It has been recently estimated that global debts stand at $284 trillion equivalent, representing 355% of global GDP. Estimates such as these must be treated with caution, and they probably underestimate financial sector debt. Furthermore, no allowance in these figures is made for OTC derivatives, which according to the Bank for International Settlements have a gross value of $15.48 quadrillion(!), netting out at $609 trillion.

This article comments on the different debt sectors: government, finance, non-financial corporate and consumer debt. It finds the dangers of excessive corporate debt have had the least attention, and that systemic risk in commercial banks is grossly underestimated.

The rapid growth of emerging market corporate debt is a recipe for a repeat of the Asian crisis in the late-1990s.

Ultimately, the whole debt burden will fall on government shoulders in their threefold attempt to protect the banks, stop a recession and to continue puffing up a wealth effect by inflating increasing amounts of currency into financial markets.

The trigger to end the debt crisis is almost certainly rising bond yields.

Introduction

Times of monetary expansion generate a shift in wealth from bank depositors to borrowers. Given that this year is the fortieth anniversary of the Nixon shock, when the world’s currencies finally came out as fiat, it is hardly surprising that each successive crisis led to the easier path of increasing debt instead of letting failing businesses and banks go to the wall. Kicking the can down the road has been the way to deal with every economic or financial blip. After all, it is argued, inflation reduces debt obligations over time.

Maybe, but it increases the net present value of future obligations to the ultimate destruction of welfare-driven states. This is why, if for no other reason, kicking cans down the road just ends up at some point with a pile of cans that can no longer be kicked. But politicians aware of mounting obligations and still doing the can-kicking believe that will be their successors’ problem, and you never know, something might turn up. After all, optimists argue, we survived higher levels of debt following the Second World War.

While most people are aware there was a financial crisis in 2008, they will surely fail to link it with the next one. For many reasons, they could be right. The Lehman crisis was driven by an excess of residential property speculation, liar loans and their securitisation. The next one is likely to be a bond, stock and currency crisis triggered by rising bond yields undermining the debt pile and weakening the dollar. It is only philosophising observers who notice that these crises happen regularly and have done so for a long time, approximately once every decade. The common link is debt, flowing and ebbing in periodic expansions followed by sudden contractions of bank credit.

It even occurred under a proper gold standard. Other than differences between successive crises the basic factors were the same, alternating between bankers’ caution evolving gradually towards carelessness, greed and then panic. But this last cycle, starting from the aftermath of the Lehman failure, has been totally different. State intervention in the form of previously unheard-of interest rate suppression has continued throughout the credit cycle. It is unsurprising that the can-kicking in the form of debt creation never paused and has accelerated with renewed vigour. Estimated to have been $175 trillion when Lehman failed, today the global debt bubble has increased to $284 trillion, according to a Bloomberg report, citing figures prepared by the Institute of International Finance. And with global GDP estimated at about $80 trillion a ball-park figure for debt to GDP of 355% is a workable assumption. Put another way, $3.55 dollars of debt are required for every dollar of GDP output.

It has always been reasonable in capitalistic markets for an entrepreneur to borrow working capital to cover the period between the initiation of a project and eventual sales of the final product, but in doing so he calculates carefully with a view to paying back his creditors out of profits. He continues to evolve his product to respond to competition and his reassessments of consumer trends. Research and development are funded by the business out of profits. Then came the financiers, who saw that a clear profit margin of, say 10%, could be turned into 20%, or even 30% by borrowing, not to finance anything but just to give leverage to profits, much of which they extract in dividends. They called it private equity, a misnomer for a process which at its base was and still is a means to gain advantage from the wealth transfer from bank depositors.

Financing for financing’s sake has taken over from honest capitalism, which is to compete to provide consumers with what they desire and need. It is no less than a corruption fully facilitated by fiat currencies issued by central banks in increasing quantities and at heavily suppressed interest rates. Micawber’s aphorism about debt being misery has been superseded by a leverage-based mantra that debt is good.

