- Last year’s oil price falls are still feeding through to the wider economy

- Oil producing states have remained resilient despite the continued lower price of WTI

- The wider economy has rebounded after the slowdown in Q1

- Stock earnings growth is regaining upward momentum

At the end of last year I became cautious about the prospects for the US stock market. The principal concern was the effect a sustained decline in the price of oil was likely to have on the prospects for employment and economic growth.

The Texan Experience

Oil rich Texas represents a microcosm of the effect lower energy prices may be having on employment and growth. This article from December 2014 by Mauldin Economics – Oil, Employment, and Growth – neatly sums up my concerns at the end of last year:-

…we need to research in depth as we try to peer into the future and think about how 2015 will unfold. In forecasting US growth, I wrote that we really need to understand the relationships between the boom in energy production on the one hand and employment and overall growth in the US on the other. The old saw that falling oil prices are like a tax cut and are thus a net benefit to the US economy and consumers is not altogether clear to me. I certainly hope the net effect will be positive, but hope is not a realistic basis for a forecast. Let’s go back to two paragraphs I wrote last week:

Texas has been home to 40% of all new jobs created since June 2009. In 2013, the city of Houston had more housing starts than all of California. Much, though not all, of that growth is due directly to oil. Estimates are that 35–40% of total capital expenditure growth is related to energy. But it’s no secret that not only will energy-related capital expenditures not grow next year, they are likely to drop significantly. The news is full of stories about companies slashing their production budgets. This means lower employment, with all of the knock-on effects.

…As we will see, energy production has been the main driver of growth in the US economy for the last five years. But changing demographics suggest that we might not need the job-creation machine of energy production as much in the future to ensure overall employment growth.

…The oil-rig count is already dropping, and it will continue to drop as long as oil stays below $60. That said, however, there is the real possibility that oil production in the United States will actually rise in 2015 because of projects already in the works. If you have already spent (or committed to spend) 30 or 40% of the cost of a well, you’re probably going to go ahead and finish that well. There’s enough work in the pipeline (pardon the pun) that drilling and production are not going to fall off a cliff next quarter. But by the close of 2015 we will see a significant reduction in drilling.

Given present supply and demand characteristics, oil in the $40 range is entirely plausible. It may not stay down there for all that long (in the grand scheme of things), but it will reduce the likelihood that loans of the nature and size that were extended the last few years will be made in the future. Which is entirely the purpose of the Saudis’ refusing to reduce their own production. A side benefit to them (and the rest of the world) is that they also hurt Russia and Iran.

Employment associated with energy production is going to fall over the course of next year. It’s not all bad news, though. Employment that benefits from lower energy prices is likely to remain stable or even rise. Think chemical companies that use natural gas as an input as an example.

I am, however, at a loss to think of what could replace the jobs and GDP growth that the energy complex has recently created. Certainly, reduced production is going to impact capital expenditures. This all leads one to begin thinking about a much softer economy in the US in 2015.

Last month’s employment report suggests we may have avoided the downturn from cheaper oil, but uncertainty remains. Earlier this month the Dallas Fed – Robust Regional Banking Sector Faces New Economic Hurdles whilst focusing on the health of the banking sector, worried that the effect of lower oil prices, combined with higher interest rates, may yet wreak havoc in the Eleventh District. Here are some of the highlights:-

Not only have district banks achieved greater profitability than their counterparts nationwide, but their loan portfolios also have grown twice as fast. District banks returned to lending sooner than banks in the rest of the country and experienced more rapid loan growth due to the region’s economic strength.

…Possibly reflecting banks’ quest for yield in a low-interest-rate environment, the so-called three-year asset/ liability gap has been growing, particularly for district banks. This measure subtracts liabilities with maturities greater than three years (certificates of deposit, for example) from loans and securities with maturities greater than three years and divides the difference by total assets. A bigger gap means that banks would be hurt by rising interest rates because their assets are tied up for a longer time relative to their liabilities. Consequently, when interest rates rise, banks’ funding costs could rise while interest income remains stagnant, squeezing profitability.

…The other big concern is potential fallout from recent dramatic oil and gas price declines, which affects Texas banks in particular. In July 2014, the West Texas Intermediate (WTI) spot price exceeded $105 a barrel; by March, it had tumbled to below $50 before bouncing back to near $60 at the start of May. The size and rapidity of the decline raised concerns about the impact on the Texas economy and Texas banks, especially given the experiences of the energy and financial collapses of the 1980s. While the state’s economy has become more diverse and thus less reliant on the oil and gas industry, the price drop has still negatively affected the Texas economy and labor market. Some pockets of the state remain heavily dependent on the energy sector, making local industries vulnerable to spillover effects. And because of community banks’ close ties to the areas they serve, they are more exposed than large banks.

