The disruption of global supply chains is seen to be a temporary problem yet to be resolved, but there are good reasons to believe it is now permanent.

Following the end of the cold war against China and the foundation of a new peaceful era, American and other manufacturers began to expand their production facilities into China and South-East Asia. It was the beginning of what became a trade system based on global supply chains, increasingly sophisticated logistics, and just-in-time inventory management.

Global supply chains deliver enormous benefits between peaceful nations, but they cease to work when they are at war.

Souring trade relations between America and China, covid, and the disruption to international logistics pits them into an undeclared conflict. The trade environment is now against a background of an increasingly belligerent geopolitical struggle, involving both China and Russia on one side, and America and its allies on another. In the absence of détente, which now seems a distant prospect, the system of global supply chains can operate no longer. They must become re-established within national borders.

The consequences are long-term product supply disruption, higher consumer prices, and soaring energy prices already evidenced in Europe. Coming on top of a new trend of rising interest rates and contracting bank credit, it has the makings of an economic crisis for the West, to which governments are bound to respond by creating an inflationary storm.

This article analyses these new war-time trade conditions in the geopolitical context and examines the likely consequences.

The background to global trade has deteriorated

There is a general assumption that eventually, perhaps next year, supply chain difficulties will be overcome. It is the main plank behind central bank expectations, that after the current hiatus restricting product supply, consumer price inflation will return to the 2% target. The mistake is to conflate two issues: the supply chain problem, for which conditions have changed fundamentally, and the declining purchasing power of fiat currencies. However, the inflation outlook is tied up with the trade outlook.

There is little doubt that price inflation at the producer and consumer levels, reflecting declining purchasing power for currencies, is out of control. At Jackson Hole last Friday, Fed Chairman Jay Powell admitted as much. He played down evidence of a recession and prioritised the Fed’s efforts to deal with the inflation problem.

The resurgence of price inflation is ending a forty-two-year decline of interest rates and bond yields that took them to the zero bound. We have almost certainly entered a new phase of rising interest rates. A small rise in a long-term downtrend is one thing, but this is now a dark force of far greater magnitude. Figure 1, of the yield on the 10-year US Treasury, probably the most watched benchmark by domestic and international bond market investors alike confirms that a major turning point has been reached.

Having peaked at 15.84% on 30 September 1981, the yield on this benchmark then began its long-term decline. And when the yield increased from time to time, it never violated the downtrend line, evidenced by four major touching points (arrowed). That downtrend was as solid as it gets; until the yield rose above it in early June. And having done so, just to make sure, it came back and tested it, and now is set to break free and properly reflect a consumer price index which is approaching 10% annually.

Both technical analysis and reality tell us that we are entering a new era of rising bond yields and interest rates. And with the end of their era of decline, rising interest rates and bond yields will also confirm that America’s period of economic financialisation which went with it has also ended. Consequently, we can expect falling values across the whole financial asset spectrum. The factors which led to the S&P 500 Index rising from under 100 in the 1980s to 4,800 last December are now going into reverse.

These factors driving Wall Street are being echoed in other financial centres. They will lead to unpredictable shifts of capital out of bonds and equities, and between currencies. The offshoring of production as America’s financialisation took place will go into reverse, with the production supply chain returning onshore for reasons revealed in this article. The trend will be for capital to migrate from financial activities back to production.

The transition will be enormously disruptive. Unable to absorb higher borrowing costs, businesses will fail and there will be failures in the global financial system. Government finances will take an extra hit, as rising welfare commitments and falling tax revenues send budget deficits skyrocketing. And politicians, always taking the line of least resistance, only know to spend, spend, spend.

The business of everybody is the business of nobody, a message politicians should have adhered to. But that genie escaped from the bottle long ago. They are now politically and legally committed to destroying their currencies in their final attempts to please everyone. And as their currencies decline, the capital that’s not destroyed by falling financial asset values will undoubtedly go into needed commodities, asset and currency hedges, and for the funding of relocated supply chains. It will be a new trend, a trend which unwinds the last forty years.