This loss of original purpose has been a bad thing, because consumption is never static, with consumers demanding progress. An entrepreneur delivers it by being flexible in his plans using debt as a temporary financing bridge. But when he is already loaded up with unproductive debt his commercial flexibility is compromised, and a needless proportion of enterprises end up as eviscerated zombie businesses. The smarter PE boys will have moved on and created similar problems elsewhere.

Then there is the legacy debt of major corporations who have become dependent on crony capitalism — the persuasion of politicians for preferential and monopolistic advantages. The replacement by lobbying of focusing on customer satisfaction has gradually driven them into a zombie state as well. Nearly half of the world’s debt is corporate, and if that’s not bad enough governments have also encouraged consumers to borrow to spend and ditch their savings.

How much debt is there?

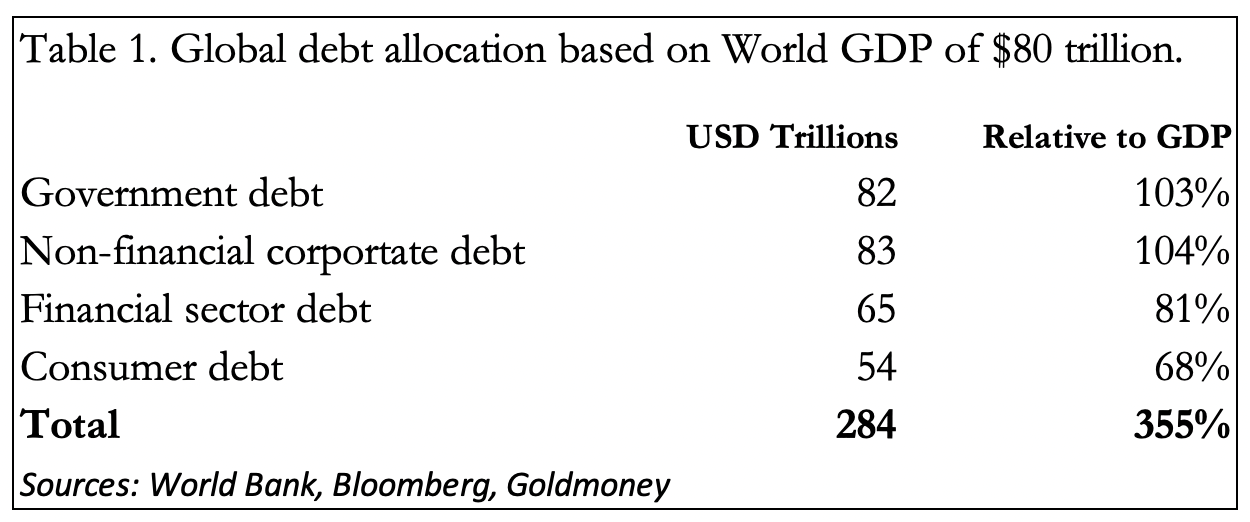

Broadly, there are four debt categories: government, financial, non-financial corporate and consumer. Table 1 shows an approximation of global debt distribution.

Within these debt categories, there is significant variance. In government debt relative to their GDPs we see Greece at over 200% and Italy at 170%. These simple ratios do not take account of the fact that tax revenues, upon which a state’s financial credibility is based, are raised by governments entirely from their private sectors.

Taking a global average of general government spending at 40% of GDP, government sector debt is 172% of its tax base. A government debt to private sector GDP for Italy stands at 314%, Greece at 324% and France works out at 264%. In fact, the socialising EU nations’ government spending, being an average of almost 50% of their economies, means that their indebtedness relative to their tax bases can be doubled from the comparison with total GDP to give a more relevant assessment of their financial sustainability.

It is against this background that government spending is now rising sharply driven by the economic consequences of the covid pandemic. With new lockdowns across the Eurozone, financial and systemic failures will have to be bought off by national governments. And government debt to private sector GDP ratios of over 400% are likely in some member states by the year-end.

