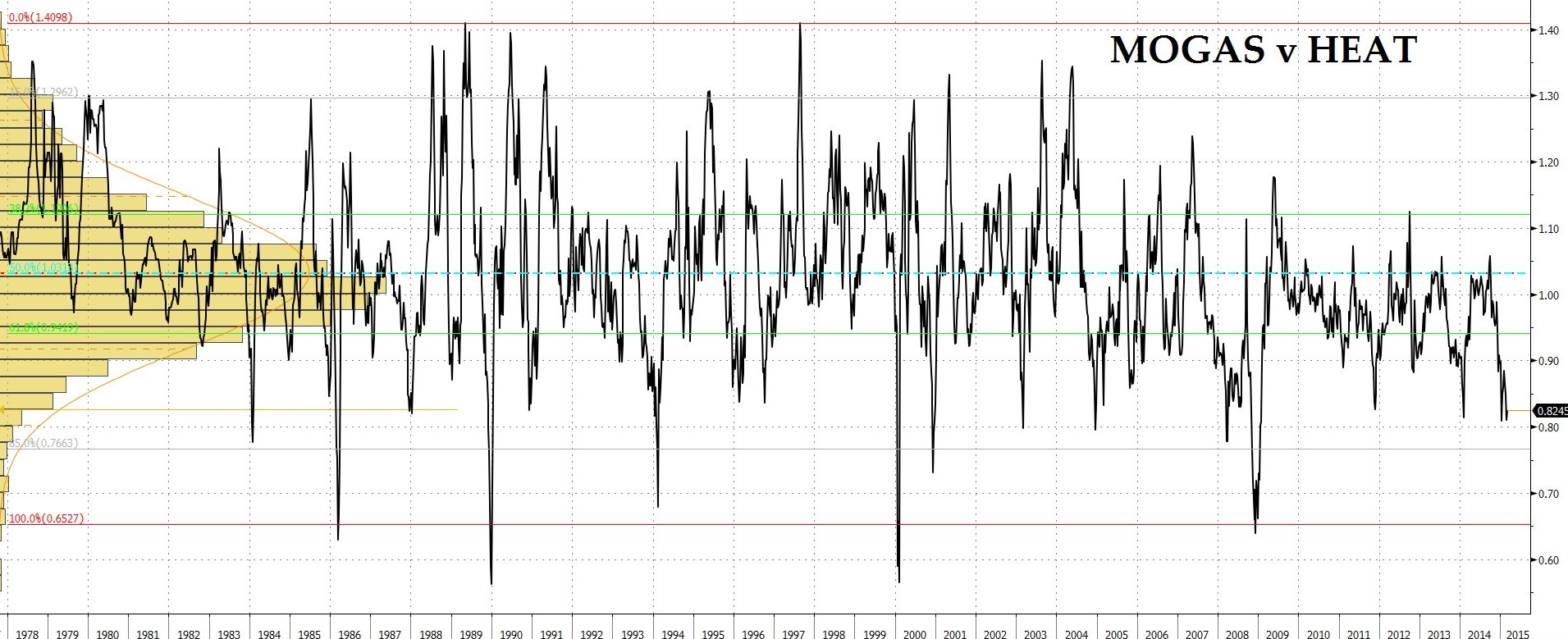

Taken over a forty year history, US gasoline is trading in its 3rd percentile – 1.8 sigmas from the mean – when expressed as a ratio of the price of heating oil. In seasonal terms, this makes sense as the winter draw for space heating coincides with the consumption lull in (discretionary) road transport and the anticipatory change of emphasis by the refiners. Given the severe weather being endured Stateside these past several weeks, it should surprise no-one to learn that stocks of heat are more than 8% below the mean for thetime of year, while those for mogas are 4.3% above that norm. Hence the wider price differential.

On a much shorter timeframe, however, we can see heat coming under pressure in the current trading session as the recent crude-led rally fades. Gasoline, conversely, is so far holding up rather better. Time to spread ‘em in anticipation of the arrival of spring?

