Why Reform?

Imagine a world where huge amounts of money are created out of nothing for private profit and destroyed again once profit is taken, so that new money can be created again (and again, and again) – for private profit.

Imagine a world where governments can borrow huge amounts of money created by private corporations (for their own profit) and charge the debt to taxpayers (without any say-so from those taxpayers); then use the money to do whatever they like, including buy arms, make wars and laws and payments to benefit themselves, their supporters and friends.

Imagine a world where the entire money supply is created as debt, and rented out at interest. Debt rented out at interest? Can such a devious a form of robbery even exist?

It can and does; for this is the world we live in today. A world where eight individuals own more than the poorer half of the world’s population;[1] where government and finance are deep in each other’s pockets; where the desires of most people for a better world are frustrated at almost every turn.

Today’s money consists of debt, created by banks in such a way that productive working people end up with debt while assets go to the rich and powerful. By ignoring the way money works, we have allowed the world to take a downward spiral. Not many people understand the process: so instead of reform, voters reach out to vicious, unstable dictators to rescue them.

The basics of the system are not exactly a secret. Many central bank websites have an account of how money is created as two-way debt.[2] But the subject and its process are so little discussed, they could be the tightest-kept secrets on earth.

For many years now, the subject has stayed ‘under the radar’. Most people in active life – certainly those with success, influence and power – have done well in the system as it is. Naturally, they do not like to think they have prospered from, and given their working lives to, a corrupt system. Furthermore, reform is alarming. Would the world be turned upside down? Would we lose what we already have? The system is unstable. Rocking an unstable boat in an open sea is not a good idea. As for voting citizens, the subject is tricky and time-consuming to understand. Meanwhile, the lives of billions of people are reduced to desperation and misery by ever-greater inequality and unaccountable powers. ‘Globalization’ is not globalization of justice, or democracy, or free trade; it is globalization of money-creation and predatory finance.

What about those people whose job is to tell us what is going on – politicians, the media, economists? There’s an old saying: ‘He who pays the piper calls the tune’. In politics, the media, and academia ignorance – or at least silence – about the unjust workings of the monetary system is a prerequisite for acceptance, let alone advancement.

How the system developed – a tiny dose of history.

The foundations of today’s method of creating money were laid in England over three hundred years ago by rich white males – Members of Parliament and others – shortly after they seized power from the monarchy. The new method solved an age-old problem which had frustrated ruling classes for centuries: how to profit more than once, and more than just a little, from the money supply.

The method emerged from banking (which was already centuries-old). The advantage (for the rich and powerful) of banks creating the money supply was that huge amounts of money could be created out of nothing, as loans. Governments wanted money to go to war; rich people wanted money to make more money. Borrowing large sums that already exist is time-consuming and perhaps impossible. It may be necessary to offer high rates of interest, and to ask many different people, who may have many different reasons to refuse. But banks create money out of nothing, so borrowing is quick and easy – and generally cheaper.[3] All that’s required is evidence that the bank will make a profit.

English innovations set the stage for banks to become creators of money across the globe. Parliament passed a few simple laws – the Bank of England Act (1694) and the Promissory Notes Act (1704) – authorizing bank-debt to circulate as money. After that, banks were free to create and destroy money as debt from themselves, rented out at interest.[4] A few years later (1720) ‘bubbles’ (massive over-creations of credit/debt) were causing economic chaos in England and France.[5] It became obvious that the system had to be restrained, or it would ruin those it was designed to benefit. Many restraints, put in place then and subsequently, were removed about thirty years ago in the ‘great deregulation’ of the late 20th century. The situation worsened further as electronic communication networks enabled huge amounts of credit to be created and destroyed at high speed, and bankers to devise new ways of evading regulators.[6]

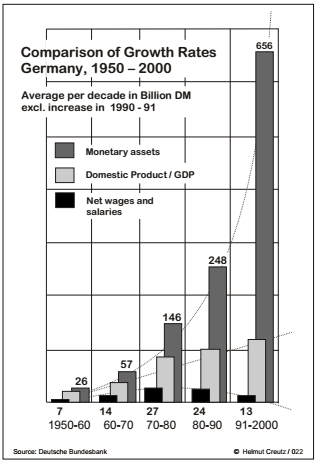

This is an illustration of relative change in wages, production and financial assets after ‘deregulation’ in one country (Germany):[7]

Why are banks still allowed to create money today?

A long-standing fantasy has it that banks exercise enormous power behind the scenes, manipulating governments and lawmakers to do their bidding. No doubt banks will try to do those things when they feel they have to: but mostly, they don’t need to. When banks create the money supply, governments can borrow quickly and easily, no questions asked: or rather, just one question: ‘Will you be able to repay us, with interest?’ ‘Of course,’ answers the government: ‘Our taxpayers will pay!’.[8] And, as if we need reminding, governments make the laws.

Laws that allow banks to create money also allow many other devices which profit those who chase money and power – as will shortly be revealed. The result is impoverishment and dependence for many, hugely increased power for governments, and vast riches for a few. Our ruling classes today: politicians and plutocrats comfortably in each other’s pockets.

Adam Smith, father of economics, declared ‘All for ourselves, and nothing for other people, seems, in every age of the world, to have been the vile maxim of the masters of mankind.’[9] It would be more accurate, perhaps, to observe that while some ruling classes are openly and unrepentantly kleptocratic, backing up their regimes with oppression and murder, some try to act with decency, convincing themselves that their rule is best for the sake of all. In most countries, the ruling class lies somewhere between those extremes. Democracy, meanwhile, is mostly an illusion – giving voters the impression that they are in charge. In reality, voters choose between powerful factions, none of which likes to recognise (let alone discuss) the way money is created, for it is the fountainhead of power.

Laws that allow banks to create money.

The way banks create and destroy money is strange, destructive and easy to hide: so much so that banking historian Lloyd Mints wrote it must have been invented by ‘an evil designer of human affairs’.[10] The effects are indeed diabolical, but the basics are simple. Complexity grows out of them like the devouring heads of a hydra.

Laws which allow banks to create money are laws that support the buying and selling of debt. Without such laws, debt from a bank could not pass from one person to another to make payment: it could not become money.[11] Debt would be a private arrangement between borrower and lender, and the State would only help to recover a debt on behalf of the original lender. In the case of banking, that lender would be a customer who makes a deposit. The customer would indeed own a debt from the bank; but that debt could not be transferred to anyone else. It could not become ‘money’.