For the moment, the ECB has sustained government finances by negative interest rates and heavily suppressed term rates. But interest rates are beginning to rise; some say because of the prospect of economic recovery and others due to the implications for prices as accumulated lockdown savings are spent against an anticipated shortage of consumer products. Whatever the reason, clearly, higher borrowing costs are likely to lead to higher risk premiums for these nations entrapped by their debt.

Non-financial corporate debt

At an estimated $83 trillion and 104% of global GDP, non-financial corporate debt is paid less attention while analysts have focused on government debt and the implications for their currencies. But as pointed out in the introduction, private sector production has become increasingly zombified, making a significant proportion of corporate debt unproductive in the sense that it no longer finances products genuinely demanded by consumers. Furthermore, with economic prospects owing much to hope rather than realistic assessments and the seemingly never-ending extensions of pandemic limitations on economic activity, business bankruptcies are bound to be on the increase. And with rising bond yields in prospect, bond financing is likely to become increasingly expensive for corporate survivors and will disrupt the soundest of business plans.

Even without an extension to pandemic troubles, there are signs that the post-Lehman crisis expansion of corporate debt was getting long in the tooth over a year ago. Major US bank balance sheets had run up to their regulatory ceilings and were increasingly restricted in their lending activities. Financial sector debt in Table 1 had actually declined by ten per cent relative to global GDP in the ten years following Lehman (but despite this represented a nominal increase of $8.2 trillion). The repo crisis combined with American tariffs aimed predominantly at Chinese imports were reminiscent of events in October 1929 behind the Wall Street Crash when the Smoot-Hawley Tariff Act was passed by Congress. And obligingly, stock markets commenced 2020 by replicating the October 1929 collapse with high precision before the Fed stepped in with a reduction in the funds rate to zero and quantitative easing at $120bn monthly on 23 March, both aimed at shoring up financial markets.

Since the Lehman crisis, the increased zombification of large corporate entities has been accompanied by economic stagnation — with the notable exception of tech industries which is not relevant to our story. The general stagnation is even worse when the underreporting of price inflation by standardised CPI method is taken into account. Furthermore, trillion-dollar annual US deficits being matched by substantial US trade deficits led to the expansion from 56% to 96% of GDP of non-financial corporate debt in emerging economies, while non-financial corporate debt in developed economies grew at a slower, similar pace to their GDPs.[i]

While some of the boost to emerging market corporate debt was down to an increase in offshoring production, the general level of risk in this fast growing, emerging market category of debt has increased due to the far lower rate of global economic growth and declining corporate earnings. In the words of the paper referenced above, “The ability of emerging markets to pay back their debts deteriorated”. This would certainly have been picked up by banks providing working capital and to an extent must be reflected in the decline in the financial sector’s share of global debt allocation.

It is against this background that the covid-19 pandemic shut down affected substantial elements of economic activity at the worst possible time. The supply chains linking emerging markets and Chinese production with advanced economies were disrupted, with goods not being shipped one way, and importantly, payments not travelling the other. The disruption continues today. Through a collapse in revenues, non-financial corporates in emerging markets now face a major crisis. Ironically, with the US budget deficit spiralling into the trillions, if only the logistics could be sorted out, demand for production from non-financial corporates in emerging markets is set to soar. But by then they could be facing a new emerging market crisis with capital flight killing business activity.

And now global bond yields are on the rise. If you look at commodity prices and non-fixed interest financial assets, the consequences of unprecedented global and dollar monetary inflation are clear to see. Fiat currencies are beginning to lose their purchasing power at an alarming rate. Markets are demanding higher interest rates and bond yields as compensation, and there is nothing that can practicably be done to stop it. Governments will be faced with a stark choice: do they debase their currencies even more in an attempt to rescue the entirety of their non-financial economies, or do they accept the reality of decades of debt-fuelled malinvestment? Will those tin cans be kicked down the road just one more time?

