In his magisterial 1936 work, ‘A World in Debt‘, Freeman Tilden treated the business of contracting a loan with a heavy serving of well-deserved irony, describing how the debtor gradually mutates from a man thankful, at the instant of receiving the funds, for having found such a wise philanthropist as is his lender to one soon becoming a little anxious that the time for renewal is fast approaching. From there, he turns to the comfort of self-justification, undertaking a little mental debt-to-equity conversion in persuading himself that his soon-to-be disappointed creditor was, after all, in the way of a partner in their joint undertaking and so consciously accepted a share of the associated risks.

Next he adopts an air of righteous indignation at the idea that he really must redeem his obligation on the due date, before rapidly giving into a growing fury in contemplation of how this wicked usurer has duped him into contracting for something he cannot hope to fulfil, as so many poor fools before him have similarly been entrapped by this veritable shark.

Likewise, our author quotes the 19th century utilitarian, Jeremy Bentham, to much the same effect.

‘Those who have the resolution to sacrifice the present to the future are natural objects of envy’ for those who have done the converse, our sage declared, like children still with a cake are for those who have already scoffed theirs. ‘While the money is hoped for… he who lends it is a friend and benefactor: by the time the money is spent and the evil hour of reckoning is come, the benefactor is found to… have put on the tyrant and the oppressor.’

Here we should realise the pointlessness of trying to decide whether the Greeks or the Germans are at fault in the present impasse and press on toward the crux of the matter. As Tilden rightly argued about the consequences of a bust:-

‘It follows that any scheme looking towards the avoidance of panics and depressions must deal with this cause [viz., debt] and any plan that does not do so is not only idle, but may be a dangerous adventure.’

‘Hence, the way to deal with a collapse of exchange is not to pretend that “prosperity” is merely in a temporary eclipse, to return again if everybody will act optimistically; but frankly to acknowledge that conditions were unsound, and to permit the natural impulses of trade to rectify them. This prescribes a bitter medicine, which people do not like and politicians cannot collect upon, but quack remedies merely put off the final reckoning.’

Are you listening, Mario?

‘The natural remedies, if the credit-sickness be far advanced, will always include a redistribution of wealth: the further it is postponed, the more violent it will be. Every collapse of credit expansion is a bankruptcy and the magnitude… will be proportional to the magnitude of the debt debauch. In bankruptcies, creditors must suffer.’

The problem with our modern world is that the ‘quack remedies’ we most routinely favour are ones which involve adding another layer of ‘debt debauch’ on top of the still uncleared detritus of the previous one. If you doubt this, I must ask what else, pray, do you think is entailed by QE in all its many variants if not the attempt to find new, biddable debtors to take the place of the grumbling, undischarged old ones?

Even if you are loth to accept this line of reasoning, you surely must concede that a ‘putting-off of the reckoning’ comes with many disadvantageous features and several self-aggravating tendencies and that this should be obvious enough to anyone with sufficient intellectual honesty to consult the record of the past few years – if not decades – objectively.

Firstly, it encourages a wasting forbearance of dead or dying enterprises in a kind of lunatic refusal to recognise that the associated costs are well and truly sunk and that the only valid criterion for continued investment is the judgement that the undertaking will be viable from today, not whether we can thereby avoid booking the losses incurred by it yesterday. Such ‘zombification’ retards, if not prevents, the necessary reallocation of men, machinery, and financial means toward more profitable (and hence more socially beneficial) employment. By propping up the diseased trunks of the past, it prevents light and nutrients from reaching the thrusting saplings of tomorrow. Creative destruction is out and destructive continuation is in to the detriment of all.

Worse, yet, the feeble, ‘stimulus’-dependent manifestation of growth which does then occur leads to that dreadful, anti-Hippocratic impatience to which all our electoral cycle overlords are prone. Bad policy thus leads to more bad policy – whether by way of simple reinforcement of ineffective treatment or by jejune ‘innovation’. As more and more market signals become scrambled, as larger and larger swathes of the economy are turned over either to run-‘em-for-cash basket cases or to newly malinvested Bubble 2.0 entrants upon the stage, the space for genuine entrepreneurship becomes progressively restricted. Growth therefore slows, cycle after cycle, until men in authority – who really should know better – start to mutter rehashed 1930s pessimism about ‘secular stagnation’.

