By David Stockman

During the 29 years after Alan Greenspan became Fed chairman in August 1987, the balance sheet of the Fed exploded from $200 billion to $4.5 trillion. Call that a 23X gain.

That’s a pretty massive increase—so let’s see what else happened over that three-decade span. Well, according to Forbes, Warren Buffett’s net worth was $2.1 billion back in 1987 and it is now about $73 billion. Call that 35X.

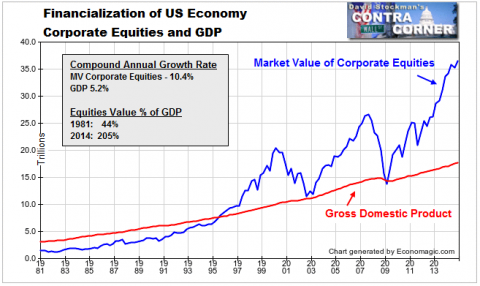

During those same years, the value of non-financial US corporate equities rose from $2.6 trillion to $36.6 trillion. That’s on the hefty side, too.

Call it 14X and take the hint about the idea of financialization. The value of corporate equities rose from 44% to 205% of GDP during that 29-year interval.

Needless to say, when we move to the underlying economy which purportedly gave rise to these fabulous financial gains, the X-factor is not so generous. As shown above, nominal GDP rose from $5 trillion to $18 trillion during the same 29-year period. But that was only 3.6X

Next we have wage and salary disbursements, which rose from $2.5 trillion to $7.5 trillion over the period. Make that 3.0X.

Then comes the median nominal income of US households. That measurement increased from $26K to $54K over the period. Call it 2.0X.

Digging deeper, we have the sum of aggregate labor hours supplied to the nonfarm economy. That fairly precise metric of real work by real people rose from 185 billion hours to 240 billion hours during those same 29 years. Call it 1.27X.

Further down the Greenspan era rabbit hole, we have the average weekly wage of full-time workers in inflation adjusted dollars. In constant 1982 dollars that was $330 per week in 1987 and is currently $340. Call that1.03X

Finally, we have real median family income. At about $54,000 then and now, call it a three decade long trip to nowhere if you credit the BLS inflation data.

But when you deflate nominal household income by our more accurate Flyover CPI per the last chapter, you end up at the very bottom of the Maestro’s rabbit hole.

Median real household income went backwards! It now stands at just 0.8X of its starting level.

So 35X for Warren Buffett and 0.8X for working people. That is some kind of divide.

OK, it’s not entirely fair to compare Warren Buffet’s $70 billion gain to the median household’s actual 21% loss of real income. There is some “inflation” in the Oracle’s wealth tabulation, as reflected in the GDP deflator’s rise from 60 to 108 during this period.

So in today’s constant dollars, Buffet started with $3.8 billion in 1987. Call his inflation-adjusted gain 19X then, and be done with it.

And you can make the same adjustment to the market value of total non-financial equity. In constant 2015 dollars of purchasing power, today’s aggregate value of $36.7 trillion compares to $4.5 trillion back in 1987. Call it 8X.

Here’s the thing. In the context of an 0.8X main street economy, Buffet isn’t any kind of 19X genius nor are investors as a whole 8X versions of the same.

The real truth is that Alan Greenspan and his successors turned a whole generation of financial gamblers into the greatest lottery winners in recorded history. They turned redistribution upside down——-sending unspeakable amounts of windfall wealth to the tippy top of the economic ladder.

ZIRP Funds Wall Street Gamblers And Inflates Financial Assets, Not The Main Street Economy

These capricious windfalls to the 1% happened because the Fed grotesquely distorted and financialized the US economy in the name of Keynesian management of the purported “business cycle”. The most visible instrument of that misguided campaign, of course, was the Federal funds or money market rate, which has been pinned at virtually the zero bound for the last 90 months.

Never before in the history of the world prior to 1995 had any central bank decreed that overnight money shall be indefinitely free to carry trade gamblers. Nor had any monetary authority commanded that the hard earned wealth of liquid savers be chronically confiscated by negative returns after inflation and taxes. And, needless to say, never had savers and borrowers in a free market struck a bargain on interest rates night after night at a yield of virtually 0.0% for seven years running, either.

