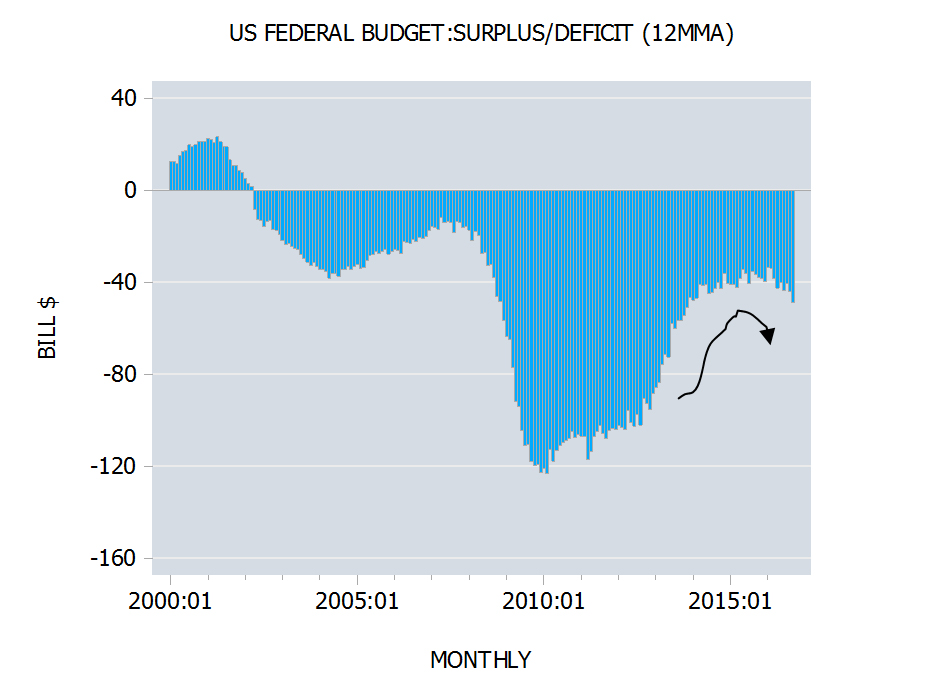

According to some commentators the US federal budget deficit still remains a major economic problem notwithstanding that it draws less attention than in the past. The Federal Government budget had a surplus of $33.4 billion in September against a surplus of $90.9 billion in September last year. The 12-month moving average of the Federal Government budget stood at a deficit of $49 billion in September against a deficit of $44.2 billion in August and a deficit of $37 billion in September last year.

Most experts are of the view that the harm from budget deficits comes from “crowding out”, the idea that government debt absorbs investors’ funds that would otherwise be used for private investment, driving up interest rates. However given that at present interest rates remain at historically low levels, they argue that there is no need to be concerned with budget deficit as such. On the contrary it is advised by many experts that it is to the benefit of the economic growth to increase deficits.

Given the still subdued economic growth, it is also argued thatan increase in the budget deficit in response to a strong increase in government outlays will boost aggregate demand and this in turn will strengthen the overall economic growth. Again these proponents regard the present low interest rates as an opportunity for fiscal policy to become more active.

In contrast, there are commentators that are in favor of a deficit reduction who are of the view that the government books must be always balanced i.e. the government must live within its means in similarity to every individual in an economy.

Government outlays, not the deficit matter

We suggest that what matters for the health of the economy is not the size of the budget deficit but rather the size of the government outlays.We hold that when the government undertakes projects to boost the aggregate demand these projects are actually of a wealth consuming nature. The fact that the private sector did not undertake these projects indicates that these projects are on the low priority list of individuals.

The implementation of these projects is going to undermine the well-being of individuals, because they are funded at the expense of projects that are of a higher priority and would otherwise be undertaken in the private sector.

When the government decides to promote a particular activity this means that the government will supply various individuals that are engaged in this activity with money. The received money in turn will permit individuals in that activity to access the pool of real wealth.

Now, the government is not a real wealth generator. It relies on its sources of funding from the private sector. This in turn means that the more government spends the less real funding will be available for the wealth generating private sector.

This will impede the creation of real wealth and impoverish the economy as a whole. Observe that if government could generate real wealth then obviously it wouldn’t need to tax the private sector.