Compounding all this, of course, is the awful truth that practitioners of mainstream economics are in thrall to age-old underconsumptionist fallacies and so require – nay, demand – that no debt must ever be paid down in aggregate (or, as they like to put it, in order to give the idea a thin sheen of respectability, the total of outstanding credit must never fall). Thus, with each successive cycle, new strata of debt are laid down upon the barely eroded bedrock of stale, older ones. Thus it is that the burden of servicing such a growing mountain of claims – an orogenesis of obligation, we might say – can only ever go up. In turn, this results in the officially-imposed interest rate cycle becoming more and more truncated, with each peak lying below the preceding one and with each trough being pushed to – and lately through – the zero bound so that the income drain imposed by that tower of debt does not become too onerous or the old problems re-emerge with renewed venom.

As official rates trend downward, the private sector usually seeks to go one better. Knowing that the debt principal holds little place in the popular imagination but that the monthly payment is the true determining factor in the bargain, lenders start to push out maturities and/or forego the requirement that loans should be smoothly amortized. Not only does this allow the already-indebted both to refinance and then to add to the sums they owe, but it helps entice new cohorts of previously unwelcome borrowers to live beyond their means as well. A fifty-year mortgage or an eight-year car loan? Step this way, sir, we’ll see what we can do.

Soon so much income has been alienated – much of it for such entirely unproductive purposes that little extra earning potential has been acquired in the process – that what we call the intertemporal imbalances again become insupportable. In the current jargon, so much spending has been ‘brought forward’ to prop up today’s faltering system that ever more desperate measures are required to find new expenditures to accelerate and new prodigals to accelerate them when arrives that tomorrow whose fruits we have ‘brought forward’ and the orchard is seen to have been long since stripped bare of its bounty.

On top of this, the eradication of any appreciable opportunity cost in keeping money for its own sake in preference to owning one of the many recognisable claims on greater future money payments (loans, bonds, etc.) leads to a dilution of the principal source of demand for money, the one only transiently expressed in respect of its imminent use as the medium of exchange. This not only confuses the indicators by which we try to balance today’s thrift with tomorrow’s hopes of improved output, but it begins to poison the monetary manipulators’ own wells, to boot.

Accordingly, if money is seen as conferring no great disadvantage should one hold it in place of an ultra-low yielding bond, then the disingenuous assertion first made by Chairman Bernanke that QE is not inflationary because it comprises nothing more than an ‘asset swap’, starts to become all too true.

The central authority, desirous of creating just such an inflation out of a predominant fear of the effect of flat or falling prices on all those whom it has been ceaselessly exhorting to continue to overborrow, easily generates base or ‘outside’ money on which new loans could theoretically be pyramided. But, alas, the commercial banks passively book a good part of these reserves as the primary balance sheet counterparts to the largely inactive settlement deposits of the sellers of the bonds earlier ‘swapped’ for them. Thus, excess reserves do not induce the creation of many additional earning assets – and hence of ‘inside’ money deposits – on top of the original influx.