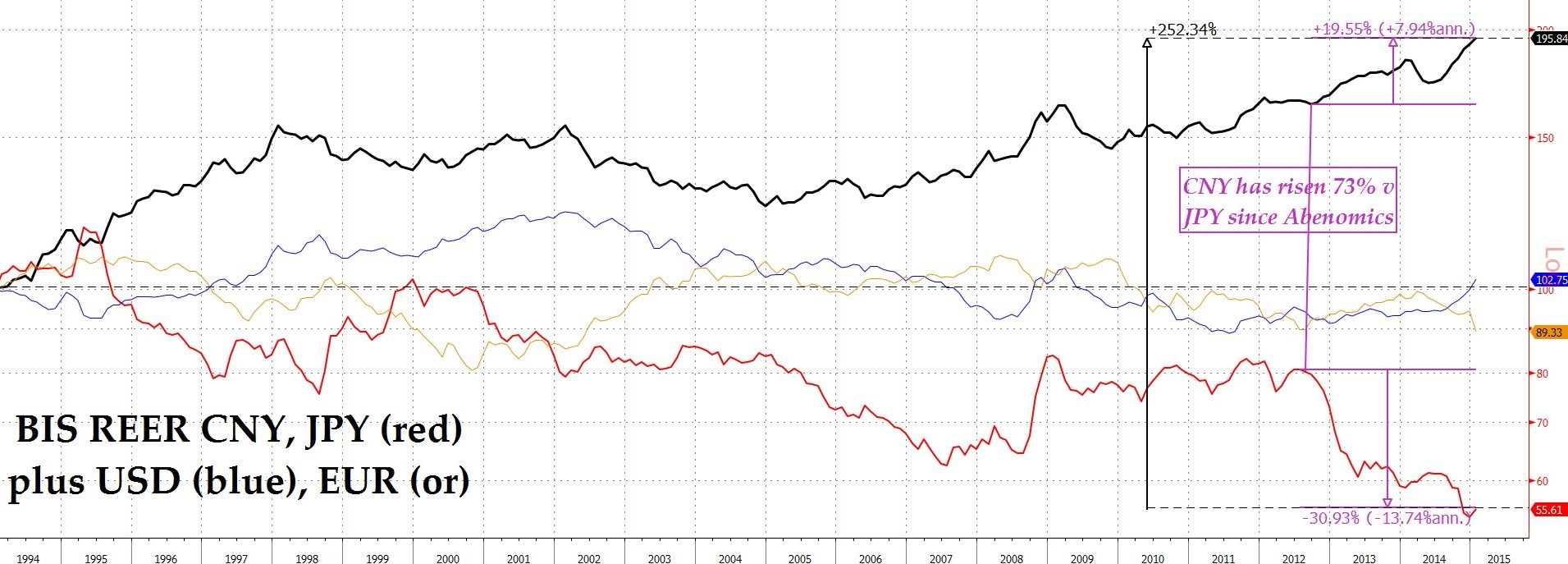

With the yuan-dollar rate edging ever higher (led by pressures which seem to emanate from activity in the offshore version in HK), the Chinese press is starting to resound to the sound of calls for a more active policy of devaluation interspersed with a counterpoint of official denials that this is in any way being contemplated.

Apart from the slump in the euro – the ‘Zone being at least as important as the US as a Chinese export destination – the real killer has been the post-Abenomics move versus the yen, especially when gauged in terms of real (i.e., domestic price-adjusted) effective (trade-weighted) rates. Since the latter part of 2012, China’s currency has undergone a 73% overall, 19% annualized, rise versus that of Japan, prompting some of the latter’s companies to start thinking about relocating production back to their homeland. Not so much yendaka, as yuandaka, this time.

As WantChina Times put it in a recent piece, the effects may already be beginning to make themselves felt:-

‘Citizen China, which produces Japanese Citizen watches, to fold its production base in Guangzhou, on the heels of Microsoft which announced on Dec. 17 its decision to close the mobile-phone factories of Nokia, under its auspices, in Beijing and Dongguan by the Spring Festival moving facilities to Nokia’s factory in Hanoi.

