Over the last couple of years we have been tracking the various bail-out schemes concocted by ingenious Eurocrats. It is truly fascinating to observe these people get entangled in one lie after another; always trying to resolve the old lie with a new one. The hard cold truth is of course that Europe is bankrupt! They cannot repay what they owe and they cannot maintain a level of consumption that for most are far higher than production. A deep-seated fundamental restructuring is long over-due, but the Eurocrats have an uncanny ability to kick the proverbial can. Our main concern today is what they will do when they run out of road. But that is a discussion for another time.

The road of course ends when there is no more real capital to leverage. We see signs of this already! In the meantime, every time our Eurocrats need to circumvent self-imposed rules or see the same signs as we do, a new destructive program, or bazooka, is launched to save Europe.

We will take you through all of these schemes in order to make a small, but important, contribution to educate our readers about the utter destructiveness the European elite is prepared to go through in order to maintain status quo!

We will try to keep a chronological order, but often it will be impossible as these arrangements run in parallel or have become too intertwined to really be easily separated. Some plans are just that, deliberate plans while others stem from poor designs in the euro-system that ended up as far larger bail-outs than the ones contrived by Eurocrats.

Before we start our exercise in European folly it is important for the reader to understand certain concepts crucial to modern economies.

First of all, the ultimate measure all tend look to when assessing the overall health of an economic system, namely gross domestic production (GDP) does not measure production at all. It measures the broadest level of monetary inflation possible. It takes into account the monetary base as given by the central bank and on top of that total commercial banking leverage. In addition, it account for overall velocity. GDP thus measure the level of excess the government can allow itself. It measures the relative debt share and it measures the amount of deficits any given government can maintain through inflation.

Secondly, as implied by our GDP discussion, it also provides a direct link between overall banking leverage and “growth”. In other words, unless the banking system is healthy enough to maintain a constant level of credit inflation GDP growth will come to a halt. It is imperative for the government to make sure the banking system is free to inflate because they will both rise and fall together. Any bail out of states is bail out of banks; any bail out of banks is bail out of states. Realize this, and everything else falls into place.

- European Central Bank (ECB)