I have written about the dynamics behind this brave new world: the inability of the global banking system to weather the storm, the mistakes western alliance politicians have made in poking the Russian bear, and the fate of nations who have put themselves in the hands of central bankers who display striking degrees of economic ignorance. Now we must turn to the issue of trade.

The law of comparative advantage

Before considering the consequences of trade losing its international supply chains and the likely consequences, it is worth reminding ourselves of why free trade benefits us.

When US-based and other corporations moved production and component sourcing to East Asia it was for the benefit of consumers, and it allowed them to enjoy a better standard of living than they might otherwise have had. Put aside the emotive issue of national boundaries, and the benefits become even more obvious. This was originally described over 200 years ago by the economist, David Ricardo, as the comparative advantage of trade.

He illustrated the point by comparing the cost of producing wine and cloth in Portugal and England. He argued that because it was cheaper to produce wine in Portugal than in England, and cheaper to produce cloth in England than in Portugal, it made no sense for England to deploy labour resources to produce wine, and for Portugal to deploy labour to produce cloth. Therefore, it made sense for the English to buy Portuguese wine, and for the Portuguese to buy English cloth.

The same logic applies to less obvious examples. A resident in New York State has a choice of products in the shops, some manufactured within the state, and comparable products manufactured in other states. We would expect the New Yorker to buy what he deems is best for his purposes, irrespective of where in America it is produced. And if enough Americans throughout the nation express a preference for a particular product manufactured, for example in North Carolina, it makes sense for that producer to devote more resources to his production of it. Equally, if the sales of a rival product manufactured in New York fails to cut the mustard, then that manufacturer must either modify and improve his product or reallocate his capital resources to doing something else. The customers’ choices send signals to both manufacturers upon which they should act.

In a properly functioning economy, the customer is always king. Producers of goods and services must devote themselves to satisfying their customers, responding to their current demands, and anticipating their future needs, irrespective of their relative locations. Producers and customers are brought together by distributers, wholesalers, and retailers who also compete with each other.

Other than jingoism, there is no difference whatsoever between a New Yorker buying a product from North Carolina or China, Europe, or Japan. The rule of comparative advantage still applies. He should be free to do as he or she pleases. It is only by following the principles behind trade which maximise competition that everyone benefits. And it was in the pursuit of offering the best of comparative advantages that corporations large and small moved production to China and East Asia and developed complimentary supply chains.

It is never the business of government to intervene in or influence choices made by consumers, but it is the business of profit-seeking businesses to satisfy it.

Trade benefits now being reversed

One of the consequences of over-regulation of businesses and of higher taxes is that there comes a point where they will abandon a familiar culture and carve a future elsewhere. Since the 1980s, this has been the story between America and East Asia. Faced with American bureaucracy which places no value on time, US corporations have built highly automated factories everywhere between China and Indonesia in half the time it takes for a similar operation to be set up in the US and is considerably cheaper. Feed these facts into a business calculation, add in the availability of cheaper labour prepared to work longer hours without trade unions, and it’s hardly surprising that funding it is a far better proposition than a similar operation in America — or in Europe, Japan, or South Korea for that matter.

For the last forty years, the peace dividend of the post-communist years led to China and South-East Asia becoming the world’s manufacturer. And as the region’s production capacity grew, so did outsourcing of production as an alternative to establishing one’s own facilities. So efficient had this process become that many US manufacturers’ domestic footprints became slimmed down into little more than design and distribution centres, further enhanced by just-in-time inventory management and sophisticated logistics tying it all together.

Furthermore, the US trade deficit ensured that dollars ended up in foreign hands, underwriting its role as the world’s reserve currency and protecting its purchasing power. As economist Robert Triffin pointed out decades earlier, it was necessary for America to run trade deficits to satisfy demand for exported dollars to act as the reserve currency. The trade arrangements with China and South-East Asia did just that. America’s balance of payments was protected by the desire to hold dollars instead of selling them into the markets. And America’s trade partners financed much of the US budget deficit.

