- Greece needs to reschedule its debt or default

- Capital Controls maybe inevitable

- A piecemeal solution is not the answer, yet it’s more likely than a “Lehman moment”

- A definitive solution presents investment opportunities

Earlier this week I paid a visit to the Greek Island of Corfu. Whilst most of what we read and observe about the Greek economy revolves around Athens, I thought it would be useful to gain a broader perspective on the state of the economy. I wanted to consider, what things might be like, if Greece stays within the Eurozone (EZ) or, conversely, if they decide to leave.

Firstly a few Greek economic facts:-

| Top of FormMarketsBottom of Form | Last | Date | Frequency |

| GDP Annual Growth Rate | 1.2% | Nov-14 | Quarterly |

| GDP per capita | 18146 USD | Dec-13 | Yearly |

| Unemployment Rate | 25.7% | Jan-15 | Monthly |

| Youth Unemployment Rate | 51.2% | Dec-14 | Monthly |

| Population | 10.99mln | Dec-14 | Yearly |

| Minimum Wages | 684 | Dec-14 | Monthly |

| Inflation Rate | -2.1% | Mar-15 | Monthly |

| Core Inflation Rate | -1.2% | Jan-15 | Monthly |

| Producer Prices Change | -4.8% | Feb-15 | Monthly |

| Balance of Trade | -1,425mln | Feb-15 | Monthly |

| Exports | 2,024mln | Feb-15 | Monthly |

| Imports | 3,449mln | Feb-15 | Monthly |

| Current Account | -850mln | Jan-15 | Monthly |

| Government Debt to GDP | 175% | Dec-13 | Yearly |

| Government Spending to GDP | 59.2% | Dec-13 | Yearly |

| Business Confidence | 96.8 | Mar-15 | Monthly |

| Manufacturing PMI | 48.9 | Mar-15 | Monthly |

| Industrial Production | 1.9% | Feb-15 | Monthly |

| Manufacturing Production | 5.8% | Feb-15 | Monthly |

| Capacity Utilization | 65.7% | Feb-15 | Monthly |

| Industrial Production Mom | -4.7% | Jan-15 | Monthly |

| Consumer Confidence | -31 | Mar-15 | Monthly |

| Retail Sales YoY | -0.1% | Jan-15 | Monthly |

| Housing Index | -22% | Feb-15 | Monthly |

| Corporate Tax Rate | 26% | Jan-14 | Yearly |

| Personal Income Tax Rate | 46% | Jan-14 | Yearly |

| Sales Tax Rate | 23% | Jan-14 | Yearly |

Source: Trading Economics

Eurostat published their European Winter Economic forecasts 5th February – this is an extract from their, ever so rosy, forecast for Greece:-

| Indicator | 2013 | 2014 | 2015 | 2016 |

| GDP growth (yoy) | -3,9% | 1,0% | 2,5% | 3,6% |

| Inflation (yoy) | -0,9% | -1,4% | -0,3% | 0,7% |

| Unemployment | 27,5% | 26,6% | 25,0% | 22,0% |

| Public budget balance to GDP | -12,2% | -2,5% | 1,1% | 1,6% |

| Gross public debt to GDP | 174,9% | 176,3% | 170,2% | 159,2% |

| Current account balance to GDP | -2,3% | -2,0% | -1,5% | -0,9% |

Source: Eurostat

According to information collated from the CIA Factbook , OECD and Eurostat, the Greek public sector still accounts for 40% of GDP. The largest industry is Tourism (18%) followed by Shipping – the Hellenic Merchant Marine is the largest in the world employing 160,000 (4% of the workforce). The Greek shipping fleet is the fourth largest in the world, representing 15.17% of global deadweight tonnage in 2013, although “flag of convenience” issues can make these figures a little misleading. The labour force is estimated at 3.91mln of which immigrants account for 782,000 (20%). This makes Greece the 8th largest immigrant population in Europe – mainly unskilled or agricultural workers. As a result of the economic crisis private saving has increased from 11.2% in 2012 to 14.5% in 2014.

The largest broad industry sector is Services (which includes Tourism) accounting for 80.6% of GDP and 72.4% of employment, followed by Industry – 15.9% of GDP and 14.7% of employment. Agriculture is third in size producing 3.5% of GDP but employing 12.9% of the population.

Greece’s largest export market is Turkey (11.6%) and its largest import partner is Russia (14.1%). Little wonder they wish to maintain good relations with Moscow.

