The Fed has just released its first public consultation paper on a dollar-based central bank digital currency. For many, central bank digital currencies (CBDCs) are a means of heading off private sector cryptos, but coincidentally the prices of bitcoin and others have collapsed, losing half their value since early November.

The CBDC proposition is being sold to us by the central banks as keeping up with the times and taking advantage of the opportunities presented by new technologies to evolve payment systems.

The Bank for International Settlements has been coordinating research into CBDCs, and this article gives a brief description of how the BIS and its committee members sees them evolving. It is early days, and there are several important issues yet to be tackled, such as will CBDCs pay interest, and what will be the likely reaction of commercial banks to seeing central banks muscle in on their territory.

There are also two separate CBDC functions to consider. There is retail, whereby individuals have direct access to their central bank as counterparty, and a wholesale function for financial intermediaries for international settlement.

Whether CBDCs will come into existence is doubtful. To have credibility, their introduction will have to be coordinated at G20 level, and they are unlikely to be widely issued before the end of the decade. That will probably be too late to save the world from a developing financial and monetary crisis which threatens to change everything. Furthermore, the Americans will need to be convinced that their dollar hegemony will not be compromised. And what will almost certainly stop it is the powerful US banking lobby, likely to remind politicians presented with the necessary legislation, that a political survivor is one who once bought, stays bought.

Introduction

This month, the credibility of cryptocurrencies came into question as the price of bitcoin and those of its imitators continued to fall heavily. Bitcoin has halved from its peak, which was only two months ago.

It leaves everyone involved with headaches. As the private sector replacement for failing fiat currencies, the credibility of bitcoin may have suffered a mortal blow, with many observers now comparing it not in the context of rapidly expanding quantities of fiat, but with the wilder tech stocks which coincidentally have taken a battering as well. But a few state actors on the fringes have become strong supporters, notably El Salvador.

As El Salvador hoovers up bitcoin, there are other governments seeking to ban or to restrict them. While appearing to be keen to develop its own digital currency, the Russian central bank recently proposed restrictions on crypto trading — admittedly this is an ongoing debate. China, being the ultimate authoritarian state, banned crypto exchanges long ago, and is already testing its own state-sponsored digital currency.

Other governments are treading more carefully, aware that the formally $3 trillion (now $2 trillion) market capitalisation of cryptocurrencies reflects considerable private sector wealth in their own jurisdictions. Surely, major central banks would love to follow the Russians and Chinese in banning bitcoin and its imitators. But instead of a full-frontal attack on distributed ledgers and the threat they mount to their fiat currencies, major governments everywhere appear to be deploying a strategy of gradual strangulation, hoping the crypto phenomenon will subside. After all, currency is the preserve of the state and other than mavericks like El Salvador, who wants a private sector alternative?

This is the statist’s view. But just in case, research is being conducted into central bank digital currencies — CBDCs. Cynics can anticipate how the relationship between private sector distributed ledgers and a centralised state version will evolve. As the development of national CBDCs progresses, increasing restrictions on bitcoin and other rivals will be introduced. There is one thing that governments and central banks cannot abide, and that is private sector rivals to their currency monopolies.

Research into the development of CBDCs is being coordinated by a committee at the Bank for International Settlements, led by the major central banks (with the notable exception of the Peoples Bank of China) and the BIS itself. All other central banks can expect to benefit from the project and follow its recommendations.

Only last week, the US Fed issued the first in what promises to be a series of consultation papers on a US CBDC. The importance of the Fed’s strategic approach is paramount, since the dollar is the big daddy of all currencies through which America controls the world. A CBDC replacement must not threaten the dollar’s hegemony. If it does, then we can assume the whole CBDC concept will end up being stillborn.

What is a CBDC?