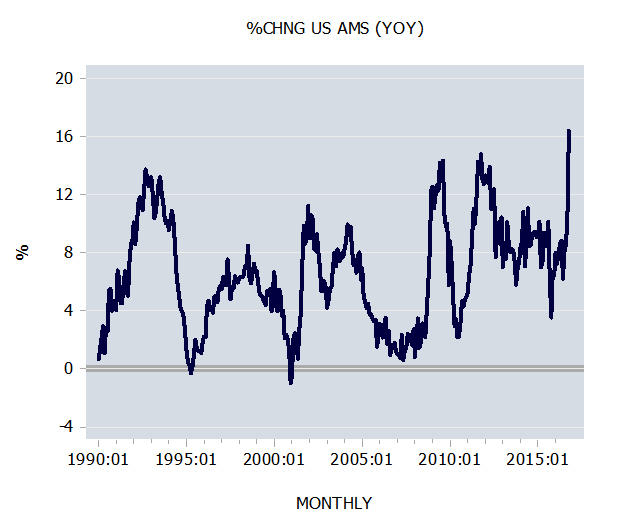

Not only did the Fed spend 29 years marching toward the zero bound, but in the process it became addicted to it. During the last 300 months, it has either cut or kept flat the money market rate 80% of the time. And until the token bump of December 2016, it had been 114 months since the foolish denizens of the Eccles Building last raised interest rates by even 25 bps!

The Fed’s Addiction To The ‘Easy Button’: Rates Falling Or Flat 80% Of The Time Since 1990 – Click to enlarge

The simple truth is, the Fed’s long-running interest rare repression policies have caused systematic, persistent and massive falsification of prices all along the yield curve and throughout all sectors of the financial market.

The single most important price in all of capitalism is the money market rate of interest. It sets the cost of carry in all asset markets and on options and futures pricing. It therefore indirectly fuels the bid for all debt, equity and derivative securities in the entire global financial system.

Needless to say, when the cost of money is set at— and held at— zero in nominal terms, and driven deeply negative in after-inflation and after-tax terms, it becomes the mother’s milk of speculation.

So an urgent question screams out. Didn’t the obstinate zealots at the Fed realize that zero cost overnight money has only one use, and that is to fund the speculative trades of Wall Street gamblers?

The reason that ZIRP is of exclusive benefit to financial gamblers is straight forward. No businessman in his right mind would fund equipment, inventories or even receivables with borrowings under a one-day or even one-week tenor. The risk of fatal business disruption resulting from the need to precipitously liquidate working assets if funding cannot be rolled-over at or near the existing interest rates is self-evident.

Likewise, no sane householder would buy a home, automobile or even toaster on overnight borrowings, either.

And, yes, financial institutions experiencing the daily ebb and flow of cash excesses and deficiencies do use the money market. That’s what the “Fed funds” market used to be until Bernanke and his band of money printers effectively abolished it in the fall of 2008.

But managing fluctuating cash balances does not require ZIRP—-especially when most banks historically alternated between being suppliers and users of funds on practically an odd/even day basis. Cash balances in the financial system can be cleared at 0.2%, 2%, 5% or even 10% with equal aplomb.

So ZIRP is nothing more than free COGS (cost of goods sold) for Wall Street gamblers. It is they who harvest the “arb”.

That is, the spread between the free funding dispensed by the Fed and any financial asset with a yield or prospect of short-term gain. And, yes, if push comes to shove, these same fast money gamblers can ordinarily liquidate their assets, repay their overnight borrowings and start with a clean book the next morning—unlike business and household borrowers in the main street economy.

Stated differently, the Fed’s ZIRP policy is a giant subsidy to speculators—-and one that is made all the more egregious by an utterly foolish communications policy. In the name of “transparency” the Fed actually telegraphs—-via such code words as “patient”—- that there will be no rate increases without ample warning. In this case, at least for the following two meetings.

Accordingly, speculators don’t even have to worry about one single dime of unexpected change in their carry cost. Nor are they ever inconvenienced by the losses that can result from needing to suddenly dump less than fully liquid assets in order to repay their overnight borrowings (or liquidate options and other similar “structured finance” positions).

The truth is, in an honest free market traders cannot earn windfall returns arbing the yield curve. The vigorish gets competed away. Likewise, asset prices and funding costs move independently, thereby causing return compression toward the time value of money and the risk differentials embedded in each trader’s specific book of assets and liabilities.

By contrast, the ZIRP market is completely dishonest and therefore deeply subsidized. And every Econ 101 student knows that when you deeply subsidize something, you get more and more of it.

In essence, by clinging obstinately and mindlessly to ZIRP the Fed is just systematically juicing the gamblers, and thereby fueling ever greater mispricing of financial assets and ever more dangerous and explosive financial bubbles.