When debt can be bought and sold, on the other hand, whoever currently owns the debt may summon the force and power of the State to help recover it. Fair enough! you might say – or maybe not; but this simple outcome is not the main problem. The main problem is that once debt can be bought and sold, value can be created where it didn’t exist before.

It is easy to show how this works. Imagine that I, the author, lend you, the reader, a thousand pounds. I no longer have the money; you have it. I won’t have that thousand pounds again until you give it back to me, and then you won’t have it. No value has been created.

If, on the other hand, I lend the government (or a corporation) a thousand pounds, I get a piece of paper – a ‘bond’ – equal in value to what I have lent. This piece of paper is effectively a kind of money, limited to circulation among the wealthy, but tied in value to money proper. I can exchange my bond among other wealthy people for other things of value, including money; and I can use it as collateral for further borrowing.[12] Valuable property has been created for the class of those who are already wealthy.

Bank-money is only slightly more complex. Banks create money by creating two equal-and-opposite debts which add up to nothing: a debt from the borrower to the bank, and a debt from the bank to the borrower.[13] The debt from the bank becomes money.[14] Debt from a bank goes into circulation when the borrower makes a payment. The borrower’s debt stays with him (or her, or it) until it is repaid, whereupon the debt and an equivalent amount of money both disappear.

The debt from the bank is a ‘promise to pay’. When you own money, you own a ‘promise to pay’ from a bank. When you make a payment, ownership of the bank’s ‘promise-to-pay’ moves to someone else – to the person you paid: the bank is now ‘promising to pay’ that person instead of you. All our money consists of promises-to-pay, from commercial banks and central banks.[15]

A bank’s ‘promises-to-pay’ are made valuable by laws; but a bank’s ‘promises-to-pay’ are bogus. Banks never pay their customers anything of value – other than more promises-to-pay. Their promises-to-pay circulate as money and are destroyed again without anything else being paid out. Meanwhile, banks charge interest on their ‘promises to pay’. An economist prepared to notice the uncongenial obvious comments that a bank is ‘in the delightful position of living on the interest of what it owes.’[16]

So, bank-money is created as two equal-and-opposite debts, which will eventually cancel each other out. But on one of the debts, interest is going the wrong way. Like water flowing upstream, interest on the bank’s debt goes to the bank, because corrupt laws have enabled it to become money. The simple injustice of these corrupt laws, designed to profit some over others, has filled the world with inequality and debt – and with insatiable, irresponsible powers.

Because of this advantage granted by law – a license to charge interest on what they owe – banks easily out-compete other forms of money. They share some of the profits from creating and re-creating the money supply with their customers, providing some services free of charge and paying for others (such as storing money long-term). Other forms of money – gold, giro accounts – are pushed out of circulation: what rational person is going to store their money elsewhere, when a bank will pay? Today, cash is under assault (it is a cost to commercial banks).[17]

Laws allowing debt to be bought and sold are nothing new. In various guises, they have been introduced into many civilizations in the past, always with catastrophic results.[18] Before such laws are introduced, prosperity for all is in everyone else’s interest – rulers included. Afterwards, a new order of people is empowered whose business is ruining other people and claiming their assets. One result has always been a corruption of the ruling order.[19]

Creating money is creating value. A national currency is a claim on the work and assets of a nation. The significance of money is not whether it is ‘redeemable’ in gold or silver; it is redeemable in the produce of the nation or ‘currency area’ that uses it. Today, money is created out of virtually nothing: 97% of it is mere numbers, the other three percent is paper and cheap metal. Its creation should be the most scrutinized process in any society, particularly any society that thinks itself ‘democratic’. Credit that circulates as money increases the wealth and power of some at the expense of others.[20] Today’s money system transfers wealth from working people to governments, banks and financial predators. How else could eight individuals come to own more wealth than half the world’s population – that is, more than 3,600,000,000 people?[21]

Money created as debt: how it makes some rich, others poor.

Banks create new money in massive amounts – always as debt. How does this work towards making financial predators rich and productive workers poor? Here are one or two examples.

First, a short-term example. Someone who has a lot of money borrows more, specially created for them by banks. The person buys a business, lowers wages, replaces humans with machines, sacks some workers and demands that others work harder, obliges the business to behave more ruthlessly. The borrower makes a great deal of money, pays back the original debt (which immediately disappears) – and moves to the next acquisition. Corporate law assists the predator in this. Living standards of workers are pushed down; predators make easy money.

A longer-term example: the so-called ‘business cycle’. The cycle begins with banks creating vast amounts of new money and lending to all and sundry.[22] This creates a rosy expectation of ‘prosperity for all’. The tide of new wealth, however, conceals an undertow of debt. The tide turns: interest payments have been draining the general prosperity, and creditors begin to demand repayment. Borrowings (which once seemed like the dawning of a new age) have become unprofitable and unsustainable. As old loans are repaid faster than new loans are taken out, the money supply shrinks. Assets go to financial speculators and creators of debt; borrowers are ruined.[23] This ebb-and-flow is repeated over and over again.

The monopoly example: someone introduces a new, good idea into business practice: perhaps the use of computers for recording transactions; perhaps a network of private cars to act as taxicabs; perhaps an internet marketplace. A financial operator borrows a huge quantity of freshly-made money to do two things: to set up a global network, and to crush rivals – putting them out of business. A monopoly results.

The result of all this is our world today, where most money sits in vast pools of private and government ownership while most people live (and die) on minimal dispensations from above. Meanwhile, debts pile up on working citizens as they borrow for basic expenses, and become less and less able to pay interest on their accumulating debts. Once again, compound interest begins to take its impossible (inevitable?) toll.

Assets were relocated from ‘the people’ to predators first in England[24] then in America[25] then in Southern Europe[26]. The process is now happening across the world, as bankers create currency for international appropriations. This kind of predatory behaviour is reproduced between nations: nations with strong currencies act somewhat like banks, creating money in their own currencies to buy the assets of weaker countries, hoping that the created currency will stay abroad, circulating or in storage (because if it comes home, it will be used to buy assets of the home country).[27] They also lend: when interest can no longer be paid on a loan, compound interest kicks in. The results of compound interest are devastating. Nigerian President Obasanjo said at the G-8 summit 2008: ‘We had borrowed around 5 billion dollars by 1985-6. To date, we have paid back 16 billion dollars. Now we are told we still have 28 billion dollars of debt…. If you would ask me what is the worst thing in the world, I would say ‘compound interest’.[28]

After several centuries of these kinds of predation, vast pools of money are owned by corporations, nations and private speculators. Financial predators are no longer so dependent on banks; they can find other, still cheaper ways of borrowing immense quantities of money.[29] Reformers should address this problem too.[30]

And all the while, interest payments on the entire money supply are going to banks and their shareholders, adding costs to everything that is purchased.[31]

Further injustices arising from laws of ‘negotiable debt’.