A CBDC is a digital form of central bank money that is different from balances in traditional reserve or settlement accounts. It is a digital payment instrument, denominated in the national unit of account and is a direct liability of the central bank.[i]

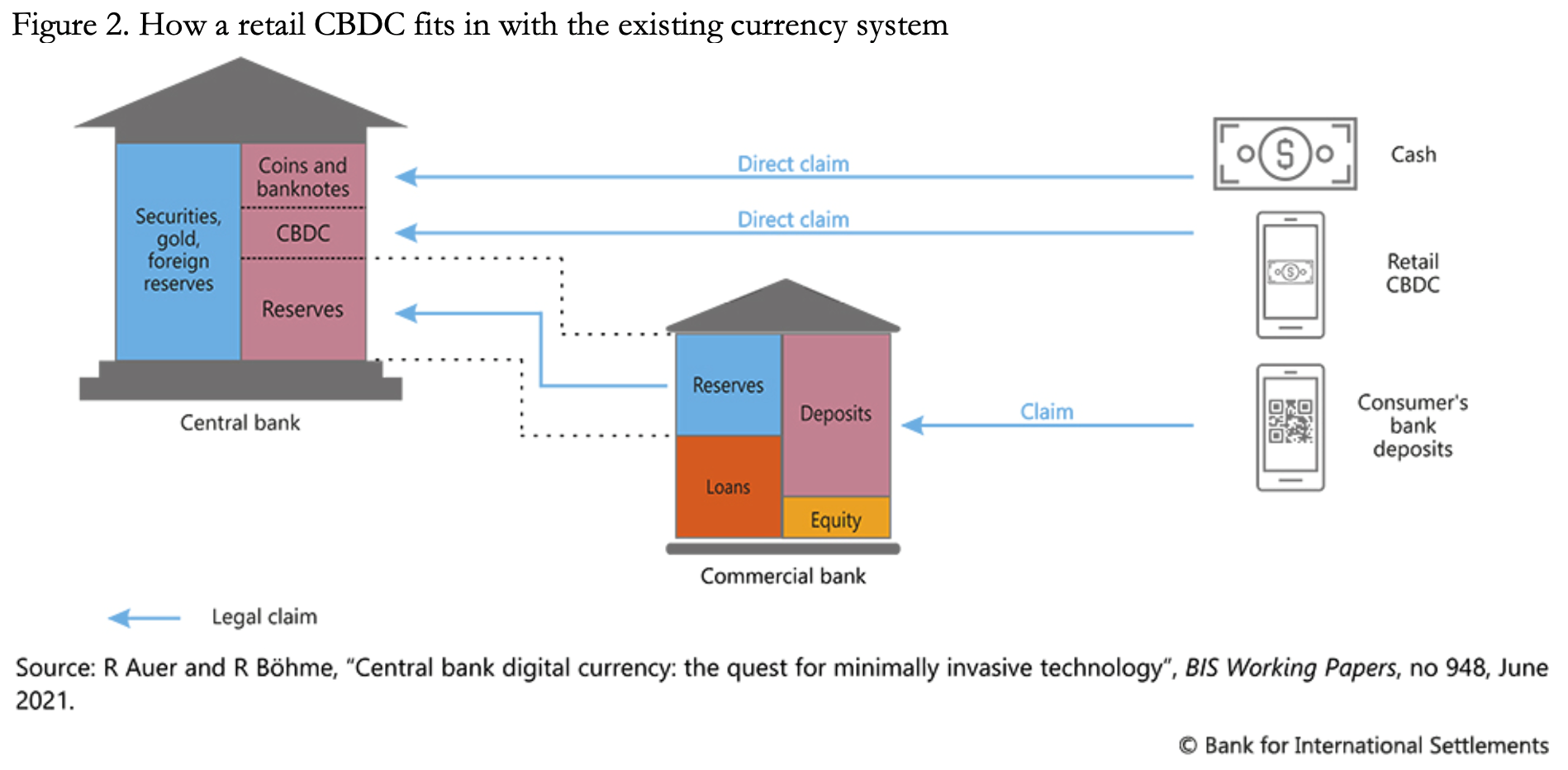

Two separate functions have been identified. There is a general purpose, or retail function, whereby a CBDC is an alternative to currency cash and commercial bank deposit money. And there is a wholesale function for use between financial intermediaries, incorporating cross-border settlements. Figure 1 above illustrates the flows of these two different functions.

Two separate functions have been identified. There is a general purpose, or retail function, whereby a CBDC is an alternative to currency cash and commercial bank deposit money. And there is a wholesale function for use between financial intermediaries, incorporating cross-border settlements. Figure 1 above illustrates the flows of these two different functions.

