Western economic commentary on China and Russia is usually coloured by monetarist assumptions not necessarily shared in Moscow and Beijing. For this reason, Russian and Chinese fiscal and monetary policies are misunderstood in financial markets, as well as the reasons their governments buy gold.

China has been notably relaxed about her own people acquiring gold, and the government itself appears to be absorbing all of China’s mine output. Russia is also building her official reserves from her own mine supply. The result over time has been the transfer of aboveground gold stocks towards these countries and their allies. The geo-political implications are highly important, but have been ignored by western governments.

China and Russia see themselves as having much in common: they are coordinating security, infrastructure projects and cross-border trade through the Shanghai Cooperation Organisation. Furthermore, those at the top have personal experience of the catastrophic failings of socialism, which have not yet been experienced in Western Europe and North America. Consequently neither government subscribes to the economic and monetary concepts prevalent in the West without serious reservations.

We saw evidence of this from Russia recently, with Putin’s appointment of his own personal economic adviser, Elvira Nabiullina, as the new head of Russia’s central bank. Ms Nabiullina is on record admiring, among others, the writings of Robert Higgs – a leading US economist of the Austrian School. She is therefore likely to take a strong line against the expansion of bank credit, which is confirmed by Russian commentators who believe she will prioritise reforms to strengthen bank balance sheets.

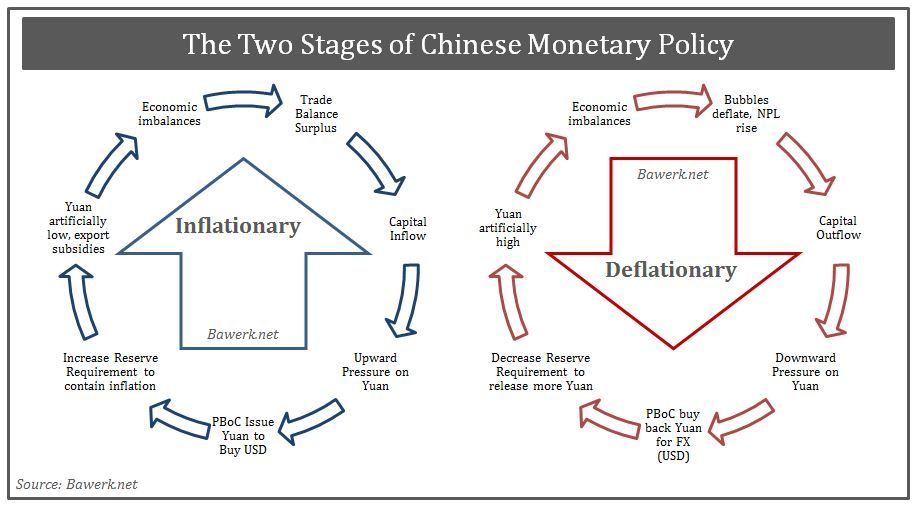

She is not alone. The People’s Bank of China recently let overnight money-market rates soar to over 20%. The message is clear for those prepared to look for it: they are not going to fuel an extended credit bubble. The two countries have learned how damaging a bank-credit-fuelled business cycle can be, and are determined to restrict bank lending. Western commentators find this hard to understand because it does not conform to the way western monetary policy works.

It seems that the leaders of both Russia and China are also painfully aware of the importance of currency stability in a way the West is not. The comparison with the West’s reckless monetary policies is stark. It follows that Russia and China are increasingly concerned about the major currencies, given both countries have substantial trade surpluses. Their exposure to this currency risk explains their keenness for gold. Furthermore, they know that if the renminbi and the rouble are to survive a western currency crisis, they must have the sound-money credibility provided by a combination of monetary restraint and gold backing. And the reason China is happy to let her citizens plough increasing amounts of their savings into gold is consistent with ensuring her people buy into sound money as well.

While the Chinese and Russian governments are authoritarian mercantilists, there are elements of the Austrian School’s economics in their approach. The tragedy for the West and Japan is they have embarked on the opposite weak-money course that can only end in the ultimate destruction of their currencies, leaving Russia and China as the dominant economic powers.

This article was previously published at GoldMoney.com.

“…that can only end in the ultimate destruction of their currencies, leaving Russia and China as the dominant economic powers.”

—————————

Isn’t there more to “economic power” than currency? Sure, if the economy is going to run effectively participants need real money but don’t they also need resources, labor, markets, etc? If the West is attempting to enable warfare/welfare states with fiat money, why would it necessarily be bad for the Russians and Chinese to follow another, more sensible path? If one of them became a “dominant economic power”, would that automatically be bad for everyone else? And what, other than big explosions, could be done to prevent their economic advance?

If one of them became a “dominant economic power”, would that automatically be bad for everyone else?

My take on the article is that the author believes it would be the collapse of the current powers that would elevate Russia and China to that status. And, so, yes — that would be bad for everyone else.

Collapse is never, in and of itself, a good thing, though it may be the only way we get out our current mess.

Don’t know whether or not the image was truthful or a photoshopped bearing of false witness, but I do recall that there were rumors of a Mao Christmas tree ornament on a White House Christmas tree back in 2009. [http://www.foxnews.com/politics/2009/12/23/white-house-christmas-decor-featuring-mao-zedong-comes/]. Russia was our best friend forever during World War II when Vladimir Putin’s, himself KGB, father was NKVD. [http://en.wikipedia.org/wiki/Vladimir_Putin#Ancestry.2C_early_life_and_education]. Maybe leaving Russia and China as the dominant economic powers as rent for the use of their political doctrine has been the goal all along.

Maybe the Berlin wall came down because it was no longer needed. When “western” governments became so collectivised, what use is a wall? The east bloc won the cold war. How many people see that?

Mercantilism is wrong – but “produce more money [from nothing]” is even more wrong.

In the land (world) of the blind – the one eyed man is King. And Putin (terrible person though he is) seems to be the one eyed man.