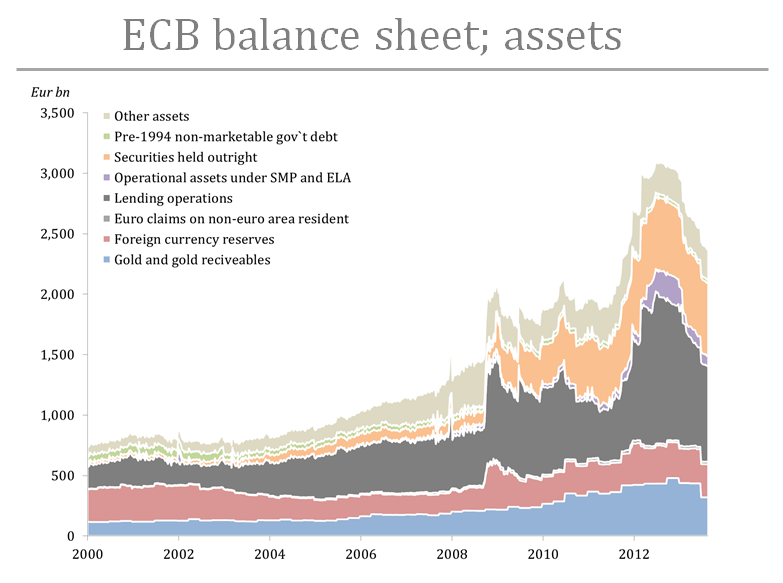

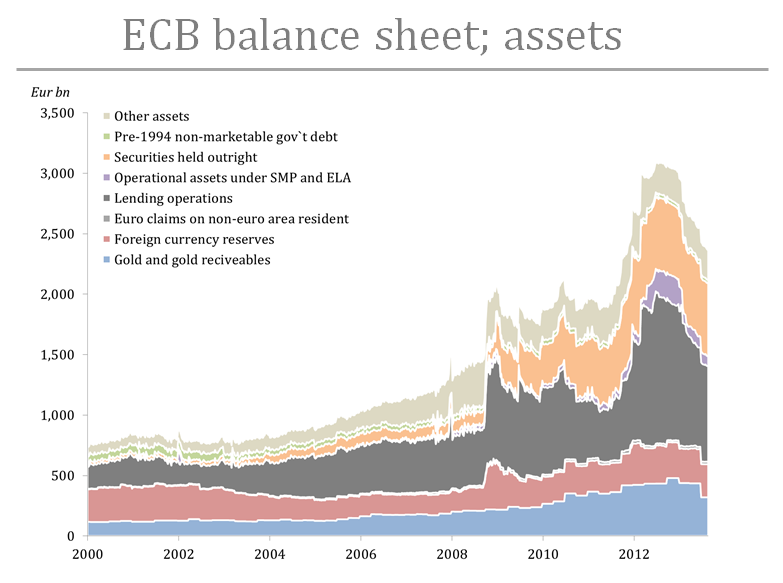

A cursory look at the ECB balance sheet immediately explode the myth that the ECB has been dragging its feet while the “enlightened” central banks of the US, Great Britain and Japan has saved the world. From its low in 2006 the ECB expanded its balance sheet by over €2 trillion to its peak in the summer of 2012.

This is nothing short of a massive monetization of encumbered legacy assets stemming from the heydays of bubble folly. Instead of writing down the assets, take the losses and move on, the ECB has facilitated the transformation of said assets into money proper by lending freely against them.

Source: European Central Bank (ECB)

1.1. Foreign currency SWAP line

In order to address money markets tensions in the euro area the ECB, along with Bank of Canada, Swiss National Bank, Bank of Japan and Bank of England, went into dollar swap lines. The first swap line was established in December 2007. Since European banks could not access short term dollar loans in order to fund their USD-denominated assets, the ECB stepped in as a middleman and provided the dollars to them.

1.2. Enhanced credit support: Fixed rate tender procedures with full allotment

As opposed to the common central bank procedure of conducting open market operations by buying financial securities outright, the ECB lends money into existence. Fearing the ECB would turn into a fiscal conduit for the various states, euro creation takes a detour through a collateral pledging banking system.

To avoid monetization of every single government bond or asset-backed security, the ECB operated on an auction basis. In other words, banks pledged collateral and bid on ECB liquidity. But, as the financial crisis escalated, every unencumbered asset the banking industry could come up with had to be used for central bank access. With money markets- and interbank lending frozen, a desperate scramble for ECB liquidity ensued.

Obviously, this put pressure on the main refinancing rate and pushed banks over to the marginal lending facility, which lends at a penalty rate. This comes with the stigma and financial cost that helped pull the rug under weak banks in the first place.

It did not take long before the ECB scrapped its old practice, and has since the early start of the crisis provided full allotment at a fixed rate for every unencumbered asset that is accepted for ECB refinancing.

Obviously, full allotment at the main refinancing operation rendered the marginal lending facility useless. Historically, central banks were supposed to be passive and re-act to situations that arose. In order for solvent institutions to continue operations, the central bank was supposed to lend against good collateral at a penalty rate. The marginal lending facility is an overnight lending scheme that charges a premium interest rate. If a bank could not secure enough liquidity by bidding in the weekly main refinancing operation, then the marginal lending facility would always stand ready to a solvent bank.

1.3. Suspension of credit rating thresholds

For many of the really troubled banks it did not take long until the pool of unencumbered assets were all pledged for ECB liquidity. Even worse, the quality of assets that had once been regarded unencumbered, such as sovereign issued bonds, deteriorated rapidly. As an extension of this, the old practice of issuing asset backed securities with a state guarantee also came to a halt. Banks were facing a margin call that would bring down the whole edifice. If, say, a Greek government bond failed the ECB standard, banks had to either repay the loan in hard cash or come up with collateral that did meet ECB standards.