Various commentators are of the view that in the US and other major economies the government could lift economic growth by upgrading roads. The improvement of roads sounds like a great idea. The key question is whether for a given pool of wealth the US individuals could afford all this?

As an example an individual in his personal capacity might establish that it is a great idea to have anexpensiveMercedes, unfortunately his pool of real wealth only allows him to have a second hand Toyota. If he were to allocate all his wealth towards the purchase of aMercedes he runs the risk of severely damaging his and his family’s well being for he will not have enough means to feed his family and himself.

The mode of diversion of real wealth from the private sector is, however, of secondary importance. What matters is that real wealth is diverted. The method of taking real wealth can be through direct taxes or indirect taxes and by means of monetary printing.

The effective level of tax then is dictated by government outlays – the more government plans to spend the more real wealth it will divert from the wealth generating private sector.In this respect we can see from the charts below that government outlays in absolute terms and relative to GDP have been following a visible up trend (see charts).

Another instrument for the diversion of real wealth is by means of borrowing. But how can this be?

A borrower must be a wealth generator in order to be able to repay the principal loan plus interest. This is however, not so as far as thegovernment is concerned. For government is not a wealth generator, it only consumes wealth.

So how then can the government as a borrower, which produces no real wealth, ever repay the debt?

The only way it can do this is by borrowing again from the same lender – the wealth generating private sector. It amounts to a process wherein government borrows from you in order to repay to you.

In this regard we can see that the government debt as percentage of GDP, which stood at 55% in 1959 has climbed to 100.5% in2015.

We suggest that the goal of fixing the budget deficit as such could be an erroneous policy. Ultimately what matters for the economy is not the size of the budget deficit but the size of government outlays – the amount of resources that government diverts to its own activities.

Note that since the government is not a wealth generating entity, the more it spends the more resources it has to take from wealth generators. This means that the effective level of tax here is the size of the government and nothing else.

For example, if government outlays are $3 trillion and the government revenue is $2 trillion then the government will havea deficit of $1 trillion. Since government outlays have to be funded this means that the government would have to secure some other sources of funding such as borrowing, printing money or new forms of taxes. The government will employ all sorts of means to obtain resources from wealth generators to support its activities.

What matters here is that government outlays are $3 trillion and not the deficit of $1 trillion. For instance, if the government revenue on account of higher taxes would have been $3 trillion then we would have a balanced budget. But would this alter the fact that the government still takes $3 trillion of resources from wealth generators?

It always amazes me that governments are allowed to spend money that they haven’t got: that they can create money out of thin air, and spend it to buy real assets: that they are allowed to manipulate interest rates to bail-out greedy, incompetent, bankrupt banks at the expense of savers and pension funds; that greedy, incompetent, bankrupt banks are allowed to lend out money that doesn’t exist.

If we were designing a new banking system from scratch, I don’t believe that the one we have got would be the favoured option.

To Chris Hulme

It always amazes me the private bankers are allowed to LEND money they haven’t got: that they can (and DO) create money out of thin air and LEND it buy real assets (actually or SPEND it to buy real assets) , that these bankers (FOMC) are allowed to manipulate interest rates to bail out greedy, incompetent fellow bankers, at the expense of the taxpaying public, etc.

We ARE designing a new money-banking from scratch. Get involved.

See PositiveMoneyUK.

Fractional reserve banking is a dead-man walking.

Or AMI’s

http://www.monetary.org/wp-content/uploads/2013/01/HR-2990.pdf

Because, today, the Guvmint has nothing to do with it.

Re Joe’s point about fractional reserve banking, it’s not just Positive Money that opposes it: four Nobel laureate economists that I know of do or did, including Milton Friedman, James Tobin and Maurice Allais. Plus Abraham Lincoln opposed it, as did the famous Scottish philosopher / economist David Hume.

Re Shostak’s claim that government spending is inherently wasteful because it involves doing things that individual people would not pay for, I’d guess about 99% of economists and 99% of the general population would disagree with that. Many men would pay more per hour to a prostitute than to a nurse. Does that make prostitutes more valuable than nurses?

And about 99% of the population favor free education for kids, and for the very good reason that in a totally free market a significant proportion parents (the feckless) would not pay to have their children taught to read, write or do basic maths: gifts which no human being should go without, unless they are mentally incapable of learning to read and write.