By Dr Frank Shostak

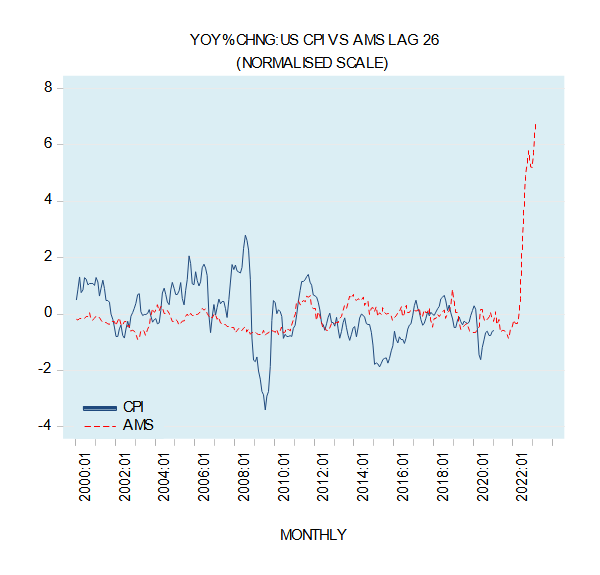

At the end of January, the yearly growth rate of our measure of US money supply (AMS) closed at 76.7% against 4.8% in January 2020. It is tempting to suggest that this massive increase in the growth rate of money supply is likely to result in massive price inflation in the months ahead.

Based on the sharp decline in the velocity of money from 6.7 in June 2008 to 2.3 by December 2020 we could however, argue that price inflation is not likely to accelerate in the months ahead. On this way of thinking, a decline in velocity is going to offset the effect from massive increases in money supply on price inflation. Here is why.

Over any interval of time, such as a year, a given amount of money can be used repeatedly in the purchases of goods and services. The money one person spends on goods and services, is used by the recipient of that money to purchase goods and services from some other individual. For example, during a year a particular ten-dollar bill used as following: a baker John pays the ten-dollars to a tomato farmer George. The tomato farmer uses the ten-dollar bill to buy potatoes from Bob who uses the ten-dollar bill to buy sugar from Tom. The ten-dollar here served in three transactions. This means that the ten-dollar bill was used three times during the year, its velocity is therefore three.

A $10 bill, which is circulating with a velocity of ‘3’ generated $30 worth of transactions in that year. Now, if there are $3000 billion worth of transactions in an economy during a particular year and there is an average money stock of $500 billion during that year, then each dollar of money is used on average six times during the year (since 6*$500 billion =$3000).

A $500 billion of money by means of a velocity ‘6’ has generated $3000 billion worth of transactions. From this it is established that,

Velocity = Value of transactions / stock of money

This expression can be also presented as,

V = P*T/M

Where V stands for velocity, P stands for the average price, T stands for the volume of transactions and M stands for the stock of money. This expression can be further rearranged by multiplying both sides of the equation by M. This in turn will give us the famous equation of exchange

M*V = P*T

This equation states that money multiplied by velocity equals the value of transactions.

Many economists employ GDP instead of P*T thereby concluding that

M*V = GDP = P*(real GDP)

The equation of exchange appears to offer a wealth of information regarding the state of an economy. Note that from the equation of exchange a fall in the velocity of money (V) for a given money (M) results in a decline in economic activity as depicted by GDP.

In addition, for a given money (M) and a given volume of transactions (T) a fall in velocity results in a decline in the average price (P).

Does the concept of velocity of money make sense?

Consider the following: a baker John sold ten loaves of bread to a tomato farmer George for ten dollars. Now, John exchanges the ten dollars to buy five kg of potatoes from Bob the potato farmer.

Note that John the baker paid for potatoes with his bread using money to facilitate the exchange. Money fulfils here the role of the medium of exchange and not the means of payment. (John has exchanged bread for money and then money is exchanged for potatoes i.e. bread is paid for potatoes with the help of money).

The so-called velocity of money has no relevance whatsoever on the bakers’ ability to purchase potatoes. What matters here is that he possesses bread that serves as the means of payment for potatoes.

In addition, it does not make any sense to argue that money circulates as the popular thinking has it. It always belongs to somebody.

