Within the framework of our econometric model the key variable that drives a currency rate of exchange is the relative money supply rate of growth between respective economies. On this score our analysis shows that since October 2011 the money growth differential is currently favourable for the US$ against major currencies. Various key US data continue to display strength. We hold that on account of a downtrend in the growth momentum of AMS since October 2011 economic activity is likely to come under pressure in the months ahead. Meanwhile the growth momentum of the Euro-zone consumer price index has likely bottomed in May. We hold that a fall in the lagged growth momentum of German AMS is behind the weakening in some of the recent key German data. The S&P500 index could weaken for a few months before bouncing back. By next year our model expects the S&P500 to follow a declining path. According to our model the yield on the 10-year US T-Note is forecast to follow a declining path during 2015.

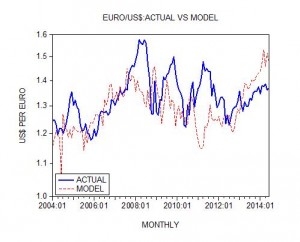

Prospects for US$ against the Euro

At the end of June the price of the Euro in US$ terms closed at 1.369 versus 1.363 in May – an increase of 0.4%. The yearly rate of growth of the price of the Euro stood at 5.3% against 4.9% in May. After closing at 13.6% in October 2011, the money growth differential (expressed in terms of our AMS) between the US and the Euro-zone settled at 0.7% in April. On account of long time lags we suggest that for the time being the effect of a rising differential between June 2010 and October 2011 is likely to dominate the scene. As time goes by the effect from a fall since October 2011 is expected to assert itself. (The US$ should strengthen).

The simulation of the model against the actual data is on the chart on the left below. Based on our model we expect the price of the Euro in US$ terms to close at 1.37 by March before settling at 1.36 in December next year.

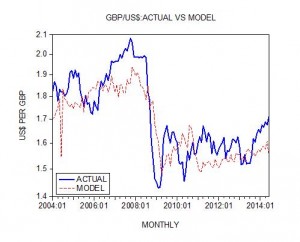

Prospects for the British pound (GBP) against the US$

The price of the GBP in US$ terms closed at the end of June at 1.71 versus 1.675 at the end of May – an increase of 2.1%. Year-on-year the rate of growth climbed to 12.4% in June from 10.2% in the month before. The money growth differential fell from 10.4% in October 2011 to 0.6% in April.

We have employed our model to assess the future trend of the rate of exchange. The model simulation against the actual is presented on the left below. We expect the effect from the declining growth differential of money supply to gain strength as time goes by. By December next year the £Sterling-USD rate of exchange could settle at 1.66.

Prospects for the A$ against the US$

At the end of June the price of the A$ in US$ terms closed at 0.943 – an increase of 1.3%. The yearly rate of growth jumped to 3.2% from minus 2.7% in May. After closing at 15.5% in April 2012 the money growth differential between the US and Australia fell to minus 8.1% in April this year. Note that between January 2011 and April 2012 the yearly rate of growth was trending up.

According to our model (see the simulation on the left below) based on a declining money growth differential the A$ could come under pressure as time goes by. By June next year the Australian $ could close at 0.896 before settling at 0.91 by December next year.

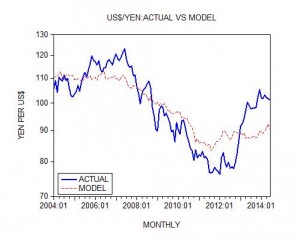

Prospects for the Yen against the US$

The price of the US$ in Yen terms closed at the end of June at 101.3 – a fall of 0.5% from May. Year-on-year the rate of growth of the price of US$ rose to 2.2% from 1.3% in May. The money growth differential between the US and Japan fell from 12.8% in August 2011 to 3.9% in January 2013. There after the yearly rate of growth followed a horizontal path closing at 4.6% in May this year.

The simulation of the model is presented on the left below (see chart). According to the model the price of the US$ could increase to 102.3 by March before falling to 101.5 by May. Afterwards the price is forecast to follow a sideways movement closing at 101.2 by December 2015.

Prospects for the CHF against the US$

The price of the US$ in CHF terms closed at 0.887 at the end of June – a fall of 0.9% from May when it increased by 1.7% from April. The yearly rate of growth of the price of the US$ in CHF terms stood at minus 6.2% against minus 6.3% in May. The money growth differential between the US and Switzerland climbed to 4.8% in April 2013 from minus 6% in August 2012. This strong increase in the differential is providing strong support to the CHF against the US$ – note also that the differential fell sharply to minus 2.8% in April from 3.1% in January this year.

The simulation of the model against the actual data is presented on the left below (see chart). According to our model the price of the US$ in CHF terms is forecast to settle at 0.890 by December this year. By September next year the price is forecast to fall to 0.83 before stabilizing at 0.834 by December 2015.

