Comes now to respectful international attention a volume entitled War and Gold: A 500-Year History of Empires, Adventures, and Debt by Member of Parliament Kwasi Kwarteng. This near-perfect volume appears with almost preternaturally perfect timing around the centenary of the beginning of World War I and, with that, the end of the classical gold standard. It, along with the work of Steve Baker, MP (co-founder of the Cobden Centre), constitutes a sign of sophistication about the gold standard in the British House of Commons.

Kwarteng, the most historically literary Member of Parliament since Churchill, is an impressive figure. As War and Gold‘s jacket flap biography summarizes, “Kwasi Kwarteng was born in London to Ghanaian parents in 1975. … After completing a PhD in history at Cambridge University, he worked as a financial analyst in London. He is a Conservative member of parliament and author of Ghosts of Empire: Britain’s Legacies in the Modern World.” Kwarteng thus possesses four crucial skill sets: an international, multicultural, perspective; rigorous training as an historian; direct experience in the financial markets; and the perspective of an elected legislator. It shows.

War and Gold is a compelling successor to Liaquat Ahamed’s delightful and invaluable The Lords of Finance, awarded the 2010 Pulitzer Prize in history. Kwarteng delivers up a successor volume worthy of such a prize. It extends Ahamed’s temporal framework by a factor of ten, to 500 years. Kwarteng, too, has compelling narrative virtuosity. His book is full of dramatic, charming, often wry vignettes of fascinating characters — heroes and villains, adventurers and knaves — spinning around, and off, the axis of the gold standard, in war and in peace.

Let us pause to pay tribute to Kwarteng’s Ghanian ancestry. Ghana, once known as the “Gold Coast,” was part of the Ashanti Empire. Ghana is a too-often overlooked gem of civilization. The most iconic piece of Ashanti regalia, as described by Wikipedia, was a Golden Stool:

The Golden Stool is sacred to the Ashanti, as it is believed that it contains the Sunsum viz, the spirit or soul of the Ashanti people. Just as man cannot live without a soul, so the Ashanti would cease to exist if the Golden Stool were to be taken from them. The Golden Stool is regarded as sacred that not even the king was allowed to sit on it, a symbol of nationhood and unity.

War and Gold provides a literary symphony in four movements.

Its first movement commences with the story of the Holy Roman Emperor whose wars bankrupted his empire. This is counterpoised with stories of rapacious Conquistadors, especially Pizzaro plundering the Inca for their gold, “the sweat of the sun,” and silver, “the tears of the moon.”

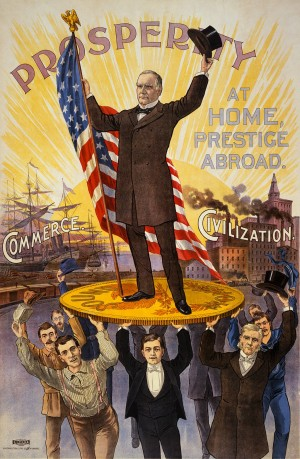

Kwarteng thereupon moves smartly to the military, political and economic skirmishing between France and England; the upheavals produced by the American and French revolutions and their aftermaths; the prosperity and stability of the Victorian era… and the rise of the United States. Many of our economic challenges have a long pedigree. The fundamental things don’t change as times goes by.

Its second movement, describing the epic era of the first World War, notes that this war destroyed the classical international gold standard. Chapter 9, “World Crisis,” contains the only significant point of confusion in this otherwise masterful work: the attribution to the gold standard of the Great Depression. That error is widespread. It is a crucial mistake to dispel for the discourse to move forward. Call it the Eichengreen Fallacy.

Prof. Eichengreen, author of Golden Fetters, was and remains non-cognizant of a subtle but crucial aspect of world monetary history — and, apparently, of the works of Profs. Jacques Rueff and Robert Triffin elucidating the implications. Eichengreen blundered by attributing the Great Depression to the gold standard. This, demonstrably, is untrue. That claim has led the discourse astray.

The classical gold standard, as Kwarteng points out, collapsed under the pressure of the first World War, long before the Great Depression. The classical gold standard was suspended when the Depression hit.

An attempt was made to resuscitate the gold standard in Genoa, in 1922, putting in place what that great French classical liberal economist Jacques Rueff called “a grotesque caricature” of the gold standard: the gold-exchange standard. Genoa authorized a deformed pastiche of gold and paper currency as official central bank reserve assets.

Genoa set up a system mistaken (then as now) as equivalent to the classical gold standard. The inclusion of (gold-convertible) currencies as an official reserve asset for central banks thwarted the ability of the system to extinguish excess liquidity balances. This, due to an intrinsic moral hazard not fully grasped even by many gold standard proponents, led to a systemic inflation — increasing all commodities except, of course, as monetized, gold. Key classical gold standard advocates, such as Rueff protégé Lewis E. Lehrman (with whose Institute this writer has a professional association), consider this the key cause of the Great Depression.

