We read the news today that Judy Shelton has been approved by the Senate Banking Committee. This means that the full Senate can vote whether or not to approve her.

She is not liked in many quarters in Washington. Unlike President Trump’s pick for the other vacant seat (Christopher Waller), the vote on Dr. Shelton fell along strict party lines.

The reason for the antipathy is that she has promoted heretical ideas, dangerous ideas. Ideas about gold, and about a gold-backed Treasury bond. She has said that the US should return to a gold standard (though, alas, she has more recently called for the Fed to cut interest rates).

Given the entire theory developed by Keith Weiner, and our very raison d’etre, we feel we should comment on the prospect of Shelton joining the Fed. We should also disclose that Keith knows Judy, and has discussed gold bonds with her.

The Friedmanites and Keynesians who populate the Fed have the same stale, old ideas. We have remarked many times that their only debate is whether to centrally plan our economy based on discretion or whether to centrally plan our economy based on rules. And within the latter camp, the choice of rules is limited to targeting one or more of: inflation, unemployment, GDP, and the quantity of dollars.

Our opinion is that Dr. Shelton has some new and better ideas.

We make no prediction as to the politics she may encounter at the Fed. But there is a more fundamental problem. The Fed is a central planning agency. Its nature cannot be changed. And there is no good way to do central planning. There is no such thing as a good central plan.

We will not join the chorus cheering for her appointment. This is not because we don’t like her. If a person with a reputation for good ideas joins an organization with a reputation for central planning, it is the latter reputation that will survive.

Some might criticize us, and demand if we don’t care to minimize the harm inflicted by the Fed. Isn’t it better to have good people at the Fed, than bad?

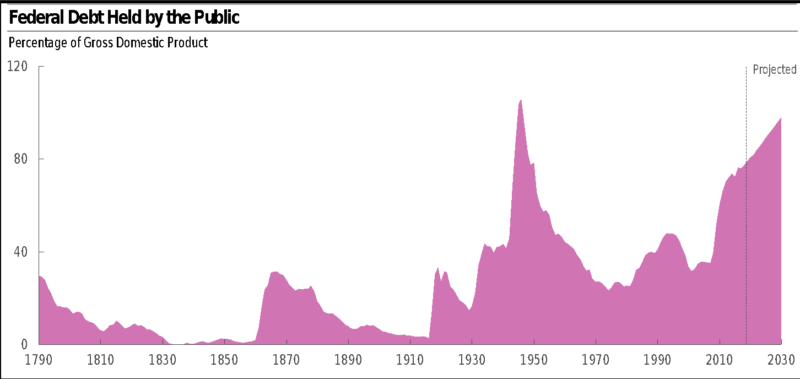

To which we reply: we trust the Fed well enough to keep working towards its true purpose. Forget GDP and inflation and unemployment. The job of the central bank is to enable the government and its cronies to borrow more, more cheaply. And this includes keeping them solvent. We trust the Fed will do what it needs to do to the quantity of dollars and the interest rate. And to buy whatever securities it needs to buy, to stave off the insolvency of any financial intermediary it cares about.

In other words, it will keep the capital-consuming machine going as long as it can, heedless of the consumption of capital. This will hold true with or without Dr. Shelton.

We wish her the best, but this does not alter our view of the Fed one iota. Or our mission to revive the gold standard, by paying interest on gold and silver to everyone.

Keith and Cobden,

Interesting points.

Totally with you on the failures of the FRS in the U.S., and your central banking BoE is just more of the same, with a few wrinkles.

On your menu of possible policy goals by the CBs, – that the ‘by-the-rules’ central bankers –

‘ rules is limited to targeting one or more of: inflation, unemployment, GDP, and the quantity of dollars.’

I presume that when you mention the quantity of ‘dollars’ you mean the money supply that supports the economy, and not those CB credits, a.k.a. “reserves” – also $US-denominated.

In an April 2015 (?) interview on the Cobden Center, Dr. William White opined on the limits of central banking to meet the needs of our fractured economies … in particular Dr. white pointed out that ‘after 2008, the problem is, will not be, one of ‘liquidity’, but of insolvency’, and further opined that actual insolvency CAN NOT be resolved with central banking.

My take is he had opined that you can’t fix a national economy that is over-burdened with private debt by using the debt-based central banking model … that the additional financial resources must come from elsewhere.

Unfortunately the Fed and most of the world’s central bankers are ignoring Dr. White’s advice – trying to Push That Liquidity String to the max, in the blind faith that somehow, more debt can solve the problem of too much debt.

Insolvency. Who’s been writing on solving that problem, anyway ??

We need a new monetary system. The Bankers School Money system – the extension of credit based on debt contracts – has more than run its course. Result : Insolvency.

More of the same? Only better ?

The brightest future today lies within or even beyond Dr. White’ s call for government actions, in a full-blown debt-money replacement with the Currency School – National Monetary Authority model.

Anyone for a National Monetary Commission, where the Gold Standard and Public Money vie equally on the discussion table?

Thanks.

.