In terms of Tourism, Greece is the 7th most visited country in Europe and the 16th most visited globally. The latest figure I could unearth, from a 2008 OECD report, indicated 840,000 workers employed in the sector, from which I estimate that Tourism accounts for more than 20% of employment.

A more detailed analysis of the island economies of Greece came from a paper published bySheffield University – A Comparative Analysis of the Economic Performance of Greek and British Small Islands – 2006. They analysed 63 islands with an average population of around 300,000. Employment was at 88.81% whilst Unemployed was a mere 11.19% – this was around the average for the whole country at that time. To my surprise, the level of reported self-employment was a relatively low 20.43%. One of the more puzzling figures was for Home Occupancy 46.05%; the Greek average for Home Ownership is 75.8% (2013). Unsurprisingly the main industry is Tourism followed by agriculture – it’s worth pointing out that Greece is the EU’s largest producer of Cotton, second largest producer of Rice and Olives, third largest producer of Tomatoes and fourth largest producer of Tobacco. It also accounts for 19% of all fish hauled from the Mediterranean, making it the third largest in the EU as of 2007 data.

The table below shows the regional breakdown of GDP by region for 2010:-

| Region | GDP Euro | GDP % | GDP Growth |

| Attica | 106,635 | 48 | -3.51 |

| Northern Greece | 55,163 | 24.83 | -4.73 |

| Central Greece | 38,767 | 17.45 | -3.03 |

| Central Macedonia | 30,087 | 13.54 | -5.19 |

| Aegean Islands and Crete | 21,586 | 9.72 | -4.84 |

| Crete | 10,955 | 4.93 | -3.79 |

| Thessaly | 10,742 | 4.84 | -6.55 |

| West Greece | 10,326 | 4.65 | -2.9 |

| Sterea Hellas | 10,059 | 4.53 | -1.25 |

| Peloponnese | 9,436 | 4.25 | -3.97 |

| East Macedonia and Thrace | 9,054 | 4.08 | -1.69 |

| South Aegean | 7,476 | 3.37 | -5.4 |

| West Macedonia | 5,281 | 2.38 | -3.3 |

| Epirus | 4,917 | 2.21 | -2.36 |

| Ionian Islands | 4,029 | 1.81 | -6.22 |

| North Aegean | 3,155 | 1.42 | -7.04 |

Source: Eurostat

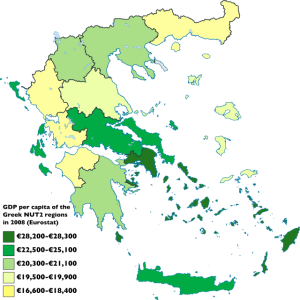

The islands are very much the “poor relation” in terms of economic output but, as the map below, from 2008, shows, the GDP per capita distribution is more dispersed:-

Source: Eurostat

I visited Corfu, the second largest island in the Ionian Sea, with a population of just over 100,000. Its main business is Tourism followed by the production of olives. Back in 2013 NCH Capital – a US investment firm, best known for their investments in agriculture in the Ukraine and Russia, agreed a deal with the Hellenic Republic Development Fund (HRDF) to build a tourist resort on the island. This was the first time the Greek state had sold land to a foreign investor for 15 years. The HRDF has been charged with raising Euro 11bln from asset sales by 2016 – this represents a small fraction of the assets available should the Hellenic Republic decide to cut and run.

The NCH investment is not moving forward as swiftly as they had hoped, as this article fromTax Law explains. It is worth pointing out that Corfu is located at the North West corner of Greece, its North East coast looking across the narrow straits to Albania; little wonder there is some concern about the reduction of a naval presence in the region. However, Albania became a full member of NATO in 2009. Since 2010 Albanians have been able to enter the EU without visas and, as of June 2014, they are officially a candidate to join the EU. As a result of these changes, property development is growing along with tourism. Prices for Albanian property are significantly lower than in neighbouring Montenegro, which in turn offer better value than Greece. Regardless of the fortunes of Albania, the prospects for a significant acceleration of Greek state asset disposals is likely, whether Greece leaves or remains within the EZ.