…One measure of potential distress is the so-called Texas ratio, the book value of an institution’s nonperforming assets as a percent of its tangible equity capital and its loan-loss reserves. Essentially, the Texas ratio compares an institution’s bad assets to its available capital. A Texas ratio above 1 (expressed as 100 percent) indicates that probable and potential losses exceed an institution’s immediate loss-absorbing cushion, putting it at greater risk of bankruptcy. There have been two instances of dramatic oil price declines since 1980; one gives rise to concern and the other to hope.

Between June 1980 and September 1986, the WTI price declined 74 percent in real (inflation-adjusted) terms. Roughly 20 percent of all Texas institutions had a Texas ratio greater than 100 percent by year-end 1988. A staggering 706 Texas banks and thrifts failed—including nine of the 10 largest banking institutions—between September 1986 and year-end 1990.9

A more recent oil price decline, in the second half of 2008 and early 2009, was also dramatic, but in a different way. Over a nine-month period beginning in June 2008, the price fell more than 71 percent. Yet less than 1 percent of Texas banks had a Texas ratio exceeding 100 percent and only seven failed in 2008–09. The slight pickup in bank troubles in 2010 is likely attributable to generally difficult financial and economic conditions that year.

From June 2014 through March 2015, the price of WTI fell 58 percent. Nevertheless, not one Texas bank had a Texas ratio greater than 100 percent as of the first quarter and only one bank had failed as of March.

The bottom line: The persistence of low oil prices seems to matter more for banks than the magnitude of falling prices. A precipitous, but short-lived, decline is likely to have only a minor impact on the banking industry. Even a longer-term decline similar to that seen in the 1980s is unlikely to provoke the same scope of disruption now as it did then.

…Mitigating factors also make Texas banks better able to weather falling oil prices. Memories of the 1980s crisis linger, and the 2008–09 financial crisis is also fresh in the minds of bankers and regulators. Apart from regulatory changes, Texas bankers manage their risks more prudently, using better risk diversification. The Shared National Credit (SNC) program is one example. Generally, large loans are held by multiple institutions through the SNC program, allowing individual institutions to spread the risk of large credit exposures. While the SNC program has been around since 1977, it has grown in importance and coverage. SNC industry trends by sector show that commodities credits, including those tied to the oil and gas industry, increased from $395 billion in 2002 to $798 billion in 2014. Regulatory filings and investor conference calls suggest that energy exposure at the larger banks in Texas is now predominantly through these shared credits.

…The low-interest-rate environment and a flat yield curve with relatively little difference in interest rates across various maturities have pressured bank earnings over the past five years. Banks have responded by extending their maturity profile in an attempt to generate more robust returns. As interest rates normalize, regulators will need to monitor banks’ ability to restructure their maturity profiles and adapt to the new environment.

The impact of recent oil price declines on banks also bears watching, particularly in Texas. While banks appear to be managing their energy exposure well—and a relatively short spell of low energy prices is not expected to have a severe, adverse effect on local banks—the importance of energy in certain regions points to the possibility of relatively large localized disruptions. The banking system has navigated a post crisis path to recovery. Conditions have improved markedly, but the industry must remain vigilant to potential risks to its financial health and stability.

According to the Dallas Fed – Texas Economic Indicators – published on 4th June, the region is showing mixed performance:-

| Region | Employment Growth |

| Austin | 7.70% |

| Dallas | 2.20% |

| El Paso | 3.30% |

| Houston | 0% |

| San Antonio | -0.50% |

| Southern New Mexico | -0.90% |

Source: Dallas Federal Reserve

For the state as a whole, April employment was 1% higher versus the US +1.9%. The largest fall was seen in Oil and Gas Extraction (-14.4%) followed by Manufacturing (-4%) and Construction (-2.6%). Leisure and Hospitality led employment increases (5.3%) Information (4.6%) Education and Health (2.6%) and Trade, Transportation and Utilities (2.3%).