The benefits for the US consumer were enormous, as they were for the Government. Cheapened goods allowed consumers to enjoy the benefits widely, while the Federal Government was able to spend more than it received in taxes without stoking consumer price inflation unduly.

Then the politicians got involved. President Trump was upset at the loss of blue-collar jobs in America, claiming China stole them through unfair practices. He upped trade tariffs and imposed product sanctions aimed at preserving America’s technology lead. He claimed that the trade deficit was evidence of China ripping America off. And his economic policy advisor Peter Navarro, and his Secretary of Commerce Wilbur Ross concurred.

Ross was a vulture investor with limited understanding of economics. Navarro should have known better. Any student of trade economics recognises that the origin of trade deficits is a combination of a national budget deficit and changes in the level of private sector savings. This is why, in the absence of any changes in the savings rate, a trade deficit ends up being similar to the budget deficit, often referred to as the twin deficit syndrome.

The logic behind this accounting identity is simple, at least for classical economists who understand that we produce to consume, and that all consumption arises from production. That is called Say’s law, which Keynes pushed aside because it got in the way of his new macroeconomics, but nevertheless it accurately defines how the division of labour works and explains the intermediating role of money in turning production into consumption of diverse goods.

If consumers and producers add to their earnings and profits by reducing their savings and there is no increase in taxes, then they are obviously spending more than they produce. The gap must be filled by additional imports. Equally, if they withhold spending thereby adding to their savings, imports must fall for the same reason. And if the government has a budget deficit, some of its spending might be directly on imports, or alternatively, excess spending over revenue through the private sector not matched by production still leads to extra imports. Consequently, the budget deficit plus or minus the change in private sector savings always equates to the trade deficit.

Therefore, if a nation runs its finances responsibly, import and export trade will tend to balance. The problem created by President Trump was his expressed desire to cut taxes to stimulate the economy without cutting government spending. The budget deficit rose over his tenure, as did the trade deficit despite his tariffs. That was why the trade deficit increased, and it was not due to external factors.

Trump’s war against Chinese production whipped up a storm. Initially, China responded in mollifying terms only to face yet more determined American aggression on trade. Accusations that Huawei was using its 5G technology as a back door for China’s security services were impossible to disprove and, true or not, only served to enhance suspicions. And Britain, which was developing financial relations with China, had little alternative but to do a policy U-turn and supported the American position taking the other five-eyes intelligence partners with it. US legislation lumping in Hong Kong with China for trade purposes along with local demonstrations — believed by China to have been covertly managed and funded by American intelligence agencies — then forced totalitarian China into taking greater political control of the island, reneging on the spirit of the independence treaty when its lease was surrendered by Britain.

The western media generally saw these developments as a series of justified actions against totalitarianism, and that over its treatment of Uyghurs China was morally in the wrong. More accurately, it was an escalation of hostilities provoked by America, commencing with trade policies, and morphing into something more serious.

Concurrently, following the Skripal affair Russia’s relations with Britain and other members of the security five-eyes organisation deteriorated. It was a path that encouraged Putin to turn his back on the Western alliance. And following America’s sudden withdrawal from Afghanistan and Britain’s Brexit, Putin saw that the western alliance was on the run.

He deemed the timing was right to secure Russia’s western borders against NATO aggression, leading to Russia’s invasion of Ukraine six months ago. Therefore, the American-led NATO alliance became fully engaged in a proxy war in Ukraine and an undeclared war with China, the long-term consequences of which, apart from the immediate debacle over sanctions, are beginning to clarify.

Between them, the two Asian superpowers dominate the West’s energy and commodity supplies and their supply chains for production. In the absence of a new glasnost, it won’t only be higher energy prices undermining the economies of the Western Alliance, but the whole basis of its trade.

As Zoltan Pozsar pointed out in two recent articles for Credit Suisse, the first entitled War and Interest Rates and the second, War and Industrial Policy, there are fundamental differences between peacetime interest rates and industrial policy compared with the current situation, where a formal war between NATO and the Asian hegemons is all but declared. Figure 1 above confirms the interest rate position. The ongoing disruption to global supply chains confirms the second.

