[The following is a shortened version of an original which first appeared on the author’s website, www.truesinews.com ]

As Britain fast approaches what is arguably the most intriguingly unpredictable election of the modern era, the question must be also asked, how well situated is the country – economically speaking – to endure such a vigorous test of its political institutions?

To this observer, the answer would be ‘not very well, at all.’ Britain, you see, is rapidly sliding back into its bad old ways of spending too much, saving too little, and all the while allowing the state to loom far too large in people’s affairs, bolstered by the fact that far too many members of the populace are loth to give up their long-accustomed habit of trying to live at their neighbours’ expense and of borrowing from abroad whatever dole transfers the state cannot raise in taxes at home.

Let us start with the latest economic round to see what we mean. Though hours worked in the UK, along with both overall and private sector GDP, are each enviably some 3-5% above the pre-Crash peak – a constellation of which many Eurozone countries can still only dream – this has come about only through a 7-year reduction in real wages of a cumulative 11%.

Pricing people back into jobs this way is one thing – if decidedly more unfair on all the other innocent victims of the Bank of England’s inflationism than would have been a simple pay cut – but it is also significant that, having trended up at around 2.3% per annum for almost four decades, real GDP per hour worked has shown no improvement whatsoever since Northern Rock closed its doors, seven long years ago. If we add in the fact that the UK has officially seen net inward migration of 1.5 million people in that same period, we can perhaps see how much of that growth has been achieved – through the blunt instrument of adding a big slug of low wage, low output, imported labour to the mix.

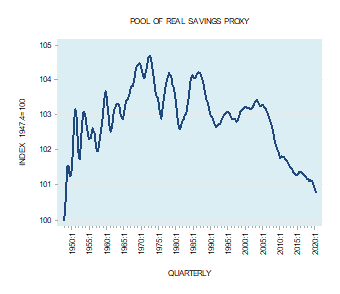

Sadly, in its policies of determined monetary laxity, Fred Karney’s army have added two malign side-effects to the short term boost to growth for which they are so widely praised. Firstly, the combination of Gilt-enacted QE with near zero interest rates has loosened the constraints on a state sector which still routinely spends a sum equivalent to almost one half of private GDP, with around a sixth of that being borrowed, even now amid a recovery vigorous enough to elicit a full measure of George Osborne’s headline-hogging boastfulness. Alarmingly, too, the punishment of savers and the encouragement of borrowers has reached a point where households have become net debtors at the aggregate level for the first time since the GFC while, simultaneously, non-financial corporates have collectively swung into the red for the first time since they were borrowing to relieve Culpability Brown of his pricey mobile phone airwave licences, back at the height of the Tech Bubble.

Mortgage debt is rising by £20 billion a year, consumer credit by £10 billion (the most since late ’08), student loans by £7 billion. Disposable income grew £29 billion in that same time which means debt:income may be swelling once more, from a point still north of 130%.

As a result, while state prodigality has diminished from its peak deficit of 10.7% of GDP (seen between QI-09 and QI-10) to today’s 5.9%, the non-financial private sector has gone from a point where it was saving 8.8% (and so funding four-fifths of Leviathan’s excesses) to a point where it, too, is now looking for 0.5% of GDP for its own consumptive purposes (all figures 4Q moving averages).

No wonder then that the current account deficit has blown up to a six decade high of 6.0% of GDP, despite the co-existence of a record surplus of 5.1% on the service account (the arithmetically astute will quickly infer that this must entail a similarly swingeing deficit on visible trade – a shortfall which in fact stretches to a hefty 7.1%). For comparison, when Chancellor Dennis Healey suffered the ignominy of appealing to the IMF for help in 1976, the balance of payments was only 1.5% in the red (though the tally had briefly hit 4.3% a year or two before, in the immediate aftermath of the first oil shock).

In fact, if we only look at the latest reported data – those for QIII – there is a chance that the BOP number may be revised to yet a deeper nadir since, in the three months to September, the ONS presently estimates that the public deficit was 5.1% of GDP, while households borrowed a six-year high balance of 2.6% of GDP and corporates took up a 14-year high credit of 2.2%, making for an aggregate shortfall of no less than 9.9%. Subtracting a net positive contribution of 0.2% from the domestic financial sector, that still leaves 9.7% to be financed, in theory, from foreigners and thereby to determine the scale of the current account deficit.

Performing the calculation in a different manner, the UK government has borrowed £109 billion ($167 billion) in the twelve months to September, an overspend which has leaked almost entirely abroad and has thus required a £98 billion ($150 billion) contribution in goods sold on credit from the world beyond Albion’s shining seas.

So, let us forget for a moment the controversy over the gaping hole which persists in the government’s finances and the laughably misnamed policy of ‘austerity’ which the regime has adopted to try to deal with this. Instead, let us lift our eyes to a horizon beyond our shores and we can surely agree that the sum of £130 a month per capita is not at all an unimpressive pace at which to be adding to a net external deficit of £450 billion (25% of GDP) or to an ex-FDI gross liability of £8,840 billion (490% of GDP), against which mountain of potentially nervy obligations the Treasury disposes of a defence against a classic ‘sudden stop’ of a paltry £63 billion in FX reserves (equal to around two months’ worth of goods imports).

Thus, not only is a full-employment Britain a country which must run an unsustainably large external deficit (since it is already setting records with 6% of the workforce still out of a job), but it has again been seduced into being one where all sectors are borrowing, not saving, largely in order to finance present consumption, meaning it is prey to a rather nasty, Hayekian ‘intertemporal’ disequilibrium – the cardinal economic sin of enjoying overmuch jam today at the cost of jam foregone tomorrow.

One day the piper to whose shrill accompaniment we are now dancing our merry jig (our Chuck Prince Charleston?) will present us with a bill which we are unlikely to be able to meet absent a great deal of sacrifice and possibly not without suffering a veritable collapse in the value of the currency to boot.

Since this is the time of year when we pundits traditionally have to set out scenarios containing an element of surprise, allow us to posit a very pleasant one, amid all the foreboding outlined above. Imagine if you will that, shortly after the election is held, our migrant cuckoo of a central bank governor will be fluttering off and away, back to his native Canada to ready his own political promotion – either by reinforcing the governing team if Junior Trudeau’s Liberals triumph there in October or perhaps by taking over the leadership should the latter’s bid ends in failure. One thing of which we can be fairly sure is that Moralising Mark will not hang around long to see a political melt-down in Britain mutate into a full blown sterling crisis and so add a few unsightly blots to his heretofore Teflon-coated escutcheon.