In a March paper from the Kansas City Federal Reserve Bank – The Lasting Damage from the Financial Crisis to U.S. Productivity – the authors observe that total factor productivity in the US has not returned to its pre-financial crisis trajectory. They ascribe this to the tightness of credit conditions:-

Our empirical analysis shows the crisis indeed altered this relationship. During normal times, total factor productivity growth fluctuates over the business cycle along with changes in the intensity with which available labor and capital are used; credit conditions are unimportant.

During the crisis, however, distressed credit markets and tighter lending conditions were significant drags on total factor productivity growth. Because productivity’s sensitivity to credit conditions once again diminished after the crisis, the post-crisis easing of credit conditions did not boost productivity growth. As a result, the financial crisis left productivity, and therefore output, on a lower trajectory. Adverse credit conditions appear to have dampened total factor productivity growth by curtailing productivity-boosting innovation during the crisis rather than by hampering the efficient allocation of the economy’s productive resources through reduced creation and destruction of firms and jobs.

The conclusion is a telling indictment on the ability of the mainstream economics profession to unravel the conundrum total factor productivity:-

Our analysis does not explain the slow pace of productivity growth since the crisis, which has been a source of great concern among economists and policymakers. From 2010 to 2014, TFP growth averaged just 0.6 percent per year, well below its average growth rate of 1 percent from 1970 to 2010.

An attempt to counter this deficiency was undertaken by Mauldin Economics – Delta Forceand summed up by this simple equation:-

The Greek letter delta (Δ) is the symbol for change. So the change in GDP is written as:-

ΔGDP = ΔPopulation + ΔProductivity

In other words, GDP growth can be achieved by an increase in the working age population or an increase in productivity. They go on to state that the problem of reduced investment is being exacerbated by low interest rates:-

Rather than encouraging businesses to compete by investing in productive assets and trying to take market share, excessive central bank stimulus encourages businesses to buy their competition and consolidate – which typically results in a reduction in the labor force. When the Federal Reserve makes it cheaper to buy your competition than to compete and cheaper to buy back your shares than to invest in new productivity, is it any wonder that productivity drops?

Mauldin go on to discuss demographics and labour force participation, they conclude:-

This demographic cast iron lid on growth helps explain why the Federal Reserve, ECB, and other central banks seem so powerless. Can they create more workers? Not really.

…What Fed policy is clearly not doing is to encourage businesses to invest in growth. Business loan availability is still a problem in many sectors

…Buyouts help shareholders but not workers, as they typically entail a consolidation of company workforces and a reduction in the number of “duplicated” workers. While this culling may be good for the individual businesses, it is not so good for the overall economy. It circumvents Joseph Schumpeter’s law of creative destruction.

…unless something happens to boost worker productivity dramatically, we’re facing lower world GDP growth for a very long time. Could we act to change that? Yes, but as I look at the political scene today, I wonder where the impetus for change is going to come from, absent a serious crisis.

…Given what we did in the last crisis, it is not clear that we still have that capacity.

For investors, this is reality: developed-world economies are going to grow slower. And companies, whose revenue is essentially a function of the growth of the overall economy, are going to grow slower, too…

The absolute level of debt is another factor which is impeding economic potential. Whilst credit creation in the private sector has been choked by continuous regulatory tightening of leverage rules for financial institutions, the capital requirements for investing in “risk-free” assets – ie. Bankrolling the state – has remained unchanged. Meanwhile the reduction of official interest rates to below the level of inflation has enabled governments around the world to dramatically expand deficit financing.

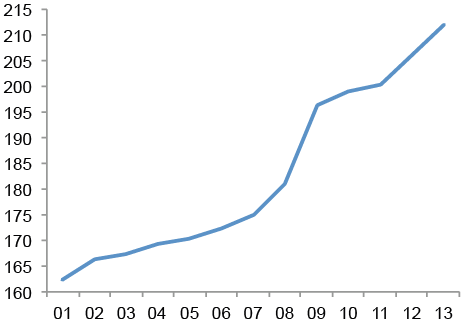

In September 2014 – Buttiglione, Lane, Reichlin and Reinhart produced the 16th Geneva Report on the World Economy – Deleveraging, What Deleveraging? Here is the chart of the growth of world debt to GDP – it caused something of a sensation:-

Source: voxeu.com, CEPR

Contrary to widely held beliefs, the world has not yet begun to delever and the global debt-to-GDP is still growing, breaking new highs. At the same time, in a poisonous combination, world growth and inflation are also lower than previously expected, also – though not only – as a legacy of the past crisis. Deleveraging and slower nominal growth are in many cases interacting in a vicious loop, with the latter making the deleveraging process harder and the former exacerbating the economic slowdown. Moreover, the global capacity to take on debt has been reduced through the combination of slower expansion in real output and lower inflation.

