“The paradox is one of the most completely established empirical facts in the whole field of quantitative economics.” – John Maynard Keynes

“The Gibson paradox remains an empirical phenomenon without a theoretical explanation” -Friedman and Schwartz

“No problem in economics has been more hotly debated.” – Irving Fisher

Introduction

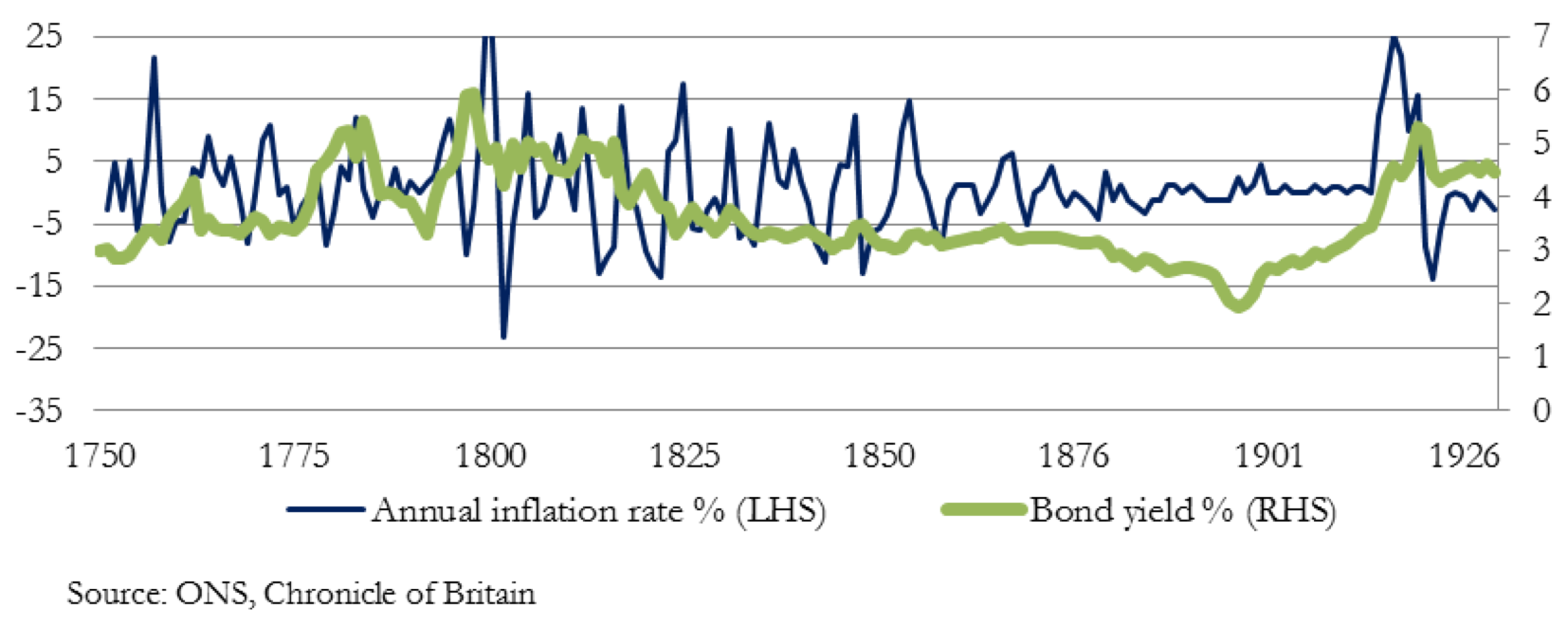

Two years ago, I found a satisfactory solution to Gibson’s paradox.i The paradox is important, because it demonstrated that between 1750-1930, interest rates in Britain correlated with the general price level, and had no correlation with the rate of price inflation. And as Friedman and Schwartz wrote, a theoretical explanation eluded even eminent economists, so economists preferred to assume the quantity theory of money was the correct guide to the relationship between interest rates and prices. Therefore, the consequence of resolving the paradox is that the supposed linkage between interest rates, the quantity of money and the effect on prices is disproved.