The adoption of a CBDC requires a central bank to upgrade their banking systems to deal with tens or even hundreds of millions of depositors and businesses — a task whose sheer scale and technological challenges should not be underestimated.

Figure 2 illustrates the relationship between a retail CBDC and existing currency liabilities.  CBDCs are intended to be an addition to current settlement systems and currency quantities. Declining use of banknotes and coins, which are a bearer form of central bank liability and a direct claim on it, is being claimed as a justification for a new electronic settlement medium with the same currency standing in the form of a retail CBDC.

CBDCs are intended to be an addition to current settlement systems and currency quantities. Declining use of banknotes and coins, which are a bearer form of central bank liability and a direct claim on it, is being claimed as a justification for a new electronic settlement medium with the same currency standing in the form of a retail CBDC.

The widespread use of debit cards has blurred the distinction between the cash notes and coins issued by a central bank, and deposit money which is a liability of commercial banks. Users of currency in retail transactions are generally unaware of the distinction, and bank regulators believe that their oversight provides justification for the seamless operation between these different risk categories.

Nevertheless, central banks are aware of the potential disruption a CBDC might cause to existing settlement systems, and for this reason amongst others are certain to proceed cautiously.

The wholesale function of a CBDC is a different one to being purely an alternative to bank notes, being more attuned to reserves on a central bank’s balance sheet. If a wholesale CBDC is introduced it will be with the objective of extending a central bank’s function into cross-border settlements, with the intention of making them more efficient with lower transaction fees. That will require the same operational and legal standards between different CBDCs, necessitating international cooperation in the way they are set up — hence the likely future role for the BIS, which already sets out the global regulatory framework under the Basel Committee to which commercial banks must adhere.

Undoubtedly, cross-border cooperation in CBDCs is a multiyear project. All that the BIS committee can do for now is come up with guidelines to which individual central banks can make long term plans, so that different CBDCs might eventually be integrated into a global settlement system. This is also behind an initial phase of designing CBDCs for retail, or domestic use with a view to them being compatible with wholesale use.

The benefit of a retail CBDC for the state

Augustin Carstens, General Manager at the Bank for International Settlements made the following comments in an IMF sponsored video about central bank digital currencies:

“We intend to establish the equivalence with cash, but there is a huge difference there. For example, with cash we don’t know who is using a $100 bill today, we don’t know who is using a MX$1,000 bill today.

A key difference with a CBDC is that a central bank will have absolute control under the rules and regulations that will determine the use of that expression of central bank liability, and we will have the technology to enforce that. Those two issues are extremely important and make a huge difference with respect to what cash is.”[ii]

Clearly, the attraction to Carstens is that CBDCs offer the potential for central banks to increase their controls over how currency is used, control not only over markets and economies, but over individuals and businesses. Carstens seems completely unfazed by the issues for personal liberty. However, Figure 1 above suggests there is an option of token based CBDCs to provide anonymity. But given all central banks’ desire for control to minimise criminal transactions and tax evasion, it is unlikely that anonymity will be preserved. And for any jurisdiction where personal freedom might be regarded as important, there’s always the pull of international conformity to ensure that in the name of preventing international fraud and tax evasion personal freedom cannot be protected.

The issue of individual freedom to buy and sell goods and services with the state being automatically informed of every transaction is a huge departure from using banknotes and coin. This could become an impediment to the widespread adoption and success of a retail CBDC in some countries. But for individuals there may be no option if retail CBDCs become the pretext to do away with cash entirely.

Furthermore, while some central banks will be wary of a CBDC interfering with the implementation of monetary policy, other central banks have expressed the desire to use them to extend control over economic outcomes. For example, by deploying CBDCs with an expiry date beyond which they become worthless, it would enable a central bank to accelerate capital spending, employment expansion, or consumer demand in favoured industries, such as green energy, or other sectors deemed worthy of state promotion and protection.

The application of positive and negative interest rates selectively on retail CBDCs might be seen as a further tool for enhancing monetary policies by directing capital investment and economic management. This, surely, is one of several possibilities that will excite the planners as CBDC concepts develop.

