“Ron Steigler: Mr. Gardner, uh, my editors and I have been wondering if you would consider writing a book for us, something about your um, political philosophy, what do you say?

Chance the Gardener: I can’t write.

Ron Steigler: Heh, heh, of course not, who can nowadays? Listen, I have trouble writing a postcard to my children. Look, uh, we can give you a six figure advance, I’ll provide you with the very best ghost-writer, proof-readers…

Chance the Gardener: I can’t read.

Ron Steigler: Of course you can’t! No one has the time! We, we glance at things, we watch television…

Chance the Gardener: I like to watch TV.

Ron Steigler: Oh, oh, oh sure you do. No one reads!”

- From the screenplay to Being There, by Jerzy Kosinski, from his novel.

“You won’t learn much about capitalism at university. How could you ? Capitalism is a matter of risks and rewards, and a tenured professor doesn’t have much to do with either.”

- Jerry Pournelle.

Being There is a bizarre little curate’s egg of a film. Directed in 1979 by Hal Ashby, who by all accounts at this stage in his career was no stranger to substance abuse, it also happens to be Peter Sellers’ last film, and it maintains an elegiac quality throughout. The film is punctuated by illness and loss. Sellers plays a simple-minded gardener named Chance, unable either to read or write, who has spent his entire life tending the garden of a wealthy businessman. After the death of his patron, and after a sequence of improbable coincidences, Chance ends up as a strategic adviser to another wealthy businessman, and then to the US President himself. Devoid of artifice, and with no practical experience of the real world, Chance is an almost total cypher, a latter-day Candide, whose only engagement with the outside world is through gadfly consumption of TV, and who speaks only in the language of gardening. Asked about his recommended economic stimulus, he replies: “As long as the roots are not severed, all is well. And all will be well in the garden.” Naturally, his near imbecilic horticultural argot is universally mistaken for genius. After his second patron dies, pallbearers at the funeral conclude that Chance has the best prospects for taking the next US Presidency.

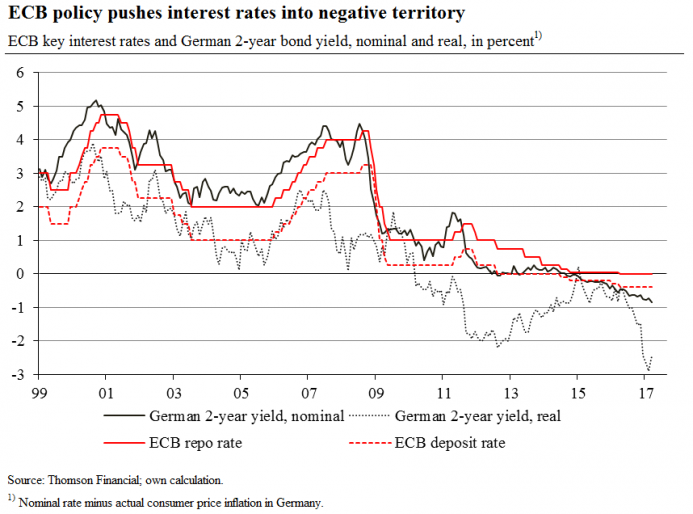

We cite Being There because it also happens to be the media pick of the economist John Hearn in our latest podcast. This interview is required listening for anybody given to suspect that economists never have a clue what they’re talking about and are pathologically incapable of giving a straight answer to a straight question. That is to say, it’s required listening for everybody. The merits and demerits of QE and ZIRP; the role of central banks; the likely future for asset markets – they’re all addressed with refreshing candour.

In The Origin of Wealth, Eric Beinhocker traces the failures in modern economics back to 19th Century France. (So it’s not all Keynes’ fault.) Léon Walras, who has singularly failed at every job he’s attempted, is out walking with his father, one evening in 1858. Walras Jr. has previously botched careers in academia, engineering, creative writing, journalism (these two have subsequently fused), and banking. He has been rejected, twice, by France’s prestigious Ecole Polytechnique due to poor mathematical skills. It is clearly now time for young Léon to try his hand at “the creation of a scientific theory of economics”. Eric Beinhocker:

Walras and his compatriots were convinced that if the equations of differential calculus could capture the motions of planets and atoms in the universe, these same mathematical techniques could also capture the motion of human minds in the economy.

In other words, Walras hijacked a bunch of principles from the realm of physics and then misapplied them to a grotesquely oversimplified model of his own economy. Economics was, plainly and simply, born out of physics envy. The principle of Walrasian equilibrium, for example, posited the theory of a perfectly balanced economy and a fully efficient market. Both of these concepts are now widely discredited. The real world is altogether more complex and chaotic than any model.

Walras was not alone. Beinhocker points out that he was “not the only economist during his era raiding physics textbooks in search of inspiration”; the British economist William Stanley Jevons is also cited for borrowing from the theories of gravity, magnetism and electricity in an attempt to turn economics into a mathematical science.