The West’s reliance on existing supply chains is its Achilles’ heel

Along with the financialisation of Western economies, the era of global supply chains developed over the last forty years is now at an end. The impact on major corporations is severe. Apple for example, will be forced to reduce their dependence on Chinese manufacturing. But relocating their production facilities to elsewhere in Southeast Asia is far from easy because the establishment of new facilities relies on building materials and manufacturing equipment being available. But due to the same supply chain difficulties, they are not. Furthermore, retraining staff in other Asian locations takes time, and they are not as available today when Apple set out on its original relocation plans into greenfield Asian sites decades ago. Just-in-time practices leaves companies in this position with no inventory cushion.

For similar reasons, it makes sense for China to secure for itself access to Taiwan’s computer chip manufacturing capacity, which is without doubt an increasingly important motive for her to claim that Taiwan must be reincorporated into a Greater China.

There can be little doubt that American industry now faces major difficulties in maintaining production and product flow into the US. Effectively, the US’s foreign manufacturing facilities are being squeezed, a problem faced by all members of the American-led alliance Consequently, supply-side shortages will persist and intensify, leading to escalating insolvencies and unemployment in America, Europe, and Britain. But the greatest and most obvious supply chain problem is the disruption of energy supplies from Russia to Europe.

Ahead of the northern hemisphere winter, European natural gas prices are soaring. By following green policies of decarbonising its domestic energy production, the EU has become dependent on carbon-sourced fuels from elsewhere, particularly Russia. That was not a problem while an uneasy peace prevailed. Supplies could be maintained, and new pipelines from Russia were being built. But now that Europe is on a financial and trade war footing against Russia, it faces a position for which the only solution is to reopen and restart its own fossil fuel production.

Apart from there being not enough time to ramp up EU fossil fuel production, to do so conflicts with targets to become carbon neutral by 2030 or 2035. In the face of reality, EU nations will have to abandon these targets entirely, and re-embrace fossil fuels, which realistically the human race cannot do without. Furthermore, supplies of grain and fertiliser supplies from Ukraine and the steppes are severely disrupted, leading to far higher food prices and shortages.

It is a problem afflicting all other nations dependent on global supply chains as well. And in reverse, Germany, for example, is finding its ability to supply both China and Russia of both intermediate goods and finished products is now hampered by its own supply chain conditions which have switched from a peacetime basis to one of economic war. All trade flows have become gummed up.

Meanwhile, China and Russia along with their allies on the Eurasian continent will still reap the benefits of supply chain diversity between them, and have a surplus of discounted energy and commodities, which Russia is prepared to settle in their own currencies.

The price consequences of returning to domesticated supply chains

It is obvious that the end of over forty years of global supply chain diversification will have a major impact on all economies involved. For Western nations, it will mean a distressing mix of consumers facing higher prices for everything and of businesses failing. The key to this outcome will be government policy: will governments make the financial resources available for consumers to pay higher prices implied by onshoring production? Most certainly, the answer is yes.

Therefore, we can see a new reason why western governments have to increase their spending to protect manufacturers in a bid to curtail job losses. Doubtless, currency will also be helicoptered to help consumers in distress and to shore up economic activity.

But the situation is considerably more complex than just subsidising domestic production. As noted earlier, we also have a change in the primary trend of interest rates, undermining asset prices, making business plans less viable, and raising the cost of funding government debt. The forty-year offshoring trend and the financial conditions that accompanied it are being reversed.