The importance of Oil and Gas to Texas, from an employment perspective, is small– only 2.5% of the workforce – but the sector’s impact on the rest of the region’s economy is much greater. Many ancillary sectors, including manufacturing, banking and finance rely on energy. The most encouraging aspect of the data above is the 2.3% increase in Trades, Transportation and Utilities. As an employer this sector amounts to 20.2% of the total. For this sector, lower energy prices are like the tax cut John Mauldin alluded back in December.

The Energy Complex and US growth

The recent energy technology boom has increased the oil and gas sector’s importance – please revisit Manhattan Institute – New Technology for Old Fuels – my personal favourite essay on this subject. The share of oil and gas in total employment peaked in the early 1980s at 0.8% it’s now back to 0.5%. Its share of GDP followed a similar path, falling from 4% in the 1980’s to less than 1% at the start of the millennium; it’s now back around 2%. Energy self-sufficiency remains elusive – the US is still a net oil importer and therefore benefits from lower oil prices. The Energy Information Administration (EIA) estimates a $700 per household saving from the decline in gasoline prices in 2015. This should also spur an increase in capital investment. The traditional estimate of a halving of output has increased dramatically; meanwhile energy efficiency has significantly improved. The fall from $105 to $60 – assuming the market remains around the current level – will probably add 0.4% to GDP.

As one might expect, the direct impact of cheaper oil on the energy sector has been negative. The US rig count fell by 850 between December 2014 and March 2015. Many energy exploration firms have reduced headcount and cut capital expenditure. I don’t believe the benefits of technology have been exhausted by the energy exploration firms, especially the shale-industry. The Manhattan Institute – Shale 2.0 – takes up the story and go on to make some policy recommendations:-

John Shaw, chair of Harvard’s Earth and Planetary Sciences Department, recently observed: “It’s fair to say we’re not at the end of this [shale] era, we’re at the very beginning.” He is precisely correct. In recent years, the technology deployed in America’s shale fields has advanced more rapidly than in any other segment of the energy industry. Shale 2.0 promises to ultimately yield break-even costs of $5–$20 per barrel—in the same range as Saudi Arabia’s vaunted low-cost fields.

The shale industry is unlike any other conventional hydrocarbon or alternative energy sector, in that it shares a growth trajectory far more similar to that of Silicon Valley’s tech firms. In less than a decade, U.S. shale oil revenues have soared, from nearly zero to more than $70 billion annually (even after accounting for the recent price plunge). Such growth is 600 percent greater than that experienced by America’s heavily subsidized solar industry over the same period.

Shale’s spectacular rise is also generating massive quantities of data: the $600 billion in U.S. shale infrastructure investments and the nearly 2,000 million well-feet drilled have produced hundreds of petabytes of relevant data. This vast, diverse shale data domain—comparable in scale with the global digital health care data domain—remains largely untapped and is ripe to be mined by emerging big-data analytics.

Shale 2.0 will thus be data-driven. It will be centered in the United States. And it will be one in which entrepreneurs, especially those skilled in analytics, will create vast wealth and further disrupt oil geopolitics. The transition to Shale 2.0 will take the following steps: 1.Oil from Shale 1.0 will be sold from the oversupply currently filling up storage tanks. 2. More oil will be unleashed from the surplus of shale wells already drilled but not in production. 3. Companies will “high-grade” shale assets, replacing older techniques with the newest, most productive technologies in the richest parts of the fields. 4. And as the shale industry begins to embrace big-data analytics, Shale 2.0 begins.

Further, if the U.S. is to fully reap the economic and geopolitical benefits of Shale 2.0, Congress and the administration should: 1. Remove the old, no longer relevant, rules prohibiting American companies from selling crude oil overseas. 2. Remove constraints, established by the 1920 Merchant Marine Act, on transporting domestic hydrocarbons by ship. 3. Avoid inflicting further regulatory hurdles on an already heavily regulated industry. 4. Open up and accelerate access to exploration and production on federally controlled lands.

Nonetheless, in the near-term, states which benefitted from $100+ crude oil and the energy related innovations it spawned, are now feeling the effects of what appears to be a sustained period of lower energy prices. The EIA predicts WTI crude will average $60 over the course of 2015.

The CFR – Energy Brief – October 2013 – predicted that a 50% oil price fall would affect the employment prospects of eight states in particular:-

| State | Fall in Employment |

| Alaska | -1.70% |

| Louisiana | -1.60% |

| North Dakota | -2% |

| New Mexico | -0.70% |

| Oklahoma | -2.30% |

| Texas | -1.20% |

| West Virginia | -0.70% |

| Wyoming | -4.30% |

Source: Council for Foreign Relations

So far, if Texas is any guide, the negative effects of the oil price decline have failed to materialise.

