The Japanese stock market peaked in December 1989, marking the end of a period of economic expansion which briefly saw Japan eclipse the USA to become the world’s largest economy. Since its zenith, Japan has struggled. I wrote about this topic, in relation to the economic reform package dubbed Abenomics, in my first Macro Letter – Japan: the coming rise back in December 2013:-

As the US withdrew from Japan the political landscape became dominated by the LDP who were elected in 1955 and remained in power until 1993; they remain the incumbent and most powerful party in the Diet to this day. Under the LDP a virtuous triangle emerged between the Kieretsu (big business) the bureaucracy and the LDP. Brian Reading (Lombard Street Research) wrote an excellent, and impeccably timed, book entitled Japan: The Coming Collapse in 1989. By this time the virtuous triangle had become, what he coined the “Iron Triangle”.

Nearly twenty five years after the publication of Brian’s book, the” Iron Triangle” is weaker but alas unbroken. However, the election of Shinzo Abe, with his plan for competitive devaluation, fiscal stimulus and structural reform has given the electorate hope.

In the last two years Abenomics has delivered some transitory benefits but, as this Japan Forum on International Relations – No. 101: Has Abenomics Lost Its Initial Objective?describes, it may have lost its way:-

The key objective of Abenomics is a departure from 20 year deflation. For this purpose, the Bank of Japan supplied a huge amount of base money to cause inflation, and carried out quantitative and qualitative monetary easing so that consumers and businesses have inflationary mindsets. This “first arrow” of Abenomics was successful to boost corporate profits and raising stock prices by devaluing the exchange rate, but falling oil price makes it unlikely to achieve a 2% inflation rate, despite BOJ Governor Haruhiko Kuroda’s dedicated effort. The quantitative and qualitative monetary easing will not accomplish the core objective.

Another reason for such a huge amount of base money supply is to expand export through currency depreciation and to stimulate economic growth, but that has neither boosted export nor contributed to economic growth. We cannot dismiss world economic downturn, notably in China, but actually, Japanese big companies that lead national export, have shifted their business bases overseas during the last era of strong yen. From this point of view, I suspect that the Japanese government overlooked such structural changes that deterred export growth, even if the yen was devalued. The “second arrow” is flexible fiscal expenditure to support the economy, and the result of which has revealed that it is virtually impossible to keep the promise to the global community to achieve the equilibrium of the primary balance in 2020.

In view of the above changes, I would like to lay my hopes on the “third arrow” of economic growth strategy. The growth strategy has been announced three times up to now, in 2013, 2014, and 2015, respectively. The strategy in 2013 launched three action plans, but they were insufficient. The 2014 strategy was highly evaluated internationally, as it actively involved in the reform of basic nature of the Japanese economy, such as capital market reform, agricultural reform, and labor reform. But it takes ten to twenty years for a structural reform like this to work. Meanwhile, it is quite difficult to understand the growth strategy approved by the cabinet in June 2015. Frankly, this is empty and the quality of it has become even poorer. Abenomics was heavily dependent on monetary policy, and did not tackle long term issues so much, such as social security and regional development. However, people increasingly worry about dire prospects of long term problems like 2 population decrease, aging, and so forth, while the administration responds to such trends with mere slogans like “regional revitalization” and “dynamic engagement of all citizens”. But it is quite unlikely that these “policies” will really revitalize the region, or promote dynamic engagement by the people.

The Bank of Japan (BoJ) has held up its side of the bargain but the “Third Arrow” of structural reform seems to be stuck in the quiver. It is prudent, in light of this policy failure, for the BoJ to look ahead to the time when they are required by the government or forced by the markets, to unwind QQE. Last month they began that process.