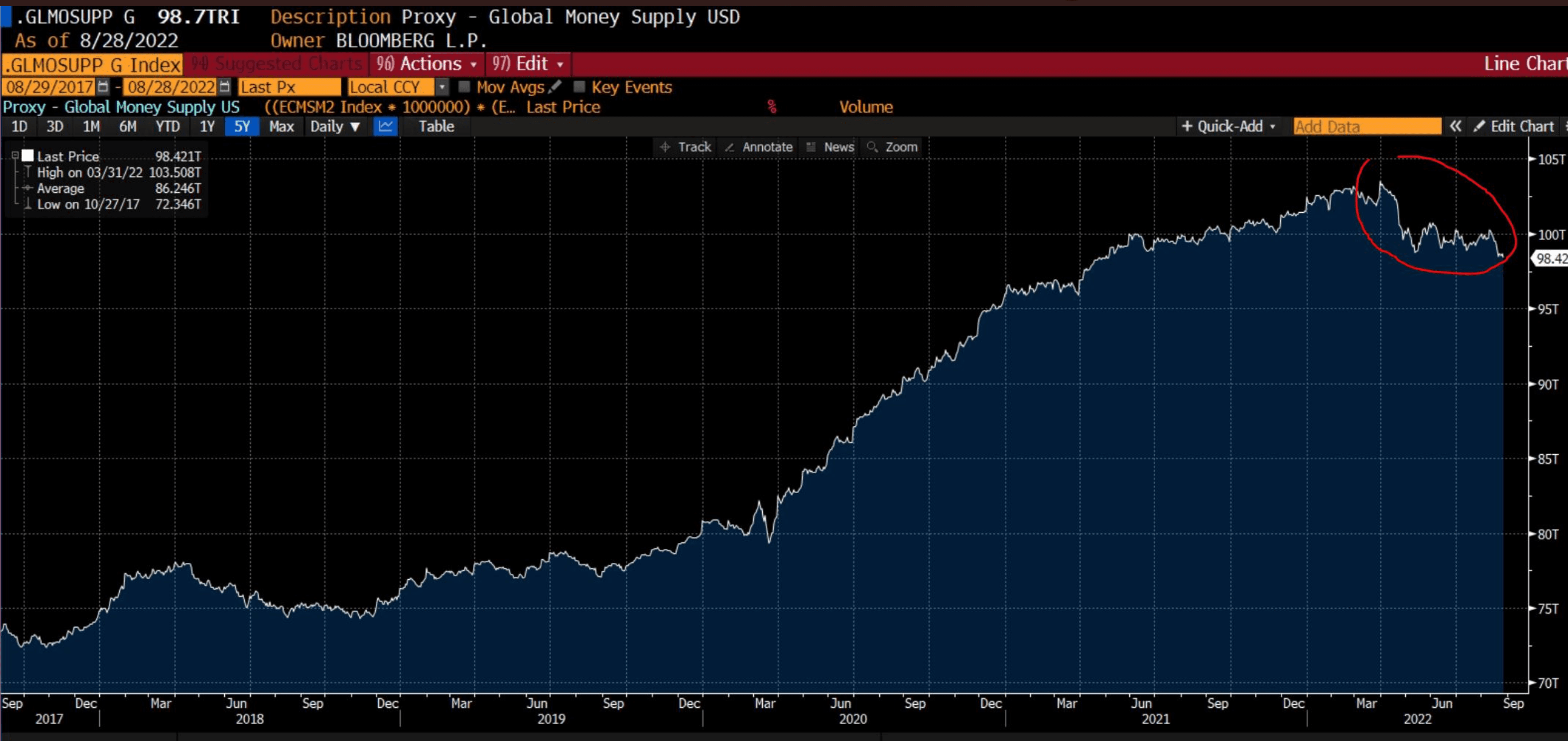

Furthermore, bank credit is already contracting, as the Bloomberg chart of global money supply below shows. Money supply is substantially outstanding bank credit, and the currency element is not contracting. Rising interest rates are making bankers more cautious.

While initially an increase in interest rates is good for credit margins, this is rapidly overtaken by banking concerns over lending risk. Today, banks are very highly leveraged measured by the relationship between assets and shareholders’ equity. Therefore, in a rising interest rate environment, banks will want to reduce their exposure, expecting escalating non-performing loans. On a global basis, we can see that that has been taking place since April and is likely to continue.

