Governments and central banks are making the mistake of believing that growth in GDP is a primary measure of economic performance. This confuses growth, measured as a total of transactions without regard to their quality, with progress, where quality of life is the driving factor.

The origin of this error is mathematical economics, which has banned human action from all policy considerations. You cannot quantify progress, while you can add up all the transactions that make up GDP. GDP only rises, or grows, when the currency value of transactions recorded increases. And that can only be the case if the quantity of currency in circulation inflates.

This article explains why this is so and describes why it is progress that should be everyone’s economic objective. But that can only be fostered by sound money, enabling economic calculation, and the state minimising intervention. That is on no one’s agenda.

Instead, the inflation of GDP is rapidly driving the world into an interest rate crisis, likely to be far worse than currently expected, indiscriminately taking out economies, financial systems, and being unbacked by anything other than diminishing faith and credit in them, fiat currencies as well.

Introduction

The stated objective of nearly all economists, policy planners, and politicians is to achieve economic growth, which they measure by gross domestic product. Attempts to quantify an economy initially focused on gross national product, which differs from GDP by including net flows to and from abroad. GNP was devised by Simon Kuznets, an American Nobel Prize winner and economist, in the early 1930s and GDP followed as the common measure of economic conditions much later.

The federal government had been collecting business and economic data from 1865, but because the dollar was fixed on a gold standard of $20.67 to the ounce in Kuznets’ time and had been since the Gold Standard Act of 1900, the price data was broadly comparable over the previous three decades, permitting reverse engineering of GNP statistics. But Kuznets focused his first report on GNP estimates over the period of the Wall Street bear market, 1929-1932. At that time, the US government was gathering evidence with the objective of ensuring a stock market and banking crisis leading to a depression would be prevented by government action in the future.

GDP replaced GNP in US statistical usage in November 1991, though in many other national accounts the switch had already been made some time before. GDP has since become central to a statistical approach to economic and monetary policies. Coupled with Keynesian theories, economic statistics have superseded the classical economics of the past as the mainstream’s economic analysis.

The human factor which underlies all economic activity has become ignored. A new form of economics was born — macroeconomics. It removes the human factor, and state management of economic outcomes became perceived as a viable policy, along with socialist welfare redistribution of economic resources as the principal feature of modern economies, replacing free markets.

With its maths-based approach, fundamental questions over macroeconomics’ appropriateness and of its statistical relevance have been papered over. The government’s statistics are assumed to be as accurate as they can possibly be, and so they go unquestioned. They are accepted as a true representation of the economic condition and increases in GDP are associated with national wealth and improvements in living standards. But besides the rejection of human factors, the underlying questions remain.

Kuznets put together his statistics under a gold standard, and changes in price levels were broadly limited by the repetitive cycle of bank credit. With no currency linked to gold today, price stability is absent due to the continual loss of the purchasing power of all currencies. Attempts to manage this problem have centred on the effects of currency debasement on prices. When statisticians talk of constant dollars, they refer to a dollar adjusted over time by the consumer price index, and not as the phrase might imply, an adjustment by changes in the quantity of currency and credit. And anyway, with measures ranging from M1 to M4, a debate could then be had as to which measure of the circulating medium is most relevant.

It is easier to recognise the concept of a price effect adjustment than to have to understand the distinctions between money, currency, and credit. As non-monetarists are quick to point out, the link between changes in money supply and its effect on prices can vary considerably, making a price index the more reliable adjustment factor in their view. But with a statistic that has so many conceptual holes in it, one still wonders why GDP and its GNP forerunner should have been treated with such reverence in the first place.

No one seems to appreciate to whom the GDP statistic is most useful. It is constructed by and for the benefit of governments, giving them an indication of potential tax revenues capable of being raised from the private sector. It explains the obsession with growth, which leads automatically to higher revenues from taxes. The inclusion of the state’s own spending is justified because the state’s spending develops taxes on its own employees and on their spending. Spending on economic management by the state is intended to yield tax revenues as well, on the statist assumption that economic activity is stimulated by successful intervention policies.

