- Borrowing in Euros continues to rise even as the rate of US borrowing slows

- The BIS has identified an Expansionary Lower Bound for interest rates

- Developed economies might not be immune to the ELB

- Demographic deflation will thwart growth for decades to come

In Macro Letter – No 108 – 18-01-2019 – A world of debt – where are the risks? I looked at the increase in debt globally, however, there has been another trend, since 2009, which is worth investigating as we consider from whence the greatest risk to global growth may hail. The BIS global liquidity indicators at end-September 2018 – released at the end of January, provides an insight: –

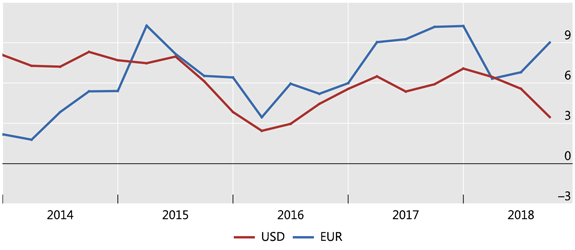

The annual growth rate of US dollar credit to non-bank borrowers outside the United States slowed down to 3%, compared with its most recent peak of 7% at end-2017. The outstanding stock stood at $11.5 trillion.

In contrast, euro-denominated credit to non-bank borrowers outside the euro area rose by 9% year on year, taking the outstanding stock to €3.2 trillion (equivalent to $3.7 trillion). Euro-denominated credit to non-bank borrowers located in emerging market and developing economies (EMDEs) grew even more strongly, up by 13%.

The chart below shows the slowing rate of US$ credit growth, while euro credit accelerates: –

Source: BIS global liquidity indicators

The rising demand for Euro denominated borrowing has been in train since the end of the Great Financial Recession in 2009. Lower interest rates in the Eurozone have been a part of this process; a tendency for the Japanese Yen to rise in times of economic and geopolitical concern has no doubt helped European lenders to gain market share. This trend, however, remains over-shadowed by the sheer size of the US credit markets. The US$ has remained preeminent due to structurally higher interest rates and bond yields than Europe or Japan: investors, rather than borrowers, dictate capital flows.

The EC – Analysis of developments in EU capital flows in the global context from November 2018 concurs: –

The euro area (excluding intra-euro area flows) has been since 2013 the world’s leading net exporter of capital. Capital from the euro area has been invested heavily abroad in debt securities, especially in the US, taking advantage of the interest differential between the two jurisdictions. At the same time, foreign holdings of euro-area bonds fell as a result of the European Central Bank’s Asset Purchase Programme.

This bring us to another issue; a country’s ability to service its debt is linked to its GDP growth rate. Since 2009 the US economy has expanded by 34%, over the same period, Europe has shrunk by 2%. Putting these rates of expansion into a global perspective, the last decade has seen China’s economy grow by 139%, whilst India has gained 96%. Recent analysis suggests that Chinese growth may have been overstated by 2% per annum over the past decade, but the pace is still far in excess of developed economy rates. Concern about Chinese debt is not unwarranted, but with GDP rising by 6% per annum, its economy will be 80% larger in a decade, whilst India’s, growing at 7%, will have doubled.

Another excellent research paper from the BIS – The expansionary lower bound: contractionary monetary easing and the trilemma – investigates the problem of monetary tightening of developed economies on emerging markets. Here is part of the introduction, the emphasis is mine: –

…policy makers in EMs are often reluctant to lower interest rates during an economic downturn because they fear that, by spurring capital outflows, monetary easing may end up weakening, rather than boosting, aggregate demand.

An empirical analysis of the determinants of policy rates in EMs provides suggestive evidence about the tensions faced by monetary authorities, even in countries with flexible exchange rates.

…The results reveal that, even after controlling for expected inflation and the output gap, monetary authorities in EMs tend to hike policy rates when the VIX or US policy rates increase. This is arguably driven by the desire to limit capital outflows and the depreciation of the exchange rate.

…our theory predicts the existence of an “Expansionary Lower Bound” (ELB) which is an interest rate threshold below which monetary easing becomes contractionary. The ELB constrains the ability of monetary policy to stimulate aggregate demand, placing an upper bound on the level of output achievable through monetary stimulus.

