The Fed will never succeed in its attempt to manage inflation and unemployment by varying interest rates, because it and its economists do not accept the relationship between, on one side, the money it creates and the bank credit its commercial banks issue out of thin air, and on the other the disruption unsound money causes in the economy. This has been going on since the Fed was created, which makes the question as to whether the Fed was right to raise interest rates recently irrelevant.

Furthermore, it’s not just the American people who are affected the Fed’s monetary management, because the Fed’s actions affect nearly everyone on the planet. The Fed does not even admit to having this wider responsibility, except to the extent that it might have an impact on the US economy.

That the Fed thinks it is only responsible to the American people for its actions when they affect all nations is an abrogation of its duty as issuer of the reserve currency to the rest of the world, and it is therefore not surprising that the new kids on the block, such as China, Russia and their Asian friends, are laying plans to gain independence from the dollar-dominated system. The absence of comment from other central banks in the advanced nations on this important subject should also worry us, because they appear to be acting as mute supporters for the Fed’s group-think.

This is the context in which we need to clarify the effects of the Fed’s monetary policy. The fundamental question is actually far broader than whether or not the Fed should be raising rates: rather, should the Fed be managing interest rates at all? Before we can answer this question, we have to understand the relationship between credit and the business cycle.

There are two types of economic activity, one that correctly anticipates consumer demand and is successful, and one that fails to do so. In free markets the failures are closed down quickly, and the scarce economic resources tied up in them are redeployed towards more successful activities. A sound-money economy quickly eliminates business errors, so this self-cleansing action ensures there is no build-up of malinvestments and the associated debt that goes with it.

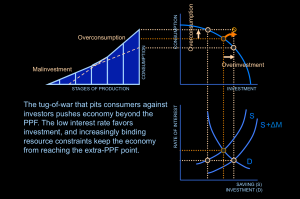

When there is stimulus from monetary inflation, it is inevitable that the strict discipline of genuine profitability that should guide all commercial enterprises takes a back seat. Easy money and interest rates lowered to stimulate demand distort perceptions of risk, over-values financial assets, and encourages businesses to take on projects that are not genuinely profitable. Furthermore, the owners of failing businesses find it possible to run up more debts, rather than face commercial reality. The result is a growing accumulation of malinvestments whose liquidation is deferred into the future.

Besides the disruption to healthy business development, monetary inflation also transfers wealth from the owners of the existing money stock into the hands of the initial beneficiaries of extra money and credit. The transfer of wealth is predominantly from savers and wage earners in the non-financial part of the economy, reducing their ability to spend. The beneficiaries of this wealth transfer are the banks and their favoured borrowers, for whom the credit has been created. How it is that destroying widespread ownership of wealth is meant to provide meaningful, lasting improvement to an economy is a mystery never properly explained.

Monetary inflation not only encourages malinvestment, but by destroying the purchasing power of savings it encourages consumers to turn from being savers into borrowers. They have learned that money no longer retains its value. The madness of weak-money policies becomes even more clear when one contrasts empirical evidence of the post-war success of Germany’s economy, which was rebuilt on the accumulation of savings, compared with the failure of the other European economies that tried unsuccessfully to inflate their way to prosperity.

Eventually, the tendency for monetary inflation to undermine the purchasing power of a currency leads to a shift in consumer preferences away from holding cash and bank deposits in favour of accumulating physical goods. This is actually the effect that central banks try to achieve, in the mistaken belief they can control the outcome. However, only a small change in this balance of preferences is enough to trigger a dramatic downward shift in the currency’s purchasing power, raising the rate of price inflation to far higher levels than previously thought likely by the monetary planners. It is the threat, or even the actuality of this development, that always forces the central bank to raise interest rates to the point where the balance of preferences between money and goods is restored. Inevitably, this triggers a crisis where malinvestments and their associated debt threaten to come dramatically unstuck.

One would have thought it blindingly obvious that the boom and the bust are two sides of the same coin. In other words, if the artificial boom had not been created by monetary stimulus, the crisis of a bust could not occur either.

Where are we in the credit cycle?