But there is an even deeper question: do GNP or GDP represent economic progress, or being only money totals are they being confused with it? Because if they do not represent progress a fatal error behind the concept of state management has been made.

The relationship between GDP, currency, and credit

If we google it, we find that GDP is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific period, usually annualised if not annual. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health (Investopedia).

One should take issue with the latter sentence in the definition above because changes in the quantity of currency and credit cannot be ignored. But the attraction of GDP is that it is deceptively easy to measure, being simply a total of currency spent. You just add up all the transactions recorded in, say, a year and you have GDP. There is room for debate, such as should it be calculated using expenditures, production, or incomes, which give different results because they are derived from different data. And there is the thorny question about what should be excluded: elements of housing costs are controversial, though there is general agreement that investment transactions in secondary markets should be completely excluded — again, it is difficult to determine precisely where the boundaries lie. And of course, there are unrecorded transactions in second-hand goods, cash and illicit activities for which estimates may or may not be made.

Adjusting the GDP total for inflation introduces a further complication. Following the price adjustment route, the task of recording the prices of each of the many millions of transactions for the same good or service conducted exactly one year before and allowing for any change in quality and quantity is impractical. Relying on an index, such as the consumer price index, is controversial because there are various ways in which an index can be constructed and calculated, besides the fundamental question whether the general level of prices is just a concept and cannot be captured statistically. Or should GDP be simply adjusted for the change in the quantity of currency and credit in circulation? Even this is an error, because it ignores variations in the human valuation imparted by its users to the purchasing power of fiat currency units independently from changes in their quantity.

In this statistical fog, we still don’t get to the basis of what an unadjusted GDP represents. We know from the definition above that it is the sum of all recorded and eligible transactions in any one period, which we can take to be a year. And because it is decided by the state, which is the largest contributor, the year is usually taken to be fiscal in tune with national accounting.

We now must consider what happens to GDP if there’s no change in the quantity of currency and credit. Preferences for some goods over others will change. We will obviously see shifts between consumption and saving. But that is only a temporary distortion because we can assume that savings will be deployed in investment, which after a variable time lag will be spent on factors of production, entering the GDP statistic sometime later than if it had been direct consumption. We can assume financial dealings in secondary markets, along with their profits and losses, are ringfenced and excluded from GDP statistics in our unchanged currency and credit environment, because under constant currency and credit conditions, there will not be a net inflationary dividend from financial assets.

We can also assume a balance in foreign trade, because without any change in outstanding currency and credit, it must be so. Without any change in currency and credit, there should therefore be no change recorded in nominal GDP, other than from statistical and other imperfections.

Another way of looking at it is that while a nation’s consumers might change their spending and savings preferences, we are describing an environment where without the expansion of currency and credit the sum of their net earnings, profits, and borrowings do not change materially from one year to another. The purchasing power of their currency units might vary due to economic progress, which is not the same thing as monetary growth. But nominal GDP will adjust to its economic inputs over time and should be regarded as remaining unchanged in a stable monetary environment. It therefore follows that changes in the quantity of currency and credit will always be the single reason behind changes in GDP.

In contemporary financial markets, with the quantity of currency and credit in circulation continually increasing, a growing distortion to the statistical relationship with GDP is the degree to which off-balance sheet credit is available. Shadow banks, which includes virtually all non-bank intermediaries in financial markets, can in some instances create credit which is not recorded in the M3 statistic. Since the financial reforms of the mid-eighties this has been a growing feature, along with the general shift into purely financial activities and away from manufacturing as a proportion of the total US economy. The growth of the hedge fund industry has particularly benefited from this trend.

Shadow banking increased rapidly following the financialisation of the British and American economies, centred on London’s big bang in the mid-eighties. Shadow banks consisted of participants in virtually all non-bank financial activities around a core of collective investment vehicles seeking to enhance their returns in a declining interest rate environment. In the US alone, net shadow bank liabilities grew from $2.5 trillion in 1990, about half traditional bank liabilities, to a peak of $16.5 trillion compared with conventional bank liabilities of $12.5 trillion at the time of the Lehman crisis. Only part of shadow banking involves credit creation of currency not recorded on commercial bank balance sheets, but there is little doubt that it was significant in the overall M3 context.