For the money masters of Europe, the situation was untenable. It did not take long before old credit rating standards were scrapped. First in May 2010 for Greek sovereign- and sovereign guaranteed bonds. Then in May 2011 for Portuguese bonds and again in July 2011 for Irish bonds.

At first sign of tension, the ECB started to monetize assets it only months before would regard as unworthy for liquidity operations!

1.4. Direct intervention in order to manipulate asset valuations

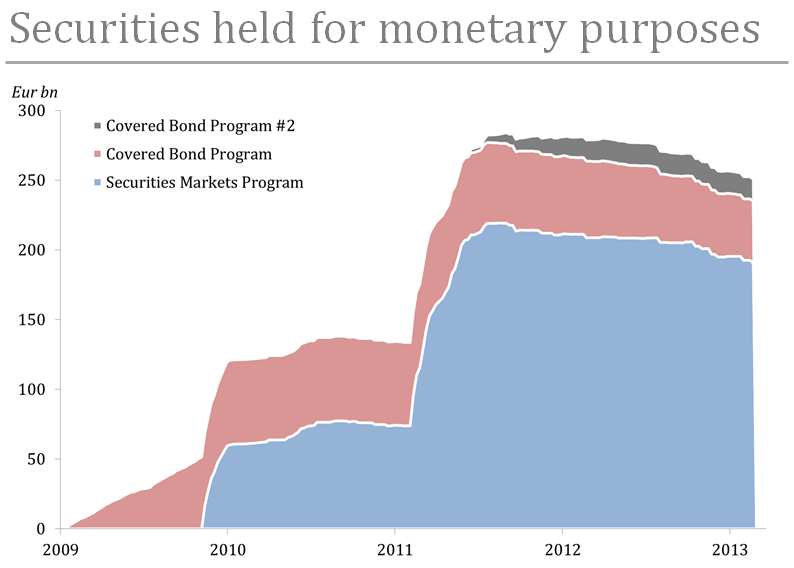

In May 2010 the ECB, under the auspice of Chairman Trichet, bought government bonds directly in the secondary market in order to push up prices. The Securities Market Program (SMP) as it was dubbed was in clear breach of the ECB tradition of refraining from outright market purchases. Chairman of the Bundesbank, Mr. Weber, resigned his position in protest. However, prior to the SMP the ECB had already started to buy covered bonds directly on the market place.

While the program never reached massive volumes, remember trillions are the new billions, it pushed the limits for what the ECB could allow itself.

Source: European Central Bank (ECB)

With banks forced to mark-to-market, the SMP obviously helped window-dress balance sheets.

In terms of improving investor confidence, the main problem with this, and as we shall see later on also with several other bail-out programs, was subordination. The more securities that ended up on official hands the larger the relative write down a private investor would have to take in case of default.

Perversely, as long as private investors were active in the market place, any act by the ECB or other official involvement only led to higher interest rates as the risk premium on remaining private sector holdings rose.