Focus on US economic indicators

Manufacturing activity in terms of the ISM index eased slightly in June from May. The index closed at 55.3 versus 55.4 in May. Based on the lagged growth momentum of real AMS we suggest that the ISM index is likely to follow a declining path. The growth momentum of light vehicle sales has eased in June from May. The yearly rate of growth stood at 6.9% in June against 8.3% in the previous month. Our monetary analysis points to a likely further softening ahead in light vehicle sales.

The growth momentum of manufacturing orders eased in May from April. Year-on-year the rate of growth fell to 2.4% from 5.1%. Based on the lagged growth momentum of AMS we can suggest that the growth momentum of manufacturing orders is likely to follow a declining trend. Also, the growth momentum of expenditure on construction eased in May from April with the yearly rate of growth softening to 6.6% from 7.9%. Using the lagged yearly rate of growth of AMS we hold that the growth momentum of construction expenditure is likely to come under pressure ahead.

US employment up strongly above expectations in June

Seasonally adjusted non-farm employment increased by 288,000 in June after rising by 224,000 in the month before. That was above analysts’ expectations for an increase of 215,000. The growth momentum of employment has strengthened last month. Year-on-year 2.495 million jobs were generated in June after 2.408 million in the prior month. Using the lagged manufacturing ISM index we can suggest that from July the growth momentum of US employment is likely to visibly weaken (see chart). The diffusion index of employment in the private sector one month span, which increased to 64.8 in June from 62.9 in May is forecast to follow a declining trend in the months to come (see chart).

Manufacturing employment increased by 16,000 last month after rising by 11,000 in May. Based on the lagged growth momentum of real AMS we expect the growth momentum of manufacturing employment to come under pressure in the months to come. In the meantime, the unemployment rate stood at 6.1% in June against 6.3% in May, while the number of unemployed declined by 325,000 last month to 9.474 million.

Focus on non US economic indicators

Manufacturing activity has eased slightly in Australia in June from May. The manufacturing purchasing managers index (PMI) fell to 48.91 from 49.22 in May. Based on the lagged growth momentum of Australian real AMS we suggest that the Australian PMI is likely to be well supported ahead. The yearly rate of growth of the EMU consumer price index (CPI) stood at 0.5% in June the same as in May. Using the lagged growth momentum of EMU AMS we hold that the yearly rate of growth of the EU CPI is likely to strengthen ahead.

Year-on-year the rate of growth of German factory orders in real terms fell to 5.8% in May from 6.6% in April. Using the lagged growth momentum of German real AMS we can suggest that the yearly rate of growth of German factory orders is likely to weaken further in the months ahead. Meanwhile, the Swiss manufacturing PMI rose to 53.96 in June from 52.54 in the month before. According to the lagged growth momentum of Swiss real AMS the Swiss PMI is likely to display volatility (see chart).

Prospects for the CRB commodity price index

At the end of June the CRB commodity price index closed at 308.22 – an increase of 0.9% from May when it fell by 1.3%. The growth momentum of the index has strengthened with the yearly rate of growth rising to 11.8% in June from 8.4% in May.

The CRB index to its 12-month moving average ratio eased to 1.0546 in June from 1.055 in the month before.

We have employed our model to assess the future course of the CRB index (see chart). The model is driven by the state of US and Chinese economic activity and by US monetary liquidity.

According to our large scale econometric model the CRB index is forecast to close at 303 by November before jumping to 316 in February. There after the index is forecast to follow a slightly declining path closing by December at 312.

S&P500 up on the week

The S&P500 added 0.55% on Thursday to close at 1,985.43. For the week the index climbed 1.25%. The stock price index rallied after strong employment report for June with the employment rising by 288,000 against the consensus for an increase by 215,000. Against the end of June the stock price index advanced 1.3% whilst year-on-year the rate of growth eased to 17.8% from 22% in June. The S&P500 to its 12 month moving average ratio has eased to 1.0833 from 1.0843 in June.

We have employed our large scale econometric model to assess the future course of the stock price index. Within the model’s framework the S&P500 is driven by our measure of monetary liquidity and by the state of US industrial production. (See the actual versus the model data on the left below). According to our model the S&P500 index could weaken for a few months before bouncing back. By next year our model “expects” the S&P500 to follow a declining path.

US long – term Treasuries yields up against the end of June

On Thursday US Treasuries fell – pushing 10-year note yields to the highest in two months in response to a strong June employment report. This lifted bets that the US central bank may consider raising interest rates sooner than previously thought. The yield on the 10-year T-Note rose one basis point to close at 2.64% against 2.53% at the end of June. Two-year note yield rose three basis points to 0.51%. Traders pushed up their bets for a June rate increase to 49% from 44% and 33% at the end of May. The yield spread between the 10 year and the 2 year T-note stood at 2.13% versus 2.08% in June.

The “TED” spread stood at 0.222% against 0.205% in June. We have employed our econometric model to establish the future direction of the yield on the 10-year T-Note. In the model’s framework the yield on the 10-year T-note is driven by monetary liquidity, by the state of US economic activity and by price inflation (see chart on the left below). According to our model the 10-year yield is forecast to follow a declining path during 2015.