That is in the future. For now, the CBDC concept needs to be consistent with promoting improved settlement options. Through commercial bank reserves, central banks supply the ultimate backstop for the banking system, and in respect of settlements generally, they offer guarantees of safety, integrity and access to currency and deposits. Central banks are also tasked with providing sufficient liquidity to ensure the smooth workings of the payments system, ultimately as the lender of last resort. Through their banking regulation, central banks oversee the integrity and efficiency of their national settlement systems.

The introduction of a CBDC must not undermine these functions but be seen to enhance them.

The consequences for commercial banks

One of the problems that is yet to be addressed is the effect of an introduction of retail CBDCs on bank deposits. The origin of bank deposits is always loan creation, acting as the double-entry bookkeeping liability counterpart of bank credit recorded on bank balance sheets as assets. As borrowers draw down their loans to make payments, deposits received by their payees are distributed throughout the banking network, and rebalancing is achieved through wholesale interbank markets.

A new class of central bank liability to be used for electronic settlements risks draining the commercial banking network of deposit money that would otherwise be recycled between them. And while it is tempting to think that deposits at the larger banks are likely to be safe, there will be many smaller ones around the world that could face deposit runs into the relative safety of a CBDC.

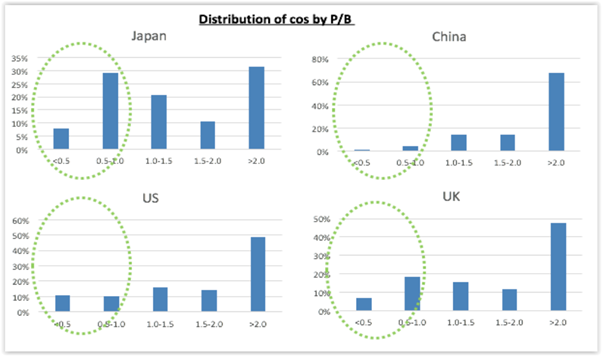

The effect of deposit flight into central banks from highly leveraged commercial banking systems, particularly the euro system and the Japanese sector, could be catastrophic. Both sport asset to equity ratios of over twenty times on average with some banks even more highly geared, so a shift of less than 5% of their deposits could tip them into crisis.

Furthermore, for bank depositors the convenience of transferring deposits electronically and immediately for a CBDC without the hassle of queuing up for cash which a bank refuses to release in quantity could turn a bank liquidity crisis into an intraday or overnight event.

For this reason alone, a CBDC giving access to the public without hinderance seems unlikely. Furthermore, when commercial bankers are presented with a CBDC scheme, they are likely to oppose it strongly because of the threat to their customer deposits. This is even likely to be more important to commercial banks than the risk that a CBDC will represent unfair competition with commercial banking, a possibility upon which views are likely to be divided.

In authoritarian regimes, the competition argument might not matter. But in the US, banks are powerful lobbyists paying for politicians’ election spending. It seems likely that their antipathy will become an insurmountable obstacle to the introduction of a dollar CBDC, if proposals get that far.

Practical and political considerations

While some central banks might find there is minimal political opposition, most jurisdictions will require enabling legislation to be passed without which a global CBDC regime cannot proceed. The course of action is probably as follows:

- With the agreement of the major central banks, the BIS finalises draft proposals for CBDCs to present to finance ministers at a G20 meeting. At the earliest, this initial step will be put before the G20 Summit in 2023 in India. More likely, it will be 2024 or 2025. Bear in mind that Basel 3, which was the response to the 2008—2009 financial crisis, is still not fully implemented more than a decade later.

- Central banks will want to reassure their legislators that their proposed systems are thoroughly tested, secure and robust before framing the necessary legislation. Testing by pilot schemes could start as early as next year in some cases but given the seriousness of this issue and the bureaucratic nature of the introduction and implementation of government IT systems, and the sheer scale of opening accounts for the entire population and its businesses, it is likely to take some time.

- The earliest an international agreement for CBDCs on common standards and the necessary legislation passed in the G20 nations and their implementation is unlikely to be before the end of this decade at the earliest, if not well into the 2030s.

To complicate matters, objections could arise from Russia and China. As a G20 member, Russia ploughs its own furrow, with the West periodically threatening to cut it off from SWIFT and imposing other penalties — hardly conducive to international cooperation. China is already testing her version of a CBDC, so is unlikely to conform to a BIS template which does not yet exist. But by far the most serious problem is likely to be with the US.

