Greece is back in the spotlight amid renewed fears of a break-up of the Euro as the Syriza party show a 3.1% lead over the incumbent New Democracy in the latest Rass opinion poll – 4thJanuary. The average of the last 20 polls – dating back to 15th December shows Syriza with a lead of 4.74% capturing 31.9% of the vote.

These election concerns have become elevated since the publication of an article in Der Spiegel Grexit Grumblings: Germany Open to Possible Greek Euro Zone Exit -suggesting that German Chancellor Merkel is now of the opinion that the Eurozone (EZ) can survive without Greece. Whilst Steffen Seibert – Merkle’s press spokesman – has since stated that the “political leadership” isn’t working on blueprints for a Greek exit, the idea that Greece might be “let go” has captured the imagination of the markets.

A very different view, of the potential damage a Greek exit might cause to the EZ, is expressed by Market Watch – Greek euro exit would be ‘Lehman Brothers squared’: economistquoting Barry Eichengreen, speaking at the American Economic Association conference, who described a Greek exit from the Euro:-

In the short run, it would be Lehman Brothers squared.

Writing at the end of last month the Economist – The euro’s next crisis described the expectation of a Syriza win in the forthcoming elections:-

In its policies Syriza represents, at best, uncertainty and contradiction and at worst reckless populism. On the one hand Mr Tsipras has recanted from his one-time hostility to Greece’s euro membership and toned down his more extravagant promises. Yet, on the other, he still thinks he can tear up the conditions imposed by Greece’s creditors in exchange for two successive bail-outs. His reasoning is partly that the economy is at last recovering and Greece is now running a primary budget surplus (ie, before interest payments); and partly that the rest of the euro zone will simply give in as they have before. On both counts he is being reckless.

In theory a growing economy and a primary surplus may help a country repudiate its debts because it is no longer dependent on capital inflows.

The complexity of the political situation in Greece is such that the outcome of the election, scheduled for 25th January, will, almost certainly, be a coalition. Syriza might form an alliance with the ultra-right wing Golden Dawn who have polled an average of 6.49% in the last 20 opinion polls, who are also anti-Austerity, but they would be uncomfortable bedfellows in most other respects. Another option might be the Communist Party of Greece who have polled 5.8% during the same period. I believe the more important development for the financial markets during the last week has been the change of tone in Germany.

The European bond markets have taken heed, marking down Greek bonds whilst other peripheral countries have seen record low 10 year yields. 10 year Bunds have also marched inexorably upwards. European stock markets, by contrast, have been somewhat rattled by the Euro Break-up spectre’s return to the feast. It may be argued that they are also reacting to concerns about collapsing oil prices, the geo-political stand-off with Russia, the continued slow-down in China and other emerging markets and general expectations of lower global growth. In the last few sessions many stock markets have rallied strongly, mainly on hopes of aggressive ECB intervention.

Unlike the Economist, who are concerned about EZ contagion, Brookings – A Greek Crisis but not a Euro Crisis – sees a Euro break-up as a low probability:-

A couple of years ago the prospect of a Syriza-led government caused serious tremors in European markets because of the fear that an extremely bad outcome in Greece was possible, such as its exit from the Euro system, and that this would create contagion effects in Portugal and other weaker nations. Fortunately, Europe is in a much better situation now to withstand problems in Greece and to avoid serious ramifications for other struggling member states. The worst of the crisis is over in the weak nations and the system as a whole is better geared to support those countries if another wave of market fears arise.

It is quite unlikely that Greece will end up falling out of the Euro system and no other outcome would have much of a contagion effect within Europe. Even if Greece did exit the Euro, there is now a strong possibility that the damage could be confined largely to Greece, since no other nation now appears likely to exit, even in a crisis.

Neither Syriza nor the Greek public (according to every poll) wants to pull out of the Euro system and they have massive economic incentives to avoid such an outcome, since the transition would almost certainly plunge Greece back into severe recession, if not outright depression. So, a withdrawal would have to be the result of a series of major miscalculations by Syriza and its European partners. This is not out of the question, but the probability is very low, since there would be multiple decision points at which the two sides could walk back from an impending exit.

I think The Guardian – Angela Merkel issues New Year’s warning over rightwing Pegida group – provides an insight into the subtle change in Germany’s stance:-

German chancellor Angela Merkel in a New Year’s address deplored the rise of a rightwing populist movement, saying its leaders have “prejudice, coldness, even hatred in their hearts”.

In her strongest comments yet on the so-called Patriotic Europeans Against the Islamisation of the West (Pegida), she spoke of demonstrators shouting “we are the people”, co-opting a slogan from the rallies that led up to the fall of the Berlin Wall 25 years ago.

“But what they really mean is: you are not one of us, because of your skin colour or your religion,” Merkel said, according to a pre-released copy of a televised speech she was to due to deliver to the nation on Wednesday evening.

“So I say to all those who go to such demonstrations: do not follow those who have called the rallies. Because all too often they have prejudice, coldness, even hatred in their hearts.”