The last crisis was triggered by the Fed’s increase in the Fed Funds rate in 2006, when it peaked at 5¼% that August. It was held at that level until the following June and reduced sharply thereafter, specifically to stop the unwinding of widespread malinvestments made by industry, investors, and the banks. Interest rates have now been increased this month for the first time since being reduced to the zero bound in December 2008.

We must put ourselves in the Fed’s shoes to try to understand why it has raised rates. It has seen the official unemployment rate decline for a prolonged period, and more recently energy and commodity prices have fallen sharply. Assuming it believes government unemployment figures, as well as the GDP and its deflator, the Fed is likely to think the economy has at least stabilised and is fundamentally healthy. That being the case, it will take the view the business cycle has turned. Note, business cycle, not credit-driven business cycle: the Fed doesn’t accept monetary policy is responsible for cyclical phenomena. Therefore, demand for energy and commodities is expected to increase on a one or two-year view, so inflation can be expected to pick up towards the 2% target, particularly when the falls in commodity and energy prices drop out of the back-end of the inflation numbers. Note again, inflation is thought to be a demand-for-goods phenomenon, not a monetary phenomenon, though according to the Fed, monetary policy can be used to stimulate or control it.

Unfortunately, the evidence from multiple surveys is that after nine years since the Lehman crisis the state of the economy remains suppressed while debt has continued to increase, so this cycle is not in the normal pattern. It is clear from the evidence that the American economy, in common with the European and Japanese, is overburdened by the accumulation of malinvestments and associated debt. Furthermore, nine years of wealth attrition through monetary inflation (as described above) has reduced the purchasing power of the average consumer’s earnings significantly in real terms. So instead of a phase of sustainable growth, it is likely America has arrived at a point where the economy can no longer bear the depredations of further “monetary stimulus”. It is also increasingly clear that a relatively small rise in the general interest rate level will bring on the next crisis.

Therefore, we are on the edge of the bust of the boom-bust credit-driven business cycle, when all historically accumulated malinvestments begin to liquidate. We are already seeing low-quality borrowers facing difficulties in trying to extend their debt. We are already seeing global trade, which is not immune to the Fed’s debt-perpetuation and wealth-transfer policies, contract. We are already seeing the collapse of collateralised loan obligation prices (CLOs) in the low-grade corporate bond market, and the halts called to investor redemptions. If rates for corporate borrowers rise by three or four percent as they have for some recently, you already have a developing debt crisis.

As to whether or not the Fed should be raising rates, it matters not. Instead of the hoped-for gently rising path for interest rates through 2016, it is more than likely this month’s rise will be soon reversed, and a whole new round of “extraordinary measures” introduced. The Fed will probably feel greater confidence it can manage a crisis this time than it did at the time of the Lehman crisis, because despite the rapid expansion in the Fed’s balance sheet, the dollar is stronger today than in 2008. The fear that open-ended monetary intervention deployed to save the banks and large corporations from insolvency would undermine the currency proved to be unjustified.

Yet more extraordinary methods will probably extend to renewed talk of the Taylor rule and even negative interest rates. From the Fed’s narrow point of view, negative interest rates have the virtue of not only transferring wealth by monetary stealth from increasingly impoverished inhabitants of Main Street to those in Wall Street, but it will also rob their bank accounts more directly as well.

For an answer as to why the Fed thinks this will save us all, I have no idea. Ask the Fed.

For those who think the Fed’s actions have any direct impacts on real economy stuff, maybe there’s something here. I doubt it, but maybe.

As the author says,

“”As to whether or not the Fed should be raising rates, it matters not””

The only thing that really matters is bank lending, as it is bank lending that creates all the money. Soooo,

How much bank lending?

What-for bank lending?

And, why not bank lending?

But sometimes, among some libertarian-type thinkers, the propriety and effectiveness of this matter of private banker privilege rises to the fore.

Just in case y’all are that way inclined, why not do an article on the recent paper by Dr. Michael Kumhof of the Bank of England who recently looked a the real macro-economic effects of having the private banks issue money when they lend, or not.

http://www.bankofengland.co.uk/research/documents/workingpapers/2015/wp529.pdf

I call it Loanable Funds Theory – Revisited (From a Public Money Perspective).

Thanks, Cobden.