Whether commercial bankers realise the consequences of this undeclared war for the future of supply chains is an interesting question. One suspects not, because they respond to information and are not known for being swayed by big-picture analysis, other than that which emanates from central banks. And clearly, central banks have lost their way: the inflation problem was wholly unexpected, and their vision is still limited by their group-thinking silo. Therefore, we must assume that the ending and reversal of global supply chain expansion is an additional factor to those already being anticipated by commercial bankers.

The effect on the primary measure of economic performance will be highly negative. Governments will be faced with sharply falling GDP. GDP is the total of qualifying transactions financed almost exclusively by bank credit. Contracting bank credit is simply mirrored in nominal GDP.

As highly leveraged banks have their capital wiped out by non-performing loans, a global banking crisis becomes even more assured. It is not just from the collapse of zombie corporations, but also from otherwise heathy businesses caught out by the destruction of their supply chains. Yet the temptation, indeed the duty of politicians, will be to do whatever it takes to rescue a rapidly deteriorating situation. Inevitably, it means that government budget deficits will skyrocket due to increasing welfare costs and attempts to support failing economies.

Unless these deficits are financed out of genuine savings, they are inflationary. But with rising high street prices and falling Wall Street values, instead of saving to fund government debt consumers are more likely to dig into savings and credit facilities to make advance purchases instead of retaining credit balances. There is evidence this is happening today and was even referred to as a threat to the currency’s future purchasing power by Jay Powell at Jackson Hole last week — though not quite in those terms.

When the public alters the relation between cash balances and goods, it has a major effect on the currency’s purchasing power. The tendency to make advance purchases accelerates a currency’s decline, and there is evidence that this is already happening. For example, only this week it was reported that credit card debt in the UK is hitting records, and Citibank forecast UK consumer prices would rise at an annualised 18% in the new year. Not to be outdone, as sterling slides on the foreign exchanges analysts at Goldman Sachs said that inflation is at risk of peaking at over 22% if energy costs continue to rise.

All this raises an interesting question. Earlier in this article, it was pointed out that there is an accounting identity whereby in the absence of a change in the private sector’s quantity of savings, a government budget deficit leads to a trade deficit — the twin deficit syndrome. With the reversal of global supply chains and the collapse in both production and consumer demand in the deficit nations, it might appear that imports will collapse, while the budget deficit will increase. Will the twin deficit syndrome be challenged?

An obvious riposte is that while imports collapse, the same influences will undermine exports. Another factor is that the purchasing powers of the currencies of countries with rising budget deficits can be expected to decline. This will be evidenced by higher import prices, particularly for energy, commodities, and raw materials thereby increasing trade deficits. Furthermore, higher prices force consumers either to do without, or to draw down on their savings. Because of the combination of these factors, trade deficits will continue to correlate with budget deficits, despite a decline in product availability and consumer affordability.

The consequences for governments and their finances

From the foregoing, it is clear that it is not the trade deficit which is bad. When US and other corporations moved production and sourced components from East Asia it was for the benefit of consumers, allowing them to enjoy a better standard of living than they might otherwise have had.

That is now ending, and consumers are already feeling the effects with prices for imported goods rising steeply and widespread shortages of goods for sale. There is evidence that the global economy is entering a deep recession, driven by bank credit beginning to contract. The increase in energy prices, with shortages exacerbated by sanctions against Russia, is pushing up costs not only for consumers, but for manufacturers and service providers alike. The costs of energy-intensive processes, such as smelting aluminium, steel, as well as cement production will rise sharply, and plant capacity will be shut down.

Food production has been badly affected by the summer drought and the loss of grain exports from Ukraine and the Russian steppes. Fertiliser costs have soared for similar reasons. This winter, it will not only be a question of malnourishment for much of the world, but starvation for many regions as well. Even people in the advanced nations will be badly affected.