McKinsey Global Institute – Debt and (not much) deleveraging February 2015 picked up the gauntlet:-

Global debt has grown by $57 trillion and no major economy has decreased its debt-to-GDP ratio since 2007. High government debt in advanced economies, mounting household debt, and the rapid rise of China’s debt are areas of potential concern.

They go on to highlight three areas of risk:- rise of government debt – which increased by $25trln between 2007 and 2015 – the continued rise in household debt (especially mortgages in Australia, Canada, Denmark, Sweden, the Netherlands, Malaysia, South Korea, and Thailand ) and the quadrupling of China’s debt to $28trln or 282% of GDP.

China has been attempting its own brand of regulatory tightening of late alongside the great rebalancing towards consumption, but even official measures of GDP suggest that the economy has stalled and stimulus has resumed during the last few months.

Global real-estate continues to benefit from the low interest rate environment, although planning restrictions in many prime locations is the principle driver of price appreciation, notwithstanding Chinese anti-corruption measures which have tempered demand recently.

The rise in government debt continues to crowd out the opportunities for private sector investment, whilst central bank quantitative easing (QE) programmes act as a natural buyer of these securities.

The BIS Working Papers No 559 A comparative analysis of developments in central bank balance sheet composition – provides an insight into the changing structure of the balance sheets of a variety of central banks. For a snapshot of the quantum, Yardeni Research – Global Economic Briefing: Central Bank Balance Sheets published on Monday, is more instructive. At end April Fed, ECB, BoJ and PBoC had a combined record total of $16.7trln, up from around $9trln at the beginning of 2010. The ECB and the BoJ have been the main drivers of growth this year, whilst the Fed and the PBoC balance sheets have marked time.

To summarise: the factors stifling economic growth are demographics, public sector crowding out of private investment, regulatory tightening of credit conditions and artificially low interest rates, however, I believe there is another factor to consider – the Financialization and the World Economy. As far as I can discern, the first academic work on this subject was published by Prof. Gerald Epstein in October 2005. Here is an extract from the introduction:-

Using the case of the US economy, Crotty argues that financialization has had a profound and largely negative impact on the operations of US nonfinancial corporations. This is partly reflected in the increasing incomes extracted by financial markets from these corporations.

…the payments US NFCs paid out to financial markets more than doubled as a share of their cash flow between the 1960s and the 1970s, on one hand, and the 1980s and 1990s on the other. As NFCs came under increasing pressure to make payments, they also came under increasing pressure to increase the value of their stock prices.

…Financial markets’ demands for more income and more rapidly growing stock prices occurred at the same time as stagnant economic growth and increased product market competition made it increasingly difficult to earn profits.

The authors conclude that the solution is redistributive taxation, I would counter that a better solution would be to reduce the tax and regulatory privileges associated with government debt, thus freeing the private sector from the yoke of unfair public sector competition. But this is a polemic for another time and place. What is clear is that the availability of credit and leverage amplifies business cycles in both directions.

Conclusions

Increasing debt and leverage for an economy with a diminishing working age population is not sustainable. Without the demographic windfall of immigration or procreation, increasing productivity is the only way to sustain real economic growth. The short term financial wizardry of the share buy-back is a function of the artificially low price of credit. The longer central bank sponsored largesse continues, the lower the trend rate of GDP growth will become. A combination of fiscal reform and gradual normalisation of monetary policy could redress the situation but I believe it is politically unachievable. Markets climb a wall of fear, even at these exalted levels, it still makes sense to be long bonds, stocks and real-estate but, once the limit of government intervention has been reached, the “levee gonna break”.

Some sense is written here.

And of course, raising interest rates very much is out of the question.

http://macro-economic-design.blogspot.co.za/p/low-inflation-trap.html