In the years after Lehman, there was an initial decline in US shadow banking as property securitisations collapsed and equity markets tanked. Furthermore, some commercial banking off-balance sheet activities were brought into the lending statistics by changing regulations, and US net shadow banking fell to $12.5 trillion, while commercial bank lending continued to rise.[i] Since then, according to a report by the Financial Stability Board at the Bank for International Settlements, the growth of US shadow banking was minimal until 2015, and subsequent estimates do not yet appear to be available.[ii]

When there is an increase in the quantity of currency and credit it will be spent into circulation, raising prices in accordance with the Cantillon effect. And if there is a contraction in the quantity of currency and credit, prices will fall. Consequently, we can confidently say that with a time lag, changes in nominal GDP should correlate with changes in the quantity of currency and credit. Whether this is understood or not, it is confirmed by the objectives of monetary policy which are to stimulate GDP by increasing the money supply.

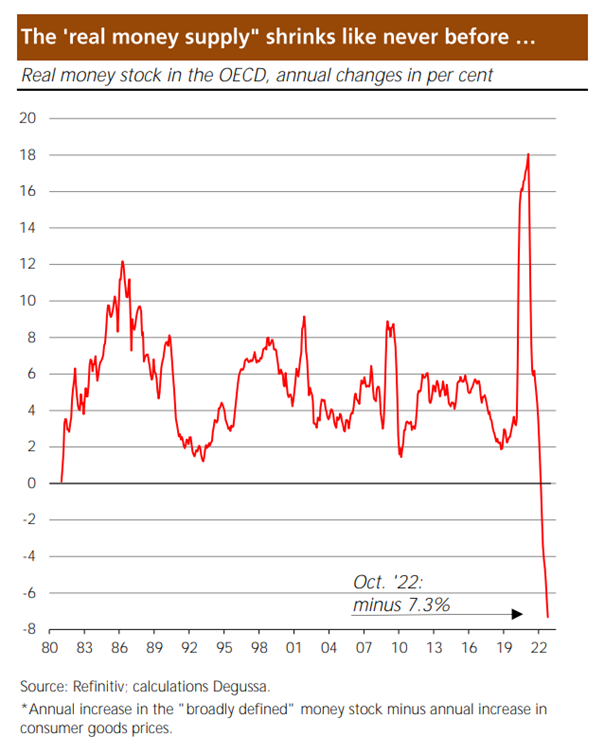

Figure 1 should be regarded in the light of this finding, which shows the relationship between GDP and M3’s previous year plotted together to allow for the approximate time that changes in the quantity of currency and credit outstanding take to be absorbed into the economy.

Until fiscal 1988, the correlation was very close. Between 1989-1999 GDP ran ahead of M3 before stabilising. In the 1990s the hedge fund industry began to boom and shadow banking grew with it. This led to growing levels of unreported credit in the system, depressing the rate of M3 growth relative to GDP. It culminated in the residential property crisis in 2007-2008 and the Lehman failure. Credit securitisations which were off balance sheet suffered substantial setbacks and the shadow banking credit-creation remaining became more reflected in bank credit statistics, contributing to M3 catching up with GDP.

Post-Lehman, the Fed’s balance sheet expanded rapidly, leading to M3 growing faster than GDP, implying a continuing stimulus for higher consumer prices as increasing quantities of currency and credit continue to be absorbed into the economy. It is perhaps too early for a full assessment of changes in the level of shadow bank credit creation since the repo market blow-up in September 2019, and more particularly since March 2020 when the Fed reduced its funds rate to the zero bound and instituted quantitative easing at $120bn every month. But clearly, with the expansion of currency and credit aimed predominantly at financial assets leading to a roaring stock market, there are still substantial debasement effects in the pipeline to work their way through from M3 into GDP. This will be reflected in unexpected increases in nominal GDP yet to come.

The consequences of GDP growth for prices

Since the Lehman crisis, the growth in M3 has undoubtedly contributed to rising consumer prices. While the price effect has been officially subdued, alternative estimates suggest that the acceleration of price inflation is significantly greater than admitted — see Figure 2 below.

