I wrote what I thought was a fairly simple article for Forbes on Tuesday. I noticed that some people really got it, and they were very excited. However, others were skeptical or asking questions that went into the weeds. The former tells me that I said something important, but the latter says that I said it in a way that not everyone could relate to.

I started with the observation that many people argue (vehemently) that money should be defined as the medium of exchange. In the US, the dollar is used to purchase everything. Therefore the dollar circulates as the medium of exchange. Therefore the dollar is money. Q.E.D.

The catch is that the dollar only circulates because the government forces it to circulate, and forces gold not to. This means that the very concept of money is under the control of the government.

Ayn Rand noted that force is not essentially about a physical push, or a bullet hitting flesh. She said, “Force and mind are opposites…” She added, “To force a man to drop his own mind and to accept your will as a substitute, with a gun in place of a syllogism, with terror in place of proof, and death as the final argument—is to attempt to exist in defiance of reality.”

She showed that force is an attack on the mind. Literally, the gun takes away your ability to see reality clearly and use logic to arrive at the best possible outcome. Instead, you must think and do as you are told. The insidious process she described is at work with the concept of money. The very concept of money has been perverted.

In most cases, people can see that government has no power to change reality, or alter the laws of physics. But in this case—by the leverage of a broken concept—many people assume that government has indeed the power to make concepts into what it wishes.

George Orwell once wrote about this.

Debt paper is not money, no matter who issues it. The government has no power to transform water into wine, or debt paper into money. I don’t think anyone is explicitly arguing that it has this power. I think their error is to gloss over why the dollar circulates, and just insist that, “well, it circulates therefore it is money.”

Thus, the government is granted the power to turn paper into gold, though the mind skitters away from openly admitting this conclusion.

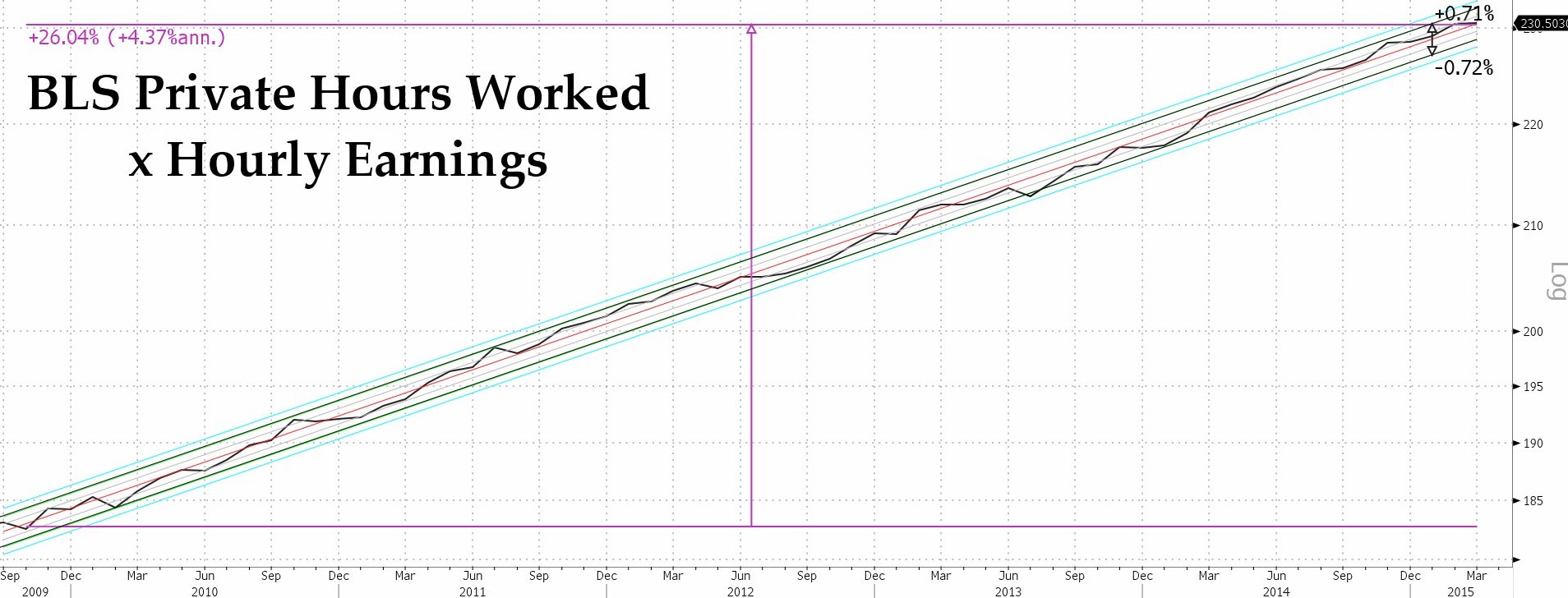

The consequence to accepting the dollar as money is to think that gold goes up. As I often say, in reality, gold is going nowhere. It’s the dollar that is going down. But if the dollar is money, then the prices of all things are measured in dollars. And so, we think gold goes up. Because that’s the only way to frame it if the dollar is money.

If gold goes up, then one has made a profit. That’s right, one makes money for doing nothing, just holding a lump of metal. Where does such a free lunch come from? No time to explore that contradiction today. Let’s stay focused.

It may not be fair, but we have a capital gains tax that applies when an investment, commodity, or asset goes up. If you buy something for $1,000 and sell it for $1,500, then you have a $500 profit. You must pay tax on that income. There are no exceptions that I am aware of: antique Ferraris, stocks, bonds, bitcoin, copper, houses, etc.

And this is where the concept of money gets real.