Adding to emerging market woes…

According to a recent World Bank report on borrowers under the International Development Association scheme, more than half of them are in distress, a situation which is worsening under the pandemic, if for no other reason. These are low-income countries, and their domestic debt relative to GDP also doubled on average between 2011 and 2019.

Figure 1 shows the World bank’s estimate of external debt distress and how it has deteriorated in recent years. The list of countries appears unimportant in the greater scale of things, including most of Africa, some in Asia and a bunch of Pacific Ocean states. They are less important in terms of production than they are in resources. It serves to remind us that China will benefit through greater control over these debt slaves, which are already the focus of its international political and economic expansion.

Consumer debt

Consumers in the developed nations now fall into two categories. There are the professional and middle classes, who through the pandemic have generally retained their employment and income, while some of their spending has been curtailed by lockdowns. It is this class which has been buying residential property, having accumulated income for the necessary deposits and have ready access to mortgage finance. And there are the low paid, particularly in the hospitality and tourist industries, who have lost their jobs and have little or no savings to fall back upon.

We hear a disproportionate amount about the fortunate, who when lockdowns end will release a tsunami of pent-up demand. They are the targeted market for the media and their advertisers; the educated who read newspapers in print and online. They are those who watch television news and have political and other opinions based on a degree of applied thought. Forecasts of economic growth are based almost entirely on this minority group of consumers. But while it includes both employees and business folk, this cuts across surveys over the years in both America and the UK that some 80% of employees in these consumption-driven economies live from paycheck to paycheck. And it is this group which has been hit hardest by the pandemic and government mandated lockdowns.

In America and the UK, for many of them foodbanks and government cheques paid into their bank accounts have been a lifeline. But read the headlines in the financial media, and they hardly exist. The consequences are that after an initial surge in consumer demand from the haves, the follow-through is bound to be muted, due to the larger number of have-nots. In the EU, any post-lockdown surge in demand is also being deferred by third waves, and given the outlook for non-financial sector bankruptcies, the future of the euro zone’s highly leveraged banking system (see below) is under dire threat.

Initially, rising interest rates might not be a major factor increasing credit card delinquencies, but as the purchasing power of the dollar and therefore global fiat currencies decline, they are sure to increase. The immediate and far larger consumer problem is over mortgage finance. As a subset to wider problems, the US and UK will face increasing defaults due to rising mortgage rates and the recent rise in house prices will then almost certainly reverse, perhaps to the point where even eighty per cent loan to value mortgages become uncovered and therefore a crisis for the lenders.

In short, a significant element of the $54 trillion of consumer debt will end up as losses to be borne by the financial sector.

The financial sector

Banks act as the intermediary between central banks and the non-finance private sector categories. They are highly leveraged ham in the sandwich between the state’s economic and monetary planners and their indebted borrowers. In troubled times it is not a pleasant place to be. Table 2 shows the capital gearing incorporating book values (market capitalisations) of the world’s global systemically important banks (G-SIBs).

With Société Generale, Deutsche Bank, Group Credit Agricole, Unicredit and Santander, the Eurozone has the most leveraged banks by far with price to book ratios between 29%-56%, market ratings that question their survival. And it only takes one of these banks to fail to put all G-SIBs at risk.

Another point — a mystery, is how the estimate of global financial sector debt is only $65 trillion, when the G-SIBs total liabilities (i.e. total assets less total equity) currently amount to $54.6 trillion, leaving all the other banks and shadow banks having liabilities of $10.4 trillion. A better assessment would probably put financial sector debt at closer to $80 trillion.

With an average ratio of assets to equity of 11.7, US G-SIBs are significantly less leveraged than most of their foreign counterparts, which might explain why so little attention is paid to systemic banking risk in the American financial press. But even at this level, mounting bad debts from the covid crisis amplifies them nearly twelve times for balance sheet equity. China’s four G-SIBs are similarly geared at an average of 11.8 times, Japan’s 21 times, the UK’s 16.8 times, and the Eurozone’s 20.5 times. The leverage ratios in Table 2 additionally take into account market capitalisation, and the three Eurozone banks heading the list tells us that markets already rate them as walking dead.