FDR did not, despite his grandiose declaration to that effect, end the gold standard. FDR performed an appropriate and crucial revaluation of the dollar from $20.67/oz to $35/oz. This was utterly needed to adjust for distortions caused by the inherent defect of the gold-exchange standard.

The revaluation worked and to stunning (if temporary, likely due to a subsequent Treasury decision to sterilize gold inflows as suggested by Calomiris, et al) effect. As described by Ahamed:

But in the days after the Roosevelt decision, as the dollar fell against gold, the stock market soared by 15%. Even the Morgan bankers, historically among the most staunch defenders of the gold standard, could not resist cheering. ‘Your action in going off gold saved the country from complete collapse,’ wrote Russell Leffingwell to the president.

Taking the dollar off gold provided the second leg to the dramatic change in sentiment… that coursed through the economy that spring. … During the following three months, wholesale prices jumped by 45 percent and stock prices doubled. With prices rising, the real cost of borrowing money plummeted. New orders for heavy machinery soared by 100 percent, auto sales doubled, and overall industrial production shot up 50 percent.

The dollar had not, in fact, been taken “off gold.” As Kwarteng astutely notes, “The United States, as already stated, was still on gold, but it had devalued the dollar by over 50 per cent.”

Given Kwarteng’s current and, likely, future importance to the world monetary discourse it really would be invaluable were he to master the arguments of Jacques Rueff, and of Lewis Lehrman, as well as those of Triffin (who shared the same diagnosis while offering a different prescription). It is important, for the long run, to recognize the innocence of the classical gold standard in the matter of the Great Depression and to grasp the insidious toxicity of the gold-exchange standard, which Rueff termed “an unbelievable collective mistake which, when people become aware of it, will be viewed by history as an object of astonishment and scandal.”

War and Gold’s third movement opens with America at its apogee: “In 1945 the United States was by far the most powerful nation on earth. It could also be argued that no nation has ever enjoyed such preponderant influence on the world’s affairs as did as the U.S. did at the close of the Second World War.”

Kwarteng then provides a vivid picture of an era in some ways nearly as distant as the 16th century. Quoting from a 1947 article in the Journal of Political Economy: “Some people are thinking in terms of only 18 or 20 billion dollars [of federal government spending] per year. Others see a possibility that federal expenditures may run to 25 or 40 billions annually.” Uncle Sam lately spends over $10 billion per day. While this sum is not adjusted for inflation or population growth, still it conveys a stunning difference of scale of government spending.

It is a pleasure to see the great Fed chairman William McChesney Martin given his due. Kwarteng references a speech by the newly appointed Martin alluding to “the Frankenstein mechanics of an uncontrolled supply of money.” If Frankenstein’s monster was an apt metaphor in the 1950s, surely Godzilla better fits the bill today. “To be a sound money man was a moderately easy task for a Chairman of the Federal Reserve in the 1950s,” Kwarteng notes. “The dollar, through the Bretton Woods Agreement, had preserved the all-important link to gold, which still held the almost magical value of US$35 an ounce.”

Kwarteng then presents a lucid presentation of post-war economic policies of Britain, Germany, and Japan. This columnist took special pleasure in his resurrection of the role of unjustly obscure Joseph Dodge, a key architect of the resurrection of both Germany and Japan and who later balanced the budget of the Eisenhower administration.

Looping back to the United States, Kwarteng describes what might fairly be called the Götterdämmerung:

The final break with gold was dramatic and, as much as any other development of monetary system, can almost be entirely attributable to the action of one man, the President of the United States, Richard M. Nixon. It was Nixon’s decision in August 1971 which substantially altered the course of monetary history and inaugurated a period, for the first time in 2,500 years, in which gold was effectively demonetized in most of what had been understood to be the Western world.

The world goes fast downhill from there.

The fourth movement delineates the chaos of, and various attempts to cope with, our current era of monetary anarchy. He recounts the oil price shocks, Reagan and Thatcher, the creation of the Euro, the rise of China, the delusions of debt, and the emergence of crises and bailouts. He goes on to provide an epilogue on the Greek economic crisis and on precarious conditions in America. Kwarteng concludes:

Gold itself…remains embedded in the public’s consciousness as a monetary metal. It is held most commonly by central banks and there remains an almost mysterious fixation with it. Its value equally mysteriously can be reflected in the growth of the world economy. … [T]he value of gold, better than perhaps any currency, reflects this process most accurately. The gold standard will never formally return, but movements in the price of gold may well suggest that investors, in their lack of faith in paper money, have informally adopted one.

Great Britain, and the world, hardly could be better served than by, in due course, elevating Kwarteng to the Exchequer. Notwithstanding his curious demurral that the “gold standard will never formally return,” gold, recovering from the false charge of blame for the Great Depression, slowly is becoming a fully respectable option. Perhaps even, in the not too distant future, a movement to consider, and restore, the classical gold standard might be led by Kwasi Kwarteng and like-minded classical liberal-minded officials around the world.