The government has several ways of forcing gold not to circulate, of making us use their debt paper as if it were money. One of them is the capital gains tax on gold. You see, if you barter—remember, gold is not money, just a commodity—gold for a car then the government considers that to be a sale of gold at the current market price. If that is higher than what you paid when you bought, then you owe capital gains tax.

This tax makes it far too expensive to use gold in transactions, not to mention the ledger you would have to keep. So gold is forced out of circulation (and into private hoards). Gold is for holding, not for using as money.

I have been arguing that this bad tax provision ought to be repealed. And that’s the crux of the problem.

Am I just a crony, like every other crony, asking the government for a special favor and preferential treatment? Is the whole point of repealing the tax on gold so that gold speculators can make more money on their gold trades?

This was essentially the allegation of one Arizona legislator, who asked why gold should be treated differently than other investments.

If the dollar is money, then there is no good answer to this question.

To advocate for special privileges that benefit one’s own purse is to fight for cronyism (also known by its older name, fascism). This is not a principled position. Nor is it a sympathetic one. Everyone has a mental picture of a fat cats, seeking to engorge himself as public expense. Once we’re into that box, once we’re perceived that way, we’re doomed. No matter what “blah blah blah” comes out of our mouths, it will be seen as self-serving and hypocritical. And rightfully so.

Huh? Rightfully so?!? Yes. If we concede that the dollar is money, gold is a commodity, and if we concede that gold is going up, which means we make a profit, and if we demand not to be taxed on that profit, then we are no different than any other special interest group seeking favoritism. We are no different than any other rent seekers.

What is a principled free marketer to do? Well, if you cling to the notion that the dollar is money, then you are disarmed. You have to concede that gold should be taxed just like other assets. You can lobby to eliminate all capital gains tax, but that’s about it. Good luck with that. I will cheer you, but don’t expect victory any time soon.

I remind you of two things. One, tax keeps gold from circulating. In other words, the gold tax is the key to socialized money. We can never have a free market in money if gold is penalized with a tax every time the dollar loses value. Two, as Ayn Rand showed, the moral is the practical. Your belief in this bad definition of money is what keeps you from effectively fighting for a free market in money.

There is much more to say about the topic of money and credit, to support the case that gold is money. In this article, I just wanted to focus on this one issue, because I think the error is an important one. I expect gold’s enemies, as they begin to mobilize and organize, will be cunning enough to see the vulnerability and go for the jugular.

If we want to win, we will need to be armed properly for the fight. This is a battle for ideas, and the most important weapons we can wield are concepts. Preferably razor sharp concepts. Let’s get it right, starting with a clear understanding of the dollar and of gold.

“In the US, the dollar is used to purchase everything. Therefore the dollar circulates as the medium of exchange. Therefore the dollar is money. Q.E.D.”

SOMEWHAT TRUE. There are some other transactions.

“…the dollar only circulates because the government forces it to circulate, and forces gold not to.”

NOT TOTALLY TRUE. People prefer to deal in money.

Skip the psycho words and get to the nuts and bolts…like we do here:

“The consequence to accepting the dollar as money is to think that gold goes up. As I often say, in reality, gold is going nowhere.

WRONG – gold goes where it is pushed to go. The value of money is what people will exchange for it. The value of gold is what people will exchange for it. That is where it goes.

A MISSING POINT

There appears to be a gap in your knowledge. Wealth as measured in money is keeping the amount of money needed to retain the number of National Average Earnings / Income (NAE) Units that you have in money terms.

TAX RELIEF

Tax relief, to be neutral, should not tax any paper profits in whatever form, money, gold, shares, property that only keeps pace with NAE growth.

THIS FACT DESTROYS THE REST OF THE ARGUMENT.

“In the US, the dollar is used to purchase everything. Therefore the dollar circulates as the medium of exchange. Therefore the dollar is money. Q.E.D.”

SOMEWHAT TRUE. There are some other transactions.

“…the dollar only circulates because the government forces it to circulate, and forces gold not to.”

NOT TOTALLY TRUE. People prefer to deal in money.

Skip the psycho words and get to the nuts and bolts…like we do here:

“The consequence to accepting the dollar as money is to think that gold goes up. As I often say, in reality, gold is going nowhere.

WRONG – gold goes where it is pushed to go. The value of money is what people will exchange for it. The value of gold is what people will exchange for it. That is where it goes.

A MISSING POINT

There appears to be a gap in your knowledge. Wealth as measured in money is keeping the amount of money or gold or other assets needed to retain the number of National Average Earnings / Income (NAE) Units that you have saved. Income is counted in money for convenience all round. It is easy to do the books and to find others willing to exchange things for it. That is its attraction.

TAX RELIEF

Tax relief, to be neutral, should not tax any paper profits in whatever form, money, gold, shares, property that only keeps pace with NAE growth.

THIS FACT DESTROYS THE REST OF THE ARGUMENT.

EXAMPLE

Your Grandpa was a wealthy man. He put half a lifetime’s income into trust. 20 NAE’s wrth of money, gold, whatever.He made sure that the value kept pace with prices by index-linking to the prices index. Now, having paid in 20 NAE, the fund only has 1 NAE left. Why? Because prices rose 3% p.a. less quickly than incomes.

For another example: if a percentage of the income of everyone reading this was taken by government and given to one person as a pension that pension would keep pace with the average income of all the readers.

Wealth preserving increases in value should not be taxed.

You can hold gold as a form of investment but there is no guarantee that it will preserve your wealth.

If it rises faster than NAE due to the vagaries of changing supply and demand levels then the profit above NAE growth might be fairly taxed.

I have had some success (trying to teach others) comparing the price of gold to the speed of light. It will NOT change, it just is what it is. Everything else maybe variable.