It is in the nature of things that when a bank fails, its net indebtedness is revealed to be significantly greater than balance sheet analysis indicates when it is a going concern. An obvious source of the difference is valuations of illiquid assets and collateral which are marked-to-myth. But a further avalanche of bad debts can arise from counterparty failure in derivative markets. For this reason, AIG, a non-bank insurer with a substantial credit default swap position was quickly bailed out in 2008. According to the Bank for International Settlements, OTC derivatives reported by banks totalled $609 trillion with gross values of $15,481 trillion at June 2020.

So, the banking ham in the sandwich between central banks and industry is extremely thinly cut – only molecules thick. A banking failure almost anywhere, must be bailed out for fear of triggering a global banking collapse the likes of which have never been seen before. The slightest hesitation in any advanced jurisdiction is bound to lead to widespread failure.

Government debt

According to Table 1 in the Introduction, total government debt stands at $82 trillion, being 103% of global GDP. But that does not take into account future liabilities, whose net present value has been estimated at over $200 trillion for the US alone (Kotlikoff, 2011). This enormous figure arises principally due to future welfare obligations, and similar considerations apply to all welfare-driven states. NPV calculations end up with wildly different answers depending on inputs. A debate about these obligations is beyond the scope of this article.

The overriding problem faced by governments and their central banks are their commitments to ensure 1) that their banking systems continue to function, providing working capital to industry as needed, 2) that any economic recession is shallow, and 3) that financial asset values continue to spread a wealth effect. Any one failure of these three objectives undermines the whole raison d’être for modern socialising democracies.

It has been decades of pursuing these objectives that have led to today’s global debt position. In the wake of the pandemic, it is leading to an accelerated increase in government debt for fear of failing in the three objectives. And the longer the crisis goes on, the greater the amount of government debt creation. This is particularly relevant for government debts in US dollars and euros. With broken supply chains both feeding into the US economy from abroad and also domestically, the Fed is tasked with supporting gross output in the region of $38 trillion in the domestic economy alone, and also an unknown external liability extending far beyond simplistic import figures.

The emphasis for the ECB is different. Failure to finance escalating budget deficits in the PIGS and France as much of the Eurozone enters yet another lockdown will lead to escalating political instability in its member states. As pointed out above, the debt situation in France, Italy and Greece when comparing government debt to its private sector tax base is extremely precarious. It is no exaggeration to conclude that the whole future of the euro, the Eurozone and of the EU Commission itself is weighing on the ECB’s shoulders.

But things are coming to a head, with rising bond yields. The realisation that prices, particularly of essentials, will rise well beyond CPI targets of 2%, is leading to losses on government bonds — a process that has only just started. The ECB is now trapped with increased fiscal revenue ruled out. Globally, it has been agreed that to raise taxes in the current economic environment would be counterproductive. Even the Keynesians sense their beliefs have led to a crisis in state finances, and the modern monetary theorists have suddenly gone quiet.

Selecting one of the three problems listed above is pointless, because they are all dangerous, and the failure of one will guarantee to trigger the others. But perhaps the least talked about is a failure of corporate debt. Some comment has been passed and generally ignored. The IMF urged policy makers to address it as it increased financial stability risks (IMF, 2017,2019). The UN weighed in similarly (UN, 2019). Some analysts predicted the corporate debt boom could trigger a financial crisis comparable to the great financial crisis (FT, 2017; Bloomberg 2019, Guardian 2019; World Economic Forum, 2019).[ii]

But the imminent failure appears to be that of using monetary inflation to puff financial markets. Once they stall on the back of rising bond yields all these debt obligations will end up being wiped out in a collapse of the fiat currencies along with the financial markets with which their fortunes have become firmly linked.

[i] World Bank Policy Research Working Paper 9394

[ii] Ibid. pp. 1-2.