In fact, after 90 months of ZIRP it must be truly wondered how supposedly rational adults can obsess over whether the another tiny smidgeon of a rate increase should be permitted this year or next, and whether the economy can tolerate a rise in the funds rate from 38 bps today to 63 bps when it finally does move.

The difference is utterly irrelevant noise to the main street economy. It can’t possibly impact the economic calculus of a single household or business!

But then, again, the Fed doesn’t serve the main street economy; it lives to pleasure Wall Street.

Having pinned the money market rate at the zero bound for so long and with such an unending stream of ever-changing and fatuous excuses, the occupants of the Eccles Building are truly lost. They do not even fathom that they are engaging in a word splitting exercise that is no more meaningful to the main street economy than counting angels on the head of a pin.

Indeed, if they weren’t mesmerized by their own ritual incantation they would not presume for a moment that fractional points of variance of the money market rate away from ZIRP would have any impact on main street borrowing, spending, investing and growth.

Caught In A Time Warp—–Why The Fed Keeps Feeding The Gamblers

So why does the Fed persist in this farcical minuet around ZIRP?

The principal reasons are not at all hard to discern. In the first instance, the Fed is caught in a time warp and fails to comprehend that the game of bicycling interest rates to heat and cool the macro-economy is over and done.

As further documented below, the credit channel of monetary transmission has fallen victim to “Peak Debt”. This means that the main street economy no longer gets a temporary pick-me-up from cheap interest rates because with tapped out balance sheets they have no further ability to borrow.

The only actual increases in household debt since the financial crisis has been for student loans, which are guaranteed by Uncle Sam’s balance sheet, and auto loans which are collateralized by over-valued vehicles.

Stated differently, home equity was tapped out last time and wage and salary incomes have been fully leveraged for years. So households have nothing else left to hock.

Accordingly, they now only spend what they earn, meaning that the Fed’s interest rate manipulations—-which had potency 40 years ago—-have no impact at all today. Keynesian monetary policy through the crude tool of money market rate pegging was always a one-time parlor trick.

Likewise, the Fed’s interest rate machinations have not induced business to acquire incremental productive assets financed with borrowed capital. Instead, virtually the entire increase in business debt outstanding—- and it is considerable, having rising from $11 trillion on the eve of the financial crisis to nearly $14 trillion today—-has gone into financial engineering.

But stock buybacks, LBOs and cash M&A deals do not cause output to expand or productivity to increase whatsoever. They just bid up the price of existing financial assets, thereby further rewarding the ZIRP-enabled gamblers who inhabit the casino.

Given the utter blockage of the credit channel of monetary transmission to households and businesses, then, why on earth do our monetary central planners cling so desperately to ZIRP?

The answer is that it even if the credit channel of policy transmission is badly diluted, they appear to believe that cheap money might still do a smidgeon of good. Besides, it hasn’t caused any consumer price inflation, or at least that’s what they contend—–so where is the harm?

Well, yes. Doing a rain dance neither causes harm nor rain. Yet there is a huge difference. Zero interest rates are not even remotely harmless. They amount to a colossal economic battering ram because they transform capital markets into gambling casinos.

So doing, they cause risk and long-term capital to be mispriced, meaning an accumulating level of malinvestment and excess production capacity. And this is a worldwide condition because all central banks are engaging in the same game of financial repression.

As is now evident in the case of oil, iron ore, copper, consumer electronics and much more, vast excess capacity ultimately results in the collapse of boom time prices and profit margins. Soon there is in motion a withering cycle of deflationary adjustment, profit collapse and a plunge in new capital spending.

So our monetary central planners are trapped in a dangerous feedback loop. Having fueled the boom with cheap money, they now justify the prolongation of ZIRP on the grounds that they must use the same tool to ward off the deflation they caused in the first place.

At the end of the day, there is nothing behind the curtain at the Eccles Building except for the specious doctrine of wealth effects. Fractional changes in the money market rate are of relevance only to the day traders and robo machines which occupy the casino.

So the spurious words clouds in the Fed’s 500 word meeting statements, and hints about the next meeting’s potential for hairline changes in the money market interest rate, or not, are all about speculator confidence.

Fed policy is designed to keep them dancing. It rests on the delusional hope that the drug of ZIRP or near-ZIRP can keep the stock market averages rising and a trickle down of extra spending by the wealthy flowing into the reported GDP and job numbers.