As this article from the Nikkei Asian Review – BOJ seen preparing for exit from easing with reserves explains, the BoJ has made a provision of JPY 450bln for the year ending March 2016 against potential capital losses which might be incurred upon liquidation of their JGB holdings. This is the first provision of its kind and substantially reduces the percentage of seigniorage profits remitted to the Japanese government. The level of remittances has been falling –from JPY 757bln in 2014 to JPY 425bln last year. As at the end of May 2016 the BoJ held JPY 319.5trln of JGBs – 36.6% of outstanding issuance. Japan Macro Advisors estimate this will reach 49.3% by the end of 2017. This year’s provision, whilst prudent, is a drop in the ocean. Under the current Quantitative and Qualitative Easing (QQE) programme they are obligated to purchase JPY 80tln per annum. The Association of Japanese Institutes of Strategic Studies – The Fiscal Costs of Unconventional Monetary Policy put it like this:-

It is quite likely that quantitative easing through high-volume purchases of long-term bonds will cause the Bank of Japan enormous losses over the medium to long term, imposing burdens on taxpayers both directly and indirectly. If the current quantitative easing continues, the Bank of Japan may find itself in the near future unable to cover such losses even using all of its seigniorage profits.

…The BoJ’s seigniorage will be roughly equivalent in present value to the balance of banknotes issued. If the BoJ procures funds by issuing cash at a zero interest rate and purchases JGBs, the present discounted value of the principal and interest earned by the BoJ from its JGBs will equal the balance of banknotes. If interest rates are about 2%, Japan’s demand for banknotes will fall from 19% of GDP at present to less than 10% of GDP, and the BoJ’s aforementioned losses would even exceed the present value of its seigniorage.

Here is an extract from the BoJ’s 16th June Statement on Monetary Policy the emphasis is mine:-

Quantity Dimension: The guideline for money market operations

The Bank decided, by an 8-1 majority vote, to set the following guideline for money market operations for the intermeeting period:[Note 1]

The Bank of Japan will conduct money market operations so that the monetary base will increase at an annual pace of about 80 trillion yen.

Quality Dimension: The guidelines for asset purchases

With regard to the asset purchases, the Bank decided, by an 8-1 majority vote, to set the following guidelines:[Note 1]

a) The Bank will purchase Japanese government bonds (JGBs) so that their amount outstanding will increase at an annual pace of about 80 trillion yen. With a view to encouraging a decline in interest rates across the entire yield curve, the Bank will conduct purchases in a flexible manner in accordance with financial market conditions. The average remaining maturity of the Bank’s JGB purchases will be about 7-12 years.

b) The Bank will purchase exchange-traded funds (ETFs) and Japan real estate investment trusts (J-REITs) so that their amounts outstanding will increase at annual paces of about 3.3 trillion yen1 and about 90 billion yen, respectively.

c) As for CP and corporate bonds, the Bank will maintain their amounts outstanding at about 2.2 trillion yen and about 3.2 trillion yen, respectively.

Interest-Rate Dimension: The policy rate

The Bank decided, by a 7-2 majority vote, to continue applying a negative interest rate of minus 0.1 percent to the Policy-Rate Balances in current accounts held by financial institutions at the Bank.[Note 2]

[Note 1] Voting for the action: Mr. H. Kuroda, Mr. K. Iwata, Mr. H. Nakaso, Mr. K. Ishida, Mr. T. Sato, Mr. Y. Harada, Mr. Y. Funo, and Mr. M. Sakurai. Voting against the action: Mr. T. Kiuchi. Mr. T. Kiuchi proposed that the Bank conduct money market operations and asset purchases so that the monetary base and the amount outstanding of its JGB holdings increase at an annual pace of about 45 trillion yen, respectively. The proposal was defeated by a majority vote.

[Note 2] Voting for the action: Mr. H. Kuroda, Mr. K. Iwata, Mr. H. Nakaso, Mr. K. Ishida, Mr. Y. Harada, Mr. Y. Funo, and Mr. M. Sakurai. Voting against the action: Mr. T. Sato and Mr. T. Kiuchi. Mr. T. Sato and Mr. T. Kiuchi dissented considering that an interest rate of 0.1 percent should be applied to current account balances excluding the amount outstanding of the required reserves held by financial institutions at the Bank, because negative interest rates would impair the functioning of financial markets and financial intermediation as well as the stability of the JGB market.