Laws that enable banks to create money – laws of ‘negotiable debt’ – make possible a host of other unjust practices.

National debts have already been mentioned. The question has been asked many times: ‘When governments have the power to create money, why do they borrow money created by banks – at great expense to taxpayers, and at great profit to richer citizens?’[32] The standard economist’s answer is that when governments create money, they get carried away and create too much, resulting in runaway inflation. This has certainly happened from time to time, and has been happening today in unstable countries run by partially-insane dictators (for instance in Zimbabwe under Robert Mugabe). But it is also true that governments have frequently created money responsibly, restoring their nations to life and prosperity.[33] These episodes of rationality and justice have always come to an end, however. The nexus between power and wealth wins out and while voters’ attention is elsewhere, the power to create money is restored to private banks.[34]

The next two injustices are good examples of why some practices are doomed to stay ‘beneath the radar’ of public debate; although they are immensely damaging, their complexity keeps them hidden. The first is ‘public-private partnerships’ (U.S.-speak) or ‘public finance initiatives’ (U.K.-speak). Government agencies create negotiable debts paying high rates of interest to financiers, who borrow at low rates of interest. Money is effectively robbed from taxpayers and paid to parasites. The process tears the heart out of public services, whose slow decline promises more profits for predators, from eventual sell-offs.

The second is a similar technique used to loot corporate industry, giving wealth to short-term owners and managers and loading debt on the workforce. Companies borrow money (via selling bonds, a form of negotiable debt) to ‘buy back’ their own shares, enhancing share values and supplying directors with large bonuses, meanwhile hobbling the efforts of productive workers with added debt.[35] The result is counterproductive in the long run, as the company becomes less competitive, but in the short term it is highly profitable – for a few.

More examples of value being created out of nothing are derivatives, money market funds and repos. These are all forms of negotiable debt. ‘Repos’ are another example whose complexity is enough to make an outside observer weep. Selling an asset, with an agreement to subsequently repurchase the same asset, is used to create a chain of valuable debts in the form of ‘repurchase obligations’. The combined ongoing value of these and other ‘negotiable debt instruments’ is today many times the total value of global GDP.[36]

These virtuoso tricks relocate assets with a few, whose prosperity contributes nothing but inequality and human misery. Possibly this is the most negative of all the negative effects of our current system: it locates wealth, and therefore power, with individuals who pursue it for its own sake, regardless of damage to others. The result is a massive loss of moral direction in the conduct of human affairs. Even the ‘charitable’ activities of such people tend to pursue personal ‘visions’ which are often in conflict with human welfare and freedom.[37]

The nature of money.

Essentially, money is a form of property. Your money is your money, mine is mine, otherwise money has no meaning. Money is property in the abstract. The most interesting example of money as pure property is the stone money of Yap: some large stones sank in the sea generations ago while being carried from one island to another; but they are still acknowledged as money. It is irrelevant that they are at the bottom of the sea; everyone knows who owns them. The stones are exchanged for other property – even though they sit on the seabed.

To be useful, of course, money must have some recognisable form. At different times and in different places it has been gold coins, shells, tobacco, salt, paper notes, stones with holes in them and many other things. Today it is mostly numbers in bank ledgers, which can be substituted with notes and coins for convenience: convenience is a supremely desirable quality in money. Today’s forms of money are not in themselves fraudulent: numbers, paper and coins do not have to be created as debt. But because they cost almost nothing to make, they are an ideal vehicle for fraud: they can be created, destroyed, and created again at little expense.

The fraudulent aspects of today’s money are add-ons to its basic quality as money. First, bank-money is rented out to us at interest; second, it is created (and destroyed) for the profit and benefit of those in power; third, it is created and destroyed without public scrutiny, oversight, or debate: in other words, without any reference to the public interest.

The fraud in bank-money has been noted time and again by individuals, many of them historically significant, without their opinions ever being firmly established in public debate. Here are a few examples (many more may be found in other chapters of this book):

- John Adams, 2nd President of the United States: ‘every bank of discount, every bank by which interest is to be paid or profit of any kind made by the deponent, is downright corruption. It is taxing the public for the benefit and profit of individuals.’[38]

- Thomas Jefferson, 3rd President of the United States: ‘If the debt which the banking companies owe be a blessing to anybody, it is to themselves alone, who are realizing a solid interest of eight or ten per cent on it…. The object… is to enrich swindlers at the expense of the honest and industrious part of the nation.’[39]

- John Taylor, U.S. ‘founding father’: ‘Banking in its best view, is only a fraud, whereby labour suffers the imposition of paying an interest on the circulating medium… the aristocracy, as cunning as rapacious, have contrived this device to inflict upon labour a tax, constantly working for their emolument.’[40]

- Adam Smith, economist: ‘A particular banker lends among his customers his own promissory notes, to the extent, we shall suppose, of a hundred thousand pounds. As those notes serve all the purposes of money, his debtors pay him the same interest as if he had lent them so much money.’[41]

- Frank D. Graham, economist: ‘So far…as the totality of bank promises becomes, and remains, part of the currency, the promises are never called and the bank is in the delightful position of living on the interest of what it owes.’

Nor was this knowledge hidden from the general reading public. For many years, if you looked up ‘Banking and Credit’ in the Encyclopaedia Britannica you would find the following paragraph: —

- ‘When a bank lends… two debts are created; the trader who borrows becomes indebted to the bank at a future date, and the bank becomes immediately indebted to the trader. The bank’s debt is a means of payment; it is credit money. It is a clear addition to the amount of the means of payment in the community. The bank does not lend money.’[42]

Reforming the Law.

Because the fraudulent qualities of bank-money are add-ons to its performance as money, reform would simply consist of removing those add-ons. It would mean repealing laws that support the buying and selling of debt – much as the laws which supported slavery were repealed in most countries, after many years of struggle. After that, debt would be once again a private agreement between two persons, and law would only commit the State to help recover a debt if the claimant made the loan in the first place. This would remove legal support for bank-money, derivatives, bonds and many other debt-assets.

After reform, money would look exactly the same as it does today – numbers, notes and coins; but instead of being owned as debt, it would be owned as simple personal property. Each unit of existing money would be legally recognised not as debt from a bank, but as a piece of ‘unencumbered’ property.