The effect of a 25% rise in crude oil prices is also worth considering:-

| State | Employment Change | State | Employment Change |

| Wisconsin | -0.74 | Ohio | -0.61 |

| Minnesota | -0.73 | Missouri | -0.6 |

| Tennessee | -0.72 | Illinois | -0.59 |

| Rhode Island | -0.71 | Massachusetts | -0.59 |

| Florida | -0.71 | Delaware | -0.58 |

| New Hampshire | -0.7 | South Dakota | -0.57 |

| Idaho | -0.69 | New York | -0.57 |

| Nevada | -0.69 | California | -0.56 |

| Arizona | -0.68 | Alabama | -0.56 |

| Indiana | -0.68 | DC | -0.5 |

| Nebraska | -0.67 | Kentucky | -0.48 |

| Vermont | -0.66 | Pennsylvania | -0.47 |

| Iowa | -0.66 | Utah | -0.38 |

| New Jersey | -0.65 | Kansas | -0.35 |

| Washington | -0.64 | Mississippi | -0.35 |

| Maryland | -0.64 | Arkansas | -0.34 |

| Georgia | -0.64 | Montana | -0.31 |

| Michigan | -0.64 | Colorado | -0.15 |

| Virginia | -0.64 | New Mexico | 0.36 |

| South Carolina | -0.64 | West Virginia | 0.36 |

| Oregon | -0.64 | Texas | 0.6 |

| Connecticut | -0.63 | Louisiana | 0.78 |

| Maine | -0.62 | Alaska | 0.87 |

| North Carolina | -0.62 | North Dakota | 1.01 |

| Hawaii | -0.61 | Oklahoma | 1.16 |

| Wyoming | 2.14 |

Sources: CFR, U.S. Bureau of Labor Statistics and the Wall Street Journal

The effect on the US as a whole is estimated at -0.43%. In other words, a fall in crude oil is good for employment and should also act as a cathartic stimulus to GDP growth.

A final measure of the vulnerability of the US economy to the recent oil price decline is shown by the next table. This shows the substantial diversification away from the energy sector seen in every one of the major oil producing states since the 1980’s:-

| Share of Oil and Gas Extraction as a % of GDP | |||

| 1981 | 2000 | 2010 | |

| Alaska | 49.5 | 15.1 | 19.1 |

| Louisiana | 35.5 | 11.1 | 9.7 |

| New Mexico | 26.1 | 5.2 | 5.1 |

| North Dakota | 20.3 | 0.9 | 4.3 |

| Oklahoma | 21.6 | 4.8 | 9.1 |

| Texas | 19.1 | 5.8 | 7.8 |

| West Virginia | 2.4 | 1 | 1.5 |

| Wyoming | 37.1 | 9.8 | 18.5 |

Source: CFR, U.S. Bureau of Economic Analysis

Looking at how unemployment has changed across the 51 states over the last 12 months:-