The residential Real Estate market is still depressed by the economic and political uncertainties of the last few years, but, from a rental perspective, tourists keep returning. The price of dining in restaurants is beginning to look attractive in comparison with other Southern European destinations; perhaps more importantly, the differential with prices in Turkey has narrowed. The cost of more expensive holiday homes in Greece is now comparable with those in Spain or Portugal – it used to command around a 40% premium due to planning restrictions. In 2013 the island of Skorpios sold to a Russian buyer for Eur100mln and the island of Oxia was purchased by a member of the Qatari Royal family for Eur 4.9mln, however, worries about a “Lehman moment” – by which I mean Grexit – have dampened enthusiasm for a number of subsequent deals.

If Greece leaves the EZ and the new currency promptly depreciates, there will still be a number of uncertainties. To begin with, the Greek government is likely to impose capital controls to prevent capital flight – Greek Prime Minister Alexis Tsipras has started the process, instructing local governments to move their funds to the central bank earlier this week. For non-domicile property owners, these controls could mean they are unable to repatriate the proceeds of sales. I was interested to notice how many restaurants no longer accept credit card payment; would you put the proceeds of a property sale into a Greek bank whilst waiting for capital controls to be relaxed?

Another factor which may delay a recovery in Real Estate is the reaction of non-EU nationals who have bought Greek property for more than Eur250,000, in order to gain EU status – a scheme also available in Portugal. This Greek Law Digest article explains.

Selling pressure on property prices will continue to come from Greek domestic investors downsizing of their rental portfolios. During the first few years of EZ membership, many Greeks bought multiple holiday rentals. Since the crisis, maintenance costs have soared as a result of the “haratsi” property tax. Meanwhile, the financial police are aggressively pursuing owners who fail to declare rental income. If Greece exits the EU, I would expect Real Estate supply to hang over the market for some while.

A perusal of the windows of Corfu Real Estate agents, whilst far from scientific, suggests that the price of holiday homes is still relatively high. The properties are normally foreign owned and, for the most part, the owners are not distressed sellers. I was struck, however, by the magnitude of the price reductions (up to 80%) on those properties which had “sold”. It feels like a market with low turnover where price discovery is intermittent at best. For the Greek market nationally residential property appraisals-transactions for 2014 were down 33.20% on 2013, dwelling permits fell by 19.3% between January to November 2014 compared to 2013 and total new floor space declined 13.9% y/y to November 2014. The chart below shows that the pace of decline has moderated in the last year but prices are still falling:-

Source: Bank of Greece

The absolute level of the property index suggests that almost all the gains seen in Real Estate prices since joining the EZ have been reversed, but the economy is still not competitive due to the strait-jacket of the Euro:-

Source: Bank of Greece

This article from The Guardian – Home ownership in Greece ‘a sick joke’ as property market collapses from February 2014, attempts to impart a flavour of the overall market, but, as any home owner knows, all property investment is local.

The year so far

To understand the Greek situation you need to go back to the eve of the introduction of the Euro, in 2000, but for a brief overview of the current crisis this excellent video from thePeterson Institute – Greece: An Economic Tragedy in Six Charts is well worth taking five minutes to peruse. Instead, I want to look at the last few months and consider the implications going forward.

As the Greek government begin further negotiations with EZ Finance Ministers today, in an attempt to reschedule their outstanding debt and interest rate payments, it is becoming clearer, to politicians in Brussels, that the “Greek Problem” will not be resolved by wishful thinking and continued austerity. Since January a new scene in this Greek tragedy has begun to unfold.

At the beginning of January Bruegal – Why Grexit would not help Greece – rebutted many commentators, but specifically the German IFO Institute’s call for Greece to leave the EZ. Bruegal focussed on the unique aspects of the Greek situation, pointing out that, unlike Portugal, Ireland and Spain, Greek imports had collapsed but their exports had only recently started to improve:-

Are high wages the main problem in Greece hampering exports? Is the absence of a real depreciation the main driver of the different adjustment experience of Greece compared to the other euro area countries?

…hourly wages have come down substantially in Greece and are in fact the lowest in the euro area with the exception of Latvia and Lithuania. This contrasts with the experience in the other three countries adjusting, where hourly wages in the private sector have increased.

Source: Eurostat

Overall, I conclude that the Greek economy would not benefit as much as hoped for from a rapid depreciation. The reasons for the weak Greek export performance might primarily lie in other factors such as rigid product markets, a political system preventing real change and guaranteeing the benefits of the few, the lack of meritocracy among other factors…

This does not mean that the current debt trajectory and debt level is sustainable. It may be necessary to further alleviate the debt burden on Greece, especially if inflation remains low and growth is weaker than the Troika believes. This has been done a number of times before by the official creditors and already now the average maturity on the European debt is 30 years. This maturity could be increased if necessary, effectively reducing the debt burden further and I could even see a nominal debt cut at some stage.