Gibson’s paradox tells us that the basis of monetary policy is fundamentally flawed. The reason this error has been ignored is that no neo-classical economist has been able to establish why Gibson’s paradox is valid, as the introductory quotes tell us. Consequently, this little-know but very important subject is hardly ever discussed nowadays, and it’s a fair bet most of today’s central bankers are unaware of it.

The relationship between interest rates and the general level of prices held until the 1970s. This article summarises why Gibson’s paradox functioned, why interest rates do not correlate with price inflation, and the reasons it failed to be evident after the 1970s.

For ease of reference, here are the two charts reproduced from my original paper that the paradox refers to, the first illustrating the correlation between interest rates and the price level, and the second the lack of correlation between interest rates and the inflation rate in Britain, the only country where such a long run of statistics is available.

Resolving the paradox boiled down to answering a very simple question: is the interest rate set by demand from the borrower based on what he is prepared to pay, or is it set by the interest rate demands of the saver, seeking a decent return on his money? The neo-classical assumption has it that in a free market it is what the saver demands to part with the temporary use of his money that controls the loan rate, and the borrower is at his mercy.

Indeed, all the literature going back to pre-Keynesian days assumes that consumers decide interest rates by dividing consumption between what is needed today, and what should be saved for the future. The problem that preoccupied theologians was that of greedy savers, morally guilty of usury. The two principal monotheistic religions, Christianity and Islam, held that usury is a sin, and Islam to this day insists its followers must not lend for interest. The vision of the idle rich living off the income of their capital also fuelled post-Marxian sentiment. The bias of opinion has always been against the seemingly idle saver and in favour of the industrious debtor. The saver is cast as a villain, and even central bank policy today is biased against him.

The assumption, that it is the saver who demands the interest rate, carried throughout the known history of economics, and finds its more recent expression with Keynes, who wanted to do away with saving altogether.ii He gave savers the epithet of rentier, an ugly word suggesting a rich man who rents out his capital, gathering in profit from the efforts of others. I found only one exception to this common view in the textbooks, and that was almost an aside in von Mises’s Theory of Money and Credit. He stated that the demand for capital takes the form of a demand for money.iii

So, money is demanded. Mises’s view of the relationship of cash to loans, which Keynes in his General Theory professed to not understandiv, overturns religious and socialist assumptions about the wicked saver. According to von Mises, he provides a service to businessmen by making capital available for production. Going back a page in von Mises’s Theory, we find that he also held that:

Capital goods or production goods derive their value from the value of their prospective products, but as a rule remain somewhat below it. The margin by which the value of capital goods falls short of that of their expected products constitutes interest; its origin lies in the natural difference between present goods and future goods.v

This being the case, clearly the rate of interest is set by what the borrower will pay to secure profitable production of future goods, not what a usurious rentier, as Keynes and others had it, will demand.

The businessman sets the price of borrowing by having the option not to borrow. In his calculations, he will attempt to quantify his fixed and marginal costs of production, and the added productive capacity additional capital will provide. He must estimate the wholesale value of his extra production, to assess his profits, gross of interest. He is then able to judge what interest he is prepared to pay to secure the capital required for a viable proposition. The businessman’s expectation of wholesale values is therefore linked to the cost of borrowing. It is for this reason that the interest paid by a manufacturer and wholesale values correlated, and therefore why interest rates correlated with the general price level.

Implications for monetary policy

Having established why bond yields correlated with the general price level, we must now show why they did not correlate with the rate of price inflation. It is easy to comprehend that the quantity of borrowing for productive purposes, as opposed to the quantity of money, can be regulated by interest rates, and indeed, if interest rates are raised, fewer manufacturing opportunities will be profitable and fewer will be embarked upon. Therefore, there is a link between interest rates and how money is used. The reason this did not translate into a correlation between interest rates and the rate of inflation is changes in interest rates only reflect changes in the allocation of money between immediate consumption and savings. You can change the quantity of money in the economy as much as you like, but this still holds true.

