By Dr Frank Shostak

By popular thinking, an increase in the consumption of goods and services is regarded as a major driver of the economy whilst an increase in savings is seen as unfavorable to economic growth. In the National Income and Product Accounts (NIPA), savings are established as the difference between disposable money income and monetary outlays.

Savings however are not about the difference between disposable money income and monetary outlays. It is about consumer goods produced in excess of the consumption of these goods by the producers of these goods.

For instance, if a baker produces ten loaves of bread and consumes two loaves his savings are eight loaves of bread.

Now, in order to enhance his oven the baker hires the services of a technician. The baker pays the technician with the saved bread. The saved bread enables the technician to maintain his life and wellbeing whilst he is busy improving the oven. With an improved oven, the baker can increase the production of bread, all other things being equal.

We can derive from this that the producers of consumer goods by exchanging these goods for the goods and services of other producers supply them with the means that support their life and wellbeing.

Note that the saved consumer goods support individuals in all the stages of production. From the producers of consumer goods to the producers of raw materials, the producers of tools and machinery, and all the other intermediate stages of production.

Observe that if the production of consumer goods were to increase, all other things being equal, the pool of savings will follow suit. This in turn is going to permit a further enhancement and the expansion of the infrastructure.

An expanded pool of savings allows individuals to introduce new stages of production, which prior to the expansion in the pool of savings could not be undertaken. This in turn permits the production of a larger quantity and a greater variety of consumer goods.

In addition, once there has been an adequate increase in the pool of consumer goods, individuals would then be in a position to aim at further enhancing their wellbeing by seeking things such as entertainment and service-related products – such as medical treatment etc.

Why supply precedes demand?

Now in the market economy, wealth generators do not produce everything for their own consumption. Part of their production is used to exchange for the produce of other producers. Hence, in the market economy, production precedes consumption. This means that something is exchanged for something else. This also means that an increase in the production of goods and services sets in motion an increase in the demand for goods and services.

According to David Ricardo,

No man produces but with a view to consume or sell, and he never sells but with an intention to purchase some other commodity, which may be immediately useful to him, or which may contribute to future production. By producing, then, he necessarily becomes either the consumer of his own goods, or the purchaser and consumer of the goods of some other person.

Note that an individuals’ demand is constrained by his ability to produce goods. The more goods that an individual can produce the more goods he can demand i.e. acquire.

If a population of five individuals produces ten potatoes and five tomatoes – this is all that they can demand and consume. The only way to raise the ability to consume more is to raise their ability to produce more.

The introduction of money does not alter what we have said so far. Observe that money is not the means of payment but the means of exchange. Individuals pay with goods and services they produce – they do not pay with money.

On this Mises wrote,

Commodities, says Say, are ultimately paid for not by money, but by other commodities. Money is merely the commonly used medium of exchange; it plays only an intermediary role. What the seller wants ultimately to receive in exchange for the commodities sold is other commodities.

By means of money, an individual can channel savings i.e. unconsumed consumer goods to other individuals, which in turn permits the widening of the process of wealth generation. Whenever the individual deems it necessary, he is likely to exchange his money for goods.

Do people save money?

Individuals do not save money but rather they exchange it for goods and services. Once savings (saved consumer goods) are exchanged for money, the holder of the money could employ it immediately in an exchange for other goods or he may hold it temporarily. How an individual decides to employ his money is going to affect his demand for it.

Whether he uses money immediately in an exchange for other goods or puts it under the mattress, or keeps it in his pocket this will not alter the given pool of savings. For instance, by lending money, an individual lowers his demand for money. The act of lending does not alter the existing pool of savings.

Likewise, if the owner of money decides to acquire a financial asset such as a bond or a stock, he transfers his money to the seller of financial assets – no present savings are affected because of these transactions.

Problems however, emerge whenever the central bank embarks on the monetary pumping. When the pumped money is exchanged for consumer goods, this amounts to consumption that is not supported by production.

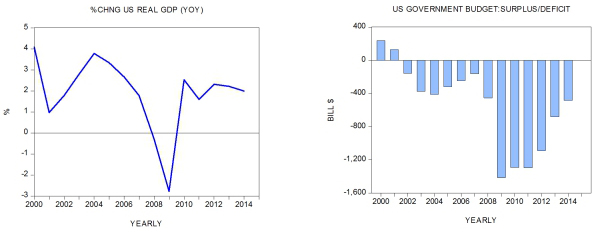

Any so-called economic growth in the framework of loose monetary policy can only take place if the private sector manages to grow the pool of savings despite the loose monetary policies undermining the wealth generation process.

Government is not wealth generator

The government as such does not produce any wealth, so how can an increase in government outlays revive the economy. Various individuals who are employed by the government expect compensation for their work. One of the ways it can pay these individuals is by taxing others who are generating wealth. By doing this, the government weakens the wealth-generating process and undermines prospects for economic recovery.

According to Rothbard,

Since genuine demand only comes from the supply of products, and since the government is not productive, it follows that government spending cannot truly increase demand.

An important factor that makes the fiscal and monetary stimulus appear to “work” if the pool of savings is growing. If however the pool of savings is decreasing then regardless of any increase in government outlays and monetary pumping by the central bank, overall real economic activity is likely to weaken. In this case, the more government spends and the more the central bank pumps the more will be taken from wealth generators, thereby weakening prospects for economic growth.

When loose monetary and fiscal policies divert bread from the baker, he will have less bread at his disposal. Consequently, the baker will not be able to secure the services of the oven maker. As a result, it will not be possible to strengthen the production of bread, all other things being equal.

As the pace of loose policies intensifies, a situation could emerge whereby the baker will not have enough bread left to even sustain the workability of the existing oven. Consequently, the production of bread will actually decline.

Similarly, other wealth generators, because of the increase in government outlays and monetary pumping, will have less savings at their disposal. This in turn will hamper the production of their goods and services and will retard real economic growth.

Therefore, not only does the strengthening in loose fiscal and monetary policies not raise overall output but on the contrary, it leads to a weakening in the process of wealth generation in general.

According to Say

The only real consumers are those who produce on their part, because they alone can buy the produce of others, [while] … barren consumers can buy nothing except by the means of value created by producers.

Conclusions

We can thus conclude that savings are about consumer goods production in excess of the consumption by the producers of these goods. It is not about money but about final consumer goods that support the life and wellbeing of various individuals that are engaged in the various stages of production. It is not money that funds economic activity but the saved pool of consumer goods. The existence of money only facilitates the flow of savings. Any attempt to replace savings with money ends in economic disaster.