Concern about domestic politics in Germany and rising support for the ultra right-wing Pegida party makes the prospect of allowing Greece to leave the Euro look like the lesser of two evils. Yet a Greek exit and default on its Euro denominated obligations would destabilise the European banking system leading to a spate of deleveraging across the continent. In order to avert this outcome, German law makers have already begun to soften their “hard-line” approach, extending the olive branch of a potential renegotiation of the terms and maturity of outstanding Greek debt with whoever wins the forthcoming election. I envisage a combination of debt forgiveness, maturity extension and restructuring of interest payments – perish the thought that there be a sovereign default.

Carry Concern

Last month the BIS – Financial stability risks: old and new caused alarm when it estimated non-domestic US$ denominated debt of non-banks to be in the region of $9trln:-

Total outstanding US dollar-denominated debt of non-banks located outside the United States now stands at more than $9 trillion, having grown from $6 trillion at the beginning of 2010. The largest increase has been in corporate bonds issued by emerging market firms responding to the surge in demand by yield-hungry fixed income investors.

Within the EZ the quest for yield has been no less rabid, added to which, risk models assume zero currency risk for EZ financial institutions that hold obligations issued in Euro’s. The preferred trade for many European banks has been to purchase their domestic sovereign bonds because of the low capital requirements under Basel II. Allowing banks to borrow short and lend long has been tacit government policy for alleviating bank balance sheet shortfalls, globally, in every crisis since the great moderation, if not before. The recent rise in Greek bond yields is therefore a concern.

An additional concern is that the Greek government bond yield curve has inverted dramatically in the past month. The three year yields have risen most precipitously. This is a problem for banks which borrowed in the medium maturity range in order to lend longer. Fortunately most banks borrow at very much shorter maturity, nonetheless the curve inversion represents a red flag : –

| Date | 3yr | 10yr | Yield curve |

| 14-Oct | 4.31 | 7.05 | 2.74 |

| 29-Dec | 10.14 | 8.48 | -1.66 |

| 06-Jan | 13.81 | 9.7 | -4.11 |

Source: Investing.com

Over the same period Portuguese government bonds have, so far, experienced little contagion:-

| Date | 3yr | 10yr | Yield curve |

| 14-Oct | 1.03 | 2.56 | 1.53 |

| 29-Dec | 1.06 | 2.75 | 1.69 |

| 06-Jan | 0.92 | 2.56 | 1.64 |

Source: Investing.com

EZ Contagion

Greece received Euro 245bln in bail-outs from the Troika; if they should default, the remaining EZ 17 governments will have to pick up the cost. Here is the breakdown of state guarantees under the European Financial Stability Facility:-

| Country | Guarantee Commitments Eur Mlns | Percentage |

| Austria | 21,639.19 | 2.78% |

| Belgium | 27,031.99 | 3.47% |

| Cyprus | 1,525.68 | 0.20% |

| Estonia | 1,994.86 | 0.26% |

| Finland | 13,974.03 | 1.79% |

| France | 158,487.53 | 20.32% |

| Germany | 211,045.90 | 27.06% |

| Greece | 21,897.74 | 2.81% |

| Ireland | 12,378.15 | 1.59% |

| Italy | 139,267.81 | 17.86% |

| Luxembourg | 1,946.94 | 0.25% |

| Malta | 704.33 | 0.09% |

| Netherlands | 44,446.32 | 5.70% |

| Portugal | 19,507.26 | 2.50% |

| Slovakia | 7,727.57 | 0.99% |

| Slovenia | 3,664.30 | 0.47% |

| Spain | 92,543.56 | 11.87% |

| EZ 17 | 779,783.14 | 100% |

Assuming the worst case scenario of a complete default – which seems unlikely even given the par less state of Greek finances – this would put Italy on the hook for Eur 43bln, Spain for Eur 28.5bln, Portugal for Eur 6bln and Ireland for Eur 3.8bln.

The major European Financial Institutions may have learned their lesson, about over-investing in the highest yielding sovereign bonds, during the 2010/2011 crisis – according to an FTinterview with JP Morgan Cazenove, exposure is “limited” – but domestic Greek banks are exposed. The interconnectedness of European bank exposures are still difficult to gauge due to the lack of a full “Banking Union”. Added to which, where will these cash-strapped governments find the money needed to meet this magnitude of shortfall?

The ECBs response

Source: Bloomberg

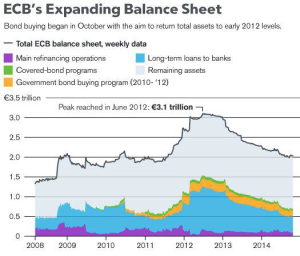

In an interview with Handelsblatt last week, ECB president Mario Draghi reiterated the bank’s commitment to expand their balance sheet from Eur2 trln to Eur3 trln if conditions require it. Given that Eurostat published a flash estimate of Euro area inflation for December this week at -0.2% vs +0.3% in November, I expect the ECB to find conditions requiring a balance sheet expansion sooner rather than later. Reuters – ECB considering three approaches to QE – quotes the Dutch newspaper Het Financieele Dagbad expecting one of three actions:-

…one option officials are considering is to pump liquidity into the financial system by having the ECB itself buy government bonds in a quantity proportionate to the given member state’s shareholding in the central bank.