Imagine for a moment an economy without the central bank imposing interest rates on the free market, restricting itself to note issuance and being lender of last resort. If interest rates rise, it is because there are fewer savings relative to demand for investment, and there is more money being used for immediate consumption. Equally, if interest rates fall, they reflect a greater relative supply of savings, and a lower proportion of income being allocated to immediate consumption.

The overall quantity of money is immaterial in this relationship. If you doubled the quantity of money, so long as you double money spent both on consumption and money saved, interest rates would be unchanged. Therefore, measures of broad money in fiat currencies can expand or contract, irrespective of the interest rates set in the market.

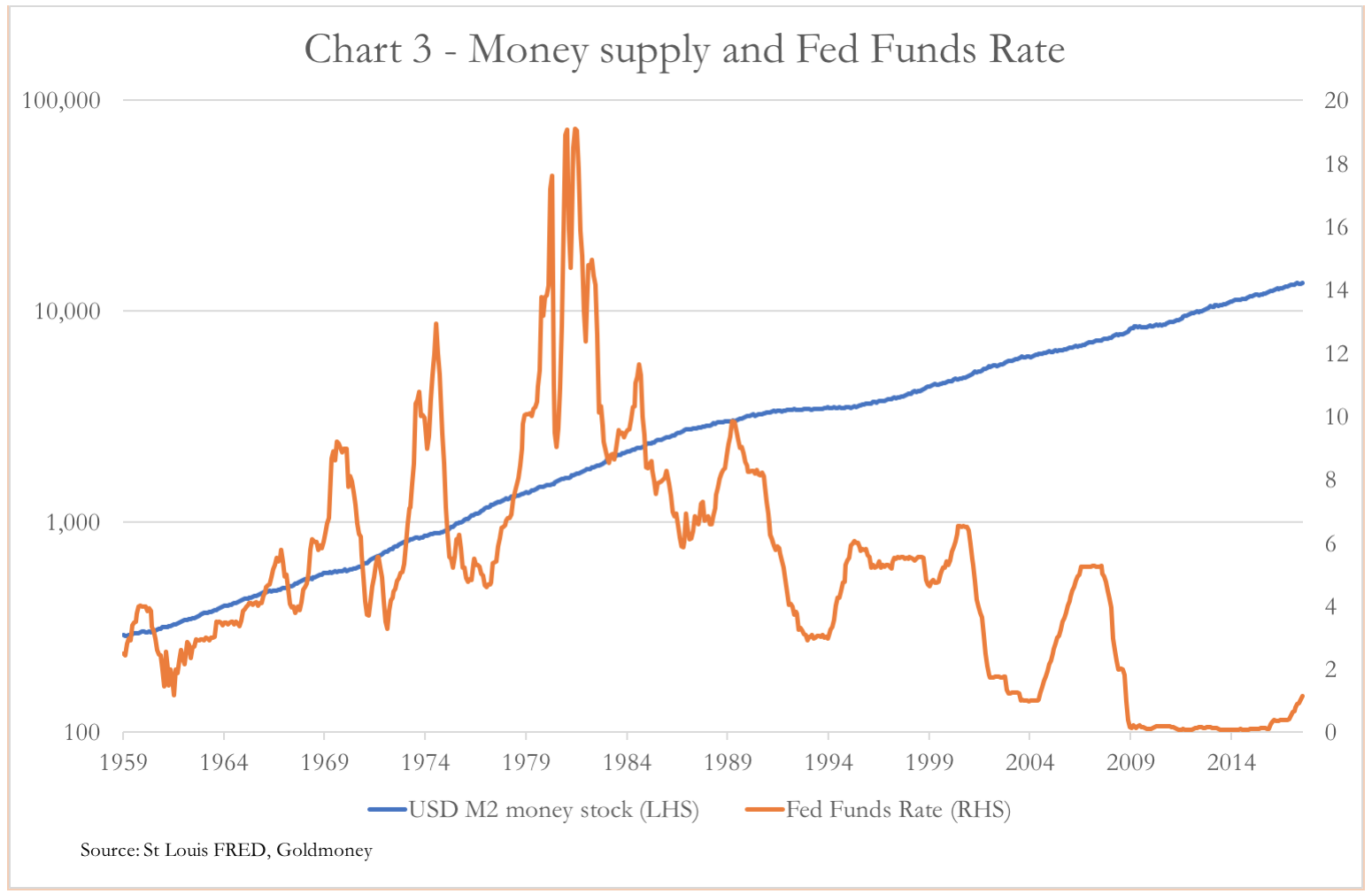

So, interest rates do not control the overall money quantity, demolishing a keystone of monetarism. Chart 3 illustrates this point, where the growth in US dollar broad money in circulation follows a steady growth path with little variance over long periods, while interest rates oscillate, violently at times, with little or no effect on the money quantity.

Therefore, attempts to control the growth in money supply by managing the interest rate fail. When a central bank reduces interest rates, the dialog is always about encouraging economic recovery. Commentators talk about stimulating the economy, stimulating consumption, and stimulating production as the occasion and their predilection suit, without seeming to understand that the changes in interest rates can only reflect shifts within the totality of current and future consumption, stimulating one, but stifling the other.

Presumably, when a central bank sets an inflation target, the thinking is on the lines that if demand for bank credit can be curbed by raising interest rates, so will be the rate of price inflation. But as Gibson’s paradox showed, this is untrue as well. The mistake is to regard interest rates as the price of money, which therefore regulates the balance of supply and demand for it. We have shown that this cannot be true, only regulating the balance between current consumption and future consumption, but there is another reason, which is interest rates can never be the business of central banks. To explain why, we must clarify what interest rates represent.

The origin of interest rates