| State | April | April | 12-month net change |

| 2014 | 2015 | ||

| Alabama | 7.1 | 5.8 | -1.3 |

| Alaska | 6.9 | 6.7 | -0.2 |

| Arizona | 6.9 | 6 | -0.9 |

| Arkansas | 6.3 | 5.7 | -0.6 |

| California | 7.8 | 6.3 | -1.5 |

| Colorado | 5.4 | 4.2 | -1.2 |

| Connecticut | 6.8 | 6.3 | -0.5 |

| Delaware | 5.9 | 4.5 | -1.4 |

| DC | 7.8 | 7.5 | -0.3 |

| Florida | 6.4 | 5.6 | -0.8 |

| Georgia | 7.3 | 6.3 | -1 |

| Hawaii | 4.5 | 4.1 | -0.4 |

| Idaho | 4.9 | 3.8 | -1.1 |

| Illinois | 7.4 | 6 | -1.4 |

| Indiana | 6 | 5.4 | -0.6 |

| Iowa | 4.4 | 3.8 | -0.6 |

| Kansas | 4.5 | 4.3 | -0.2 |

| Kentucky | 7 | 5 | -2 |

| Louisiana | 5.7 | 6.6 | 0.9 |

| Maine | 5.8 | 4.7 | -1.1 |

| Maryland | 5.9 | 5.3 | -0.6 |

| Massachusetts | 5.8 | 4.7 | -1.1 |

| Michigan | 7.5 | 5.4 | -2.1 |

| Minnesota | 4.2 | 3.7 | -0.5 |

| Mississippi | 7.8 | 6.6 | -1.2 |

| Missouri | 6.3 | 5.7 | -0.6 |

| Montana | 4.7 | 4 | -0.7 |

| Nebraska | 3.4 | 2.5 | -0.9 |

| Nevada | 8.1 | 7.1 | -1 |

| New Hampshire | 4.5 | 3.8 | -0.7 |

| New Jersey | 6.7 | 6.5 | -0.2 |

| New Mexico | 6.7 | 6.2 | -0.5 |

| New York | 6.5 | 5.7 | -0.8 |

| North Carolina | 6.4 | 5.5 | -0.9 |

| North Dakota | 2.7 | 3.1 | 0.4 |

| Ohio | 5.9 | 5.2 | -0.7 |

| Oklahoma | 4.7 | 4.1 | -0.6 |

| Oregon | 7 | 5.2 | -1.8 |

| Pennsylvania | 6 | 5.3 | -0.7 |

| Rhode Island | 8.1 | 6.1 | -2 |

| South Carolina | 6.1 | 6.7 | 0.6 |

| South Dakota | 3.4 | 3.6 | 0.2 |

| Tennessee | 6.5 | 6 | -0.5 |

| Texas | 5.2 | 4.2 | -1 |

| Utah | 3.8 | 3.4 | -0.4 |

| Vermont | 4 | 3.6 | -0.4 |

| Virginia | 5.3 | 4.8 | -0.5 |

| Washington | 6.2 | 5.5 | -0.7 |

| West Virginia | 6.8 | 7 | 0.2 |

| Wisconsin | 5.5 | 4.4 | -1.1 |

| Wyoming | 4.3 | 4.1 | -0.2 |

Source: Bureau of Labor Statistics

Only Louisiana (+0.9%) North Dakota (+0.4%) and West Virginia (+0.2%) of the top oil producing states, have witnessed increased levels of unemployment. South Dakota (+0.2%) and South Carolina (+0.6%) were the only other states in the union to see unemployment rise. This is not the picture of a faltering economy.

The Federal Reserve Leading Index, whilst it hit a low point of +0.9% in January – down from +2% in July 2014 – has rebounded – April +1.12% – and has remained in positive territory since August 2009. The Conference Board Leading Economic Index increased 0.7% in April to 122.3, following a +0.4% in March, and a -0.2% February. The Conference Board commented:-

April’s sharp increase in the LEI seems to have helped stabilize its slowing trend, suggesting the paltry economic growth in the first quarter may be temporary. However, the growth of the LEI does not support a significant strengthening in the economic outlook at this time. The improvement in building permits helped to drive the index up this month, but gains in other components, in particular the financial indicators, have been somewhat more muted.

The outlook appears steady rather than robust but this has been the pattern of the economic recovery ever since the first round of quantitative easing (QE) in November 2008.

Conclusion and Equity Investment Opportunities

The US economic recovery remains intact. The long run economic benefits of structurally lower energy prices and energy security are slowly feeding through to the wider economy. This is good for the US and, as long as the US continues to run a trade deficit with the rest of the world, it’s good for the US main trading partners too.

After a sharp correction in October 2014 the S&P500 recovered. Since its January lows the market has ground slowly higher:-

Source: Barchart.com

The table below shows a series of additional valuation measures:-

| Indicator | Ratio | Date | Start of Data |

| Trailing 12 month P/E | 20.53 | ||

| Mean | 15.54 | ||

| Min | 5.31 | Dec 1917 | |

| Max | 123.73 | May 2009 | 1875 |

| Shiller Case P/E | 27.1 | ||

| Mean | 16.61 | ||

| Min | 4.78 | Dec 1920 | |

| Max | 44.19 | Dec 1999 | 1885 |

| Price to Sales | 1.81 | ||

| Mean | 1.4 | ||

| Min | 0.8 | Mar 2009 | |

| Max | 1.81 | Jun 2015 | 2001 |

| Price to Book | 2.89 | ||

| Mean | 2.75 | ||

| Min | 1.78 | Mar 2009 | |

| Max | 5.06 | Mar 2000 | 2000 |

Source: multpl.com

On most of these metrics the market looks relatively expensive but the current level of interest rates is unprecedented. JP Morgan Asset Management predict average corporate earnings to grow by 4% in 2015 – stripping out energy stocks this rises to 11%. They also remind investors that the S&P has seen 10 bear markets since 1926. Eight occurred as a result of economic recessions or commodity price shocks (price increases not decreases) and extreme valuations were a contributing factor only on four occasions. They go on to refute the idea that interest rate increases by the Federal Reserve will derail the bull market, pointing to the positive correlation between rising interest rates and rising equity prices when interest rates start from a low point. They make the caveat that the initial reaction to interest rate increases is negative but in the longer term stocks tend to rise.