History proves beyond a shadow of doubt that bubbles fueled by bad money ultimately splatter into a world of harm. Soon, therefore, will come the Wreck of the Monetary Hesperus. And unlike the foolish captain in Longfellow’s poem, the Fed is not only ignoring the coming storm, but is actually fueling its intensity with malice of forethought……

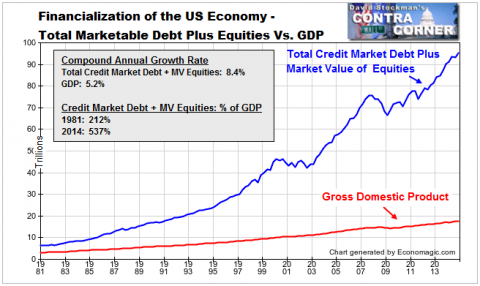

In a word, the Greenspan era of central bank driven price falsification and monetization of trillions of existing assets with credits conjured from thin air has generated a $45 trillion overhang of excess financialization.

Even when you purge the cumulative price inflation out of that gargantuan figure, the story does not remotely add-up. That is, while real median household income has shrunk by 21% since 1987 if inflation is honestly reckoned, the GDP deflator-adjusted value of corporate equities and credit market debt outstanding stands at 8X and Warren Buffett’s real net worth at19X.

How St. Warren Buffett Rode The Fed’s $45 Trillion Bubble

Needless to say, the above outlandish graph does not capture capitalism at work. Nor did the speculators who surfed upon this $45 trillion bubble harvest their monumental windfalls owing to investment genius.

Instead, it is the perverted fruit of Bubble Finance, and there is no better illustration of this bubble surfer syndrome than the sainted Warren Buffett.

The Bard Of Omaha is no genius and he did not invent anything, even a unique method of investing and allocating capital. He may have read Graham and Dodd as a youthful punter, but his nominal net worth did not grow from $2.1 billion in 1987 to $73 billion at present by following the old fashioned precepts of value investing.

Instead, he bought the obvious consumer names of the baby boom demographic wave like Coke and Gillette; had a keen ear for buying what he believed slower footed investors would also be buying later; appreciated the value of banks and other financial companies (like Goldman Sachs) that suckled on the public teat; and mainly rode the 29-year wave that caused finance to soar from $12 trillion to $93 trillion after Greenspan took the helm at the Fed.

Stated differently, under a regime of honest money and free market finance no mere insurance company portfolio manger could make 19X in real terms in 29 years. It can’t be done purely through the money game.

Moreover, on the insurance side of the Berkshire Hathaway house, Buffett didn’t invent any new products or services, either—–except the standard gambit of paying claims as late as possible.

That’s right. A 19X real gain in three decades can occasionally be achieved by inventors of something fundamentally new and economically transformative. Thomas Edison, Henry Ford and Bill Gates fit that mold, but not an insurance portfolio manager from Omaha.

The truth of the matter is that the better part of St. Warren’s fortune was manufactured in the Eccles Building.

Even he backhandedly admitted as much in his famously unctuous and gratuitous letter thanking the Fed for bailing out the financial system (and his investment in Goldman, Well Fargo and other financial institutions) during the so-called “financial crisis”.

The actual purpose of the Wall Street meltdown was to purge decades of speculation, leverage and excess risk-taking—–the very thing that Buffett thanked them for averting and that kept his ill-gotten fortune intact……

Gawd.

Stockman again.

The austere hand of rational suffering. (be nice. be nice).

Another capitalist with a false identity of a whipping boy – the central bank – flogging the institution as if it had any better options.

Under our monetary-asset (debt) based money system, all new money issued runs first to the financialistas (in the form of new loans). This is causal to them already having more money, owning more wealth, esp. in the form of capital ( monetary ) assets, making them more …………..

roll-the-DRUMS …………….credit – WORTHY.

First up: the bankers and brokers.

They get the money first.

And they get it cheapest.

This is where trickle-down capitalism should be evident, rather than trickle -up Billionaire-building.

But what is the CB to do?

If it implements ANY monetary policy, it must increase the amount of debt in the world ….. that’s ALL there is to it. We MUST live on ever more debt.

Unless we can have a monetary system not based on debt. Like for the first time in ages.

Then debt would cease to be the societal destroyer.

And money would become the builder of progress.

And Stockman could sell widgets.

The means of exchange.

For the national economy to make commerce.

In dire NEED of reform.

https://www.govtrack.us/congress/bills/112/hr2990/text

For the Money System Common.

Excellent. And terrifying.