In his article released on March 21 2018 – Economics failed us before the global crisis – Martin Wolf the economics editor of The Financial Times expressed some misgivings about macroeconomics.

Economics is, like medicine (and unlike, say, cosmology), a practical discipline. Its goal is to make the world a better place. This is particularly true of macroeconomics, which was invented by John Maynard Keynes in response to the Great Depression. The tests of this discipline are whether its adepts understand what might go wrong in the economy and how to put it right. When the financial crisis that hit in 2007 caught the profession almost completely unawares, it failed the first of these tests. It did better on the second. Nevertheless, it needs rebuilding.

Martin Wolf argues that a situation could emerge when the economy might end up in self-reinforcing bad states. In this possibility, it is vital to respond to crises forcefully.

It seems that regardless of our understanding of the key causes behind the crises authorities should always administer strong fiscal and monetary policies holds Martin Wolf. On this way of thinking, strong fiscal and monetary policies somehow will fix things.

A big question is not only whether we know how to respond to a crisis, but whether we did so. In his contribution, the Nobel laureate Paul Krugman argues, to my mind persuasively, that the basic Keynesian remedies — a strong fiscal and monetary response — remain right.

Whilst agreeing with Krugman, Martin Wolf holds the view that, we remain ignorant to how economy works. Having expressed this, curiously Martin Wolf still holds the view that Keynesian policies could help during an economic crisis.

For Martin Wolf as for most mainstream economists the Keynesian remedy is always viewed with positive benefits- if in doubt just push more money and boost government spending to resolve any possible economic crisis. It did not occur to our writer that without understanding the causes of a crisis, administering Keynesian remedies could make things much worse.

The proponents for strong government outlays and easy money policy when the economy falls into a crisis hold that stronger outlays by the government coupled with increases in money supply will strengthen monetary flow and this in turn will strengthen the economy. What is the reason behind this way of thinking?

In this way of thinking, economic activity is presented in terms of the circular flow of money. Spending by one individual becomes a part of the earnings of another individual, and spending by another individual becomes a part of the first individual’s earnings.

So if for some reason people have become less confident about the future and have decided to reduce their spending this is going to weaken the circular flow of money. Once an individual spends less, this worsens the situation of some other individual, who in turn also cuts his spending.

Following this logic, in order to prevent a recession from getting out of hand, the government and the central bank should step in and lift government outlays and monetary pumping, thereby filling the shortfall in the private sector spending.

Once the circular monetary flow is re-established, things should go back to normal and sound economic growth is re-established, so it is held.

Given that the government is not a wealth generator, this means that whenever it raises its outlays it also lifts the pace of the wealth diversion from the wealth-generating private sector. Hence the more the government plans to spend the more wealth it is going to take from wealth generators.

By diverting real wealth towards various non-productive activities, the increase in government outlays in fact undermines the process of wealth generation and weakens the economy’s growth rate over time.

The whole idea that the government can grow an economy originates from the Keynesian multiplier. On this way of thinking an increase in government outlays gives rise to the economy’s output by a multiple of the initial government increase.

Let us examine the effect of an increase in the government’s spending on an economy’s overall output. Can such an increase give rise to more output as popular wisdom has it? On the contrary, it will impoverish producers. By means of taxation or other means such as borrowings, Government forces producers to part with their products for Government services i.e. for goods and services that are likely to be on a lower priority list of producers and this in turn weakens the production of wealth.

As one can see, not only does the increase in government outlays fail to raise overall output by a positive multiple, but on the contrary this leads to the weakening in the process of wealth generation in general.

According to Mises,

…there is need to emphasize the truism that a government can spend or invest only what it takes away from its citizens and that its additional spending and investment curtails the citizens’ spending and investment to the full extent of its quantity.[1]

For most commentators including Martin Wolf, the occurrence of a recession is due to unexpected events such as shocks that push the economy away from a trajectory of stable economic growth. Shocks weaken the economy i.e. cause lower economic growth so it is held.

Following the Austrian Economics School of thinking – which Martin Wolf seems to ignore – we suggest that as a rule a recession emerges in response to a decline in the growth rate of money supply.

Usually this takes place in response to a tighter stance of the central bank. Various activities that sprang up on the back of the previous strong money growth rate (usually because of previous loose central bank monetary policy) come under pressure.

These activities cannot support themselves – they survive because of the support that the increase in money supply provides.

The increase in money diverts to them real wealth from wealth generating activities. Consequently, this weakens these activities i.e. wealth-generating activities.

A tighter stance and a consequent fall in the growth rate of money undermines various nonproductive activities and this is what recession is all about.

