On Wednesday last the Fed surprised most people by deciding not to taper. What is not generally appreciated is that once a central bank starts to use monetary expansion as a cure-all it is extremely difficult for it to stop. This is the basic reason the Fed has not pursued the idea, and why it most probably never will.

That is a strong statement. But consider this: Paul Volcker faced this same dilemma in 1979, when he was appointed Chairman of the Fed. In raising interest rates to choke off inflation he had two things going for him that his successor has not: rising inflation was already over 10% so was an obvious priority, and importantly private sector debt-to-GDP was at a far lower level than today. It was a tough decision at the time to nearly double interest rates. Today, with official inflation low and private sector indebtedness high it would be extremely difficult.

Until official inflation picks up, it is far more comforting to pretend it won’t be an issue, which reasonably describes the Fed’s approach. Instead it is targeting unemployment rates, on the basis that price inflation is tied to capacity utilisation, which in turn is tied to employment.

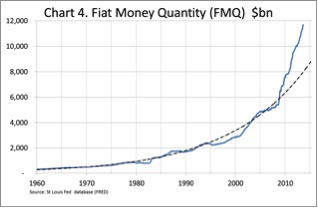

One thing is certain in life, besides death and taxes, and that is if you expand the quantity of money prices eventually rise; or more accurately the purchasing power of debased money falls. The problem is how to measure currency debasement, and this has been a topic of heated debate since fiat currencies first developed. This has led me to propose a new measure of money, which at James Turk’s suggestion I am calling the Fiat Money Quantity (FMQ). The purpose is to gives us a measure of fiat money that enables us to assess the danger of currency hyperinflation. I shall be publishing a paper on this shortly explaining the methodology.

The principle behind it is to signal deviations from the long-term trend of currency growth to alert us to both monetary crises and excessive inflation. The approach is to unwind the historic progression from full gold convertibility to the current state of no convertibility. Our gold was first deposited with our banks, and then from there with the central bank. In return for our gold deposits we have been issued cash notes and coin and credits in the form of deposits at the bank, and our bank equally has deposits at the central bank.

The FMQ is therefore comprised of the sum of cash and coin, plus all accessible deposits, plus our bank’s deposits held at the central bank. This for the US dollar is illustrated in the chart below.

The dotted line is the long-term exponential trend rate, and it is immediately obvious that the FMQ is now hyper-inflating. It currently requires a $3.6 trillion contraction of deposits to return this measure of currency quantity back to trend.

This accurately sums up the problem facing the Fed. We must understand they are in an almost impossible position that dates back to their monetary response to the banking crisis. Not even Paul Volcker could have got us out of this one. Once the addiction to weak money hits this pace there is no solution without threatening to bring down the whole system.

This article was previously published at GoldMoney.com.

It is now clear that Paul Volker did not save the fiat money system – he just bought it a few more decades of life. An impressive achievement – but one that is now coming to an end.

And, by the way, many of the leading figures in the financial industry (in both Britain and the United States) are just as guilty in these matters as are the politicians and administrators.

All want gain without real sacrifice.

To lend (or borrow) without first saving (real saving – the denial of consumption).

Kipling’s “The Gods of the Copybook Headings” is ignored by all of them.

It’s clear that the inflation monster hasn’t reared its head because of the Obama administration’s dismal policies. But if a Republican is elected in 2016 and succeeds in abolishing Obamacare and reining in the worst of the excesses of the EPA, et al, he risks setting off the hyper-inflation we’ve so far avoided.

One hopes he would have the wisdom to appoint someone very wise as Fed chairman, but my confidence on that is low.

Alasdair Macleod is totally clueless.

QE is often described by journalists as “money printing”. The people who so describe it are either clueless or they are trying to attract attention to themselves with a view to furthering their careers. That certainly applies to journalists.

And given that Austrians have fetish about money printing, the above description causes instant apoplexy amongst Austrians.

QE is actually just an asset swap: the central banks hands out money in exchange for something with is very near money: government debt. That is, government debt is simply a promise by government to pay £X to someone on a particular date. What’s the difference between that and £X? Not much.

Moreover, recipients of such money are unlikely to spend it and give any sort of boost to inflation and for the simple reason that they regarded their £X of government debt as savings, thus they’ll regard their £X of cash as savings as well.

Ralph,

you confuse monetary inflation with the EFFECTS of monetary inflation. Just because the prices where you happen to be looking are not rising does not mean the supply of money is not increasing. If you focused instead on the govt and mortgage prices, the largest market in the world, there you will find the effects of the monetary inflation. When, not if, that bubble bursts, then consumer goods prices will skyrocket, and then you will finally believe in monetary inflation. Stay tuned.

correction to my reply to Ralph

“If you focused instead on the govt

and mortgage prices”

should read:

“If you focused instead on the govt

and mortgage bond prices”

Ralph, I have read your comment and the replies, none of which touch on the error of your argument.

You suppose that “…the central banks hands out money in exchange for something with is very near money”.

Gilts are far from near money; they represent liquidity trapped for the tenor of the Gilt. You may be able to sell your G

Ralph, I have read your comment and the replies, none of which touch on the error of your argument.

You suppose that “…the central banks hands out money in exchange for something with is very near money”.

