This chart strongly suggests that US Treasury bond yields, widely regarded as the risk-free yardstick against which all other credit is measured are going significantly higher, not stabilising close to current levels before going lower as commonly believed. I conclude that US Treasury bond yields could easily double, and the political class will be powerless to stop them going even higher. The implications for interest rates globally are that they will be forced considerably higher as well.

This article concludes that reasoned analysis takes us to this inevitable conclusion. It is consistent with the end of the post Bretton Woods fiat currency era, and the return to credit backed by real values.

The collapse of unbacked credit’s value was only a matter of time, which is now rapidly approaching. The Great Unwind is under way. It is the consequence of monetary and currency distortions which have accumulated since the end of Bretton Woods fifty-two years ago. It will not be a trivial matter.

The trigger will be capital flows leaving the dollar, creating a funding crisis for the US Government. Foreigners, who have accumulated $32 trillion in deposits and other dollar-denominated financial assets will no longer need to maintain dollar balances to the same extent, perhaps even paring them back to a minimum. Furthermore, economic factors are turning sharply negative with energy prices rising ahead of the Northern Hemisphere winter, springing debt traps on western alliance governments. So how could bond yields possibly decline materially in the coming months?

Bond yields are embarking on their next rise…

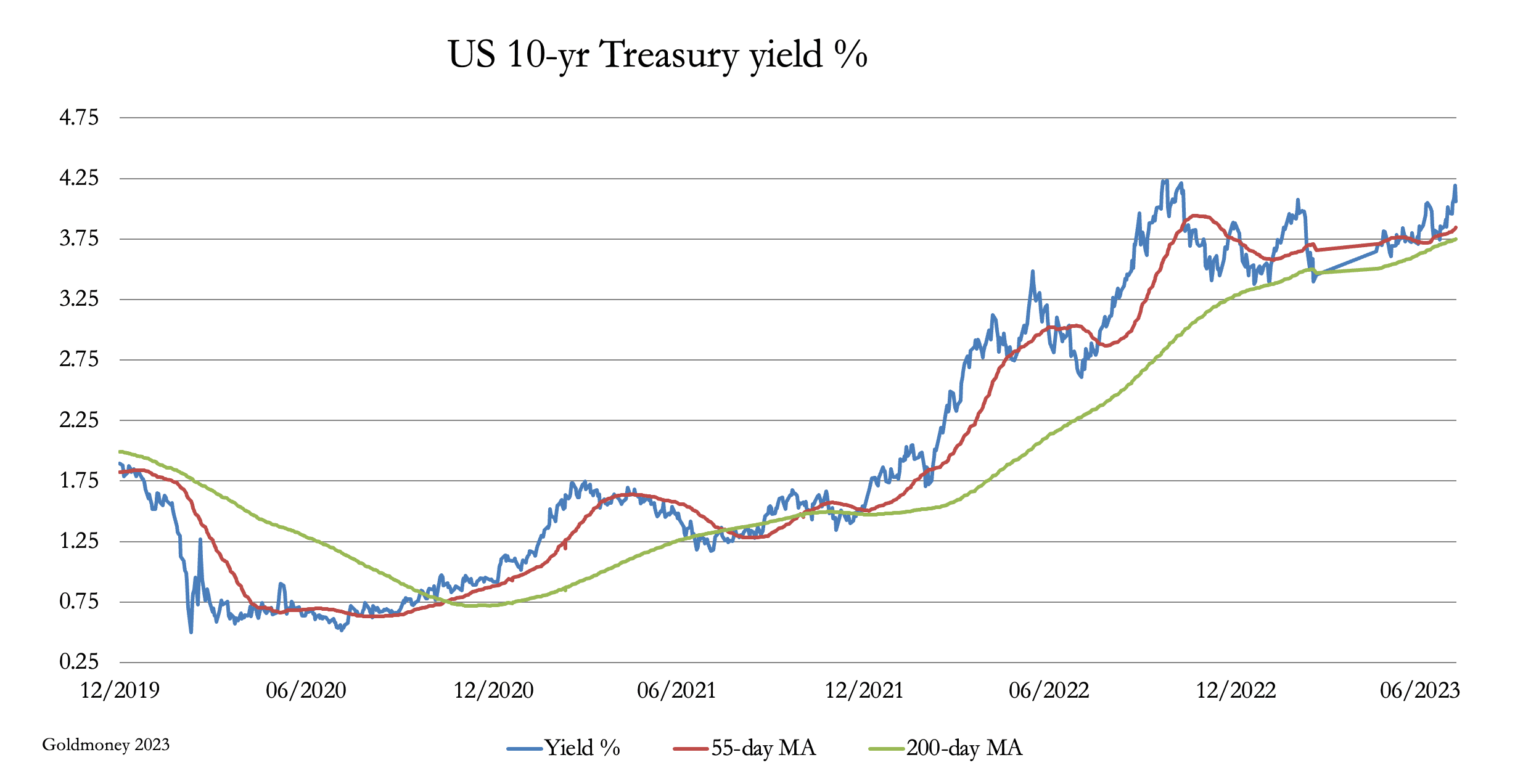

The chart above of the yield on the 10-year US Treasury note exhibits the classic bull market of Dow theory. The price, which is the bond yield, is above the shorter rising moving average which in turn is above the longer-term moving average which is also rising. After an initial increase between March 2020 and October 2022, bond yields had entered a period of consolidation lasting since then, finding concrete support at 3.75% last month where it converged with the two moving averages. And with rising yields, bond prices fall as the bankers at Silicon Valley Bank discovered to their cost.

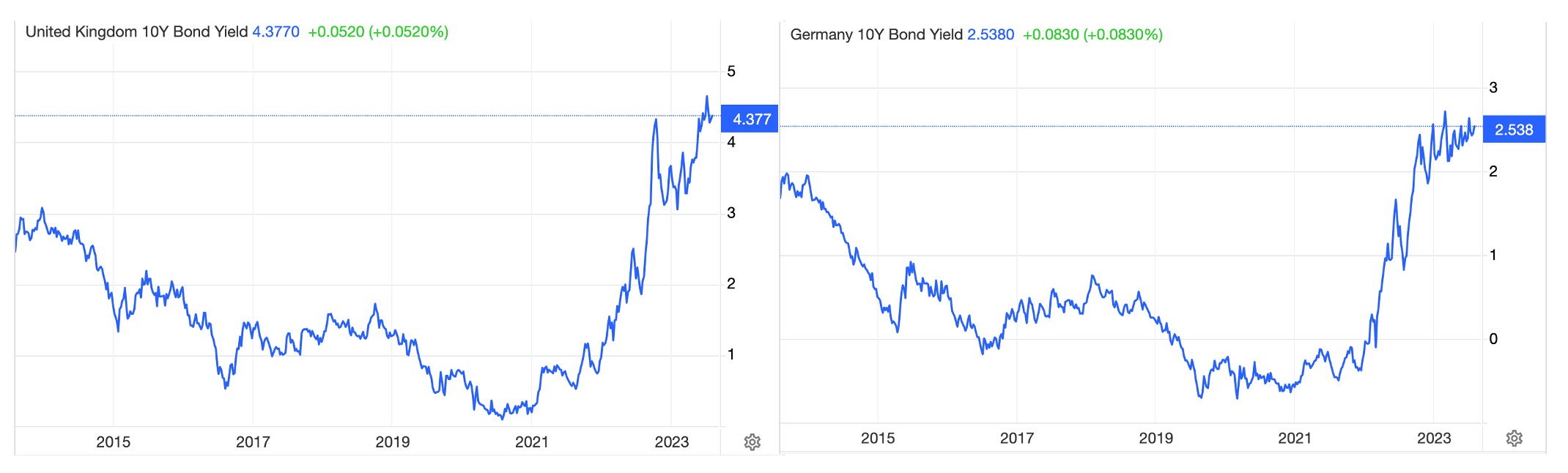

US Treasury yields are not alone. All the Eurozone bonds, UK gilts, and Japanese government bonds exhibit the same frightening condition. The two charts below of 10-year maturity UK gilts and German bunds illustrate the point.