The decision by the BoJ not to increase QQE at its last two meetings has surprised the markets and lead to a further strengthening of the JPY. Governor Kuroda, gave a speech Keio University on June 20th – Overcoming Deflation: Theory and Practice in which he described the history of BoJ policy in its attempts to stimulate the Japanese economy:-

As mentioned, the aim of QQE is to overcome the prolonged deflation that has gripped Japan. Even if this deflation has been mild, the fact that it has continued for more than 15 years means that its cumulative costs have been extremely large. Looked at in terms of the price level, an annual inflation rate of minus 0.3 percent over a period of 15 years implies that the price level will fall by around 5 percent, but an annual inflation rate of 2 percent over a period of 15 years means that the price level will rise by around 35 percent.

It is worth noting that the UK and USA was subject to a long period of deflation during the “Great Depression” between 1873 and 1896 (approximately -2% per annum) by this comparison Japan’s experience has been very mild indeed. The BoJ has a 2% inflation target, however, so we should anticipate more QQE. Kuroda-san, who has previously stated that the effect of NIRP will take time to feed through and that NIRP may be increased from -0.1% to -0.5%, gave no indication as to what the BoJ may do next; although he did say that Japan provides an interesting case study for academia.

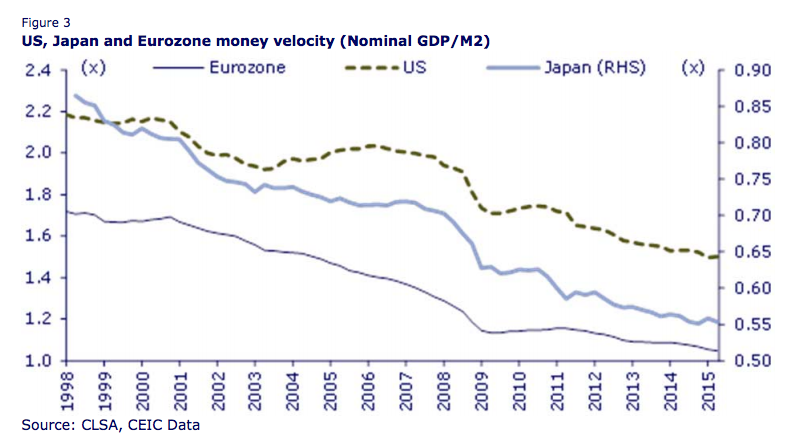

On June 8th Professor George Selgin delivered the Annual IEA Hayek Memorial Lecture –Price Stability and Financial Stability without Central Banks – lessons from the past for the future in which he discussed good and bad deflation together with “Free Banking” – the concept of financial stability without central banks (if you have 45 minutes and enjoy economic history, the whole speech it is well worthwhile). With regard to the current situation in Japan – and elsewhere – he highlights the different between good deflation which is driven by supply expansion and bad deflation which is the result of demand shrinkage. Selgin also goes on to allude to Hayek’s view that that stability of spending should be the objective of monetary policy rather than the stability of prices – akin to what Market Monetarists dub the stability of monetary velocity.