The ELB can occur at positive interest rates and is therefore a potentially tighter constraint for monetary policy than the Zero Lower Bound (ZLB). Furthermore, global monetary and financial conditions affect the ELB and thus the ability of central banks to support the economy through monetary accommodation. A tightening in global monetary and financial conditions leads to an increase in the ELB which in turn can force domestic monetary authorities to increase policy rates in line with the empirical evidence presented…

The BIS research is focussed on emerging economies, but aspects of the ELB are evident elsewhere. The limits of monetary policy are clearly observable in Japan: the Eurozone may be entering a similar twilight zone.

The difference between emerging and developed economies response to a tightening in global monetary conditions is seen in capital flows and exchange rates. Whilst emerging market currencies tend to fall, prompting their central banks to tighten monetary conditions in defence, in developed economies the flow of returning capital from emerging market investments may actually lead to a strengthening of the exchange rate. The persistent strength of the Japanese Yen, despite moribund economic growth over the past two decades, is an example of this phenomenon.

Part of the driving force behind developed market currency strength in response to a tightening of global monetary conditions is demographic, a younger working age population borrows more, an ageing populous borrows less.

At the risk of oversimplification, lower bond yields in developing (and even developed) economies accelerate the process of capital repatriation. Japanese pensioners can hardly rely on JGBs to deliver their retirement income when yields are at the zero bound, they must accept higher risk to achieve a living income, but this makes them more likely to drawdown on investments made elsewhere when uncertainty rises. A 2% rise in US interest rates only helps the eponymous Mrs Watanabe if the Yen appreciates by less than 2% in times of stress. Japan’s pensioners face a dilemma, a fall in US rates, in response to weaker global growth, also creates an income shortfall; capital is still repatriated, simply with less vehemence than during an emerging market crisis. As I said, this is an oversimplification of a vastly more complex system, but the importance of capital flows, in a more polarised ‘risk-on, risk-off’ world, is not to be underestimated.

Returning to the BIS working paper, the authors conclude: –

The models highlight a novel inter-temporal trade-off for monetary policy since the level of the ELB is affected by the past monetary stance. Tighter ex-ante monetary conditions tend to lower the ELB and thus create more monetary space to offset possible shocks. This observation has important normative implications since it calls for keeping a somewhat tighter monetary stance when global conditions are supportive to lower the ELB in the future.

Finally, the models have rich implications for the use of alternative policy tools that can be deployed to overcome the ELB and restore monetary transmission. In particular, the presence of the ELB calls for an active use of the central bank’s balance sheet, for example through quantitative easing and foreign exchange intervention. Furthermore, the ELB provides a new rationale for capital controls and macro-prudential policies, as they can be successfully used to relax the tensions between domestic collateral constraints and capital flows. Fiscal policy can also help to overcome the ELB, while forward guidance is ineffective since the ELB increases with the expectation of looser future monetary conditions.

Conclusions and investment opportunities

The concept of the ELB is new, the focus of the BIS working paper is on its impact on emerging markets. I believe the same forces are evident in developed economies too, but the capital flows are reversed. For investors, the greatest risk of emerging market investment is posed by currency, however, each devaluation by an emerging economy inexorably weakens the position of developed economies, since the devaluation makes that country’s exports immediately more competitive.

At present the demographic forces favour repatriation during times of crisis and repatriation, at a slower rate, during times of EM currency appreciation. This is because the ageing economies of the developed world continue to drawdown on their investments. At some point this demographic effect will reverse, however, for Japan and the Eurozone this will not be before 2100. For more on the demographic deficit the 2018 Ageing Report: Europe’s population is getting older – is worth reviewing. Until demographic trends reverse, international demand to borrow in US$, Euros and Yen will remain popular. Emerging market countries will pay the occasional price for borrowing cheaply, in the form of currency depreciations.

For Europe and Japan a reckoning may be nigh, but it seems more likely that their economic importance will gradually diminish as emerging economies, with a younger working age population and higher structural growth rates, eclipse them.