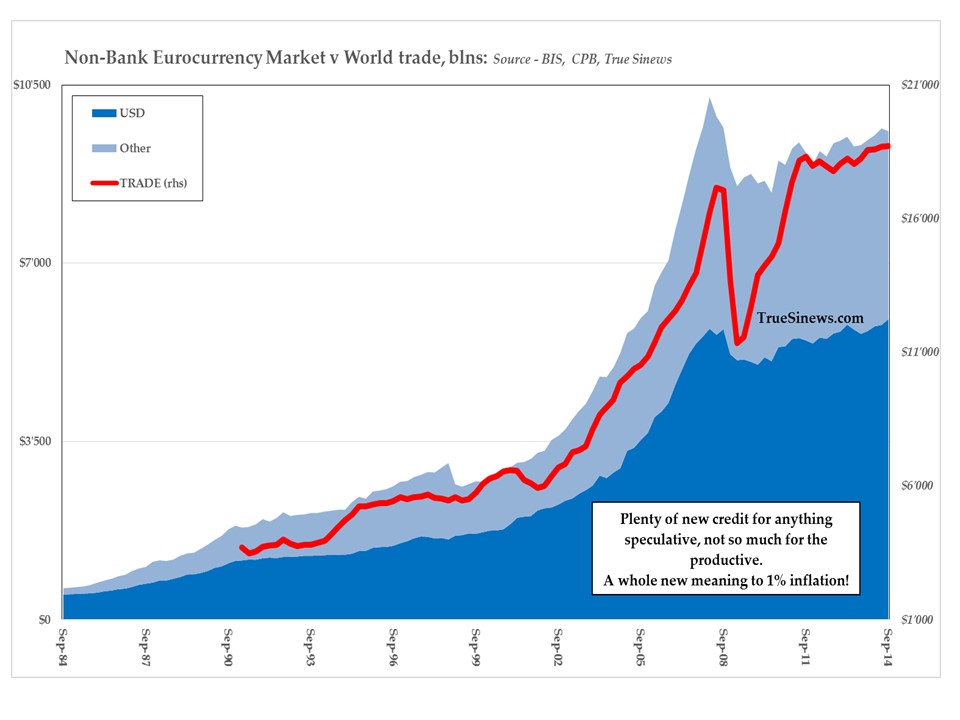

Moreover, where those same depositors do start to feel their trouser pockets heating up, they typically start to play pass-the-parcel with one another by engaging in a bidding war for bulk credits or listed equities on the financial market, inflating their values and further reducing yields below their optimum levels. What they do not do is rush out and make loans to small businessmen so that these latter earnest souls can improve their capital stock or expand their workforce, no matter what M. Sarkozy may have blustered in 2008 about wanting to ‘…put down the foundations of a capitalism of the entrepreneur and not of the speculator’ as a response to the ongoing financial apoplexy.

With barely a nod to the operation of the much vaunted ‘transmission channels’ so beloved of academia, real-side monetary ‘velocity’ is therefore seen to decline and before too long, the central bank is casting about again for new, more ‘unorthodox’ ways to engineer a perceived surfeit of money and hence to promote a more rapid transactional circulation of the stuff. The vicious circle takes another turn as it does: rates decline further across the curve and yet both borrowing and real-side activity are again only modestly excited.

Before long, men in authority – who really should know better – start to mutter freshly cooked forms of idiocy, claiming that the ‘natural’ rate of interest has fallen to a negative value – a state of affairs in which they must imagine that all of us intemperate, impatient, indulgent mortals have somehow switched en masse to a rare preference for the delayed, rather than the instant, gratification of our wants. Even worse, they find no paradox in supposing that the inexhaustible Horn of Plenty, without which no such unmitigated satiation can have been brought about, must have made its wondrous appearance in a period of mass unemployment and so, presumably, also one of mass want.

In the Looking Glass world of ‘secular stagnation’ and ‘negative real natural rates’ to which all this monetary accommodation has supposedly consigned us, can you guess what the prescription for a restoration of normality must be? Of course! A determined effort to swamp the world with yet more central bank money, to further suppress interest rates, to co-opt more of the decision-making to the central planners, and to annexe more of the economic realm to the fiefdoms of Frankfurt, Washington, and Threadneedle St.! Whatever it takes, don’t you know?

So, with all that said, we come today to yet another major confrontation between lender and borrower in the respective shape of Germany and Greece, one which has foolishly been delayed for more than seven years by the unshakable intransigence of those in power.

This all began with the early crisis vainglory that ‘no strategic bank will fail – and, yes, they are all strategic’. It continued into 2010 when M. Trichet pointed his metaphorical revolver of the refusal to continue with emergency support right at the head of the unfortunate Irish Finance Minister Brian Lenihan – a kind of financial Melian dialogue which the Greeks seem to have well taken to heart, now that such threats are being repeated once more. It rolled on and on with the efforts of the so-called Troika and with the ever-changing, but never truly effective programmes of the ECB itself. It mounted with the widespread abuse of Target2 – something that is, after all, supposed to be a clearing system, not a continent-wide credit wrapper – and with the inordinate strain placed on the balance sheet of the neighbouring SNB.