From remarks on the subject by Jay Powell, the Fed is taking a very cautious line. Earlier this month the Fed issued what promises to be only the first in a series of public consultation papers, and from reading it there emerges an impression of a reluctance to engage with the real issues. A suggested list of twenty questions to be answered makes the point, so that this CBDC plan is likely to be kicked into the long grass.[iii]

That the Fed is dragging its heels is obviously a matter of opinion. A crucial issue behind this opinion is the effect of CBDCs on the dollar’s existing hegemony. While the Fed might engage with a retail dollar CBDC, arguing it will offer the prospects of an improved settlement system, we can be reasonably sure that the Treasury will balk at the BIS setting the agenda for a wholesale version of the American currency. For international settlements, the dollar is already under attack from the renminbi and the euro, a rot which the Treasury will be keen to contain.

We cannot guess the outcome of this issue. And there are also the spanners to be thrown into the works by powerful commercial banking interests, which will not want to see their credit creation monopoly threatened because of the drain on their deposits.

The threat to state fiat currencies from bitcoin

That central banks are banding together to provide a viable alternative to bitcoin and its imitators before banning them from being used as media of exchange is a supposition supported by the interests and actions of the central banks. If this is indeed the case, we should not be surprised, given that the monetary authorities have demonstrated that they do not admit to the relationships between money, currency, and credit. They are therefore unable to decide on whether bitcoin fits into any of these categories, and therefore the seriousness of the threat.

To act as the principal media of exchange as a replacement for government fiat, bitcoin must fulfil all these functions. Through millennia, gold has been money without counterparty risk, more recently as the backing for currency substitutes with only small quantities of physical gold actually circulating. In theory, bitcoin in a wallet could fulfil that role of traditional money, backing a currency system based upon it. This backing would also be fundamental to its backing for a new currency, perhaps in the form of an obligation to deliver bitcoin held in custody by a trusted counterparty. Where it will fail is as the medium of credit due to its inflexibility compared with gold.

Besides its physical qualities, gold’s success as money is because the quantity of above ground stocks used as money is flexible and demand for the money function is set by its users (not the state, which is the important distinction from fiat currencies). The quantity of gold circulating as money draws upon reserves used mainly for ornamentation. Consequently, over the centuries there has been remarkable price stability for commodities and products exchanged by those dividing their labour measured in gold.

This is not possible with bitcoin, whose quantity is finite, and if it was to be adopted as money its purchasing power measured in goods would rise inexorably as billions of people build their cash reserves. This would continue after the shock of the collapse of the fiat regime because of the hard limit on bitcoin’s quantity, while the purchasing power of gold and its substitutes can be expected to stabilise.

A borrower of bitcoin investing in production would be faced with repayments of uncertain value measured against his final output, making it impossible to conduct the economic calculations necessary for the investment.

Besides this hurdle the promoters of bitcoin would have to convince most of the inhabitants of this planet that it is the only replacement for fiat currencies when they fail. Unlike the promoters, people dividing their labour are not speculators, only seeking a stable means of exchange. Indeed, the speculators’ motives are to encourage as high a price for bitcoin as possible, which is not the function of money.

It should therefore be obvious that bitcoin and other cryptocurrencies are incapable of providing a monetary role because of their unsuitability as media of exchange. This being so we can only surmise that cryptocurrencies are little more than a concept which has succeeded in attracting speculation on a scale seen only when currency and credit to inflate it are available in unlimited quantities. In short, the phenomenon is a bubble that eclipses most of those seen hitherto.

As such, cryptocurrencies do not pose a threat to fiat currencies. It is gold the authorities should look out for, and there is no sign of them doing so.

The economic and monetary consequences of CBDCs

It is clear from Augustin Carsten’s comments quoted above that the objective is to use CBDCs to increase state control over how currencies are used. That being the case, personal freedom and free markets will be further suppressed through their introduction. All the evidence is that state-determined economic outcomes are failures. We can explain this simply by pointing out that only acting individuals can take the decisions that lead to economic progress, while government plans always lack the basis of economic calculation.