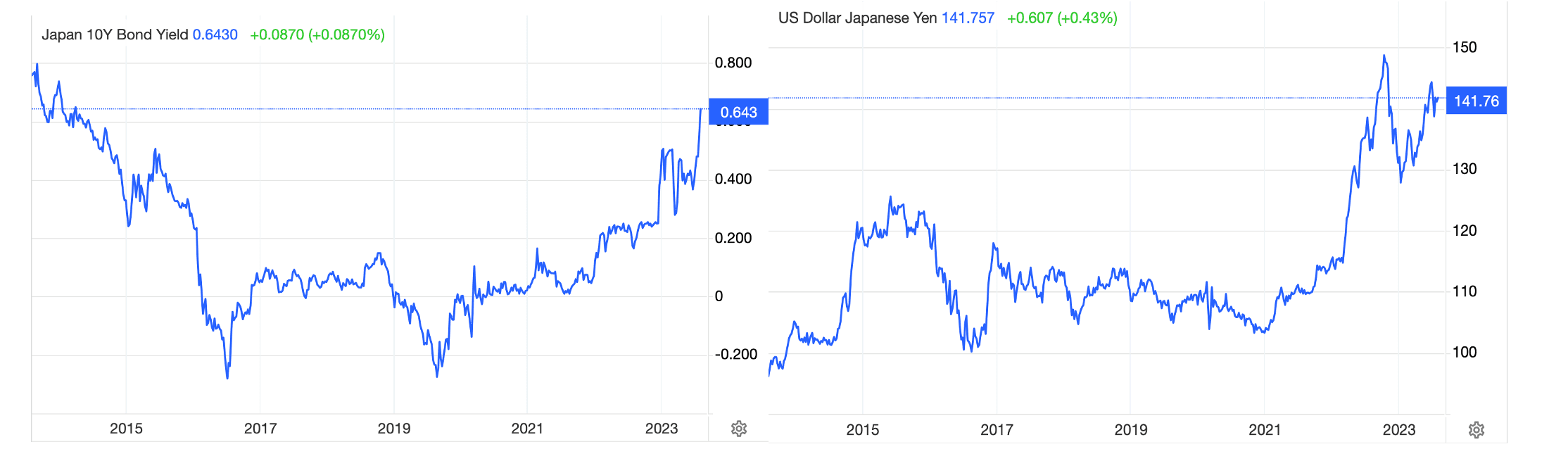

UK Gilt yields appear to have even more upside momentum than US Treasuries, and the underlying bullish forces driving German bund yields are powerful enough to have skewed the consolidation upwards. And in Tokyo, where the Bank of Japan is still clinging onto negative interest rates, its grip on market forces is slipping, as shown in the first of the two charts below.

The Bank of Japan’s determination to keep interest rates and bond yields in negative territory undermined the yen’s exchange rate by as much as 30%. Now that it appears to be losing control over bond yields, the yen carry trade is reversing. And the extent to which Japanese banks and investment funds along with international investors have borrowed and sold yen to invest in higher yielding bonds in other currencies, these flows are reversing to the benefit of the yen cross rate and the detriment of foreign bond markets.

There are other good reasons to suspect that the outlook for bond prices is not as benign as the majority of investors appear to believe. Clearly, those who think like the central banks that monetary policy is working, and inflation is gradually being conquered, and therefore that interest rates are sure to decline next year are in for a shock. The error comes from ignoring international investment flows and the complacency of projecting the experience of the last forty years into the future while assuming that current interest rate levels will suppress consumer demand without impacting on supply. But for all that to be even partly true, the currency and dependent credit must be sound.

It’s less about economics and more about faith in fiat

Fiat currency is inherently unstable. It is entirely dependent in the oft quoted phrase about the dollar’s value being based on the “full faith and credit in the government as its issuer”, a phrase that originated in “the authority to borrow on the full faith and credit of the United States is vested in Congress by the Constitution”. Taken literally, economics and monetary policy are secondary factors in a fiat currency’s valuation — lose faith in the issuer and the currency is doomed irrespective of economics. This, surely, is what has undermined tinpot regimes as much as their currency policies.