All the while, the insidious transfer of debt from the private sector to the state (or at least to banks which could not survive absent either explicit or implicit support from that state) has continued, so rendering the necessary resolution between creditor and debtor too diffuse, too indirect, and too legally undefined ever to achieve.

Pity then a Greece which is unfortunate enough to be stuck at Europe’s bottom-right corner instead of at Asia’s top-left, or an Iberian peninsula separated from its neighbours by the Pyrenees to the north rather than by the Atlas mountains to the south, for can we find it at all conceivable to think that they would both not have long ago have seen their debts meaningfully restructured, much of their dead wood cut away, and many of their people set back on the road to prosperity if they had been ‘emerging market’ nations and not satrapies subject to the reality-denying Canutes who run the EU?

For all the hand-wringing about ‘mindless austerity’ on the part of that economic luminary who occupies the Oval Office between golf rounds and for all the wailing conducted over ‘deleveraging’, the sorry truth, of course, is that neither a shrinkage of government outlays nor an overall reduction in debt levels is to be found in even the smallest corner of the globe.

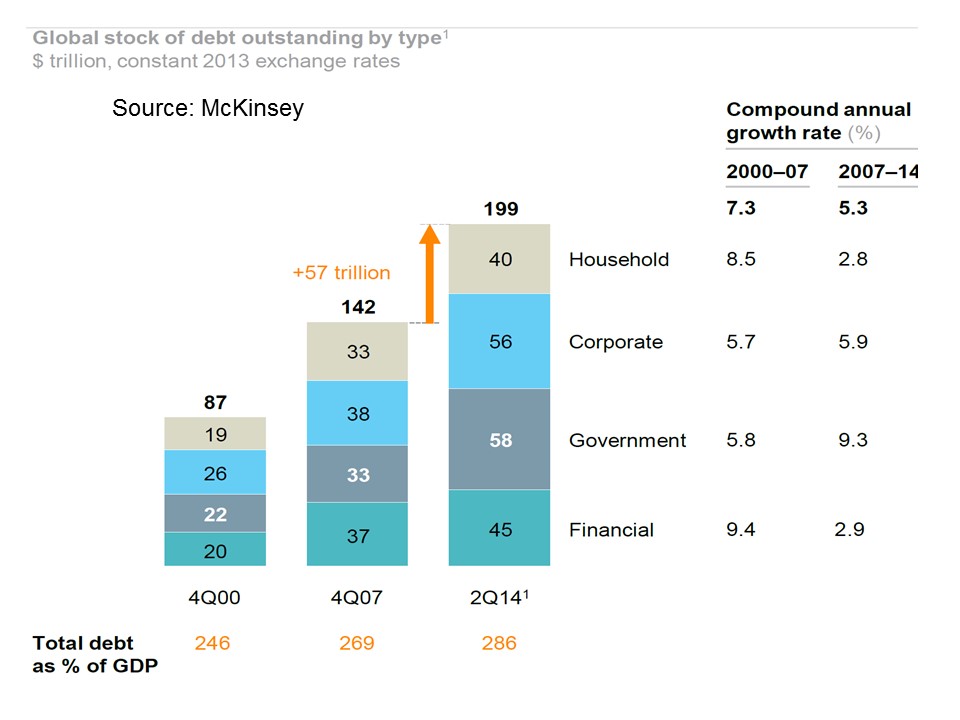

To take one much quoted recent study, this month’s McKinsey report estimates that, since the start of the Crisis in 2007, global debt has risen by some $57 trillion (so, by around $8,000 for every man, woman, and child on the planet) with almost exactly half of the increase in the sub-total attributable to non-financial entities being the fault of those oh-so heartlessly austere governments who have run up an additional tab of a cool $25 trillion in that brief space of time! This means that, in the 6 ½ years of slump and reflation, Leviathan has treated himself to almost $11 billion a day in deficit spending, a sizeable deterioration of almost 2 ½ times the paltry $4.3 billion it was gobbling up during Pharaoh’s preceding seven years of plenty.