In a previous podcast we had the pleasure of hosting the economist and strategist Sean Corrigan of Cantillon Consulting. Sean is an unashamed Austrian school economist and we are indebted to him for this coinage from the interview:

There are four types of people in the world. There are entrepreneurs – who are the guys who get out of bed in the morning and say ‘How can I make money by making things better for people ?’ There are contra-preneurs – who are all the governments and bureaucrats and regulators who try to stop that happening, make it difficult or ban it. There are the con-trepreneurs.. who pretend to be doing the first thing but are just lining their own pockets, usually with government subsidies, with the help of the second group. And there are the non-trepreneurs – which is all the rest of us, who must be pretty bloody thankful every time we jump out of bed that the first lot keep doing it.

The problem with Keynesian and neo-Keynesian economics is that the government intervention which they both advocate always carries unintended consequences. (John Hearn’s views on the utility of QE and the harm done by ZIRP will be of particular interest to all investors.) The beauty of classical or Austrian economics is that they both recognise that the true and singular origin of wealth in modern society is the risk-taking entrepreneur.

In an investment context, we seek not just risk-taking entrepreneurs, but entrepreneurs with an exceptional ability to allocate capital. These will often be in the form of family-owned and family-run businesses. Informed and disciplined capital allocation – whether of unitholders’ funds, or of disparate corporate revenues – is the bedrock of our portfolios and moreover the heart of the modern free enterprise economy.

But as the tortuously winding road to Brexit is showing us, if we want a legitimate, free enterprise economy, we are going to have to fight for it. As the philosopher John Gray puts it,

The vote for Brexit demonstrates that the rules of politics have changed irreversibly. The stabilisation that seemed to have been achieved following the financial crisis was a sham. The lopsided type of capitalism that exists today is inherently unstable and cannot be democratically legitimated.. As it is being used today, “populism” is a term of abuse applied by establishment thinkers to people whose lives they have not troubled to understand. A revolt of the masses is under way, but it is one in which those who have shaped policies over the past twenty years are more remote from reality than the ordinary men and women at whom they like to sneer. The interaction of a dysfunctional single currency and destructive austerity policies with the financial crisis has left most of Europe economically stagnant and parts of it blighted with unemployment on a scale unknown since the Thirties. At the same time European institutions have been paralysed by the migrant crisis. Floundering under the weight of problems it cannot solve or that it has even created, the EU has demonstrated beyond reasonable doubt that it lacks the capacity for effective action and is incapable of reform.

John Hearn has also written about Brexit, again from the context of a free market libertarian (as opposed to an interventionist authoritarian). Here is what he wrote before the referendum itself:

- On my blog in “Unwinding the euro” and “The cause of the Eurozone/EU/worldwide continuing crisis” I have raised significant doubts about the survival of the euro and the union.

- Politics is very prone to resource misallocation through waste, a lack of market discipline and its access to a source of compulsory financing for its actions. Therefore I hope that by leaving the EU we can remove a layer of political waste from our budget and redirect resources more efficiently into productive investment and faster economic growth.

- I have no doubt that free market capitalism will make us all better off in the future and I explained this on my blog in “Capitalism: is it worth fighting for?”. I further made the point that this can only happen with limited government that accepts more constraints on its ability to intervene in the economy. This was explained in “A balanced budget: goodbye fiscal policy” and “A reappraisal of interest rates and market interest rates”

- There is a lot of criticism of what is now being referred to as the “Shadow Government” which is that group of unelected decision makers, experts, bureaucrats, administrators etc. that sit behind government. If we are worried about those behind the UK government then think how many more there are to worry about in the EU. This leads me to think that in our democracy I have less control over our politicians as they are now more controlled by their EU political overlords. I have often heard the line from politicians that they would like to do something but their hands are tied by Brussels.

As an individual I have always considered advice, but I do like to make up my own mind and not be instructed how to act by unelected people who think they know better. In the same way I like to be left alone to do the best I can for my students, my family and myself, and I hope that on June 23rd the wisdom of crowds will continue to limit political power by taking us out of the EU.

Against all odds, the vote for independence went as we hoped. Now to win the peace.

Chance the gardener, meanwhile, is the perfect metaphor for our age. For the asinine impact of television on the general culture in the 1970s, we now have the Internet instead (and we still have television, lingering on like a gut-shot tramp). For moronic nonsense spouted by a man-child, read economic forecasting by just about anybody, especially those in the service of the Establishment. As for the political overtones.. As the great American satirist H.L. Mencken once wrote,

As democracy is perfected, the office of the President represents, more and more closely, the inner soul of the people. On some great and glorious day, the plain folks of the land will reach their heart’s desire at last, and the White House will be occupied by a downright fool and a complete narcissistic moron.

Insert your own punchline here.