Later in January Bruegal – How to reduce the Greek debt burden? Looked at the options available to Greece and her creditors:-

Option 1: Reducing the lending rate on the Greek Loan Facility

Option 2: Extending the maturity of the loans in the Greek Loan Facility

Option 3: Extending maturity of EFSF loans

Option 4: Buying-back the Greek government bond holdings of the ECB and National Central Banks

Option 5: Swapping the currently floating interest rate loans to fixed rate loans

Option 6: Swapping the current loans to GDP-indexed loans

Option 7: Pre-privatisation using European funds

The tone of quasi-official commentary changed in February, when the ECB ceased to accept Greek government bonds as collateral for normal refinancing operations. Bruegal – The Greek banking system: a tragedy in the making? finally acknowledged the ECBs obligation to “lend freely” but only “against good collateral”:-

One can criticize the ECB’s decision for aggravating the crisis but one can also argue that the ECB had no choice but to act as it did given the self-proclaimed insolvency of the Greek state.

Greek Finance Minister – Yanis Varoufakis – announced their new plan shortly after Syriza won the election. The FT – Greece finance minister reveals plan to end debt stand-off – 2ndFebruary described it as:-

Attempting to sound an emollient note, Mr Varoufakis told the Financial Times the government would no longer call for a headline write-off of Greece’s €315bn foreign debt. Rather it would request a “menu of debt swaps” to ease the burden, including two types of new bonds.

The first type, indexed to nominal economic growth, would replace European rescue loans, and the second, which he termed “perpetual bonds”, would replace European Central Bank-owned Greek bonds.

He said his proposal for a debt swap would be a form of “smart debt engineering” that would avoid the need to use a term such as a debt “haircut”, politically unacceptable in Germany and other creditor countries because it sounds to taxpayers like an outright loss.

…“What I’ll say to our partners is that we are putting together a combination of a primary budget surplus and a reform agenda,”

…“I’ll say, ‘Help us to reform our country and give us some fiscal space to do this, otherwise we shall continue to suffocate and become a deformed rather than a reformed Greece’.”

After talks broke down later in February Bruegal – Europe needs a lasting solution for the Greek problem wrote:-

I expect that fear of Grexit will prompt an agreement between Greece and euro-area partners. But my concern is that the agreement will be only a short-term fix and the various constraints will prevent reaching a lasting solution, thereby just postponing the problems. That would be the next stage in the Greek tragedy, as debt sustainability problems would likely return in a few years.

The following two tables show the payment flashpoints on the Greek road to redemption:-

Source: Datastream

Source: IMF

Early March saw the publication of the Greek State Budget Execution Monthly Bulletin – the primary balance was only slightly below forecast, but closer inspection revealed that the majority of the improvement in the primary balance has been achieved by reducing expenditures. Revenues were Eur 7.8bln – around Eur 1bln below target. Without the benefit of currency devaluation, the broader Greek economy is still struggling to adjust.

A Closer look at the chances for a Greek recovery

The Greek government debt burden is unsustainable, in 2013 its Debt to GDP ratio was 174.9. According to Nationaldebtclocks.org the current figure is Eur 354bln. Greek 2014 GDP was $246bln (Eur189) and GDP for 2015 is estimated to be +0.7% (Eur 190bln) I assume a EURUSD 1.30 exchange rate so, perhaps, I’m painting an overly bleak picture. Official estimates put Greek government indebtedness at nearer to Eur 228bln.

Assume Greece manages to run a primary surplus of 3% in perpetuity – that equates to around Eur 5bln per annum. Assume they manage to negotiate zero interest on all their outstanding debt. It would take 70 years to repay – and 35 years to bring it back below 100% of current GDP. You may argue that 1. National Debt is the wrong measure, since Government Debt is the issue, but, if Greece leaves the EZ, creditors will need to consider all her obligations. 2. That it is unrealistic to assume no growth in GDP, but Greek GDP growth averaged 0.97% from 1996 to 2014, reaching an all-time high of 7.50% in the fourth quarter of 2003. It crashed to -9.9% in Q1 2011. Meanwhile Greek Inflation averaged 8.94% between 1960 and 2015. Recently deflation has set in, with prices falling to a record low of -2.90% in November of 2013.