It may not be enough to satisfy a Krugman or a Lagarde, but for our taste that represents a dreadfully large quota of capital either frozen in place, shovelled (sometimes literally) into sub-marginal, make-work projects, or simply squandered on recipients of welfare – whether corporate, individual, or among the serried and largely sacrosanct ranks of the place-holding bureaucracy.

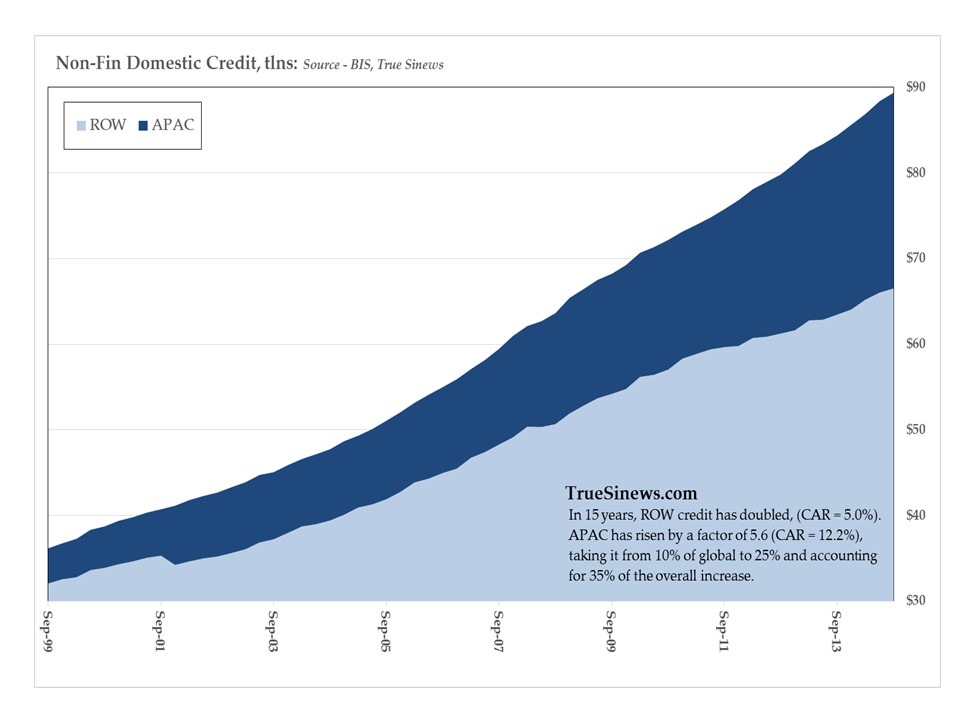

Looking instead to the subset represented by the BIS numbers for ‘global liquidity’ – i.e., the loans extended to and securities bought by banks from non-bank borrowers –we see a similar picture. Since Lehman fell, $25 trillion has been added to this particular pile, an increase of one-third from its starting point. Somewhat alarmingly, two-fifths of that increment has its origins in the Asia-Pacific combination of China, Taiwan, Indonesia, India, Korea, Malaysia, the Philippines, and Thailand. Indeed, the last twelve months’ 21.4% increase in cross-border lending to the region has capped off a nearly 80% rise in debt owed by this octet in the period under consideration. To gain some perspective on the magnitude of this, it should be noted that the $10.3 trillion which this involves matches the sums jointly accumulated by governments, households, and non-financial companies in the whole of Europe, the US, Japan, and Latam put together.