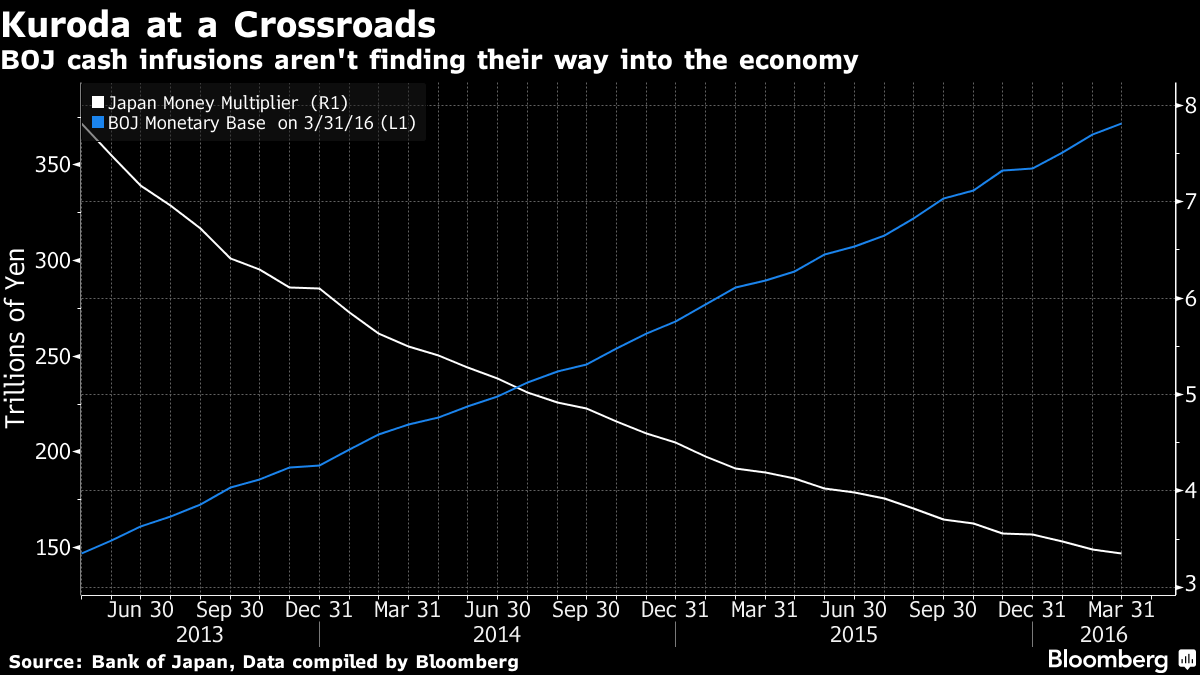

Japan’s monetary base has expanded by 170% since March 2013 but at the same time the money multiplier – Money Stock/BoJ Monetary Base – has declined from 8.27 times (April 2013) to 3.35 times (March 2016). Lending market growth was at its weakest for three years in March (+2%) principally due to household hoarding.

Source: Bloomberg, BoJ

Since the announcement of Negative Interest Rate Policy (NIRP) in January the sale of safes for domestic residences has increased dramatically. Whilst I have not found evidence from Japan, this article from Bloomberg – Cash in Vaults Tested by Munich Re Amid ECB’s Negative Rates reports that MunichRE – the world’s second largest reinsurer – is setting a worrying precedent, it’s one thing when individuals hoard paper money but, when financial institutions follow suit, monetary velocity is liable to plummet. I suspect institutions in Switzerland and Japan are also assessing the merits of stuffing their proverbial mattresses with fiat money.

The chart below reveals that declining monetary velocity is not exclusively a Japanese phenomenon:-

Source: CLSA, CEIC

The Yotai Gap – the difference between bank deposits and loans – is another measure of household hoarding. It widened to JPY 207.6trln in March, close to its record high of JPY 209.9trln in May 2015. The unintended consequences of NIRP is an increase in demand for paper money and a reduction of demand for retail loans even as interest rates decline.

Japanese industry looks little better than the household sector, as this excellent article fromAlhambra Investment Partners – It’s Not Stupidity, It Is Apathy (For Now) explains:-

Japanese industry has not gained anything for the surrender of Japanese households, with industrial production falling 3.5% in April, the 18th time in the past the 22 months. IP in April 2016 was slightly less than the production level in April 2013 when QQE began. Worse, IP is still 3.4% below April 2012, which further suggests both continued economic decline and a distinct lack of any effect from all the “stimulus.”