This would take care of one-half of the debts created by banks – the debts from banks to ‘depositors’. The other half – debts to the banks – would remain. If the latter were left intact, the result would be the greatest windfall of all time – to the banks: their own debts abolished, debts to them still extant. Joseph Huber makes the obvious suggestion: that those debts should now be owed to the government, which could use the repayments as expenditure, reducing the need for taxation.[43] Some small recompense for taxpayers and the indigent, after centuries of being robbed!

As for the immense pools of money created by banks over time, should all of it be recognised as ‘pure’? Or should there be a progressive reduction in the amounts eligible for conversion? The danger in making any politically-motivated reduction would be that money would rush, prior to reform-day, into other forms of property. Looking at it from the point of view of a just money supply, however, it seems wrong that these fruits of robbery should remain fully intact.

There is a historical precedent for reduction in the money supply, and it is the most startling single event in economic history. After World War Two, Germany was in a situation in some ways similar to (though far more extreme than) the situation we have today. Vast amounts of credit had been created by the German government, and used to make war and reward its supporters. As a result, the economy was in sclerosis. Economic activity had ground to a halt; people were hungry and living hand-to-mouth. The currency reform of 1948, instituted by the U.S. occupying forces, simply abolished over 90% of money-wealth and distributed free money to each household. The result (literally overnight) was frantic economic activity.[44] Soon, however, the cycle began again; for there had been no fundamental reform, only adjustment.

There are earlier, more fundamental precedents for turning back the clock on forms of negotiable debt. Solon set the stage for the Athenian experiment in democracy by putting an end to debt slavery. The Roman Empire prolonged its existence for centuries by putting tax-farming on pause (early 1st century C.E.).[45] We could begin a genuinely democratic future by ending today’s global tyranny of bank- and government-created debt.

Reforming the regulations.

Many advocates of monetary reform do not recommend an end to negotiable debt: they want to adjust the regulations, so the system still works, but more in the public interest.

Their reasons for limiting reform in this way are various. Some wish to keep the power of created credit/debt alive, hoping to regulate it so that it is socially useful (‘left’) or efficient and profitable (‘right’). Others think that a fundamental change to the laws would be impossible: it is surely enough of an uphill battle to try and reform the regulations! Still others worry that unless large amounts of money can be summoned from nowhere, the kinds of massive infrastructure projects which the modern world needs will be impossible.

Whatever their reasons, many reformers focus on making the money-creation system more just, and less damaging. The kinds of change they recommend can be summarized under various headings. These changes are recommended by different reformers, sometimes in combination:

- ‘National banks of credit’: the idea here, is that state-owned banks would operate alongside (and in the same manner as) commercial banks; but instead of lending purely for profit, they would lend to projects with a social benefit. Banking profits would go to governments, thereby reducing taxation.[46]

- 100% reserve. The idea here is that banks would be obliged to keep as much value in reserve as they create in loans. If reserve was gold, this would mean keeping stocks of gold. Now that reserve is numbers loaned or sold by the government, it would mean a source of revenue for government. Many 100% reservists advocate going back to a reserve of gold, whose value would depend less upon private and/or government manipulation. The aims here are financial and market stability, and less profit to creators of credit.[47]

- Free banking. Any private business would be free to create money; the marketplace would determine which currencies would be successful. Most free-bankers favour a gold reserve. Some free-bankers wish to see money loaned into existence; others would prefer that only pre-existing money be loaned. The common aim here is to reduce ‘crony capitalism’ – the damaging relationship between government patronage and wealth-creation.[48]

- Sovereign Money. The idea here is that the money-supply should be created by the government, not by private banks; and as pure property, not as credit (with the possible addition of a state bank that issues credit for public works). Non-credit money would be permanent, so more would only be created as the economy expanded (and conversely, destroyed if the economy contracts).[49]

- An expanded role for community currencies, supplemented by credit-clearing circles based on actual goods and services. These systems already exist, but have been side-lined into relative insignificance by the dominance of bank-created money. Credit would no longer be created out of nothing as interest-bearing debt.[50]

- Simple displacement of bank currency by externally-created digital currencies such as bitcoin, backed by the open ledger system of recording transactions (‘blockchain’).

- Changes to accounting rules, so that banks may no longer count debts to themselves as assets.[51]

- Access for everyone to accounts in reserve money – digital cash – at central bank accounts. At present only banks and a few other select financial institutions are allowed accounts at central banks, The Bank of England is researching the possibility of ‘central bank digital currency’: in its own words, ‘a universally accessible and interest-bearing central bank liability, implemented via distributed ledgers, that competes with bank deposits as a medium of exchange.’[52]

The two websites which have serialized this book, those of Positive Money and the Cobden Centre, take different approaches to solving the problem of how to achieve a money supply that is more just, more efficient, and more stable. Positive Money favours 1, 4 and 8 of the above proposals; the Cobden Centre is keener on 2, 3 and 6. Both, I believe, would look kindly on 5 and 7.

The transition.

The transition would involve a one-off re-definition of money units as units of pure property, not ownership of debt from banks. The rest of this chapter addresses money not created as debt, but as circulating ‘pure’ money. This kind of money is referred to by reformers as ‘sovereign money’ or ‘pure money’.

The transition, according to the realistic proposals of Joseph Huber, The Cobden Centre and Positive Money, would consist of redefining present-day bank-created money as pure money.[53] This would coincide with reform of the laws of negotiable debt. Existing debt to banks would be re-allocated to governments.

Money-Creation under the New System.

To summarize: for many centuries, reformers interested in ‘just’ distribution have suggested that money be created in accord with definite principles:

- Not as debt.

- Value roughly constant, so as not to favour debtors or creditors.

- Not as a political act to curry favour with voters, but to establish and maintain a just supply.

It has long been recognised that justice must be kept separate from the selfish short-term interests and vagaries of political power; the same must surely be true for the money supply. For this reason, many reformers have recommended the establishment of an independent authority to command the government in how much money should be created or destroyed.[54] The authority would be governed by a single, simple objective: to steady the value of money.

The reason for aiming at a steady value is simple. A steady value favours no one: it is even-handed and just. When the value of money alters, some win, some lose. If money goes down in value (inflation), debtors get an advantage. If money goes up in value (deflation), creditors get an advantage.[55] The scales of justice must be balanced, not weighted to favour one side or another. The authority would be bound by this rule.[56]

When there is a need for more money – perhaps because the economy has grown – the authority would tell the government to create and spend a certain amount of money into the economy – thereby reducing the need for taxation. If, on the other hand, inflation is detected, money should be destroyed. The authority would then command the government to destroy a certain amount of money, to be gained by increasing taxation but not state spending.