A number of other foreign enterprises are scheduled to join the exodus this year, including Panasonic, Sharp, Daikin, and TDK, all Japanese firms, which plan to transfer some capacity from China back to Japan or to other countries. Others, such as Uniqlo, Nike, Foxconn, Funai, Clarion, and Samsung, are setting up new factories in Southeast Asia and India, while scaling down their Chinese operations.’

So, you can see why some think China will be tempted to – err – address the balance, shall we say?

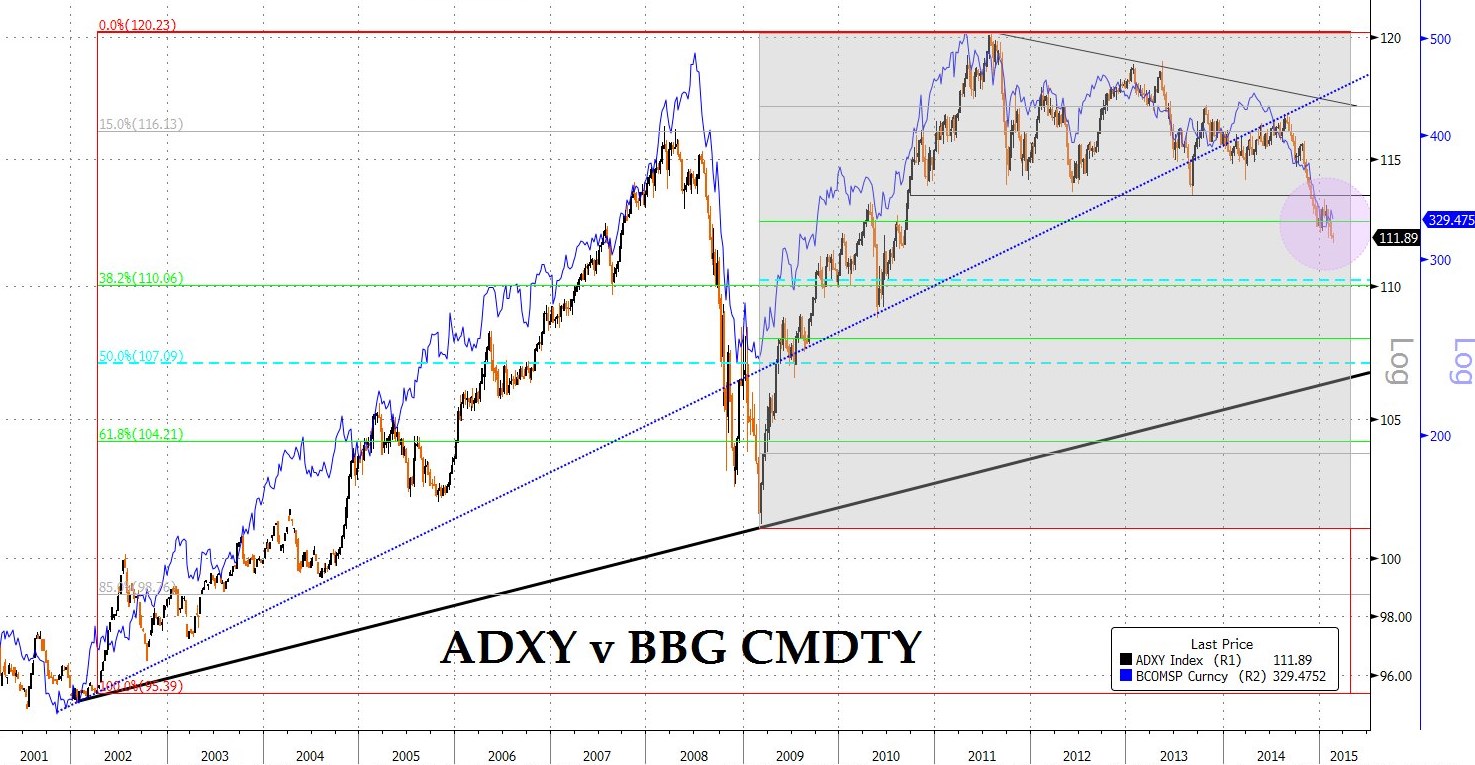

One thing is for sure, whether we look at Asian currencies’ relationship to the Greenback with (ADXY+J) or without (ADXY) the yen, the charts are pointing lower and that, in turn, suggests there is only one way for commodites to trade, too.