Interest rates are an expression of time preference, in other words the difference in value between possessing a good today, compared with agreeing to possess it at a date in the future. Let us assume a consumer is offered a choice in buying an item from two retailers, which we will call a widget. The first retailer tells him he has widgets in stock. The second tells him he can match his rival’s price, but none are in stock, and he should get some in next week. The instant gratification of having the widget today obviously gives the first retailer an advantage. If the second retailer wishes to secure the customer’s business, he will probably have to reduce his price, or offer some other benefit to make up for the delay in gratification. The discount or benefit required is the time-preference between instant availability and future delivery of the widget.

Nearly all items have a greater value for delivery today than at some time in the future, and the greater the difference in time, the greater the discounted future value. Different goods and services will have different time-preferences, reflecting their own individual supply and demand characteristics. But since money is the common medium of exchange, these time preferences considered over a range of goods and services tend to be reflected in an omnibus time-preference for money itself, which is the premium, or interest, paid to someone for foregoing the use of his money for a defined period.

Interest on money is the other side of the discounted value of goods for future delivery. Money is not the origin of discounted values for future delivery, only a reflection of it. We see this illustrated in financial markets, when a commodity goes into backwardation. In this instance, the shortage of physical for immediate delivery creates a time-preference that is greater than the average for all goods, reflected in money’s interest rate.

Saving, the willing dispossession of money for future use, is often referred to as deferred consumption for this reason. Now, let us extend our earlier example of a widget, and assume our buyer is the retailer, who tells the wholesaler he anticipates selling more widgets in the coming year, and the wholesaler tells the manufacturer that demand for widgets is expected to increase. To increase his production, the manufacturer will have to devote more capital to fund the extra production between the time when production costs are due to be paid, to when he can expect to sell it.

Again, time preference applies, because the manufacturer is reallocating his capital, or acquiring money from someone else, to buy goods and labour today to produce future goods. If he is reallocating his own resources, he substitutes a return on capital from one use for another. Alternatively, he may temporarily acquire the capital from financial markets acting as intermediary for savers; in which case, the manufacturer pays a premium for the use of the money, and that premium is conveniently expressed as an annualised interest rate.