Like most aims, this procedure could never operate to perfection; it would involve periodical adjustments of the money supply, always aiming at a steady value of money in relation to assets and consumables.

Compatibility Issues.

Would a new ‘pure’ money system, in a defined area, be compatible internationally with the system of ‘fractional reserve banking’ at present dominant throughout the world?

I have been assured by economists and others that there would be no problem. If troubles do arise, however, a number of emergency techniques exist that have been developed, tried and tested in today’s chaotic financial world, such as: capital controls; price and wage controls; restrictions on currency movements, purchases and exchange; and use of an intermediate and neutral international ‘world’ currency.

After reform, how would money be different?

Although ‘pure’ money would seem pretty much the same to people using it, it would behave differently from bank-money in a number of interesting ways.

First, money could no longer sit in a bank and command interest: it would have to be lent for some purpose, and at some risk, before it yielded profit. Today, banks pay depositors to let their money sit idle because it maintains their supply of ‘reserves’. Without reserves, a bank cannot function in today’s system, in which banks compete and cooperate (a monopoly banking system would not need ‘reserves’).[57]

On the other hand, transferring money would become relatively simple and cost-free, because it would mean no more than transferring a number between ledgers. Transferring bank-money today is complex and expensive for banks, requiring a great deal of ancillary activity.[58]

Second, the quantity of money in circulation would remain much steadier, and be much more controllable. Money would no longer be destroyed when debts to banks were repaid, so a great deal less would have to be created. In today’s system, huge amounts of bank-money are created when the mood is optimistic; huge amounts are routinely destroyed when loans are repaid to banks, and also when pessimism strikes and banks call in their loans. ‘Pure’ money would remain in circulation, and its amount would be controlled by public decision-making, not by private profiteers.

Third, the profit in making new money would be ‘one-off’. The profit in making ‘pure’ money has always been one-off: coining gold; gathering shells; growing tobacco; making holes in stones.[59] After its creation, ‘pure’ money is in lasting circulation.

Fourth, borrowing would involve human, and therefore more moral, decision-making. Borrowings would be of money which already exists, from individual humans. There would no longer be amoral corporations setting rules of pure profit, guiding loan-creation.[60] A bank is legally obliged to create and lend money purely on the criterion of the profit it will yield. Private humans, when lending money, have all kinds of motives, and often profit is not even one of them.

Fifth, money would no longer siphon wealth from the working to the wealthy. As already pointed out, the kinds of individuals who gain great wealth and power in our present system are not distinguished by great intelligence, sagacity or skill, so much as by a common lack of concern for the results of their activities. The great tragedy of our civilisation, pointed out again and again by commentators of many different persuasions, is that the moral element is no longer influential. A restoration of morality in our economic and political dealings would be transformative.[61]

Sixth, the whole behaviour of money would be simpler to understand, not only for the general public (see below under ‘Democracy and the Money Supply’) but also for politicians and workers in financial services.

Where reform might take us.

For better or worse, one of the main engines of human activity is money. ‘For better or worse’ is no mere phrase: money can act for good, enabling interchange and prosperity, or it can act for bad, funding exploitation, destruction, and misery. In other words, it can either enable, or disable, human aspiration.

The ideals to which most of us aspire – freedom, democracy, peace, justice, living together in harmony – are impossible when the world is owned by so few and managed by their corporate servants. Freedom depends upon widely distributed ownership, rights, and law that is seen to be just. Democracy means active ‘rule by the people’, not just choosing every few years between well-financed and powerful factions. Peace depends on governments acting on the desires of citizens not to have their homes blown to pieces and they and their children killed, not on ‘economic’ goals set to profit those in power. Justice becomes possible when law is created and administered for all, not skewed in favour of certain interests. Living in harmony emerges when communities are aware of laws and their consequences – not when law-making operates beyond the notice of most citizens. Finally, ever-increasing inequality must lead eventually to unrest and dictatorship, as the poor majority reaches the end of its tolerance and looks to some thug for deliverance.

Reform would make it possible for the ideals listed above (and many other good things) to take root and flourish. How many of the evils and malaises that affect our human world have their origin in inequality? Inequality of wealth brings with it other inequalities: of freedom, opportunity, moral choice, pursuit of health etc. Humans are social animals and instinctively moral (unless defective, as Darwin explains at length in The Descent of Man).[62] When we are obliged to behave in destructive ways, and deprived of our moral freedom to look after common interests, mental distress naturally follows. The authors of The Spirit Level trace connections between economic inequality and a host of evils such as crime, drug addiction, mental health problems, broken families, violence, obesity and other dysfunctions.[63]

Money would be gained in exchange for work that contributes, not for legalized misappropriation. Ordinary citizens could begin to regain control of their lives, and of the world we live in.

Wealth would be more widely distributed. Wide distribution of money and power would transform our world. At present, money and power are concentrated in the hands of a few people who devote their lives to getting them. In other words, they are concentrated in the hands of the wrong people. For civilisation to survive, lust for power and money should not be systemically subsidized. ‘Now power is in itself evil, no matter who wields it. It is not constant or dependable: it is a lust, and therefore insatiable, unhappy in itself and bound to make others unhappy too.’[64]

In a ‘pure money’ economy, prosperity would increase. What evidence is there for this assertion? Prosperity today is provided by machinery, technology, entrepreneurship, human labour and free markets – not by the efforts of a few people to own the world. With too much inequality, spending dries up, and bank-money fuels inequality. A healthy economy is in a healthy balance between money being used for exchange, and money being stored for future use.

The immense complexity in money and finance today would disappear. Everyone could begin to understand the workings of money; which leads directly to…

Democracy and the money-supply.

‘Democracy’ was traditionally understood to be rule by the not-so-well-off, because the not-so-well-off are always in the majority. But today’s ‘democracies’ are dominated by the rich. There are some reasons for this discrepancy. First, what we like to call democracy – electoral representation – is in truth not very democratic.[65] Second, most voters are in the dark about laws and practices that favour wealth.

It is hardly surprising that the powers of politics and money are attracted to each other. As powers they are complementary, and if they cooperate their powers increase in tandem. The days of pure competition for power between ‘left’ and ‘right’ are over.