Given that, nonproductive activities cannot support themselves since they are not profitable, once the growth rate of money supply declines, these activities begin to deteriorate. (A fall in the money growth rate means that nonproductive activities access to various resources is curtailed).

Recession then is not about a weakening in economic activity as such but about the liquidations of various nonproductive activities that sprang up on the back of increases in money supply.

Obviously then both aggressive fiscal and monetary policies, which will provide support to nonproductive activities, will re-start the weakening process of real wealth generation thereby weakening the prospects for a meaningful economic recovery.

It is for this reason that economists from the Austrian School such as Ludwig von Mises and Murray Rothbard held that once an economy falls into a recession the government and the central bank should restrain themselves and do as soon as possible nothing.

Summary and conclusion

To conclude then, contrary to Martin Wolf during an economic crisis what is required for the government and the central bank is to do as little as possible. With less tampering, the more real wealth remains with wealth generators, which allows them to facilitate a further expansion in the pool of real wealth.

With a larger pool of wealth, it will be much easier to absorb various unemployed resources and eliminate the crisis. Aggressive monetary and fiscal policies will only hurt the process of wealth generation thereby making things much worse.

As long as the pool of real wealth is still growing, the government and the central bank could get away with the illusion that they can grow the economy.

Once the pool starts to stagnate or decline the illusion of government and central bank policies is shattered.

We suggest the key reason why Keynesian economics fails to explain the occurrence of recessions is because it ignores the key factor behind this, which is the tampering policy of the government and the central bank.

Rather than regarding these policies as detrimental to the wealth generation process, Keynesian economics considers these policies as an important remedy to fix the economy.

As long as this mindset remains intact, commentators such as Martin Wolf and Paul Krugman who advocate Keynesian remedies will find it difficult to ascertain the emergence of recessions. They will continue to describe rather than explaining what is going on in an economy.

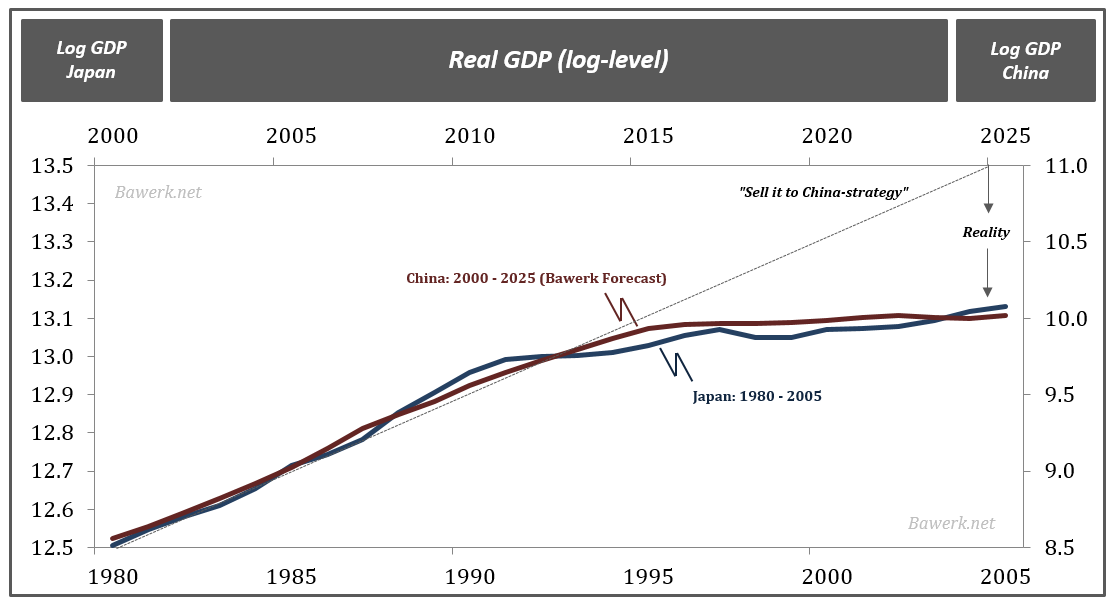

(To validate his argument, Martin Wolf’s resorts to an abundance of graphs in his article to explain what is going on. However graphs without a coherent theory cannot explain much. By showing a declining growth rate of some key economic data, one does not explain but rather describe economic data).

Martin Wolf could have done a great service to economics if he would acknowledge the futility of deriving ideas solely from the data and basing ideas on flawed logical assumptions such as that the government and the central bank can grow an economy.

[1] Ludwig von Mises, Human Action ,3rd revised edition, Contemporary Books Inc, p. 744.