These numbers don’t add up; either the creditor nations and institutions embrace substantial rescheduling and debt forgiveness, or Greece defaults, exits the EZ, devalues and potentially precipitates an EZ wide financial crisis. In PWC – Global Economy Watch – What would a Greek exit mean for the Eurozone? The authors estimate the impact of a Grexit on the rest of the EZ, Germany’s banking sector is most exposed (Eur29.5bln) although this still only amounts to 0.8% of GDP:-

Banking sector – Our analysis suggests that the Eurozone banking sector should be able to manage the impact of a Greek exit without severe consequences. The exposure of banks in the four largest Eurozone economies (Germany, France, Italy and Spain) to Greece has fallen from around $104bn in 2010 to $34bn. While the German banking system is the most exposed to Greece, this exposure equates to only around 0.8% of its GDP. For the other economies, France, Italy and Spain, the direct exposure of their banks to Greece is less than 0.1% of GDP.

Greek debt holders – around 60% of Greek government debt is held indirectly by Eurozone governments. If the Greek government defaults on its obligations, then that debt will be written off (at least in part). This could pose a risk to countries which already have a relatively large public debt burden. For example, a Greek exit could have negative implications for Italy, which guarantees around 20% of the Eurozone’s bailout funds, and has a ratio of gross government debt to GDP of around130%. Italy’s exposure to Greek government debt is equivalent to around 2% of its GDP meaning a default could lead to a fiscal squeeze in Italy as the government attempts to fill the hole left in its finances.

Unexpected contagion – A Greek exit could also have effects outside the realm of economic data and financial statistics. It would likely add to political uncertainty as other countries may push for concessions on their commitments or it could set a precedent that sees other countries leave the Eurozone. For example, Spain and Portugal are both experiencing double digit unemployment rates and must hold general elections by the end of 2015. While the domestic consequences of Greece leaving the Eurozone could deter voters in other countries from seeking to leave the single currency area, there remains a possibility of surprising developments occurring in the Eurozone. In addition to this, a Greek exit could also call Greece’s role in the European Union and NATO in to question, spurring even more uncertainty.

Of course, the largest creditors are EZ institutions, led by the ECB which holds Eur 104bln – 65% of Greek GDP, according to Governor Draghi.

By the end of March rumours were starting to circulate of Brussels preparing to impose capital controls in the event of the Greek government running out of money. The Peterson Institute – Can Greece Make a Deal with Europe? – suggests a cut-off, but it’s still some way off:-

When Must a Deal Be Struck?

At the very latest, June/July 2015 would seem to be the deadline. At that point, Greece faces about €6.5 billion in euro bond repayments to the ECB, which it will not have the cash to honor without a new arrangement. A default against the ECB would end all liquidity provisions to Greek banks, including emergency liquidity assistance (ELA) from the Greek central bank. A quick economic death spiral would ensue.

According to an article this week the New York Times – European Central Bank Squeezes Greek Banks, Tightening Access to Loans the Greek banks have resorted to issuing bonds to themselves in order to access the ECBs ELA facility: –

For more than three months, Greece’s largest banks have been forced to borrow short-term, higher-interest money from their central bank — a process called emergency liquidity assistance — because the E.C.B. deemed it too risky to extend credit to the banks itself.

The banks, in turn, have to provide adequate collateral to obtain these loans, which now stand at 74 billion euros, $79.7 billion, or more than half the amount of Greek domestic deposits.

…Controversially, Greek banks have even begun to issue bonds to themselves and, after securing a government guarantee, have used the securities to secure short-term financing…

…On April 8, for example, the National Bank of Greece self-issued €4.1 billion of six-month bonds that carried state backing.

Inevitable “Lehman”?

A number of commentators have been predicting a Greek exit for several years. This was the view expressed in February by David Stockman – History In The Balance: Why Greece Must Repudiate Its ‘Banker Bailout’ Debts And Exit The Euro:–

The true evil started with the bailouts themselves and the resulting usurpation by the EU politicians and apparatchiks of both financial market price discovery and discipline and sovereign democratic prerogatives. Accordingly, the terms of Greece’s current servitude can’t be tweaked, “restructured” or “swapped” within the Brussels bailout framework.