According to Ludwig von Mises money never circulates as such,

Money can be in the process of transportation, it can travel in trains, ships, or planes from one place to another. But it is in this case, too, always subject to somebody’s control, is somebody’s property. (Human Action p 403).

Why velocity of money has nothing to do with the prices of goods

Does velocity of money have anything to do with the prices of goods?

Thus, John the baker holds that he will raise his living standard by exchanging his ten loaves of bread for ten dollars, which will enable him to purchase five kg of potatoes from Bob the potato farmer.

Likewise, Bob the potato farmer has concluded that by means of ten dollars he will be able to secure the purchase of ten kg of sugar, which he holds will raise his living standard.

By entering an exchange, both John and Bob are able to realize their goals and promote their respective well-being.

John had agreed that it is a good deal to exchange ten loaves of bread for ten dollars for it will enable him to procure five kg of potatoes.

Likewise, Bob had concluded that ten dollars for his five kg of potatoes is a good price for it will enable him to secure ten kg of sugar.

Individual’s purposeful actions determine the prices of goods and not velocity. Observe that price is the outcome of different ends.

The fact that so-called velocity is ‘3’ or any other number has nothing to do with goods prices and the purchasing power of money as such.

According to Mises,

In analyzing the equation of exchange one assumes that one of its elements–total supply of money, volume of trade, velocity of circulation–changes, without asking how such changes occur. It is not recognized that changes in these magnitudes do not emerge in the Volkswirtschaft [political economy, or more loosely ‘economy’] as such, but in the individual actors’ conditions, and that it is the interplay of the reactions of these actors that results in alterations of the price structure. The mathematical economists refuse to start from the various individuals’ demand for and supply of money. They introduce instead the spurious notion of velocity of circulation fashioned according to the patterns of mechanics (Human Action p 399).

Velocity does not have an independent existence

Contrary to popular way of thinking velocity is not an independent entity – it is always the value of transactions P*T divided into money M i.e. P*T/M.

On this Rothbard wrote (Man Economy and State p 735),

But it is absurd to dignify any quantity with a place in an equation unless it can be defined independently of the other terms in the equation.

Given that V is P*T/M it follows that the equation of exchange is reduced to M*(P*T)/M = P*T, which is reduced to P*T = P*T. It is like stating that $10=$10. This conveys no new knowledge of economic facts.

Since velocity is not an independent entity, it as such causes nothing and hence cannot offset effects from money supply growth on prices of goods and services.

The whole thing is not a tenable proposition and covering it in mathematical clothing cannot make it more tenable.

Moreover, the average purchasing power of money cannot be even calculated. For instance, in a transaction the price of one dollar was established as one loaf of bread.

In another transaction, the price of one dollar was established as half kg of potatoes, while in the third transaction the price is one kg of sugar.

Observe that since bread, potatoes and sugar are not commensurable no average price of money can be established.

Now, if the average price of money cannot be established it follows that the average price of goods (P) cannot be established either.

Consequently, the entire equation of exchange falls apart.

Price inflation and monetary inflation

We suggest that what matters for price inflation in the months ahead is the past and present growth rate in money supply i.e. monetary inflation and not the state of the velocity of money. The so-called velocity of money cannot cause anything since it is not an independent entity.

Note that when money is injected it always starts with a particular individual and the then goes to another individual. In this sense money moves from one market to another market. This is the reason why the effect from changes in money supply on various markets operates with a time lag.

Note that the price of something is the amount of money paid per unit of something. It follows then that once the new money enters a particular market more money is paid for goods in this market.

This means that the price of goods in this market i.e. the amount of dollars paid is now higher than before the increase of money took place.

Using the lagged annual growth of money AMS we can suggest that the yearly growth rate of the US consumer price index is likely to accelerate from early next year (see chart).

Conclusion

By popular thinking a sharp decline in money velocity since June 2008 is likely to neutralize the effect of recent strong increases in money supply on price inflation ahead.

We suggest that because of massive monetary pumping by central authorities the yearly growth rate of the consumer price index i.e. price inflation is likely to strengthen during 2022. This increase in CPI inflation is likely to take place notwithstanding the sharp decline in the velocity of money.

Contrary to popular thinking, the velocity of money does not have a life of its own. It is not an independent entity and hence it cannot cause anything, let alone offset strong increases in money supply.