Barron’s – Unintended Consequences of NIRP listed the following additional effects:-

1) compress net interest margins and bank profits;

2) damage consumer and business confidence;

3) provide little incentive for business invest in capital rather than buy back stock;

4) hurt savers;

5) makes active management more difficult by dampening dispersion;

6) increase demand for gold and other hard assets; and,

7) likely widen the wealth gap

The BoJ can continue to buy JGBs, Commercial Paper, Corporate Bonds, ETFs and, once these avenues have been exhausted, move on to the purchase of common stocks and commercial loans. It can nationalise the stock market and circumvent the banking system in order to provide liquidity to end users or even consumers. At what point will the markets realise that they have been pushing on a string for decades? I suspect, not yet, but a dénouement, an epiphany, draws near.

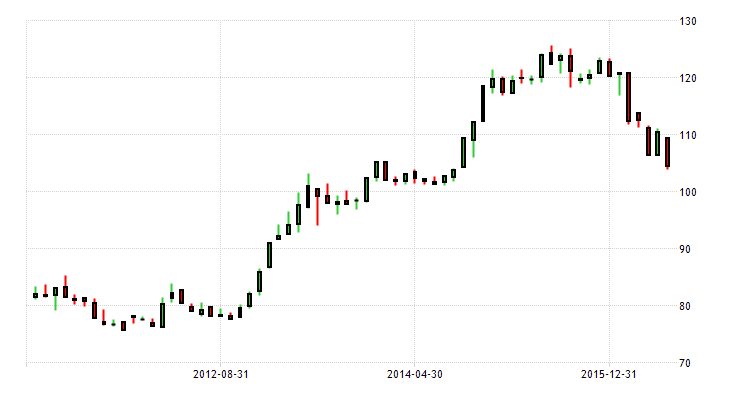

Markets since the announcement of NIRP

Since the BoJ NIRP announcement at the end of January, the JPY has strengthened by around 14%. The five year chart below shows the degree to which the hopes for the first arrow of Abenomics have been dashed:-

Source: Trading Economics

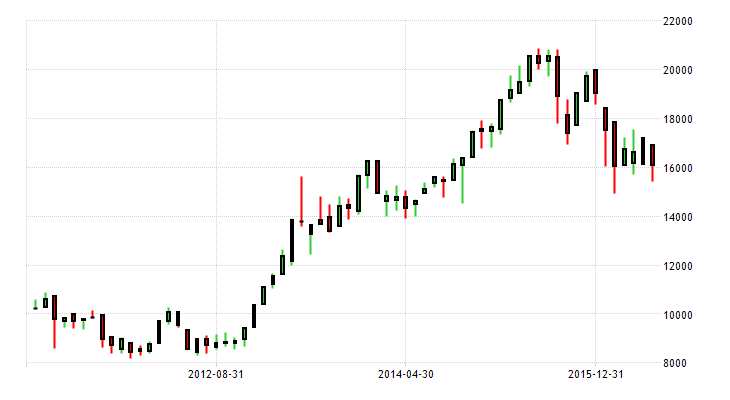

Currency weakness has put pressure on stocks. International investors sold around JPY 5trln during in a 13 week selling binge to the beginning of April:-

Source: Trading Economics

The Government Pension Investment Fund (GPIF) and other domestic institutions took up the slack – the GPIF has moved from 12% to 23% equities since October 2014 – here is the 31stDecember breakdown of the asset mix for the JPY 140trln fund:-

| 31-12-15 % Allocation | Policy Target | Permitted Deviation | |

| Domestic Bonds | 37.76 | 35 | 10 |

| Domestic Equity | 23.35 | 25 | 9 |

| International Bonds | 13.5 | 15 | 4 |

| International Equities | 22.82 | 25 | 8 |

| Short term assets | 2.57 |

Source: GPIF

In theory the GPIF could buy another JPY 15.5trln of domestic stocks and reduce its holdings of JGBs by nearly JPY 18trln. I expect other Japanese pension funds and Trust Banks to follow the lead of the GPIF. Domestic demand for stocks is likely to continue.

