroom stuff behind those electronic cards.

All the above is true of silver and so on.

The argument, Paul, is that notes in lieu of payment settlement/clearing will arise spontaneously in any case. For example, goods that are on order, to be paid for upon delivery to the end buyer, will generate IOU credit notes along the manufacturing chain to pay workers and intermediate suppliers until actual gold payment is received from the end buyer. And those notes will circulate as currency. There is no way to stop credit , and you would not want to. What you want is for that credit to be tightly linked to the non inflating store of value and clearing unit of account. Expiring real bills can be, and have been , such a system. These bills will naturally exist in any case if legal tender laws were abolished and gold becomes money.

I agree Gary – I do not want to “stop credit”, but one must be careful of definitions. Credit is NOT money – and must not be treated as money.

If I let you have goods “on credit” (i.e. in the hope you will pay me later), I have NOT been paid, and I can not use the money you have NOT paid me to go and buy other stuff.

Treating credit as money is the road to madness.

Credit is a claim on money, but it can circulate as currency. That is what we have now. All cash(bank notes) are treasury IOUs but circulates as currency. The problem that we have now is the currency never gets cleared for non debt money. It is irredeemable and always ends in disaster. No matter what debt free money we have, IOUs will circulate as currency, and as long as they are timeously cleared for the debt free money(marked to market) there is no problem. We now have a system that is marked to fantasy by govt decree. The yardstick has been removed and we are flying blind.

Irredeemable currency, in this system, is also the store of value, forced by legal tender laws. The property boom is as a result of people trying to circumvent this rigged system and seek other ways to store value. Maybe they will wish they had used gold instead. ?Eventually.

“Credit can circulate as currency” I know it can, and that is the road to madness. It means (for example) that I can let you have goods “on credit” and then get the money you have NOT paid me, and use it to buy other goods – whilst you use the money you should have paid me (and did NOT) and use it to buy other things (the same money being used to buy different things by different people AT THE SAME TIME) – and thus the “boom” is born, without any need for government action. And the “bust” (as this credit expansion shrinks back down to the “monetary base”) is inevitable. Treating credit notes (and other such) as if they were currency (money) is indeed possible – but it is also terrible in its consequences.

However, such 19th century style boom-busts are naturally limited (although still terrible) if Central Banks are created and get involved (it is possible for a Central Bank to exist and resist involvement in the madness – as the Bank of England sometimes resisted in the 19th century, but the temptation to “save the financial system” from the inevitable collapse of the insane “boom”, is very strong) then the boom-busts are (in the end) vastly larger – an obvious example being the terrible Benjamin Strong boom of the late 1920s.

The present “property boom” is the deliberate result of government policy (both directly and via the Bank of England). Extra money has been created – and is directed (again DELIBERATLY directed) into an unsustainable property boom (and an unsustainable stock market boom).

There is no doubt about this – the government is not just creating money and throwing it about at random (although that would also be terrible), it is deliberately directing the money into the housing market, thus DELIBERATLY propping up the inflated prices and DELIBERATLY distorting the economy by leading people to use a larger fraction of resources on the MALINVESTMENT that is the present property market.

I sometimes think that Kipling’s poem “The Gods of the Copybook Headings” is more useful in such matters than reading books on monetary economics and banking.

The idea that lasting prosperity (genuine economic progress) can be built upon credit (i.e. magic pixie dust, spread from the fairy castle in the air) without any eventual need to pay a real price for this “prosperity”, is (at its heart) a MORAL failing as much as an intellectual one. And, although in modern times it does involve government, it can happen (to a limited extent) without direct state action.

When Paul Krugman sneered that Austrian economics was a “moral” theory of the business cycle he angered (and meant to anger) followers of the view of Mises that economics is a “value free” science (“science” in the old sense of a “body of knowledge” – not a physical science such as physics). However, Krugman was, in an odd way, actually correct.

The central cause of the “boom” (the idea that people can spend without earning – that there can be lending greater than REAL savings)is a MORAL failing.

This is why it appeals to “intellectuals” just as much (perhaps more) than to bankers. Specifically those “intellectuals” who reject traditional (“conservative”) society of thrift (self denial – not consuming, so that one has money to invest) and hard work.

“Adam’s curse”(work – the agony that is human life) is not optional – no matter how clever people are at building inverted pyramids of debt.

The deception (including the SELF DECEPTION) can be incredibly complicated – but, at its heart, it is still magic pixie dust, sent by Moonbeams, from the fairy castle floating in the air.

It every last bit of loans is not matched by REAL savings (i.e. people GIVING UP consumption) then there is a “boom” and there will be a “bust”.

“It every last bit of loans is not

matched by REAL savings (i.e.

people GIVING UP

consumption) then there is a

“boom” and there will be a

“bust”.”

Amen to that, Paul. Avoiding the boom-bust is what I may call ” regularly marking the credit to market” , OR matching the loans to savings

Indeed Gary – if the loans come from savings (real savings) there can be no “boom” and (therefore) no “bust” – as the bubble is destroyed (because no bubble would exist in the first place).

The thing is that establishment economists (not just Keynesians – but others also) believe that no economic progress can occur without financial manipulation (the blowing of credit bubbles), they are wrong. Indeed the boom-busts make economic progress less (not more) than it otherwise would be.