We know that the divergence between M3 and GDP is mainly due to excess monetary inflation still in the pipeline, to which we can probably add changing liquidity balances held by the general population.

In the short term, the divergence between M3 and GDP is leading to additional falls in the dollar’s purchasing power for consumers in the future, which according to Shadowstats has prices rising at over 15% annualised already. But it should be made clear that the dollar’s loss of purchasing power is not a direct reason for the divergence between GDP and M3 shown in Figure 1. The divergence is an indication of the inflation of currency and credit yet to be reflected in GDP. In the current debate about how persistent rises in consumer prices will be, this is an important observation, pointing to a further acceleration of consumer price increases instead of the hoped-for transition once supply chain issues diminish.

We can conclude that nominal GDP will continue to follow the course of M3, with some catching up to do. Real GDP recorded by the authorities will depend on the suppression of the consequences for prices from increases in M3 yet to be reflected in the dollar’s purchasing power. And if in the light of accelerating price rises domestic users of the currency reduce their spending liquidity by bringing forward their purchases of goods, the gap between a higher M3 and nominal GDP will tend to close more rapidly. There is some evidence that this is beginning to be the case.

These findings are at odds with the conventional view about GDP, that increases in GDP represent economic growth, when all they represent is growth in the quantity of currency and credit. Furthermore, not only is there no sound basis for its adjustment by consumer prices, but official estimates of real GDP growth depend on a combination of the lagged Cantillon effect delaying the price consequences of monetary expansion and outright statistical deception by suppressing the evidence.

What should be measured, if it were both desirable and possible, is economic progress, which is not the same thing as economic growth, which as we have seen is a non sequitur.

Measuring economic progress

The mistake of regarding increases in GDP as the same thing as economic progress is the equivalent of stating that progress requires rising prices. This is obviously nonsense, when it is understood that progress is the condition where the amenities in life become more easily accessible to the wider population. But even before attempting to measure it, we need to understand the economic conditions that lead to this error.

Before the industrial revolution, most of the populations in Europe were merely subsisting in agricultural economies, just producing enough food to feed and clothe themselves. Energy supplies were limited to foraging for wood. Slavery and serfdom were the only means of detaching people from the land, whereby they would be fed and clothed in return for their labour. The industrial revolution changed that through a combination of transportation and energy from coal. The development of inland waterways interconnected communities which traded with each other for the first time, and coal provided efficient energy resources for homes, the development of steam power, and replaced charcoal in the casting of iron.

These developments were unorganised other than by the individuals who saw profits in them. It was the end of feudalism and the birth of what was subsequently called capitalism. And instead of families providing for themselves in their hovels, individuals developed skills which they deployed to their greater benefit through the development of the division of labour.

The socialists of the late nineteenth and twentieth centuries were essentially anti-progress, with Marxian philosophy seeking to destroy the individualism and personal wealth accumulated by successful entrepreneurs. They latched on to the image of Blake’s dark satanic mills, an imagery which ignored workers’ previous conditions of abject poverty. Child labour was recognised as an evil, and was gradually legislated against, mindful of the damage to family incomes from too sudden a change, and the lack of alternative education.

But the driving force behind progress was the deployment of resources for profit. These resources were raw materials, labour, and monetary capital. The ownership of both fixed and movable property was also a necessary condition for economic progress as well.

These factors were well recognised by British politicians at the time of the Napoleonic wars. They funded wartime borrowing by issuing further tranches of undated gilts at discounts to par value, to turn a 3 ½ per cent coupon yield into a running yield of 6 % for example, by funding at 58% of par. Wealthy investors taking on the risk of war finance were rewarded by the return to lower peacetime yields, investing the capital gained in coal mines and related production. By keeping and enhancing their wealth, these entrepreneurs created wealth for others.

Central to the development of progress was technological advancement and a reliable medium of exchange, the latter permitting economic calculation and providing security for savers. Except for technological development, in every sense these conditions were the opposite of those imposed on their people by governments and their central banks today.