As I mentioned earlier, JGBs are being steadily accumulated by the BoJ even as the GPIF and other institutions switch to equities. This is the five year yield chart for the 10 year maturity:-

Source: Trading Economics

JGBs made new all-time lows earlier this month, with maturities out as far as 15 years turning negative, amid international concerns about the potential impact of Brexit.

Looking more closely at Japanese stocks, non-financial corporations have followed the lead of the eponymous Mrs Watanabe, accumulating an historically high cash pile. Barron’s – Abenomics Watch: Japan’s Corporates Are Hoarding Cash, Too takes up the story:-

During the three years of Abenomics between 2013 and 2015, Japan’s non-financial corporate sector increased its holding of cash and deposits by roughly 30 trillion yen, or 6% of GDP. This amount is equivalent to about 35% of retained earnings, estimates Credit Suisse.

This amount is high by historical standards. During the previous economic upswing between the end of 2002 and the beginning of 2008, Japan’s corporations held only 11.5% of their retained earnings.

So why are Japanese companies hoarding cash?

One explanation is larger intangible assets. It is easy for companies to put up their fixed assets as collateral for loans, but how should banks value intangible assets such as intellectual property? Cash would be a viable collateral option. However, Credit Suisse finds that there is not much correlation between cash and intangible asset positions. The ratio of cash to intangible fixed assets investments has moved broadly between 8.6 years and 11.6 years over the two decades since 1994.

A second explanation is lax corporate governance, which Abe has been trying to fix. Are Japanese companies only paying him lip service?

A third explanation is increasing pension liabilities. As Japanese society ages, companies feel compelled to hoard more cash to pay off employees who are due to retire in the coming years. Encouraging women to enter the labor force is a key component of Abenomics’ Third Arrow. He has not gone very far.

Last, perhaps Japanese companies are feeling uncertain about the future? Toyota Motor, for instance, drastically changed its yen assumption from 120 to 105 in the new fiscal year. Companies hoard more cash when they don’t know what’s going to happen.

According to the latest flow of funds data from the BoJ – corporate cash was estimated to be JPY 246trln in Q1 2016 – the 29th consecutive quarterly increase, whilst household assets rose to JPY 902trln the highest on record and the 36th quarterly increase in a row. A nine year trend.

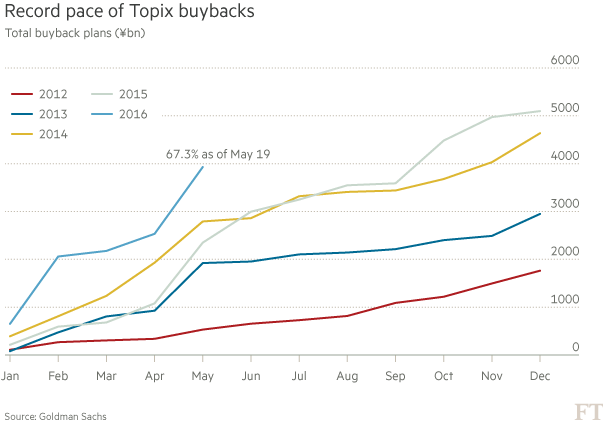

Another trend which has been evident in Japan – and elsewhere – is an increase in share buybacks. The chart below tells the story since 2012:-

Source: FT, Goldman Sachs

Compared to the level of share buy backs seen in the US, Japanese activity is minimal, nonetheless the trend is growing and NIRP must assume some responsibility. Perhaps it was the precipitous decline in capital expenditure, which prompted the BoJ to introduce NIRP. The chart below is taken from the December 2015 Tankan report:-

