Professor Joachim Starbatty is a member of the European Parliament. He kindly hosted our event “The Lessons of Economic History” earlier this year. Here he speaks about how monetary policy has created bubbles and made the European situation worse.

Have Draghi’s policies at the ECB solved any of the problems or made things worse for the future?

The policy of Mario Draghi, President of the European Central Bank, to act as a guarantor for overindebted member states of the Eurozone (statement of Mario Draghi at a London investors conference on July 26, 2012: “Whatever it takes”) and his policy of buying government bonds on secondary markets have eliminated the interest spreads between the benchmark German Bunds and bonds of overindebted member states. This policy has kept the Eurozone together, but it hasn’t changed the underlying differences in competitiveness between member states.

What were the effects of interest rate convergence between member nations that joined the Euro?

The decrease in interest rates weakened the will of overindebted countries to lower their debt levels sustainably by improving their competitiveness and reforming their budgets. Also, Draghi’s policy of interest rate convergence disrupted the margins in banks’ traditional business model: investment of retail deposits in government bonds yields such low returns that banks had to increase their lending to riskier debtors, such as companies with low creditworthiness. Already, banks suffer from the risk of earlier lending to such companies. Draghi’s zero-interest policy has not lowered risk but rather increased it.

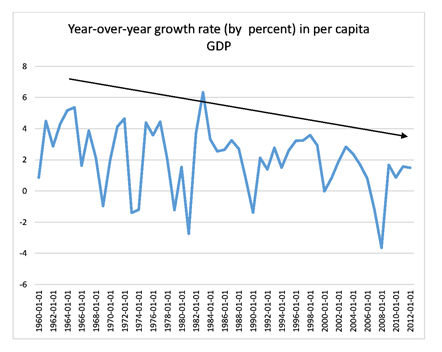

At the Austrian School event in the European Parliament I discussed the idea that there has been a massive global debt bubble building over the last generation through lower and lower interest rates, what are your thoughts on this concept?

The most recent financial crisis is a consequence of “underpricing of risk”. Investments turned out unsustainable. The consequences were burst financial bubbles in real estate and equity markets. The interest rate policy of the big central banks (ECB, FED, BoJ) has fuelled these bubbles. The bubbles also cause misallocation of resources in the economy. When they burst, the necessary realignment causes unemployment and value adjustments of respective asset classes. After the burst, politics has not followed the recipe of Joseph Schumpeter — to allow creative destruction to find a new growth path — but instead adapted John Maynard Keynes’ ideas of flooding the economy with cheap money and to stimulate demand. This has not solved any problems but postponed them into the future. Banks continue to finance companies that should go bankrupt (“zombie firms”) until they themselves are in trouble (“zombie banks”). In Japan, government debt has grown threefold since the 1990s without achieving a return of the country to sustainable growth.

In your experience, are policy makers at the ECB and elsewhere aware of the bubbles that they create through zero percent interest rates?

It is general knowledge that politics usually acts short-sighted to avoid a potentially massive backlash by voters. The danger that such short-sightedness will cause the next bubble is not denied but neglected. The mantra is: everything will turn out just fine. Until the subsequent bubble bursts, everybody will be happy: zero interest rates facilitate refinancing of deficits, increasing stock and property prices suggest a steady rise in wealth. In times like these, thoughtless politicians and central bankers ignore the sobering advice of economists.

Will there be a point at which interest rates will be forced to rise, and what would be the effects in Europe?

Cheap central bank money mostly floods into property and stock markets. If trade unions refrain from large wage increases, unit labor costs remain mostly unchanged and therefore also the price level of private consumption. In such a situation, people live in a money illusion: today’s money is of equal value than tomorrow’s money. If this perception changes and people realize that tomorrow’s money is worth less, we will see inflation. Then, interest rates will necessarily rise, and no central bank will have the power to prevent it. This will cause trouble in the financial sector because banks have assumed that interest rates remain unchanged. Let’s look at interest rates on German bunds: ten-year bunds have almost zero and occasionally even negative yields. Also, mortgage interest rates are at a historic low. In case of an unforeseen rise in interest rates, market actors will be over-indebted because they lent long-term money with too low interest.

At this point, what would be the ideal policies for Europe to recover and develop economically?

The answer is easy but painful: If interest rates rise, the misallocation of capital will become visible, and the economy will need to rid itself of legacy burdens to start to recover. These are the consequences of “underpricing of risk”. Every postponement of necessary adjustments will direct resources in the wrong direction and increase the cost of eventual recovery.