At the risk of uttering that most dangerous of phrases – “this time it’s different” – I believe the majority of the rise in equity prices was a function of the reduction in the level of interest rates since 2008. This had two effects; investors switched from interest bearing securities to equities, hoping that capital appreciation would offset the declining income from bonds: and corporations, faced with negative real interest rates, decided to raise dividends and buy back stock, rather than make capital investments when interest rates were artificially low. The chart below shows US 10yr Government Bond yields since 1790:-

Source: Global Financial Data

The chart ends in 2013, since when yields have plumbed new depths. Ignoring the inflation shock of the 1970’s and 1980’s it would be reasonable to expect US Treasuries to yield around 3% but that was before the Federal Reserve moved from a stable price target – i.e. around zero – to a 2% inflation target. I think it is reasonable for corporates to assume a long-term cost of finance based on a 3% real yield for US Treasuries plus an appropriate credit spread. Is it any wonder that corporates continue to buy back stock?

The impact of the oil price collapse is still feeding through the US economy but, since the most vulnerable states have learnt the lessons of the 1980’s and diversified away from an excessive reliance of on the energy sector, the short-run downturn will be muted whilst the long-run benefits of new technology will be transformative. US oil production at $10/barrel would have sounded ludicrous less than five years ago: today it seems almost plausible.

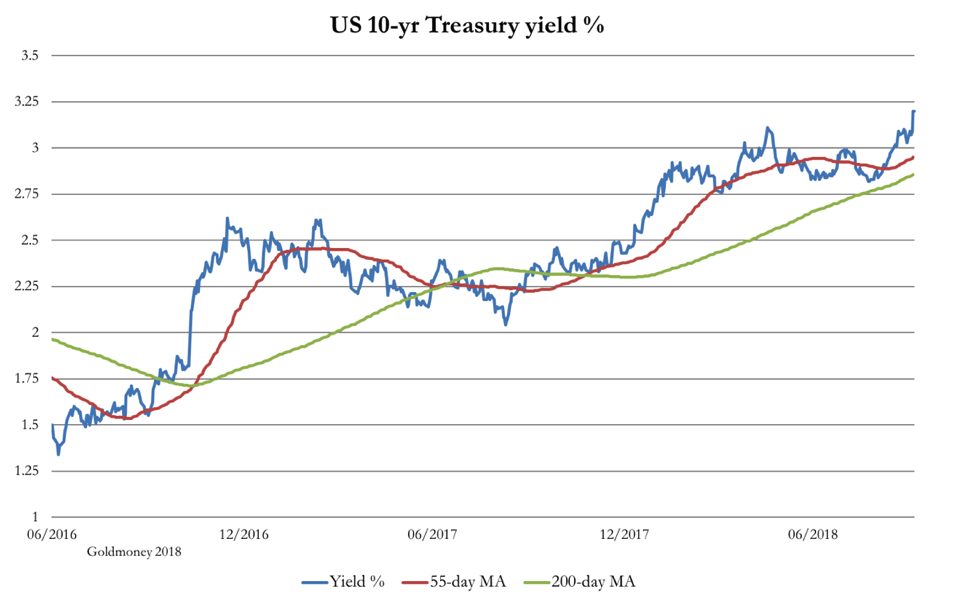

US stocks are not cheap, but Q1 earnings declines have been reversed and, whilst growth is muted, the longer term benefits of lower energy prices are just beginning to feed through. At the beginning of the year I was cautious and considering reducing exposure to the US market. Now, I am still cautious, but, if earnings start to improve, today’s valuations will prove justified and further upside may be well ensue. The US bond market is doing the Fed’s work for it – 10yr yields have risen from a low of 1.64% in January to 2.30% today. Whilst the first rise in official rates is likely to act as a negative for stocks, the market will recover as long as the momentum of earnings growth remains positive and energy prices remain subdued.