Instead of providing solutions for failing economic and monetary policies, CBDCs are a continuing move in the same direction. Nowhere in all the literature emanating from the BIS, or in the Fed’s consultation paper, is there any suggestion that an expansion of the quantity of CBDCs will be offset by a contraction in central bank balance sheets or in the quantity of bank credit. The only offset is the declining use of banknotes and coins, which is a minor portion of the circulating currency.

Therefore, CBDCs represent an additional source of inflationary finance, reminding us of the fate of mandats territoriaux in revolutionary France in 1796, when they replaced the assignat which had become virtually worthless. The mandats lasted barely six months. The only material difference is that CBDCs are planned to be issued contemporaneously with existing fiat currencies while they still retain public credibility.

There can be no doubt that the expansion of currency and bank credit since the Lehman crisis in 2008 has instilled in all major states an enhanced dependency on inflationary financing of government spending. Rather than raising taxes or cutting spending, it is far easier to cover their deficits by expanding the media of exchange, and while notionally independent from the political class, central bankers have fully embraced this use of inflation.

But inflation is an invidious tax, eventually realised by those who suffer under it. A lethal combination of the monetary arithmetic that an expansion of currency invokes, together with a loss of all confidence in the integrity of the issuer is always the death knell for fiat currencies. The only question remaining is the time taken for the public to realise that far from its government providing free lunches ad infinitum, they are not only paid for through their taxes but also through currency debasement.

There comes a point where this realisation leads to a widespread revulsion and rejection of the currency, when it then becomes worthless. The best that might be said of CBDCs is that by adding a layer of confusion, the final rejection of government fiat by the public might be delayed briefly. But as the experience of revolutionary France showed, the replacement of one fiat currency with it in another form changes nothing.

Existing currency problems are more immediate than plans for the adoption of CBDCs can possibly allow. In the coming months, a fatal destabilisation of fiat currencies is in prospect as central banks are forced to choose between submitting to the inevitability of interest rates rising to reflect the loss of their currencies’ purchasing power or continuing to provide inflationary finance for their governments. Without doubt, the problem is becoming urgent. Only this week, we have seen the hold fire in the face of rising interest rates, leaving US Treasuries on negative yields of over six per cent, according to official CPI figures.[iv] On an independent estimate of price inflation, negative bond yields for US Treasury debt exceed double that.[v]

Clearly, a consequence of monetary policies is that markets now fail to function. The Eurozone and Japan face the additional difficulty of surmounting negative interest rates as well as negative nominal yields on government bonds. We can only surmise that these extraordinary conditions persist due to the success of central bank propaganda backed by false and misleading statistics, while the financial world is in thrall to the false gods of Keynesianism.

As pointed out above, a further falsity is the belief that cryptocurrencies could become a viable medium of exchange. It is those dividing their labour who decide their medium of exchange, and not a shadow issuer comprised of technology enthusiasts who have achieved no more than create a bubble to end all bubbles. Bitcoin is simply another form of fiat, and as fiat dies, we can expect bitcoin and its imitators to do so as well.

And given the time taken to introduce CBDCs, not only will we be writing a further chapter on extraordinary popular delusions and the madness of crowds over the entire cryptocurrency phenomenon, but we will have found CBDCs to be stillborn.

[i] See Central Bank Digital Currencies: foundational principals and core features, Report No 1. Published by the BIS.

[iI] See https://www.youtube.com/watch?v=mVmKN4DSu3g at 23 minutes in.

[iiI] See https://www.federalreserve.gov/publications/files/money-and-payments-20220120.pdf

[iv] 12-month US T-bills currently yield 0.7% compared with a CPI of 7% (27 January, 2022).

[v] See http://www.shadowstats.com/alternate_data/inflation-charts

Great article, except for the Bitcoin analysis part.

> but coincidentally the prices of bitcoin and others have collapsed, losing half their value since early November.

> the credibility of bitcoin may have suffered a mortal blow,

Rookie mistake this one.

It is not the first, nor will be the last time Bitcoin price plunges a great deal. It is volatile as any emerging and truly free market is. Not even gold behaves like that because it is mostly suppressed by states, which grabbed it and control most of it long ago.

The way Bitcoin hikes work is, “weak hands” buy BTC, but they do not understand it. “Strong hands” take profits by selling BTC as it is going up quickly. These strong hands might be early adopters that understood bitcoin earlier. They do not need to be wealthy, at least in fiat terms. Many of these are people that usually understand Austrian Economics and Technology both, which explains why they figured out Bitcoin’s value early on.