Instead, Varoufakis must firmly brace his interlocutors on the true history and the condition precedent that stands before them. Namely, that the Greek state was effectively bankrupt even before the 2010 bailout, and that the massive amounts of debt piled upon it thereafter was essentially a fraudulent conveyance by the EU.

Accordingly, Greece’s legitimate debt is perhaps $175 billion based on the pre-crisis euro debt outstanding at today’s exchange rate and the haircut that would have occurred in bankruptcy. Greece’s new government has every right to repudiate the vast amount beyond that because it arose not from the actions of the Greek people, but from the treachery of EU politicians and the Troika apparatchiks—-along with the unfaithful stooges in the Greek parliament and ministries which executed their fraudulent conveyance.

The Peterson Institute – Greece Should Ponder the Benefits of Devaluation – presents a couple of novel alternatives:-

There are two other mechanisms through which devaluation could occur, but both are more painful and less efficient than the currency (so called external) devaluation. One way is to simply reduce wages, thus achieving lower prices of domestically-produced goods and making them cheaper abroad. This is easier said than done. Wages are notoriously sticky, and even the wage cuts that Greece accepted have already brought protesters to the streets. Greece reduced wages of public-sector workers in 2010 and again in 2012 and endured months-long strikes. The new Syriza government has just started to undo these measures, with pledges to increase wages to precrisis levels.

The other mechanism to achieve internal devaluation is through tax policy—by reducing taxes on labor and increasing consumption taxes. Reducing taxes serves to reduce the overall cost of labor and hence production. It also encourages firms to look for other markets, as higher consumption prices at home reduce demand. Several European countries tried this, including Italy under Prime Minister Mario Monti in 2012—with some success.

I remember discussing a “devaluation and re-joining” concept, with a hedge fund manager friend of mine back in 2010. “How would it work in practice, and what would happen to the bond holders?” were his perfectly valid responses. From the current vantage, five years on, that 20% devaluation would have been a small price for the bond holders to pay. Meanwhile Greek bank accounts are being siphoned of deposits as the crisis deepens, these charts from an article published by CFR -Greece—a Destabilizing Financial Squeeze – tell an alarming tale:-

Source: Goldman Sachs

It’s amazing that household deposits remain so high, but, with the majority of the Greek people wishing to remain in the Euro, perhaps this is logical.

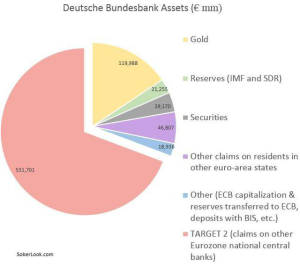

The chart below shows the breakdown of the balance sheet of the Deutsche Bundesbank:-

Source: Soberlook.com

TARGET2 claims represent around 70% of the total – this is the loans of peripheral EZ national central banks. If “Grexit” leads to “Contagion” this half-trillion Euro accounting entry will start to crystallise – the hole in the Bundesbank balance sheet will have to be footed by the German tax payer.

Personally I still favour an EZ solution. Towards the end of February Michael Pettis – When do we decide that Europe must restructure much of its debt? Took up the theme, reminding us of the, less quoted, preamble to Mario Draghi’s “whatever it takes” speech:-

And this is clearly not just about Greece. Everyone understands that Greece has already restructured its debt once before and received partial forgiveness — in fact once coupon reductions are correctly accounted for Greece’s debt ratio is probably much lower than the roughly 180% of GDP the official numbers suggest. Most people also understand that the Greek debate is not just about Greece but also about whether or not several other countries — Spain, Portugal and Italy among them, and perhaps even France — will also have to restructure their debts with partial debt forgiveness.

What few people realize, however, is these countries have effectively already done so once. This happened two and a half years ago at the Global Investment Conference in London when, on July 26, 2012, Mario Draghi, President of the European Central Bank, made the following statement:

“When people talk about the fragility of the euro and the increasing fragility of the euro, and perhaps the crisis of the euro, very often non-euro area member states or leaders, underestimate the amount of political capital that is being invested in the euro. And so we view this, and I do not think we are unbiased observers, we think the euro is irreversible. And it’s not an empty word now, because I preceded saying exactly what actions have been made, are being made to make it irreversible.

“But there is another message I want to tell you. Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.”