Source: Business Insider Australia, BoJ

In the March 2016 Tankan, the Business Conditions Diffusion Index remained generally positive but the decline of momentum is of concern:-

| Dec-15 | Mar-16 | June-16(F/C) | |

| Large | |||

| Manufacturers | 12 | 6 | 3 |

| Non-Manufacturers | 25 | 22 | 17 |

| Medium | |||

| Manufacturers | 5 | 5 | -2 |

| Non-Manufacturers | 19 | 17 | 9 |

Source; BoJ

I doubt capital expenditure will rebound while share buy backs appear safer to the executive officers of these companies. The Japanese stock market is also attractive by several valuation metrics. The table below compares the seven most liquid stock markets, as at 31st March, is sorted by the yield premium to 10 year government bonds (DY-10y):-

| Country | CAPE | PE | PC | PB | PS | DY | 10y | DY-10y |

| Switzerland | 20.3 | 22.5 | 13.9 | 2.3 | 1.8 | 3.50% | -0.33% | 3.83% |

| France | 16 | 20.9 | 6.5 | 1.5 | 0.8 | 3.50% | 0.41% | 3.09% |

| Germany | 16.8 | 19 | 8 | 1.6 | 0.7 | 2.90% | 0.15% | 2.75% |

| United Kingdom | 12.7 | 35.4 | 12.8 | 1.8 | 1.1 | 4.00% | 1.42% | 2.58% |

| Italy | 11.1 | 31.5 | 5 | 1.1 | 0.5 | 3.50% | 1.23% | 2.27% |

| Japan | 22.7 | 15.3 | 7.9 | 1.1 | 0.7 | 2.20% | -0.04% | 2.24% |

| United States | 24.6 | 19.9 | 11.6 | 2.8 | 1.8 | 2.10% | 1.77% | 0.33% |

Source: StarCapital.de, Investing.com

For international allocators, the strength of the JPY has been a significant cushion this year, but, for the domestic investor, the Nikkei 225 is down 16.2% YTD. Technically the market is consolidating around the support region between 16,300 and 13,900. If it breaks lower we may see a return towards to 10,000 – 11,000 area. If it recovers, a push through 18,000 should see the market retest its highs. I believe the downside is supported by domestic demand for stocks as bond yields turn increasingly negative.

International investors will remain wary of the risks associated with the currency. Further BoJ largesse must be anticipated; that they have made a first provision against losses from the unwinding of QQE is but a warning shot across the bows of the ministry of finance. As I suggested in Macro Letter – No 49 – 12-02-2016 Why did Japanese NIRP cause such surprise in the currency market and is it more dangerous? a currency hedged equity investment is worth considering. Prime Minister Abe, who began campaigning, this week, for the upper house elections on July 10th, has promised to boost the economy if he wins a majority of the 121 seats being contested. The monetary experiment looks set to continue but the BoJ may be the first central bank to discover the limits of largesse.

Sigh …

Since Central Bankers seem to live in the land of Counterfactual, being a CB means never having to say you’re sorry or wrong (unless you’re Bernanke, in which case “sorry” merely means apologizing for not doing enough of what you would like to do anyway). Therefore, any chance of the BOJ exiting extraordinary monetary policy (of any shape or form) is zero. They have a hammer, and all they see about themselves are nails – the hammering shall continue.

Plainly put, under the definition (mis) attributed to Einstein, Japanese monetary policy is thoroughly insane – and given that the Japanese are likely to vote for more of the same – so is Japan as a people and a nation.

Lastly, the fact that economists, CBers and financial journalists are surprised that a policy of setting interest rates below a value that would be collected in a free market for money* would cause “hoarding” (the term itself, and its connotations, betrays a misunderstanding of the role of savings and investment) is astounding! Had none of them ever heard of Friedman’s “Permanent Income Hypothesis”? Does the idea shock them that if one is necessarily planning for an amount of annually expendable cash in retirement, they the return on investment is so drastically reduced that the saver will have to increase the amount of principal saved to make up the difference? You really have to wonder.

*With all due respect to Wicksell, I refuse to use the term “natural rate” as, at this point, is a meaningless concept since everyone has a model for what it should be that conveniently favors policy outcomes that suit their own biases. One would think at this point that we would have learned the lesson that markets are the preferred way to set prices, but I guess as a culture we will continually “return to our vomit” and look toward top men for control.