Fear comes at some point, for whatever reason, and so weak hands sell en masse. Many of them do not even have a choice because they bought highly leveraged, another rookie mistake. Strong hands take the opportunity to buy more BTC at “discounted prices”, and HODL it. Some play the game to try to buy the dip and sell the peak, but most just keep buying at all times and HODLing. String hands taking most of their BTC off the exchanges shortly after buying.

This time around the fear on the weak hands came from the imminent interest hike, but the hodlers behavior does not change. In this wave, weak hands are mostly institutional investors.

Then sell offs ends up drying up, as money in exchanges drops dramatically, so finally Bitcoin price continues going up. Some weak hands might learn the lesson and become strong hands for the next price peak. And the asset class capitalization continues to grow eventually, in a volatile way.

Note as of now the biggest component of Bitcoin appreciation is adoption, not deflation yet. Adoption is a logarithmic curve, but once that completes you should see “natural deflation”, as technology keeps improving productivity so prices must go down in BTC terms. This is good deflation, and will not be faster than the rate at which productivity increases, unlike the fiat money printer that can virtually go at any speed, see the Fed graphs in 2020 as an example.

> This is not possible with bitcoin, whose quantity is finite, and if it was to be adopted as money its purchasing power measured in goods would rise inexorably as billions of people build their cash reserves.

Why should that be a bad thing. Maybe the fiat money thinking talking. Inflation is not needed, natural deflation is better for every one. Such deflation only happens as productivity grows. If good and services shrink for whatever reason, you would see prices rise instead, even in BTC.

> as billions of people build their cash reserves

Saving is hard, maybe we have forgotten it in the fiat world because in such world it is not hard is just impossible.

But even in a Bitcoin world to save you need to postpone consumption, and we are mortal beings with a finite amount of time in our hands, we need to eat every day, etc.

People now may HODL Bitcoin indefinitely on countries where fiat still works, for the most part. It makes sens, fiat ther ei sgreat for exchange, it is okish for unit of account, over short periods of time, and completely useless as store of value. So You use bitcoin as store of value.

On countries with failed fiat, they need to actually exchange bitcoin, or gold or dollars or any combination of those. They may only save bitcoin (build reserves) after they already payed for all else they need, day to day.

correction, adoption is a logistics curve (not a logarithmic one)

> A borrower of bitcoin investing in production would be faced with repayments of uncertain value measured against his final output, making it impossible to conduct the economic calculations necessary for the investment.

Is there a difference in that phrase if you replace the word “bitcoin” by “gold” in there?

OK, so gold has a mostly stable natural inflation of 2% yearly, and bitcoin inflation will go to zero.

But finally both of them ALSO have a natural deflation of whatever the productivity grows yearly. We do not know accurate historic data of that yet, because in the fiat world is virtually imposible to calculate how productivity is increasing as GDPs are not only a questionable measure, but are inflation-tampered. And in fact, inflation can affect productivity increases, or even reverse it.

So you have:

gold that has a (~2% inflation) – (unknown productivity deflation rate)

vs

bitcoin that has a (virtually 0% inflation) – (unknown productivity deflation rate)

Result?

We do not know, in any case!

And neither do you know today with fiat money.

Economic calculations are always hard and based on past projections.

Inflation is NOT necessary for ANYTHING. Remember that Bitcoin is infinitely divisible, it is even possible to subdivide the satoshi, if needed.

IMHO this point is moot.

BTW, bitcoin does not abolish “paper” money IOUs, the same way gold did not. The difference between gold and bitcoin in that regard is that with gold you needed to trust that gold was actually there backing the debt paper titles, while in bitcoin you can eventually verify it, at settlement or withdraw time.

In fact, with bitcoin, not your keys, not your coins, any amount of BTC in your favor on any 3rd party other than your own wallet is a debt and might be subject to fractional reserve, just like paper backed gold was.

With fiat there is no difference between IOUs, all is debt with different risk levels.

> Besides this hurdle the promoters of bitcoin would have to convince most of the inhabitants of this planet that it is the only replacement for fiat currencies when they fail.