As well as providing mandated welfare costs which will be rising with the recession, it is the duty of western governments to ensure that their populations are protected as much as possible from the impending disaster now looming over them. Consequently, their finances will suffer a double blow from falling tax revenues and rising expenditure. Budget deficits will soar, and trade deficits with it, as exports collapse and the costs of raw materials skyrocket. Unlike the covid crisis, which was of limited duration, the ending of global supply chains is set to have a prolonged economic impact and detriment on government finances.

Financing these deficits will be against a background of rising interest rates and bond yields, reflecting the erosion of currencies’ purchasing power. In the past, the US Government has benefited from deficit financing provided by foreigners holding on to dollars gained through their exports to America. Not only will this benefit cease, but it can be expected to reverse.

Because America’s importers chose to accumulate dollars instead of selling them for their own currencies, to some extent its purchasing power had been protected from the consequences of currency inflation. That has led to an accumulation of dollars and dollar denominated financial assets in foreign hands totalling $33.5 trillion (March 2022, US Treasury TIC figures — see below).

The securities element totals $27.251 trillion, values which are exposed to the negative consequences of higher interest rates and bond yields. Instead of adding to their dollar holdings, foreigners will almost certainly be selling on portfolio grounds alone. Indeed, monthly US Treasury TIC data shows that since March holdings of long-term securities has fallen from the $25.967 trillion in the table above to $23.534 trillion, a fall of $2.433 trillion. Some of it will be due to declining market valuations, but there is little doubt the Great Unwind is just starting…

The consequences for the dollar of reversing the system of global supply chains poses an additional problem. As well as for pricing commodities, the dollar is primarily used for transfer pricing across supply chains. With the death of global supply chains, this function will fall away, leading to excess dollars and dollar assets in weak foreign ownership. It may not be an immediate problem, but it will be over time, and it should not be long before foreign holders foresee a continually declining trend and accelerate their sales of dollars and dollar assets.

It will be extremely difficult to fund budget deficits against this background.

Conclusion

The trade war against China started by President Trump combined with Putin’s initiative against Ukraine have led to the end of the benign global trade conditions that evolved since the 1980s. The combination of rising interest rates and the permanent collapse of global supply chains is the result of policies originated in the west.

The political class appears unaware of the importance of these developments. We see no evidence of sufficient competence in their economic advisers either. While some intelligence analysts may be vaguely aware of the importance of these trade developments, we cannot be sure in these days of group-thinking that they would be listened to.

These long-term trends tend to be understood, if they are at all, in retrospect. Politicians will pursue policies which they believe worked yesterday in changed conditions with catastrophic results. Both they and central bankers have dismissed the link between the expansion of currency and a fall in its purchasing power. Because dollars were bought by foreigners, the dollar was supported, giving rise to an illusion that the quantity of money has little or nothing to do with the inflation of prices. That is no longer the case. And if, as seems certain, the response to contracting bank credit and continuing supply chain failure is to reopen the currency spigot, there will be a rude awakening as to the inflationary consequences.

When currency held its value reasonably in the past, a similar debasement exercise tomorrow will lead to a rapid depreciation, higher bond yields, difficulties in government funding, and undermine the financial asset values in which central banks put so much store as a marker for consumer confidence.

We approach a northern hemisphere winter with energy prices soaring along with food prices. As well as consumers, businesses large and small face unaffordable electricity, natural gas, and heating oil bills. Still indebted from the covid shutdowns, many businesses will not survive. There will be severe hardship for the poor, and particularly the elderly whose pensions cannot accommodate the higher prices for warmth and food. It will be winter in reality and in all the various metaphors the word is used to represent.

Meanwhile, the antagonists against which America and its allies have aimed their trade and financial war will almost certainly strengthen their resolve against the west. China and Russia, together with their Asian partners are economically in a far stronger relative position, because it is the west that loses its supply chains. China will suffer, but not beyond what it can handle. And as America sees its dollar and hegemony slipping away, we must hope she does not escalate the situation even further, if only to distract its people from the inflation, the bankruptcies, the banks that have to be rescued, the unemployment and the poverty which her government has unwittingly inflicted on the people.