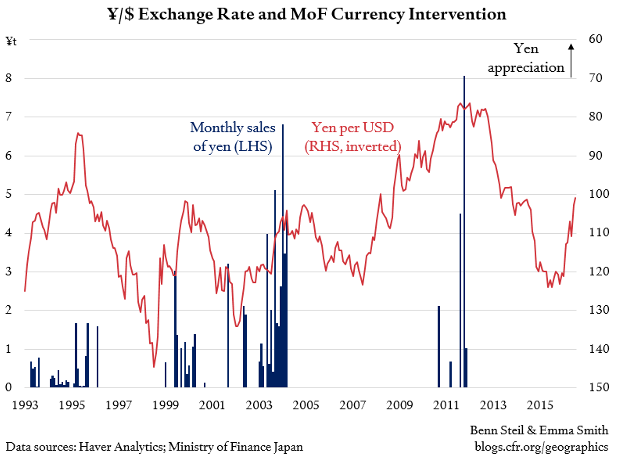

As shown in the graphic above, the yen has risen almost 20 percent over the past year. A quarter of the rise has taken place since the Brexit shock. The stronger yen threatens to derail efforts by the Bank of Japan, involving massive asset purchases and negative interest rates, to push the country away from deflation and towards its 2 percent inflation target.

If the Ministry of Finance does start buying dollars to push the yen down, it will mark its first direct market intervention since 2011. It will also mean the U.S. Treasury labeling Japan a currency “manipulator.”

Since April, Treasury has been applying a quantitative framework to determine if a country is managing its currency inappropriately for competitive advantage—that is, keeping it undervalued. Japan already meets two of the three criteria—a bilateral trade surplus with the U.S. over $20 billion, and a current account surplus greater than 3 percent of GDP—and will meet the third if intervention exceeds ¥10 trillion in a twelve-month period. This is not a high threshold historically—Japan sold ¥14 trillion in 2011 and ¥35 trillion in 2003-4.

If Treasury were to label Japan a manipulator, the country would be the first such designee since China in 1994. But what would it actually mean?

In the first instance, according to the Trade Facilitation and Trade Enforcement Act of 2015, bilateral talks would need to be held to agree on a path of corrective action. If after one year the Treasury secretary determines that such action is not in train, the president would then be required to take one or more of the following steps: (1) deny the country U.S. Overseas Private Investment Corporation financing, (2) exclude it from U.S. government procurement, (3) call for heightened IMF surveillance, or (4) reconsider open trade discussions.

The fourth is clearly the most consequential, since it would involve the as yet unratified twelve-nation Trans-Pacific Partnership (TPP). Neither U.S. presidential candidate currently backs TPP. But whereas Donald Trump has called it a “rape” of the United States, Hillary Clinton was for-it-before-she-was-against-it—and some suspect she would want to flip back once in the White House. The interesting question would then become under what conditions she would hold the agreement hostage to a manipulation dispute.

We actually think that, perversely, a manipulator designation for Japan could save TPP. This is because a cosmetic agreement with Japan to modify its currency policy, perhaps after a period of yen depreciation, would give Clinton a fig leaf for claiming she hadstrengthened TPP—by establishing a precedent outlawing manipulation. Despite inevitable howls in Washington and Tokyo, the end result will be welcomed with relief by the agreement’s supporters.

Source: http://blogs.cfr.org/geographics/2016/07/07/japantreasurycurrencymanipulator/