Promoters do not have to convince anyone, they just need to teach about it. People will chose.

In countries with failing fiat money and with all the hurdles of gold exchange, which is still hijacked by states, many are already turning to bitcoin for exchange. Specially in young countries where people do understand technology better and know gold way less, as they might have never even seen a coin.

Right now I would say in such countries the preference is still dollars first, then either gold (if/when available) or bitcoin (specially with young people with a mobile and internet access, which is more pervasive that gold is today).

> Indeed, the speculators’ motives are to encourage as high a price for bitcoin as possible, which is not the function of money.

Speculators are weak hands in bitcoin. They do not matter in the long term, they are purged on each price plunge as explained before, replaced by strong hand HODLers.

HODLers understand bitcoin price will only go up “forever” in fiat terms, but just because fiat supply goes to infinite while its purchasing power goes to zero.

HODLers also know that, in case of success (which is in no way guaranteed) what will happen is a logistics adoption curve. Growth will stabilize.

If/when most people have Bitcoin, then there will be not such a rush and volatility in the price. Specially because it will become the unit of account, and thus it will be measured in itself.

The price appreciation vs goods and services will only come from gains in productivity or whenever people manage to save more than usual.

Remember, saving is hard, even when your money allows for it. I do not believe saving will increase forever, people need to spend and also enjoy it.

> Bitcoin is simply another form of fiat, and as fiat dies, we can expect bitcoin and its imitators to do so as well.

You are kidding, right?

Fiat means “command or act of will that creates something without or as if without further effort”

Is is “DO IT (because I say so)”

You cannot make bitcoin, once the 21 million are minted, no more are to come. And minting bitcoin today is quite expensive, as you know very well. Is not the money printing press.

You cannot change the monetary policy of Bitcoin, as many altcoins do, like Ethereum ultrasound money, as of today, tomorrow who knows. With bitcoin you can run a validator node with a raspberry pi and an SSD, ensuring the network stays stable and does not change behavior.

Bitcoin is digital scarcity, cannot be tampered with, and not does it take orders from anyone.

The geniality of bitcoin is to allow for humanity to have money whose supply cannot be tampered with or controlled by humans.

Fiat on the other hand is political driven money, controlled by humans, and with incentives to grow its supply forever, as its purchasing powers plunges to zero.

Bitcoin is the opposite of fiat, even more so than gold itself.

Gold has the best track record to date. Nobody denies that. It is probably the best physical non designed money there can be.

But money in essence is information/energy, and gold being physical cannot reach that status.

As technology improved, gold started to show its problems. Paper bills started replacing gold exchanges, gold started to centralize. And finally centralized gold reserves allowed states to hijack it. Game over for gold. Sorry.

Note that the economics of gold custody vs bitcoin custody matter and are the reverse:

– Gold is cheaper to custody centralized, because you can hold 10, 100 or 1000 times more of it while not expending 10, 100 or 1000 times more in security.

– Bitcoin in the other hand is easier to safely custody, even at personal level. Its custody costs actually grow with concentration, because the higher the reward, the more investment will pay off on the hacker’s side. While if it is scattered around in people’s personal wallets, as it should be, you need to attack a lot of targets for smaller gains each time… not as economically advantageous. And that also means states cannot hijack, it as they did with gold.

The key difference today with gold and bitcoin, is gold needs permission from the states to get un-repressed… bitcoin is out of states hands already and is unlikely it will get hijacked so long as people learn to use it and store ir properly. This for now is working, strong hands move off exchanges as they buy more bitcoin and intend to keep HODLing it.

Nope, sorry. Bitcoin is many things, but fiat is quite the opposite of it.

In short…

Gold failed us once already.

And it will fail us again, if we try it.

Its fundamental “bug” is that it tends to centralization, due to its custodian economics. In fact any physical money would suffer the same way. That bug is what allowed states to hijack money and change us to fiat.

Now fiat is dying, it is already accelerating its journey to zero purchasing power.

Bitcoin?

The only real problem with bitcoin is that it does not have a track record, yet. Its history so far is not comparable with fiat even, and surely not with gold. So nobody knows for sure if it will work.

But if Bitcoin does not work, then we have a big problem. Because we have yet to invent or discover what will work.