Sometimes people wonder whether philosophy is of any use in understanding daily life. Aren’t philosophers “in wandering mazes lost”? Away with such nonsense, say some. Elaine Sternberg illustrates by her example that this view is wrong. In her excellent Economic Affairs article “Defining Capitalism,” she shows in convincing fashion that providing an exact definition of pure laissez-faire capitalism is of great help in responding to many common objections to the free market. In an article two weeks ago, I quoted some of her criticisms of that abomination called “stakeholder theory,” and in this week’s article, I’d like to discuss some of her arguments in the article just cited.

Sternberg explains the aim of her article in this way:

Without a clear definition, advocates of capitalism are handicapped. They are like defenders of eagles who characterise them simply as “large birds”: by including vultures, that general description leaves eagles open to charges of scavenging. To function effectively with either sort of bird alone—to attack, defend or even to identify members of the group properly—a clear and separate notion of each type is required. Similarly, an explicit, operational definition of capitalism is needed to differentiate capitalism properly understood from all other things, especially those with which it is often confused. (p. 380)

Because of the failure to set forward a clear definition of capitalism, critics often blame the free market for practices and policies in fact alien to it. Probably the most notorious instance of this involves the practice of “crony capitalism,” in which corrupt businesspeople earn monopoly gains by alliance with the state and its agents, which is treated as an instance of “capitalism” and confused with the genuine article. In like fashion, some people condemn capitalism because they disagree with the preferences of consumers. For example, critics scorn capitalism because many people purchase artistic trash and pornography, but such preferences obviously aren’t intrinsic to the capitalist system. As Ludwig von Mises says,

Many critics take pleasure in blaming capitalism for what they call the decay of literature. Perhaps they should rather inculpate their own inability to sift the chaff from the wheat. Are they keener than their predecessors were about a hundred years ago? Today, for instance, all critics are full of praise for Stendhal. But when Stendhal died in 1842, he was obscure and misunderstood. Capitalism could render the masses so prosperous that they buy books and magazines. But it could not imbue them with the discernment of Maecenas or Can Grande della Scala. It is not the fault of capitalism that the common man does not appreciate uncommon books. (Mises, The Anti-capitalistic Mentality, p. 52)

If we want an exact definition of capitalism, how are we to proceed? Not, Sternberg says, by relying solely on examples.

Pointing to examples is generally less helpful for definition than is commonly supposed; it often doesn’t work even for simpler things. Pointing doesn’t identify what differentiates items that look similar: consider shrimp and prawns…. Pointing can only pick out physical objects, not the principles of organisation that constitute systems; significantly, it cannot indicate which features are essential…. The essential features of a thing are just those that are individually necessary and jointly sufficient for it to be that kind of thing and not some other. (p. 382)

She notes that

more fundamentally, it is never possible to find instances of essences unadulterated with accidents. There are no examples of triangularity or terrier that do not display the accidental characteristics of some particular triangle or some individual dog. As a further complication for isolating capitalism, actual economies are typically not pure breeds but mutts. They are hybrids that result from complex interactions, in which contingent events and historical circumstances combine with human intentions and unintended consequences. (pp. 383–84)

To this, I would add that some things have properties (i.e., characteristics) that necessarily follow from the thing’s definition but aren’t part of it. In Euclidean geometry, for example, all equilateral triangles are equiangular, but this property isn’t included in the essence of this kind of triangle.

What, then, is the essence of free market capitalism? Sternberg finds wanting the answers of many who have essayed a response. Her own suggestion is this: “Capitalism is an economic system characterised by comprehensive private property, free-market pricing, and the absence of coercion” (p. 385, emphasis in original). If coercion is absent, is this consistent with having a state? Sternberg, in a way readers of the mises.org page will find of interest, does not shrink from the implications of her definition.

Strictly speaking, a society with a government cannot be completely capitalist, insofar as government necessarily involves coercion and public property. For convenience, however, a society with a government may be allowed the unqualified label “capitalist” if—but only if—the government is minimally coercive: it can be at most a “night watchman”. As such, it must do nothing but protect people and their property against coercion, typically by providing police and military services to oppose aggression, and courts to enforce contracts. (p. 387)

With this definition in place, Sternberg can respond effectively to many of capitalism’s critics: her stance is to say that by ignoring capitalism’s essence, they are really complaining about something else.

Critics who denounce capitalism for not achieving positive goals, or for necessarily promoting outcomes they denounce—e.g., greed or acquisitiveness, alienation or inequality.—are thus fundamentally mistaken. The outcomes that ensue from the workings of capitalism are not necessary, and neither are nor could be the choice or responsibility of capitalism as a system. Holding capitalism responsible for them, is as misguided as blaming the thermometer when the patient has a fever. (p. 388)

Sternberg has made a vital point, but I would inject one note of caution. One should not argue that because some undesirable state of affairs is not part of the essence of the free market, a claim that the market would cause this state of affairs cannot succeed. Not all causal accounts rest on appeal to essences; a critic of the free market might, for example, claim that allowing people to follow their own preferences inevitably leads to economic crises, even though this characteristic isn’t part of the free market’s essence. (You could argue in this way even if you think that causal explanation must appeal to necessities; as mentioned earlier, it’s false that every necessary property of something is part of its essence. And some people defend other theories of causation, such as appeal to “nomic necessities” that fall short of logical or metaphysical necessity.) I hasten to add that Sternberg does not commit this fallacy.

Sternberg deploys her view of essences with great effectiveness. I’ll end with one instance of this.

Consider the claim that the financial crises of 2007–2009 were caused by and “represented a failure of capitalism”…. By clarifying the nature of capitalism, the essential definition lends credence to the opposing view, that government action was the cause of the crises. Persistent government regulation of housing and financial services restricted key uses of private property, and skewed operation of the price system; government action limited individual and institutional choices, and obstructed market corrections. Moreover, it did so by employing the coercion that capitalism necessarily excludes. Blaming capitalism for the crisis thus seems doubly unjust. (p. 389)

Sternberg is a major philosopher, and supporters of the free market should be glad she is on our side.

Note: The views expressed on Mises.org are not necessarily those of the Mises Institute.

Author:

David Gordon is Senior Fellow at the Mises Institute and editor of the Mises Review.

Source: https://mises.org/library/whats-name-why-definition-capitalism-matters

For me the definition of capitalism, at its most basic core, is non-ideological, but pragmatic:

Capitalism is what happens when producers DO NOT spend or save all their produce earnings on themselves, but rather INVEST part of them on improving their productivity. To do so they need to use money to store value, like saving, but to be used sooner or later to acquire capital goods that allow for the productivity to increase, which in turn increases earnings and allows to enter a virtuous cycle.

This should be uncontroversial. Is just the way it works.

Then free market capitalism is ideological to some extent. But to me is also only logical as well: Increasing your productivity will only increase earnings if you are producing value. How can you produce value if you do not know what people want? it is impossible! And how do you know what people really want if they are not free? or how do you make proper decisions and can rely on a price system if there is not, at the very least, some degree of freedom.

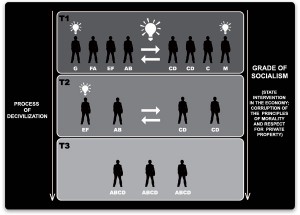

All other kinds of capitalism, communist centrally planned capitalism, crony-capitalism, etc, are bound to fail if they mess with price signals, the money supply or both. Because those manipulations compromise value discovery, and the virtuous cycle of capitalism breaks down.