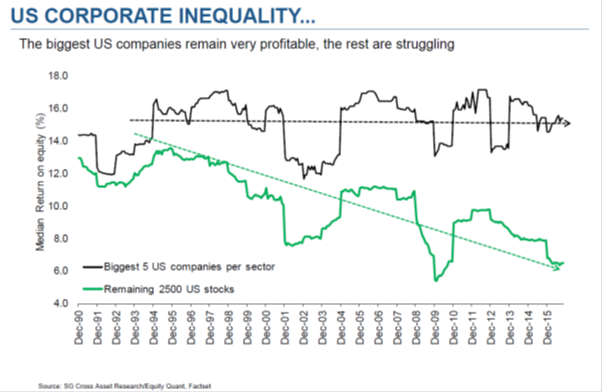

Pettis puts the case for a Europe-wide debt resolution. He quotes from McKinsey – Debt and (not to much) deleveraging – but since “a picture paints a thousand words”:-

Source: Haver Analytics, McKinsey

As Pettis sees it, this is most certainly not about Greece in isolation:-

For now I would argue that the biggest constraint to the EU’s survival is debt. Economists are notoriously inept at understanding how balance sheets function in a dynamic system, and it is precisely for this reason that we haven’t put the resolution of the European debt crisis at the center of the debate. But Europe will not grow, the reforms will not “work”, and unemployment will not drop until the costs of the excessive debt burdens are addressed.

Conclusions and investment opportunities

The yield on Greek 10yr government bonds has begun to rise again (see the monthly chart below) following the dramatic rise in shorter maturities – 2yr yields were at 28% on the open yesterday versus 10yr at 12.7%. This is a clear trend breakout but could be swiftly reversed by an EZ resolution of the current impasse:-

Source: Trading Economics

During the last year Greek stocks have trended lower losing more than 45% since the spring of 2014, yet they are still higher than during the teeth of the last storm that battered the EZ in 2012 when the index plumbed the depths of 471:-

Source: Yahoo Finance

Perhaps of greater relevance, in light of the potential failure of the Greek banking system, is the Greek Bank Index. This, six month chart, highlights the degree to which the economy is being constrained by the spectre of bank defaults:-

Source: Yahoo Finance

The Greece will either remain mired in the morass of debt, successfully restructure or exit the Euro and default on its obligations. In the first scenario bonds will be rescheduled piecemeal but yields should return to single digits in 10yr maturities, reflecting the continued deflation risk associated with the over-hang of debt, the stock market will under-perform due to continued uncertainty and lack of investment but is unlikely to make fresh lows given the steady improvement in growth prospects for the rest of the EZ. Real Estate will continue to trend lower since the only buyers are likely to be domestic firms or individuals – the substantial inventory of domestic sellers will take a considerable time to clear, whilst net outward migration will increase the supply of Real Estate further. This chart shows the net changes in population since 1980:-

Source: The Economist, Eurostat

In the second scenario, bond yields will trade in a range between high single digits and mid-teens, trading in a broadly similar way to scenario one, though, with less deflation risk, the yields are likely to be structurally higher. The stock market will clear and investment will return. House prices will recover as foreign buyers return and ex-patriot workers come home. Scenario three is the most cathartic. Bond yields will rise dramatically since there will no longer be a strong central bank and few businesses or institutions will be organised to exchange the replacement currency. The new currency will devalue and remain volatile, deterring investors from rushing to invest – once the currency stabilises, bond and equity markets will follow suit. High yield investors will be ready to invest in bonds, equity investors will look for businesses with comparative advantages due to their proximity to, and established trading links with, the EZ. Property will also gradually recover, especially in tourist destinations where “holiday homes” will suddenly become even more affordable for many EZ investors.

As I mentioned already, I think scenario two is most likely (45%) though we may have to wait until the “eleventh hour” to see it come to pass. Sadly scenario one is also quite likely (35%) since the EZ political apparatus seems incapable of addressing tough decisions head-on. This still leaves a 20% chance of a “Lehman moment”.

Prospects for the islands

As the paper from Sheffield University explains, island economies are relatively insulated from the external ebb and flow of the wider economy. Proximity to Athens is clearly a factor, but the performance of Crete is a typical example of the localised nature of these economic units. Corfu is only 30 miles from the heel of Italy and its Venetian architecture is testament to these links. The islands are most reliant on Tourism and, despite the crisis and the rioting in Athens, tourists keep coming back to these beautiful, welcoming islands. Not unlike Greece’s second industry – Shipping – Tourism is an international business; it is not held hostage to the fortunes of the hapless Greek political elite.