There are only a small minority of cases where the value attached to the use of a good, service or facility involves a time sacrifice, instead of a time benefit. But these are restricted to instances such as taking a lower salary today in return for better prospects. A student might extend his education, sacrificing earnings, in hope for a better income in the future. A venture-capitalist might invest in a project, which has no income stream, in the expectation an income stream will materialise that is sufficiently rewarding to justify his investment. These are examples where normal time-preference considerations are overridden.

However, these are exceptions to the rule, and interest rates must always have a positive value, their origins being in the laws of time preference, and set by the interaction of those that require capital and those that have a surplus to lend. The quantities are immaterial, and in the case of capital required to finance production, the level of interest is set regarding the added value of the output, as Gibson’s paradox illustrated.

It is only the actions of central banks that overturn this rule.

The relationship between prices and interest rates is now corrupted

The time preference of possession and use of money is therefore fundamental to the allocation of resources in an economy. We have seen that in a normal economy, one that is not dominated and controlled by the state, it is business that takes the initiative in setting the value of time preference by its overall demand for capital. The demand for capital is synonymous with production in a competitive environment, whereby sales are gained by improving products. This is the engine that drives economic progress.

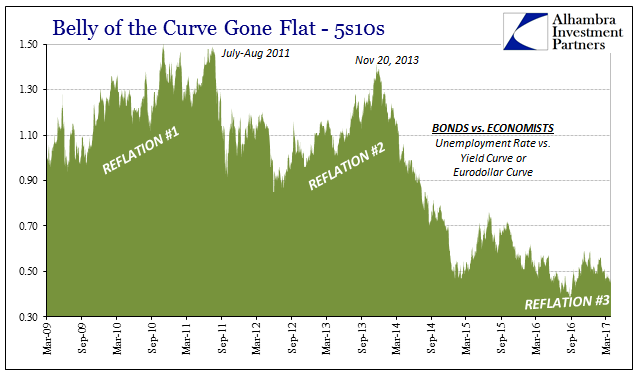

The correlation between the cost of borrowing and wholesale prices was evident from the earliest days of the industrial revolution in Britain, and continued until the mid-seventies, after which the relationship changed, as shown in our next two charts.

So why, after over two hundred years of correlation between wholesale prices and bond yields, did it end in the early 1970s? It is obvious that the continuing rise in prices denominated in state-issued currencies, lacking the anchor of gold, could not lead to a continuing rise in interest rates. It is the reasons the relationship ended which concerns us. There were two distinct periods to consider.

From late-1973, bond yields in Britain lost their correlation with the price index when the Bank of England raised its minimum lending rate to 13%, effectively cutting out commercial borrowers from the loan market. In the US, the summit of long-term rates was in 1981, when the yield on the long bond peaked at 14.4% after the Fed raised the effective Fed funds rate to 19.1%.

In both countries, the likelihood that price inflation was accelerating into hyperinflation became the overriding concern, and the Bank of England and the Fed dealt with the problem by raising nominal rates to the point where industrial demand for savings collapsed. And when demand for savings collapses, Gibson’s correlation between prices and interest rates is obviously broken.

The price inflation problem had its roots in the beginning of the decade. In August 1971, America abandoned the Bretton Woods agreement, which had loosely linked global prices to the purchasing power of gold. The consequences for price inflation in the UK, where the unions had a high degree of political control, were relatively immediate. Monthly price inflation rose to an annualised rate of over 20% by the mid-seventies. Equity markets had topped out in May 1972, and the economy enjoyed a credit boom for the next eighteen months, propelled by negative real interest rates. In November 1973, the credit crisis commenced with an oil crisis that led to a sterling crisis, requiring the Bank of England to raise its minimum lending rate to 13%, as mentioned above. The most conspicuous victim was the commercial property market, which collapsed suddenly, taking down several banks. The following months saw a catastrophic fall of asset values at the same time as consumer price inflation was spiralling out of control.

Despite the financial crisis and asset deflation, hyperinflation of prices remained the most serious threat. The Bank of England had been reluctantly forced to raise interest rates above what businesses were prepared to pay to finance production, mainly because sterling was under pressure and the government was unable to fund itself at a lesser rate. The application of credit was, in a sense, being progressively nationalised.