Many of the ways in which our financial system corrupts the democratic process are obvious and well-known – lobbying, corruption, revolving doors, tax concessions, et cetera, et cetera. But perhaps none is more important than its being a hidden obsession which dominates the electoral contest. For a long time now, elections in most countries have tended to lurch alternately between parties of ‘left’ and ‘right’. The reality is that ‘left’ and ‘right’ are two wings, state and private, of the same (corporate) vulture. When money is issued as debt – and called credit – by commercial banks, citizens live with kleptocracy; when money is issued as credit by the State, citizens live with totalitarianism.[66] In a ‘mixed’ economy, citizens lose progressively to both ‘left’ and ‘right’ wings. Today, the wings are renamed ‘neoliberal’ and ‘neoconservative’ and the vulture is more voracious than ever.

This is how money dominates the ‘democratic’ process to its great detriment. Paralyzed in choice between ‘left’ and right’, elections neglect the great problems confronting humanity: arms proliferation, weapons of mass destruction, environmental decline, inequality, destruction of homelands, the spread of fascism.

It was a sad day when the framers of the U.S. constitution could not agree on rejecting banks as currency-creators.[67] The value of a constitution is that it enshrines certain principles in a simple, open document, available to anyone. Constitutions are taught and remain familiar across the generations, whereas today, ‘it is a melancholy fact that each generation must relearn the facts of money in the bitter school of experience.’[68]

Conclusion: How Possible is Reform?

There is no point in belittling the problem. We live in a system that’s tailor-made to end civilization as we know it. At present, there seems little hope for reform. No powerful interest group wants it. Elites chase money and power – and bank-money fuels the chase. Nervous and dependent middle classes, frightened of rocking the boat, avoid thinking about uncongenial truths. Further down the social hierarchy, many are excluded, and others feel helpless, cowed or apathetic. Still others feel complacent, or assume they won’t be able to understand. Yet others are bought off with subsistence provisions and/or diverted by mass entertainment. The Roman Empire collapsed because no simple ideology of reform developed to reverse its drift to self-destruction.[69] A similar situation exists today: a smattering of would-be reformers, powerless to do anything, is in any case divided over what should be done.

On the other hand, more people are becoming aware that the system is corrupt and kleptocratic. Banks are becoming increasingly – and more obviously – toxic drivers of inequality. Backed by state guarantees, they behave ever more greedily and irresponsibly. They invest more in asset-speculation than in productive investment. Their insolvency is becoming more obvious, more well-known, and more of a threat to the rest of us. This might be the right time for the insights of people like Jefferson and Adams (referred to above) to take centre stage. It has taken many years for their predictions to come true, but today they are undeniably valid.

Another factor pushing us towards reform may be that colonialism-by-money-creation, exploited for so long by the West, is now subject to competition from other powers. Will the West respond by noticing the predatory nature of these techniques?

In these circumstances, reform might begin to happen almost by itself. Today, payment systems outside banks are proliferating. At the moment, new payment systems use money created by banks, because there is no viable alternative.[70] But as truth begins to seep out between the cracks, central banks are beginning to distance themselves from the results of money-creation by emphasizing that actually, they do not create the money supply.[71]

The Bank of England, for instance, has announced its intention to give ‘non-bank Payments Service Providers’ access to its settlement system – the central payment ledger of the British economy, to which only banks have hitherto had access.[72] One possible route towards reform is if central banks – or even just one central bank – begins to issue ‘pure’ money and allow ordinary people to hold accounts. A pioneering example of a new money system, avoiding commercial-bank-created money completely, might open the eyes of many to the possibilities of a more just and prosperous world.

And that would surely be a good thing.

On this, hopefully hopeful, note, the book ends.

[1] Oxfam report: http://www.oxfam.org.uk/media-centre/press-releases/2017/01/eight-people-own-same-wealth-as-half-the-world

[2] E.g. the Bank of England: http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q102.pdf The German central bank has only acknowledged this recently (to declare itself not responsible for creating too much money): http://www.bundesbank.de/Redaktion/EN/Topics/2017/2017_04_25_how_money_is_created.html?startpageId=Startseite-EN&startpageAreaId=Teaserbereich&startpageLinkName=2017_04_25_how_money_is_created+397964

[3] An example from early days of the Bank of England. During the recoinage of 1696, the Bank was temporarily short of cash. King William III was wanting to go to war with France. ‘Ministers of State went from shop to shop and office to office’ offering up to 30% interest; but the King was so short of funds that ‘he could not even despatch a certain diplomatic agent, being actually unable to defray his travelling expenses.’ A few months later, the Bank was out of trouble and came to the rescue; ‘bullion was pouring into the King’s coffers, the Allies presented an imposing front in the field, and a decision of the money-market had, not for the last time, exercised a momentous effect upon a military campaign.’ And all at 8% interest! Cambridge Modern History (1908), vol. 5 pp. 267ff: and Sidney Homer, A History of Interest Rates 1977 pp. 149ff.

[4] Richards, R.D. The Early History of Banking in England (1958); Holdsworth. A History of English Law Vol 8 (1925) pp. 177-192; Coquillette, Daniel, The Civilian Writers of the Doctors’ Commons, London (1988).

[5] The Mississippi and South Sea Bubbles, both 1720.

[6] Jonathan McMillan, The End of Banking – Money, Credit and the Digital Revolution (2014). ‘Banking that is not or only lightly regulated is often called shadow banking. Within a few decades, shadow banking became more important than traditional banking.’

[7] Source: Helmut Creutz, The Money Syndrome www.TheMoneySyndrome.org

[8] Here is a paraphrase of a paragraph from a book praising banking and other forms of debt-creation: ‘Negotiable debt is not just a way of oppressing the lower classes. It has other functions too. Firstly, by creating large concentrations of capital, it allows governments to create military power and exercise control over wide areas. Secondly, it involves wealthy people in government where they all profit together. Third, it creates a system of dependence, poor on rich, that ensures social stability. Fourth, when debt itself becomes money, a huge variety of speculative techniques is opened for the wealthy to increase their wealth. Lastly, negotiable debt enables governments to reward their supporters with stable and long-lasting incomes.’ This paragraph, shorn of economese, is from The Origins of Value (2004) p.163.

[9] Wealth of Nations Book III, Chapter IV.

[10] Monetary Policy for a Competitive Society (1950) p. 5.

[11] The legal development of debt negotiability in England culminated in the Promissory Notes Act of 1704. See Chapter 3 of this book.