This leads us to a simple definition of economic progress and how it should be regarded:

“Economic progress is seen in an economy in which the per capita quota of invested capital is increasing. This increase in capital goods results in an increase in per capita income. In a progressing economy, total entrepreneurial profits thus exceed total entrepreneurial losses. Since incomes and capital accumulation are incapable of measurement the existence of a progressing economy can only be grasped by resorting to historical understanding.”[iii]

Instead, we are encouraged to believe that growth in GDP is economic progress, by statists who seem incapable of engaging with the changes that progress entails.

The consequences of confusing GDP with progress

That mainstream economists and policy planners cannot distinguish between monetary growth and progress has impending consequences. They abandoned long ago the wisdom of those who adhered to sound money and non-intervention as the conditions under which progress flourished, replacing it with the false gods of statistical objectives. It has taken everyone to the brink of an economic, financial and currency crisis.

So far, the final crisis has been averted by spraying monetary water on the flames. But the conflagration is now beyond being cured by these means: it needs the oxygen of additional currency and credit to be completely cut off to preserve anything. But that is not anyone’s mandate or agenda, so as well as an economic and financial crisis, state-issued currencies, whose only backing is the public’s faith and credit in them, is destined to be destroyed as well.

The irony in all this is that by aiming for growth while suffocating progress, the authorities have committed themselves to a continual debasement of their currencies. Never have we seen all nations dedicated to a single economic and monetary suicide mission. In the past, some nations have seen their governments destroy their economies, but there was always an option to their imposed medium of exchange. Venezuelans today survive by using US dollars. In 1920-1923 some lucky Germans had access to gold-backed dollars earned mostly through exports, while the middle classes without that benefit were impoverished.

Without a swift reappraisal by governments and central bankers of their economic and monetary policies, there will be no state currencies left, and no alternatives either.

The journey to the end of the interventionist road has been a long one. It started with a socialist revolution over a century ago, dragging governments into policies of increasing intervention and of the redistribution of wealth to appease the socialists. Central banks have moved from a hands-off approach to becoming lenders of last resort, and finally to continual policy intervention. They have taken upon themselves to replace genuine money and its credible substitutes with their own unbacked currencies, which they now issue in increasing quantities without regard for the repercussions.

Over the last forty years, they have progressively buried the evidence of the consequences of inflationism. They change definitions, so that no one talks of inflation as a monetary phenomenon, to allow the issuers to continue to debase their currencies. They corrupt the statistics by which they measure their results. The difference between official CPI and independent estimates, such as those by John Williams at Shadowstats bears testament to that.

The wisdom of experience tells us that markets will reassert themselves — they always do eventually. Classical economists in the vein of Hayek and von Mises explained why: it is human action, which even in communist Soviets finally overcame state suppression. Markets will do it again, and for those of us not fully immersed in the false religion of mathematical economics, we can now see how they will bring about a crisis. It will be through rising interest rates, not under the control of anyone, but because market participants are realising that currency debasement is robbing them of their wealth. It matters not whether the CPI suggests that a five-year US Treasury bond is on a negative real yield of five per cent, or on Shadowstats’ calculation it is on a negative yield of thirteen (see Figure 2). Rising interest rates are the markets’ expression of what total compensation for debasement, time preference and counterparty risk should be. And markets will move bond yields higher accordingly.

But for now, the whole establishment is in thrall to statist solutions, which includes those who invest under the Keynesian assumption that the state will always control markets and prevent a crisis from developing. Some of them are beginning to see the dangers, the need for a reset as they put it. But a statist reset solution, perhaps with the widely anticipated central bank digital currencies, misses the point entirely: the public is losing faith in statist intervention and currency debasement entirely.

At some point, high levels of government debt supported by diminishing tax bases and of unproductive debt in the private sectors will turn rising interest rates into a combined economic, financial and currency crisis. It appears that the time is near.

[i] See the chart on pp 7 at https://www.newyorkfed.org/medialibrary/media/research/epr/2013/0713adri.pdf

[ii] Underling data for Exhibit 4-6 in Global Shadow banking Monitoring Report 2016.

[iii] Adapted from the definition of a progressing economy in the glossary of von Mises’ Human Action.