The Federal Reserve under Ben Bernanke committed several unforgivable mistakes during his tumultuous tenure, but cumulatively they could be easily summarized as “they really don’t know what they are doing.” Time and again whoever followed monetary policy and the conventions built upon it were led either off a cliff or somewhere just less dramatic. Federal Reserve actions are at best a reaction to what already occurs, and most often just plain irrelevant.

Yet for all the mountains of evidence establishing just that sort of relationship, it remains 1999 for so many, especially those in the media. It was at that time where Fed officials enjoyed a zenith in prestige bordering on worship. But as if the nearly twenty years since had never happened, though there are questions today that weren’t ever asked then there is still so much undue influence attributed to monetary policy.

Every time the Fed engaged in another QE, it was immediately labeled a success regardless of the obvious contradiction that anything more than a single program demonstrated the very opposite case. Relatedly, official economic forecasts were always far too optimistic because the Fed’s models only modeled success for QE (and ZIRP) no matter what. That optimism, however, hid a more decisive condition, one which most economists either refuse to admit or somehow have missed.

The Fed did no one any favors by being so wrongfully optimistic all along, but what they are doing now is in many ways worse. At least they believed in those forecasts and of the success in QE. In very plain terms, they don’t now, but you wouldn’t know it from how how rate hikes are being described in the media without full clarification. The Fed is “raising rates” for very different reasons than everyone seems to assume, and because of that the implications are being dramatically misconstrued.

“I really try to have clients take a disciplined approach to their investing over the long term,” says Ward Mayer, managing director at Metropolitan Wealth Management of Raymond James. “I put it in perspective for them. If the Fed is going to raise interest rates, what they’re trying to do is tell us that the economy is doing better — if we are experiencing more inflation, the economy is stronger.”

This is just false; the most you can say about monetary policy in its current setting is that the Fed is no longer fearful of emerging downside risks. Those risks are still there, just not an active concern at this particular moment. But this difference is misinterpreted as if the economy is improving in a meaningful way, which Fed officials refuse (intentionally, I believe) to set straight.

And so the media is filled all over again with “interest rates have nowhere to go but up”, a term that was first used in the New York Times all the way back in April 2010 using the very same assumptions that proved rather quickly wholly unwarranted.

“Americans have assumed the roller coaster goes one way,” said Bill Gross, whose investment firm, Pimco, has taken part in a broad sell-off of government debt, which has pushed up interest rates. “It’s been a great thrill as rates descended, but now we face an extended climb.”

When that quote was published in the article titled, remarkably, Interest Rates Have Nowhere To Go But Up, the 10-year UST was yielding 3.90%, having touched 4.00% just days before. Almost exactly seven years later, the opposite time and again has proven to be true. Back then, however, anticipated economic recovery was still somewhat realistic, whereas now not even the Fed actually believes in one (all public rhetoric aside, if you actually listen to what they are actually saying Fed members coyly, quietly admit the output gap has been closed from above, not up from below). Even after the latest “reflation” selloff, it is the 30-year bond that flirts with 3% not 4%, where the 10-year is closer to 2%.

Bill Gross’ former colleague at PIMCO, Mohamed El-Erian wrote yesterday (thanks to M. Simmons) to try to get our attention back where he thinks it belongs:

When it comes to investor positioning, an important takeaway from last month should have been that the Federal Reserve, now less worried about the economic outlook, is becoming more assertive in leading, rather than following markets.

Some recent signals suggest that this phenomenon could accrue further momentum. Yet investor attention has been distracted, making bonds less sensitive to an important Fed policy regime shift and a lot more reflective of political uncertainty in the US and Europe.

He doesn’t say it, but his message is perfectly clear: interest rates have nowhere to go but up. His reasoning, somehow, is the same as Mr. Gross’ was in April 2010, without, apparently, reconciling how it could be that monetary assumptions have all been wrong about everything between then and now. Allianz’ chief economic advisor claims the bond market is “distracted” rather than dazzled by hawkish monetary policy, but it is the bond market that time and time again has proven itself at the expense of the Federal Reserve.

He makes the same basic mistake that is always made, that bond yields are nothing more than toys for the amusement of monetary policy. What El-Erian means by “distraction” is that supposedly the bond market came out of the last “rate hike” in March with a “dovish impression”, and because bond yields are to the mainstream nothing more than monetary policy extrapolated to the outer maturities, lower yields relate solely to that perceived “dovishness.”

It is an amazing error especially for someone in his position; he might have just written “conundrum” and saved himself all the words. Lower yields over this many years can only relate to monetary policy in how it has failed, and is further expected to be mostly immaterial for the foreseeable future. The selloff last month and the considerable doubts expressed by UST’s, eurodollar futures, and a great deal more all relate instead to interpretations of just what that means; just how low is a paradigm of only low growth?

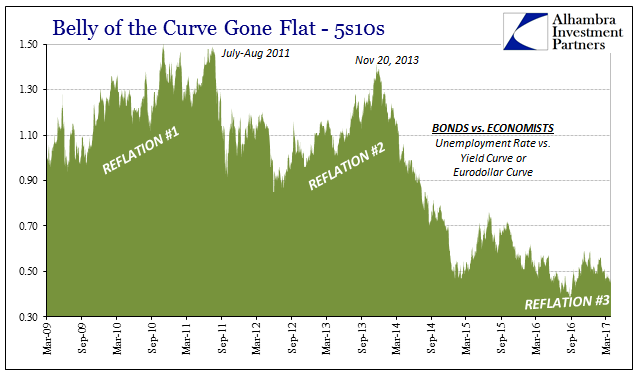

The combination of eurodollar futures (and that curve) along with US Treasuries (and that curve) are instructive here, especially in their lockstep fashion regardless of last year’s “reflation.” The curves are telling us that what the Fed is actually doing, not what the mainstream, including El-Erian, take that to mean. Any perceived “dovishness” is not that at all, but rather a signal further confirming those doubts. I wrote last year (on this same topic because the interest rate fallacy refuses to go away):

While the wholesale monetary system is different in format and varied in complexity, functionally it amounts to the same tendencies. That is why interest rates have behaved as they did; when the market viewed “stimulus” as stimulus, rates reacted in accordance with this “income effect” where successful completion was supposed to lead to plentiful money and economy in the near future – rising interest rates. And each time the market was sorely disappointed to find out that what the Fed’s “stimulus” actually amounted to was far from functional money, and therefore didn’t actually stimulate anything other than central banker self-regard (so many “heroes”).

This view on interest rates provides us with some insight as to why the events of 2011 were a seemingly permanent alteration in both banking (eurodollar basis) and the global economy. QE2 was supposed to be a large expansion of money, yet there was almost immediately another crisis where it was clear that even short-term liquidity had never been repaired let alone restored (a global problem again). If the short-term liquidity expectations surrounding QE (and really bank reserves) were all wrong, what did that suggest about monetary assumptions in regard to the real economy?

All bond yields have done over the years is to test the limits of monetary failure in their relation to the economy, exactly what we find today. Until something actually changes, how can anyone expect the bond market or eurodollar futures to do something different? If your only answer to that question is “the Fed is raising rates”, then, unlike the bond market, you have severely misunderstood the last decade.