1.5. Emergency Liquidity Assistance (ELA)

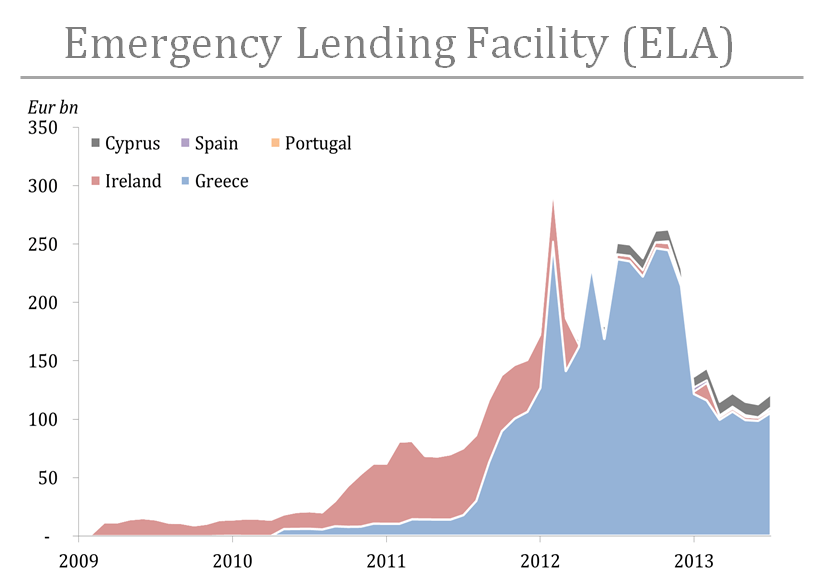

As the ECB felt forced to take on ever more credit risk, some conservative and powerful national central banks (NCBs), like the German Bundesbank, became reluctant. The siren song of debt monetization without regard for underlying credit risk became a compelling way out of the mess for many troubled nations. The Bundesbank did not want more risk-sharing for legacy assets.

Quite a conundrum for our money masters presented itself; either they disregard the Bundesbank and with it much of their credibility or they let the banking system sink.

Luckily for them the statutes of the European System of Central Banks and of the European Central Banks states in article 14.4 that

“National central banks may perform functions other than those specified in this Statute unless the Governing Council finds by majority of two thirds of the votes cast, that these interfere with the objectives and task for ESCB. Such functions shall be performed on the responsibility and liability of national central banks and shall not be regarded as being part of the functions of the ESCB.

In other words, as long as the governing council of the ECB does not vote no, the NCB can do whatever it wants as long as it is ready to bear that burden itself.

From this springs what is commonly referred to as emergency lending. When the national banking system has pledged all eligible collateral within the European system of central banks, the national central bank can extend lending at even lower credit standards.

Source: Banco de España, Central Bank of Cyprus, Banco de Portugal, Central Bank of Ireland, Bank of Greece, own calculations, *estimates provided by Bawerk.net

For Ireland where banks held large pools of underperforming mortgages and in Greece where banks exposure to defaulting government bonds, the emergency lending facility became tantamount to holding a rotten and dying banking system alive.

1.6. Issuing state guarantees on bank bonds to enhance credit rating

Notwithstanding the loophole called ELA, the ECB has lowered rating standards even further. More specifically, on September 6 2012 the ECB decided on “additional measures to preserve collateral availability for counterparties to maintain their access to the Eurosystem`s liquidity-providing operations.”

The press release goes on and states that the ECB has decided to “suspend… …minimum credit rating thresholds in the collateral eligibility requirements for the purpose of the Eurosystem`s credit operations in the case of marketable debt instruments issued or guaranteed by the central government…”

In plain English, it means European banks can pool all sorts of outstanding loans of dubious quality into one single “marketable debt instrument” get the government to sign a guarantee and pledge the bond as collateral at the ECB!

To our knowledge, a delinquent loan does not improve its quality by being pooled by other delinquent loans. And it certainly does not help the quality of the asset that a bankrupt sovereign signs a piece of paper where they “guarantee” the bond!

We know that, the ECB knows that, the banks know that and maybe even the government officials know it, but it has become necessary for the ECB to circumvent their own rules to keep the banks afloat.