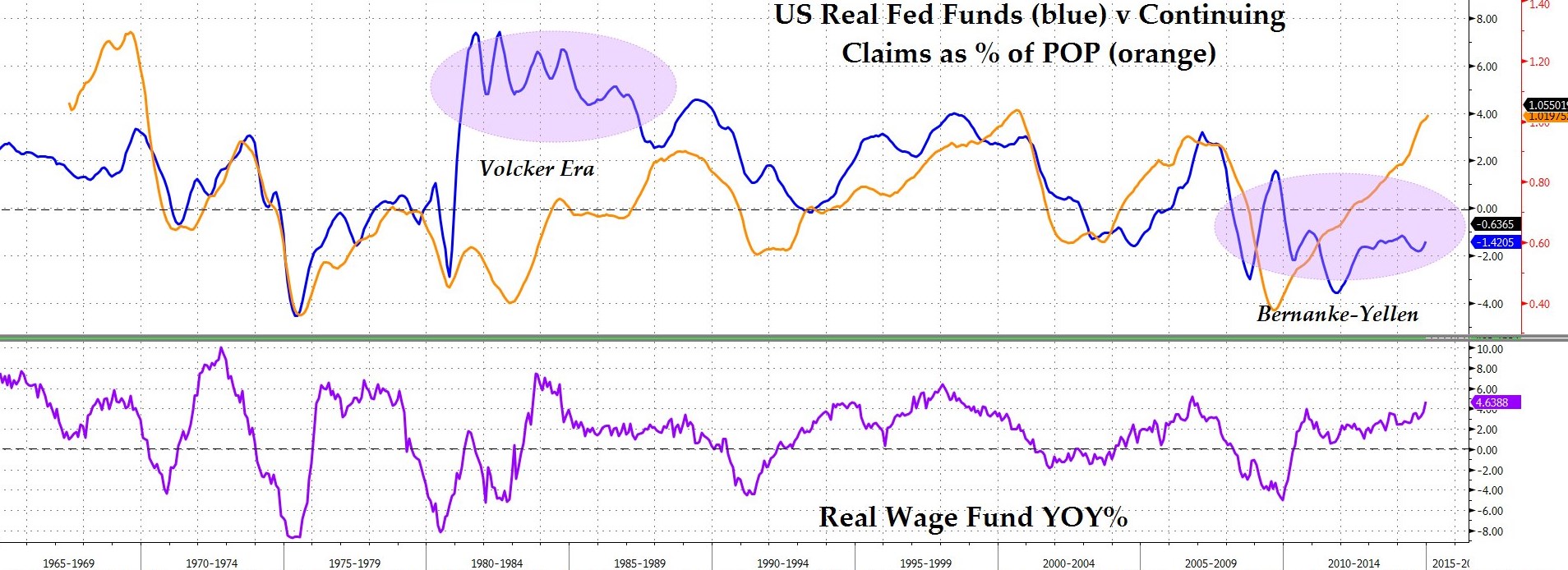

Finally, as Mme. Yellen gives us the usual rigmarole of soft-cop-hard cop-soft cop in her Congressional testimony, the market’s first reaction has been to believe that the Ghost of ’37 is still far from being laid: bonds have rallied nicely, especially in the belly where mid-curve euro$ have jumped 12bps or so in the immediate aftermath of her comments.

If, however, we compare the actual real Fed funds rate to the state of the job market – either using continuing jobless claims as a percentage of the population (here inverted) or the real wage fund (hours x pay rates / CPI) – you can see that Ms. Yellen is taking rather more of a gamble than she is willing to admit. From the Volcker Era to the Anti-Vocker Era, indeed.