In the US, similar economic distortions were accumulating. Freed from the discipline of gold, the purchasing power of the dollar was also declining at an accelerating rate. Paul Volcker, Chairman of the Fed, finally broke industrial and mortgage demand for savings in 1981 by hiking the Fed funds rate. Shortly afterwards, the global economy entered a new phase, characterised by a change of use in the application of bank credit.

The breaking of demand for savings was the first time that Gibson’s paradox was nullified in the history of the cost of borrowing, stretching back to 1750. We then entered an era of financial revolution, where the application of capital changed from financing production to financing government deficits and personal consumption.

It started with the UK Government forcing the London Stock Exchange to admit outside shareholders in member firms. In 1983-6, the City of London underwent “big bang”, which allowed banks to acquire and develop securities businesses. The combination of bank lending and investment banking was banned in America under the Glass-Steagall Act, so London regained its historic role of being the world’s premier financial centre, with American banks the leading buyers of London stock brokers. The American banks then successfully lobbied Washington to progressively rescind provisions of Glass-Steagall, allowing them to extend their newly acquired securities businesses into Wall Street. Glass-Steagall was eventually replaced by the Financial Services Modernisation Act of 1999. The spirit of John Law had been invoked, ringmaster of the Mississippi Bubble, with banks given the facility to issue both money and securities at will.

The use of credit was being hijacked. From London’s big bang onwards, regulation of markets evolved from private-sector associations, collectively known as self-regulatory organisations, to full government regulation. At the same time, restrictions on consumer credit were lifted, and demand for credit shifted from industrial lending and some restricted residential mortgage finance, progressively in favour of the consumer. Today, as well as mortgages, US credit card student loans and vehicle finance now total nearly $13trvi, exceeding total corporate bonds of $5.2trvii, to which must be added bank lending to non-financial corporates currently at $2.1tr.viii

With consumers now borrowing nearly twice as much as non-financial corporates, the correlation between wholesale prices and interest rates has been lost. Additionally, there is government debt, which has accumulated to a further net figure of $14tr, so one can see that industrial demand for credit is now only 20% of total US credit.

We now have an explanation as to why Gibson’s paradox no longer holds today. It has been superseded by the predominance of financing for consumption by both consumers and government, replacing the long-standing prevalent use of credit to finance production. The economic relationship between consumption, deferred consumption, and the financing of production effectively came to an end over thirty-five years ago.

Neo-classical economists will doubtless claim that the baggage of free market economics, such as Gibson’s paradox, is no longer relevant today. But that claim is one born out of the vested interest in the state control of money. And if the objective of the state is to manage the allocation of economic resources through control of money, even history tells us it always eventually fails.

We are always told that this time it is different. But the consequences of ignoring the lessons of free markets, and of the mechanism whereby businesses borrow to progress their production in the interests of the consumer, is manifest in the accumulation of unsustainable debt. The purpose of profitable enterprise is to pay down debt from the profits of production. Consumers who borrow are usually seeking greater satisfactions than are afforded from their income, which if they are to pay down the debt incurred requires a matching sacrifice in their satisfactions subsequently.

This is the difference between the world of yesteryear, when Gibson’s paradox summarised the relationship between borrowing for production and interest rates, the engine of economic progress, and of today’s world of borrowing for immediate gratification and to finance the state’s overspending.

i See https://www.goldmoney.com/research/goldmoney-insights/gibson-s-paradox

ii See the Concluding Notes (II) in Keynes’s General Theory of Employment, Interest and Money.

iii See pp341.

iv See his Appendix to Chapter 14, Section III, in his General Theory

v Ibid pp340.

vi New York Times: https://www.nytimes.com/2017/05/17/business/dealbook/household-debt-united-states.html?mcubz=0

vii Source: https://fred.stlouisfed.org/series/CBLBSNNCB

viii Source: https://fred.stlouisfed.org/series/BUSLOANS