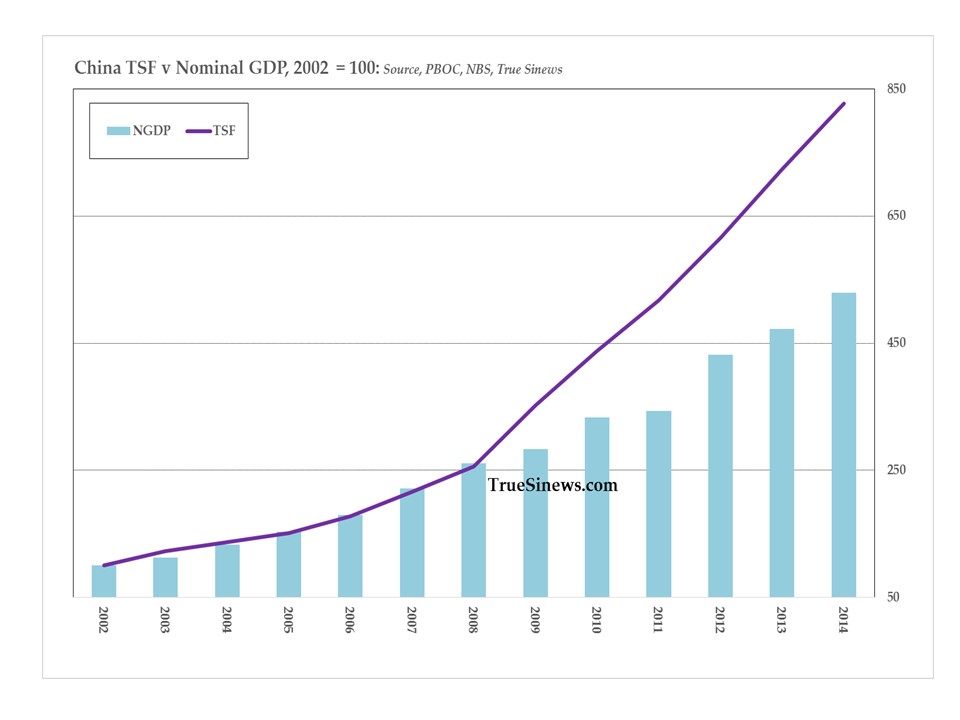

A sizeable proportion of that, it almost goes without saying, lies at the door of the Chinese and, coincidentally, the PBoC has been gracious enough this week to reveal its estimate of what it calls Total Social Finance (a hybrid of bank and non-bank credit, together with a smattering of non-bank equity issuance) – an inclusive agglomeration which the likes of Fitch would argue even so does not in any way account for the whole of the web of obligations being woven so densely across the Middle Kingdom.

Nevertheless, the totals we are given are impressive enough. As of the end of last year, the central bank reckons that TSF outstanding came to CNY124 trillion (around $20 trillion). Having pretty much been stable at a ratio of just over 120% of GDP in the prior six years, the massive stimulus programme unleashed in the immediate aftermath of the GFC and never truly attenuated since has seen the credit measure more than triple in absolute size the most recent six, pushing the ratio dangerously skyward to 193% of national income.

This is the legacy whose baneful influence makes up those ‘Three Overlays’ of debt overhang, surplus capacity, and urgent restructuring with which Beijing likes to remind us it has to tussle on the (Silk) road to its ‘new normal’ of slower, more rational growth, and more market-oriented, value-added activity.

So here we have both a major peril and a possible source of hope. The Chinese authorities appear to have recognised that, by following the practices preached by the execrable Western mainstream – albeit on a truly gargantuan, command-economy scale – it has gone beyond the bounds of merely diminishing to reach the Omega point of no return.

So far, as its economy has stuttered and stumbled along, it has resisted the temptation to add just one last, generous coup de whiskey in order to postpone the inevitable hangover (which does not mean it has been entirely abstemious since the new boys took over in 2013). But now not only is growth stuttering, but many prices are falling, too – principally, if not exclusively, those of the raw materials for which it has such a voracious appetite. However beneficial this discount may be to cash-strapped processing firms, it has nevertheless raised the bogey of so-called ‘deflation’ in the counsels of the wise

The question therefore presents itself: will Xi and Li stick to their guns and rely on broader micro-economic and institutional reform to foster a national renaissance – albeit one backed up with a little judicious concrete pouring ‘Along the Way’, i.e., along the route of the new trade routes being constructed to Europe? Or will the pressure to deaden the pain in the interim prove too intense and so unleash both indiscriminate policy easing and possibly an export-boosting devaluation of the yuan?

So far, all the signals are that they will resist the urge, despite a barrage of domestic commentary to the contrary, but a great deal hangs on the fortitude of Xi himself, that one lonely man, perched at the top of the CCP hierarchy – an organisation which itself sits uneasily at the very peak of a true Mount Olympus of debt.