[12] A fact noted in 1776 by Adam Smith, the ‘godfather of economics’: ‘The security which it [the government] grants to the original creditor is made transferable to any other creditor; and from the universal confidence in the justice of the state, generally sells in the market for more than was originally paid for it. The merchant or moneyed man makes money by lending money to government, and instead of diminishing, increases his trading capital.’ Wealth of Nations, Book V, Chapter 3. Also, Alexander Hamilton in Report on Public Credit (1790): ‘It is a well-known fact, that in countries in which the national debt is properly funded, and an object of established confidence, it answers most of the purposes of money. Transfers of stock or public debt are there equivalent to payments in specie; or in other words, stock, in the principal transactions of business, passes current as specie.’

[13] The Bank of England describes how this works in its Quarterly Bulletin, 2014 Q1. ‘The process by which banks create money is so simple that the mind is repelled’ wrote John Kenneth Galbraith. Money: Whence it came, Where it Went p. 29. He then goes on to describe the process in a rather complex manner! Banks also create money (deposits) when they purchase assets.

[14] The official euphemism for this debt is ‘liabilities’ – which simply means debt.

[15] Again, the Bank of England states this quite clearly in its Quarterly Bulletin, 2014 Q1.

[16] Frank D. Graham, ‘Partial Reserve Money and the 100 Per Cent Proposal’ in The American Economic Review (1936).

[17] Banks rent or buy ‘reserves’ from the central bank or equivalent: cash is part of ‘reserves’.

[18] Other, more ancient examples of negotiable debt are debt slavery and tax farming. With debt slavery, the debtor became the ‘negotiable property’ of the creditor. With tax farming, tax liabilities of citizens were sold off by States to the highest bidder: brutality, corruption and excessive demands were common results. Republican Rome and pre-Revolution France were casualties of tax-farming. Debt-slavery led to social dislocation and catastrophe in many parts of the ancient world.

[19] This has been noted again and again. An example from 1832: ‘The direct tendency of the principles of the Economists is to destroy the intermediate links of society; or, more correctly, to consolidate them in one end of the chain; —to replace the feudal aristocracy, from which Europe has suffered so much, with a monied aristocracy more base in its origin, more revolting in its associations, and more inimical to general freedom and enjoyment.’ From John Wade, The Black Book, An Exposition of Abuses in Church and State, 1832.

[20] For more on this, including how banks are exempt from various rules of law, see Chapter 3.

[21] Oxfam: http://www.oxfam.org.uk/media-centre/press-releases/2017/01/eight-people-own-same-wealth-as-half-the-world

[22] The synchronicity of banks creating credit, not from conspiracy but from individual self-interest, is well-described by C.A. Phillips in Bank Credit (1931) pp 74-5.

[23] The process used to be much more discussed. For instance, William M. Gouge, in his authoritative book A Short History Of Paper Money And Banking In The United States (1833, p.26) describes how during business cycles ‘Multitudes become bankrupt, and a few successful speculators get possession of the earnings and savings of many of their frugal and industrious neighbors.’

[24] Bolingbroke on the aftermath of credit-creation by bankers: ‘A new interest has been created out of their fortunes and a sort of property, which was not known twenty years ago, is now increased to be almost equal to the terra firma of our island.’ Letter to the Earl of Orrery, quoted H.T. Dickinson Liberty and Property 1977 p 52. Originally written sometime between 1709 and 1711, the letter was reprinted in Camden Miscellany XXVI 1975 p 146.

[25] Jefferson complained in 1825 that government in the United States was becoming “an aristocracy, founded on banking institutions and moneyed incorporations under the guise and cloak of their favored branches of manufactures, commerce and navigation, riding and ruling over the plundered ploughman and beggared yeomanry.” Letter to William B. Giles, Dec. 1825.

[26] Michael Hudson covers this in Killing The Host (2015).

[27] This is why the U.S. both enjoys the privilege of the dollar as the principal international currency, and the highest external debt.

[28] Quoted in Margrit Kennedy, Occupy Money (2012) p. 18. From the same book, same page: ‘In 2008 developing countries were paying back $13 for every $1 they were receiving in development aid’.

[29] For instance, Uber is borrowing from Saudi Arabia to advance its global monopoly: https://www.nytimes.com/2016/06/02/technology/uber-investment-saudi-arabia.html?_r=0

[30] Aristotle’s idea of distributive justice, the modern concept of ‘unjust enrichment’, and pragmatic desires for functioning economies would all suggest this. See later in this chapter, under ‘Reforming the Law’. The provision of basic income might also be a desirable extra – in conditions when machines are producing most consumables – and also more possible to realise.

[31] ‘How much’ is being paid on the primary debt of the money supply itself should be an easy calculation for a statistician: average bank lending rate times the money supply; for the UK perhaps £80 billion per annum? This does not include the costs of secondary debts taken on to cope in a world where money itself is debt

[32] Montesquieu: ‘(National) debt takes the wealth of the state from those who work, and gives it to those who are idle; in other words, it gives the wherewithal to work to people who do not work, and difficulties to people who do work.’ De L’esprit des lois, 4, 22, 17. Or William F. Hixson, It’s Your Money (1997) p.114: ‘The very idea of a government, that can create money for itself, allowing banks to create money which the government then borrows and pays interest on, is so preposterous that it staggers the imagination.’

[33] American colonies of Great Britain were especially good at the constructive use of state-issued paper money: Maryland, Pennsylvania and Virginia are examples. See Richard A. Lester, Monetary Experiments and ‘State-Issued Currency and the Ratification of the U.S. Constitution’ by Mary M. Schweitzer in The Journal of Economic History Vol. 49, No. 2 (June 1989), pp. 311-322.

[34] See, for instance, Chapter 19 in William F. Hixson, Triumph of the Bankers: ‘Union Financing of the Civil War, 1864-1866’.

[35] Michael Hudson, Killing the Host (2015) gives a good overview and account of this. Also see http://www.barrons.com/articles/stock-buybacks-are-driving-companies-into-debt-1470459686 and http://www.reuters.com/investigates/special-report/usa-buybacks-cannibalized/

[36] ‘The 2007 global GDP was $54.5 trillion. In the same year, the capitalization of financial markets, public and private securities and banking system assets reached 4.2 times the global GDP. However, if we add to this the ‘value’ of OTC products and derivatives, then this figure is 16.6 times.’ From Panagiotis E. Petrakis, The Greek Economy and the Crisis: Challenges and Responses, 2014.

[37] Such as the war on cash promoted by Gates and others (http://norberthaering.de/en/32-english/news/784-gates-india-demonetization); or fantasies of intergalactic travel, so that when the planet is made uninhabitable a select few may escape; or robotization of work, so that the few may clean up completely and render the rest of humanity redundant.