Gilts are far from near money; they represent liquidity trapped for the tenor of the Gilt. You may be able to sell your Gilts for cash but in doing so you swap your illiquidity for someone elses liquidity.

In other words the transacion is economically benign and the liquidity remains trapped forduration of the tenor of the Gilt in spite of the sale and purchase.

In printing money to purchase Gilts the Bank of England is not swapping one liquid asset for another it is changing an illiquid asset for an liquid assset and is indeed printing money.

Ralph,

What you say really isn’t right. QE is an asset swap, but the money swapped has been created anew. Hence, to the extent that the central bank only buys government bonds, this purchase acts as an artifical support to the government bond price, as well as introducing new money over time.

All this said, the total money in the system available to pay for goods now is – depending on your definition – mainly a whole bunch of commercial bank liabilties, plus their reserves.

I wonder if the reason you find it difficult to swallow some of the Austrian scare-stories around hyperinflation is that you see that inflation has been relatively well-behaved despite high growth in the central bank balance sheet….if so, I share some of these concerns.

Replacing commercial bank assets with new money would ordinarily result in the creation of new deposits, and so likely inflation. However, this has occured at the same time that commercial banks are reducing their reserve ratios (remember money is their liabilities and this acts to reduce them), meaning that the net creation of new deposits (and thereby systemic ‘money’) has been relatively limited.

In my view, the real danger to the system is that it has now become very political. Government now relies on the central bank in order to deliver its social policies through deficit spending. Historically, this has tended to result in problems since governments tend to be reluctant to stop this policy when inflation begins (Argentina throughout the 20th century, Weimar Germany, Zimbabwe). Hence, back in the UK, the time when the commercial banks stop shrinking their balance sheets and start to increase lending is likely to be a time of real interest, since at this point, the central bank will have to back off asset purchases. Will the government let it? Why has it appointed Mark Carney? I think that these are the key questions.

Tim,

Re your third paragraph, (“I wonder if…”), obviously if the size of the monetary base expands, the risk that the private sector suddenly goes mad and tries to spend that increased money supply will rise. And if it does, then inflation will rise (unless there is a lot of spare capacity in the economy).

But even if the monetary base is CONSTANT, it’s still possible for the private sector to have a fit of irrational exuberance, as a result of which the velocity of circulation of money rises and demand rises. Or the opposite is possible: a sudden fit of caution is possible. The velocity of circulation of money in New York state in 1932 had collapsed to about a third the rate in early 1929.

In short, if government and central bank try to raise aggregate demand, I fully accept there is finite rise in the risk of excess inflation. But I don’t think in the case of QE, the increased risk is dramatic, and so it has proved.

Re your last paragraph, obviously if a government and/or central bank don’t ease off stimulatory measures when private banks and the private sector generally get more confident, then the result is inflation. But I don’t think that citing Argentina and Weimar proves much.

About 95% of governments have got enough sense to ease off stimulus when inflation looms. Even Mugabwe has seen sense and has got his inflation rate down to about 5% I believe.

Ralph,

While governments have historically eased off stimuluss once inflation picks up, this is by no means the case for all of them. I suspect that success rates in doing this has been lower, the higher the primary deficit since the political incentive to keep going longer is greater. This is the key point: this decision has become much more political now.

Mark Carney’s appointment is disappointing since he is incrementally more dovish than King and this is indicative of the types of policies that may in future be followed.

And phew! what a relief that we might only be as bad as Zimbabwe!

Ralph – in Zim they have basically just adopted the South African currency.

So Comrade Bob has had to find nonmonetary ways to undermine the economy (for example by just grabbing productive companies and smashing them up).

As for private sector credit expansion – of course it can happen, and of course it is harmful. I get into serious trouble with our “Free Banking” friends for pointing this out. They seem to hate the idea that anyone (apart from governments) can do bad (or silly) things. It is like those people who refuse to believe that criminal gangs violate the non aggression principle (because they believe only government can violate the non aggression principle).

However, credit expansion is (and always has been) backed-by-the-state (it would be much less without state intervention).

For example, in the period you mention (the late 1920s credit-money bubble – the credit-money expansion that led to the 1929 bust) it was actually Benjamin Strong of the New York Federal Reserve who was pushing it – far more than either the Morgans or the Rockefellers. The big banking families supported the creation of the Federal Reserve system – but (like the monster of Dr F.) it grew bigger than they had ever guessed it would.

A private credit expansion inevitably “busts” with the credit “money” shrinking back down towards the “monetary base”.

Only if government actually expands the monetary base (via its fiat money) can the inflation become real hyper inflation.

“Only if government actually expands the monetary base (via its fiat money) can the inflation become real hyper inflation”.

I think that the essence of hyperinflation is a loss in trust in the currency. People prefer to transact in potatoes than in paper, and so refuse to hold it and thus its purchasing power drops. While the government expanding the monetary base is the most obvious way that this psychological button gets pushed, it is probably not the only one. If – say – a super method of forging new money were created, and government were unable to deal with it, this might also result in hyperinflation. Also, if an alternative money were discovered that fitted the needs of savers better, this could also result in hyperinflation.

No Republican will become President till January the 20th 2017 – and the economy will have collapsed long before then.

The one good thing about this situation is that (for once) the left really will get the blame.

However, President Rand Paul or someone like him (for it will not be a Bush style RINO this time) will inherit an economic waste land.