“The media select, they interpret, they emotionalize and they create facts.. The media not only reduce reality by lowering information density. They focus reality by accumulating information where “actually” none exists.. A typical stock market report looks like this: Stock X increased because.. Index Y crashed due to.. Prices Z continue to rise after.. Most of these explanations are post-hoc rationalizations.. An artificial logic is created, based on a simplistic understanding of the markets, which implies that there are simple explanations for most price movements; that price movements follow rules which then lead to systematic patterns; and of course that the news disseminated by the media decisively contribute to the emergence of price movements.”

– Thomas Schuster, ‘Meta-Communication and Market Dynamics: Reflexive Interactions of Financial Markets and the Mass Media’.

“Who’s afraid of cheap oil ?” asks ‘The Economist’ on its front page this week. Judging by the last fortnight in the stock market, just about everybody is. Forget supply and demand imbalances in the petrochemical market; there is evidently a huge demand for nonsense, because the financial media and a cavalcade of inane commentators have gone into overdrive in order to supply it. Stocks are off because the oil price has collapsed, we are told.

Here is a “lesson” from history. In October 1973, OPEC initiated an oil embargo in response to US involvement in the Yom Kippur War. Within five months, the oil price quadrupled. By the end of 1974, US stocks had fallen by over 45%. The US got off lightly. UK stocks fell by almost 75% during the same period. Oil up, stocks down. Now the oil price is down sharply, and many stock markets are down sharply. Since they fall when the oil price goes up, and when it goes down, perhaps stock markets will also collapse if the oil price goes sideways. Or if it enters some alternative dimension not wholly perceptible by human consciousness.

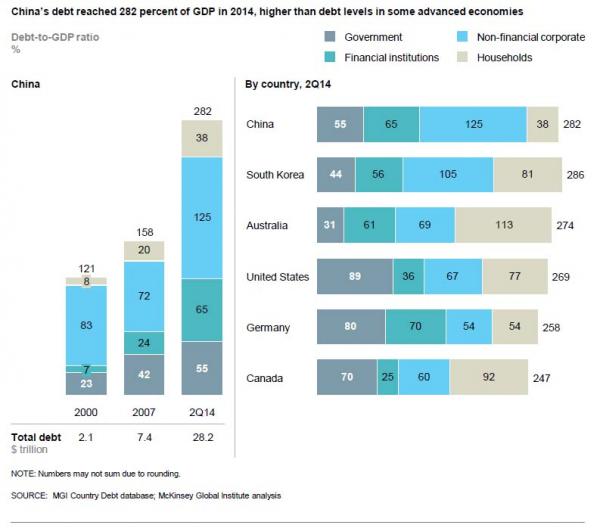

Or perhaps stock markets are complex systems, markets and investors are not entirely rational, and correlation is not the same as causality. In Britain in 1974, the oil shock was compounded by a property and banking crisis. This time round, the “reverse oil shock” has been compounded by clear deterioration in China’s economic prospects, uncertainty over its currency, and the conspicuous overvaluation of many stock markets, aided by years of Quantitative Easing.

Helpfully for the bulls, ECB President Mario Draghi promised the support of “plenty of instruments” on the part of the European Central Bank. By “plenty of instruments”, he probably means: plenty of euros. The money printing will likely continue. Stock market investors, hearing Pavlov’s bell, cheerfully started to salivate, on cue.

More QE is reality (and gravity) deferred. And a new front in the ongoing currency wars. Hold hard assets rather than paper.

Cheaper oil clearly has implications depending on the production and consumption habits of different economies. Oil producers, especially those with hefty foreign borrowings, should rightly be experiencing distress. But for net oil consumers, all things equal, this should be good news. This includes much of Asia, and notably Japan.

It is plausible, however, to see malign effects spreading from rising credit risk and infecting other parts of the global financial system, sub-prime style. Ailing oil producers with foreign debts face the rising likelihood of defaulting. Commercial banks, especially the more stupid ones, are on the other side of that trade. And in Europe, as we pointed out last week, a new bail-in regime happens to be in place. A causal linkage between cheaper oil and cheaper banking stocks is entirely justifiable. US banks, including Goldman Sachs (even after fines for mis-selling mortgage securities) reported better results than expected last week. But Deutsche Bank once again managed to fall off the top of the ugly tree and hit every branch on the way down. There is no obligation whatsoever for investors to own crappy bank stocks beset by rumours of insolvency.

The rather pathetic way in which the market greeted Mario Draghi’s nannyish attempts to make the nasty pain go away indicate that many investors have yet to learn to stand on their own two feet and look after themselves. From our perspective, we don’t seek solace from some paternalistic money-printing bureaucrat who looks like a crow. We try and protect our capital by not consciously overpaying for anything in the first place, be it stocks, bonds or anything else.

But not consciously overpaying is difficult when the great scam of QE looks set to be unleashed even more powerfully in the months to come. (It’s a good job that doctors haven’t discovered QE – all their patients would be dead by now.)

We resolve these various quandaries by, first, diversifying, and then by focusing solely on value from the bottom up.

Rather than speculate (in every sense) about unknowable macro stuff, we prefer to concentrate on hard fundamentals and the here-and-now.

Tony Jackson wrote the following in a piece for the Financial Times in September 2011:

“For as long as I have been around the business, analysis has been tilting away from the here-and-now towards the future. Go back several decades and the primary task of the analyst was to describe a company’s current condition, drawing on such balance-sheet arcana as the quick ratio or the stock turnover ratio. Then the pressure came on to predict the future. First came profit forecasts, then share price predictions. This was resisted initially by some firms, on the grounds that the first was shaky and the second impossible.

“But eventually they had to swallow their principles and get out their crystal balls. While balance-sheet analysis may seem backward-looking, it has real predictive power in times like these. For while it is no guide to future earnings or dividends, it indicates a company’s capacity to resist shocks that we cannot yet specify.”

A company’s capacity to resist shocks that we cannot yet specify. Sounds like a solid approach to stock-picking in January 2016. Whatever happens to the oil price.

What a relief!

An essay that makes sense amid all the total nonsense out there.

But tell me – please- how do I get to buy these resilient stocks?

You may write to me at my email address which is known to this website