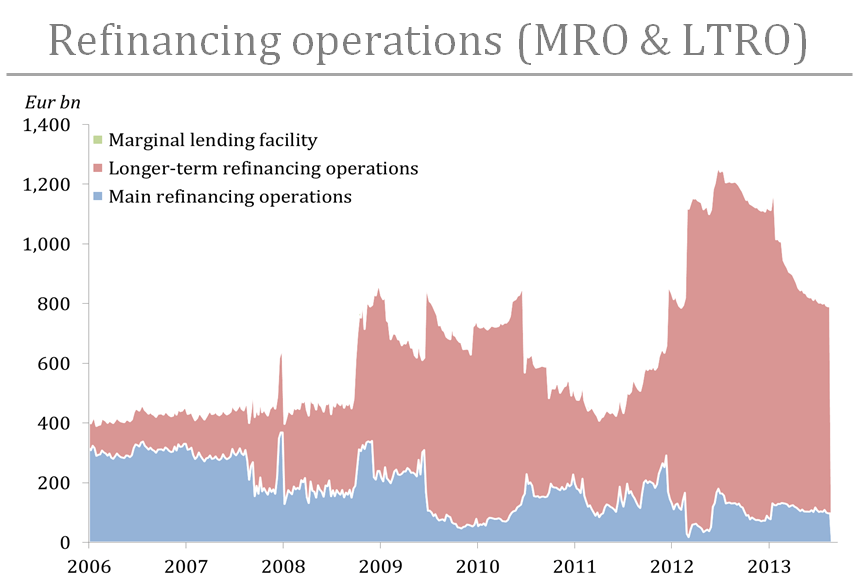

1.4. Long term refinancing operations (LTRO)

As outlined in chapter 1.2, the ECB quickly opened up for full allotment in the main refinancing operations, but with maturities stretching only one week, it was thought banks found it hard to plan accordingly. What if the ECB would one day end the full allotment? A liquidity squeeze would immediately ensue.

It is true that the ECB has also a standing long term refinancing facility available with maturities up to three months. However, the maturity is still relatively short and the facility was traditionally not a means to conduct interest rate policy. In other words, the ECB would not use the long-term facility to manage interest rates.

In order to end uncertainty in the bank funding market, the ECB with the newly appointed leader Mario Draghi announced they would conduct three-year LTRO`s with fixed rates.

The response was almost overwhelming as the LTRO facility rose to more than €1.1 trillion during two operations in December 2011 and March 2012.

Source: European Central Bank (ECB)

1.5. Outright market transactions (OMT)

Despite all the unconventional measures taken by the ECB to paper over reality it is hard to escape the inevitable fact that European nations was and is bankrupt. Yield spreads on peripheral bonds continued it relentless rise until July 26 2012 when Chairman of the Governing Council, Mario Draghi utter three words in a speech held at the Global Investment Conference in London:

“…whatever it takes”

From that very moment yield spreads came in and has done so ever since. Capital flight was reversed on the lure of investing in high yielding Spanish bonds with a free and explicitly announced put-option from the ECB.

One week later Draghi formally announced a program that would buy unlimited amounts of sovereign bonds in the secondary market for every country that signed up for the precautionary ESM-program (more on this below).

Attaching conditionality to the OMT made it part of a fiscal program and hence outside the ECB mandate. From now on, the ECB cannot act unless fiscal authorities oblige to certain preconditions.

To no surprise, the OMT is currently being scrutinized by the German constitutional court in Karlsruhe.

From an investor point of view, the second most important aspect of the OMT, beside the free put it provides, is the fact that all OMT purchases will be treated “pari passu” in case of default.

In short, the OMT is unlimited and pari passu. A bet with no downside to every investor with access to the sovereign bond market!

Source: Bloomberg

1.6. Putting it all together – the full ECB bail-out of Europe

The schematic below is an attempt at putting all the ECB bail-out facilities into one single coherent money making machine (in the literal sense of the word). While it may look a bit messy at first sight, it is actually an extremely simple form of debt monetization.

- The banking system is allowed to pool securitize into “marketable” bonds which will receive a “guarantee” from the sovereign state. As the ECB accepts all sovereign guarantees the new marketable bonds are almost money good.

- The bonds can be pledged as collateral at the national central bank, which in turns receive the right to manufacture euros from the centralized central bank

- The national central bank provide euro liquidity (and dollar through the swap line if needed) to the banking system.

- As a gratitude for the state guarantee, the banking sector will buy government bonds for the euros received from the NCB

- That said the banks are obviously not reluctant to buy these bonds since the OMT put provided by the ECB guarantees the price through an implicit yield ceiling.

- In this elaborate scheme developed since the crises erupted the ECB is bailing out both banks and sovereigns by allowing monetization of increasingly dubious assets.

Source: Bawerk.net

1.7. Concluding remarks

The ECB, through its widespread reach and market manipulations has succeeded in maintaining European capital consumption. While it “buys time” it does not hide the simple fact that Europe is getting poorer by the day as the ECB continues to operate.

If it were not for the ECB the long term gain would far outweigh the short term pain we would have to endure.

Next update will look at the Target2 system.