A second option is for the ECB to buy only triple-A rated government bonds, driving their yields down to zero or into negative territory. The hope is that this would push investors into buying riskier sovereign and corporate debt.

The third option is similar to the first, but national central banks would do the buying, meaning that the risk would “in principle” remain with the country in question, the paper said.

The issue of “monetary financing” – forbidden under Article 123 of the Lisbon Treaty – has still to be resolved, so Outright Monetary Transactions (OMT) in respect of EZ government bonds are still not a viable policy option. That leaves Covered bonds – a market of Eur 2.6trln of which only around Eur 600bln are eligible for the ECB to purchase – and Asset Backed Securities (ABS) with around Eur 400bln of eligible securities. These markets are simply not sufficiently liquid for the ECB to expand its balance sheet by Eur 1trln. In 2009 they managed to purchase Eur 60bln of Covered bonds but only succeeded in purchasing Eur 16.9bln of the second tranche – the bank had committed to purchase up to Eur 40bln.

Since its inception in July 2009 the ECB have purchased just shy of Eur 108bln of Covered bonds and ABS: –

| Security | Primary | Secondary | Total Eur Mlns | Inception Date | |

| ABS | N/A | N/A | 1,744 | 21/11/2014 | |

| Covered Bonds 1 | N/A | N/A | 28,817 | 02/07/2009 | * |

| Covered Bonds 2 | 6015 | 10375 | 16,390 | 03/11/2011 | |

| Covered Bonds 3 | 5245 | 24387 | 29,632 | 20/10/2014 | |

| Total | 76,583 | ||||

| * Original purchase Eur 60bln | |||||

Source: ECB

These amounts are a drop in the ocean. If the ECB is not permitted to purchase government bonds what other options does it have? I believe the alternative is to follow the lead set by the Bank of Japan (BoJ) in purchasing corporate bonds and common stocks. To date the BoJ has only indulged in relatively minor “qualitative” easing; the ECB has an opportunity to by-pass the fragmented European banking system and provide finance and permanent capital directly to the European corporate sector.

Over the past year German stocks has been relatively stable whilst Greek equities, since the end of Q2, have declined. Assuming Greece does not vote to leave the Euro, Greek and other peripheral European stocks will benefit if the ECB should embark on its own brand of Qualitative and Quantitative Easing (QQE):-

Source: Bloomberg Note: Blue = Athens SE Composite Purple = DAX

It is important to make a caveat at this juncture. The qualitative component of the BoJ QQE programme has been derisory in comparison to their buying of JGBs; added to which, whilst the socialisation of the European corporate sector is hardly political anathema to many European politicians it is a long way from “lending at a penal rate in exchange for good collateral” – the traditional function of a central bank in times of crisis.

Conclusion and investment opportunities

European Government Bonds

Whilst the most likely political outcome is a relaxation of Article 123 of the Lisbon Treaty, allowing the ECB, or the national Central Bank’s to purchase EZ sovereign bonds, much of the favourable impact on government bond yields is already reflected in the price. 10 year JGBs – after decades of BoJ buying – yield 30bp, German Bunds – without the support of the ECB – yield 46bp. Aside from Greek bonds, peripheral members of the EZ have seen their bond yields decline over the past month. If the ECB announce OMT I believe the bond rally will be short-lived.

European Stocks

Given the high correlation between stocks markets in general and developed country stock markets in particular, it is dangerous to view Europe in isolation. The US market is struggling with a rising US$ and collapsing oil price. These factors have undermined confidence in the short-term. The US market is also looking to the Europe, since a further slowdown in Europe, combined with weakness in emerging markets act as a drag on US growth prospects. On a relative value basis European stocks are moderately expensive. The driver of performance, as it has been since 2008, will be central bank policy. A 50% increase in the size of the ECB balance sheet will be supportive for European stocks, as I have mentioned in previous posts, Ireland is my preferred investment, with a bias towards the real-estate sector.

The Euro

Whilst the EUR/USD rate continues to decline the Nominal Effective Exchange Rate as calculated by the ECB, currently at 98, is around the middle of its range (81 – 114) since the inception of the currency and still some way above the recent lows seen in July 2012 when it reached 94. The October 2000 low of 81 is far away.

If a currency war is about to break-out between the major trading nations, the Euro doesn’t look like the principal culprit. I expect the Euro to continue to decline, except, perhaps against the JPY. Against the GBP a short EUR exposure will be less volatile but it will exhibit a more political dimension since the UK is a natural safe haven when an EZ crisis is brewing.