[38] Letter to Benjamin Rush, August 1811. Life and Works of John Adams, Boston 1854, vol. ix, p. 638.

[39] Letter to John W. Eppes, 6 Nov. 1813.

[40] An Enquiry into Principles and Tendency of Certain Public Measures, 1794, p. 18.

[41] Wealth of Nations, Book 2 Chapter 2.

[42] 14th edition (1929) & 15th edition (1951). The article was written by Ralph Hawtrey, an English economist.

[43] Joseph Huber, Sovereign Money (2017)

[44] Alan Kramer, The West German Economy, 1945-1955 (1991). The monetary reform abolished the wealth of savers. Further reforms to reduce the wealth of great landowners and industrialists and ‘equalize the burden’ were, however, abandoned. The main difference between the two situations is that in post-war Germany, inflation was suppressed by rationing and wage and price controls whereas today, inflation is suppressed by the fact that most money is in possession of the rich, who are not spending it, but waiting to invest it.

[45] ‘The Roman state never had an adequate fiscal organization. Under the republic, it had farmed out the collection of taxes to private bankers. These abused their position not so much by extorting more than was due in taxes as by lending money at extortionate rates to permit the communities to pay their taxes in anticipation of their own collections or during periods of financial stress. Because of the evils of this system, Augustus so curtailed it that it gradually vanished during the early empire.’ ‘Economic Stagnation in the Early Roman Empire,’ Mason Hammond, The Journal of Economic History, Vol. 6, Supplement (May 1946), p. 85.

[46] See for instance Ellen Brown, The Public Bank Solution: From Austerity to Prosperity (2013).

[47] The classic text is Irving Fisher, !00% Money downloadable at http://fisher-100money.blogspot.co.uk/

[48] Lawrence White, Competition and Currency (1992); George A. Selgin, The Theory of Free Banking (1988) downloadable at Liberty Fund.

[49] See Positive Money publication DIGITAL CASH: Why Central Banks Should Start Issuing Electronic Money by Ben Dyson & Graham Hodgson (2016); and Joseph Huber, Sovereign Money (2017).

[50] Thomas H. Greco, Money: Understanding and Creating Alternatives to Legal Tender (2001).

[51] Jonathan McMillan, The End of Banking – Money, Credit and the Digital Revolution (2014).

[52] Bank of England Staff Working Paper 605 (2016) proposes a form of ‘digital cash’ to be created as debt: downloadable at http://www.bankofengland.co.uk/research/Documents/workingpapers/2016/swp605.pdf

[53] For the Cobden Centre, see: Jesús Huerta De Soto, Money, Bank Credit and Economic Cycles (2009), Chapter 9. For Positive Money, see: Sovereign Money: An Introduction by Ben Dyson, Graham Hodgson & Frank van Lerven, Chapter 5. For Joseph Huber, see: Sovereign Money (2017) pp. 170-4.

[54] See Henry C. Simons, ‘Rules versus Authorities in Monetary Policy’ The Journal of Political Economy, Vol. 44, No. 1. (Feb. 1936), pp. 1-30; reprinted in Economic Policy for a Free Society (1948).

[55] See Lectures On Economic Principles by Dennis Robertson, Vol III Chapter 2 (1959).

[56] ‘The importance of rules, and of focussing democratic discussion on general principles of policy, calls for emphasis… only by adherence to wise rules of action can we escape a political opportunism which jeopardizes and destroys what we wish most to protect and to preserve.’ Henry C. Simons, Economic Policy for a Free Society (1948) p. 202.

[57] For a more detailed explanation, see Joseph Huber, Sovereign Money pp. 70-1 (note16). When debt from a bank (i.e. money) moves from one bank to another, ‘reserves’ move to square the accounts. Banks buy or borrow ‘reserves’ from central banks. Thus they pay out on their debts to each other; only the public is paid nothing beyond promises. Sidney Homer noted in his classic tome on interest rates that once banks adopted fractional reserve, ‘instead of charging a fee for deposits, they began to pay interest on deposits.’ A History of Interest Rates (1977) p.148. Benjamin Franklin also noted the same difference (Works, vol. 5 (1906) pp 12-14.)

[58] Joseph Huber, Sovereign Money (2017) pp. 64-67.

[59] Rulers did sometimes resort to desperate measures to profit a second time: for instance, Henry VIII recalled all the coin, diluted it with cheap metal, and reissued it.

[60] This taps into a long debate about the amoral demands of corporations. Johannes Andreae (c.1270–1348) argued: How can you trust a creature that cannot be shamed or punished? Maitland (1850-1906) wished to write a book on ‘the damnability of corporations’ before his life was cut short.

[61] In Keynes’ (somewhat hopeful and somewhat overstated) words, ‘The love of money as a possession – as distinguished from the love of money as a means to the enjoyments and realities of life – will be recognised for what it is, a somewhat disgusting morbidity, one of those semi-criminal, semi-pathological propensities which one hands over with a shudder to the specialists in mental disease.’ From ‘Economic Possibilities for our Grandchildren’ (1930).

[62] Chapters 3 and 5 concentrate on ‘the moral sense’. The Descent of Man can be downloaded from many websites, for instance: https://ia902606.us.archive.org/7/items/descentmanandse09darwgoog/descentmanandse09darwgoog.pdf

[63] Richard Wilkinson & Kate Pickett, The Spirit Level (2009).

[64] Jacob Burckhardt, from Weltgeschichtliche Betrachtungen 1905.

[65] In The Name Of The People, Ivo Mosley 2013.

[66] Marx admired the power of capitalist credit-and-debt creation. The fifth plank of his Communist Manifesto was that it should be taken over by the State: ‘Centralization of credit in the hands of the state, by means of a national bank with state capital and an exclusive monopoly.’ The Nazis also took control of credit creation with banks obeying orders – or else.

[67] See Triumph of the Bankers, William F. Hixson (1993) Chapters 12 and 13; and ‘State-Issued Currency and the Ratification of the U.S. Constitution’ by Mary M. Schweitzer in The Journal of Economic History Vol. 49, No. 2 (June 1989), pp. 311-322.

[68] Maurice Allais, in Arrow and the Foundations of the Theory of Economic Policy ed. Feiwel, 1987, p. 491.

[69] Alföldy, The Social History of Rome (1988) Chapter 7.

[70] Privately-created digital currencies such as bitcoin are, at present, mostly vehicles for speculation.

[71] See note 2.

[72] www.endofbanking.org/fintech-revolution-in-the-united-kingdom/ and http://www.bankofengland.co.uk/publications/Documents/speeches/2016/speech914.pdf