But the world is now tired of faith and credit in a weaponised dollar, and therefore of all the currencies which tag along with it. Other than the arrogance of weaponization of the fiat dollar, the trigger for a collapse in the faith and credit in the fiat dollar is the US Government’s policy of banning fossil fuels. The strategic wisdom of President Nixon and Henry Kissinger to tie the dollar’s future to energy demand has been undone in a stroke. The entire Gulf Cooperation Council, led by the Saudis, has now abandoned the 1973 agreement. The link is gone, and with it the dollar’s future security.

Inevitably, politicians in undeveloped economies around the world with safety in numbers now feel freed from the dollar’s tyranny. This is why they seek better international relationships with the Russian and Chinese axis. It coincides with a new realism in Africa and elsewhere, that the days of politicians lining their pockets with western aid programmes are over. Instead, genuine investment in infrastructure is the way forward and that is what China is already providing.

Part of the Asian package will be a better payment alternative to the dollar for commodity and raw material exports. There is also the promise of vertical infrastructures, enabling these countries to capture not just commodity values, which they believe to be suppressed by the American financial system, but more of the downstream value chains as well. Global capital will flow away from yesterday’s story, which has been America and Europe, into this new virgin territory of investment opportunities.

There is little doubt that US foreign policies have become very sensitive to capital flows. This issue made sense of President Trump’s attack on Chinese technology and on Hong Kong during his tenure. America could ill-afford to see international investment capital be diverted from America to China. And today, the US Treasury is feeling this pressure with foreign investment in its debt stalling at a time when they are most needed, and threatening to turn into net selling.

Since Nixon’s deal with the Saudis in 1973, the accumulation of dollars in foreign hands has grown to enormous proportions. According to the US Treasury’s own TIC figures, on current valuations, about $24.5 trillion are invested in long-term financial assets, comprising US Treasuries, agency, and corporate bonds totalling about $10 trillion, and $14.5 trillion in equities. Additionally, there are $7.5 trillion in short-term securities and bank deposits.

These have accumulated under the widespread assumption that the dollar’s reserve and hegemonic status will continue for ever. By the Saudis abandoning the 1973 Nixon deal with King Faisal, that assumption is no longer true. In conjunction with Russia and the Iranians, the Saudis will undoubtedly seek a better settlement alternative for their energy exports to the fiat dollar, and that is what the Russians say is on the agenda for the BRICS summit later this month.

What comes out of that summit is probably less material than a growing sense that the dollar’s days are numbered. And when this message dawns more fully on foreign owners of dollar assets there can be little doubt that they will turn sellers en masse. It is increasingly difficult to see how the drip-drip of selling won’t turn into a flood.

It should be noted that this attack on the faith and credit the rest of the world has for the dollar has little to do with economics directly, and more with marking the end of the era of fiat currencies. Perhaps this is why it has not been picked up by Western media, and why investors in America seem oblivious to the danger. It is a mistake to think of prospective market values purely based on economic models, and the demand for dollars to settle trade continuing.

Economic conditions are additional to geopolitical developments. And here, we need to think in terms of the 1970s decade after the Bretton Woods Agreement was abandoned. Measured in energy costs, the purchasing power of all currencies which were no longer tied to gold collapsed, with a barrel of WTI oil increasing from $3.56 when Bretton Woods was suspended to $10.11 in January 1974. The reason was that oil exporters, organised in the OPEC cartel led by Sheikh Yamani of Saudi Arabia, did not possess the same full faith and credit in the fiat dollar as they had in it when it was a gold substitute. The Nixon—Faisal agreement didn’t change the loss of faith but at least the Americans retained control over the settlement medium. But in a lesson for today, it did lead to soaring interest rates, gold values, and collapsing financial values over the rest of the decade.

This brings us back to the headline chart of the 10-year US Treasury note. Yields are bound to go higher if foreigners start selling down their massive $7.5 trillion position in US Treasuries at a time when the US Government’s borrowing requirements are rising strongly. Unfortunately, underlying economic factors can be expected to drive Treasury yields higher as well.

The US Government’s debt trap

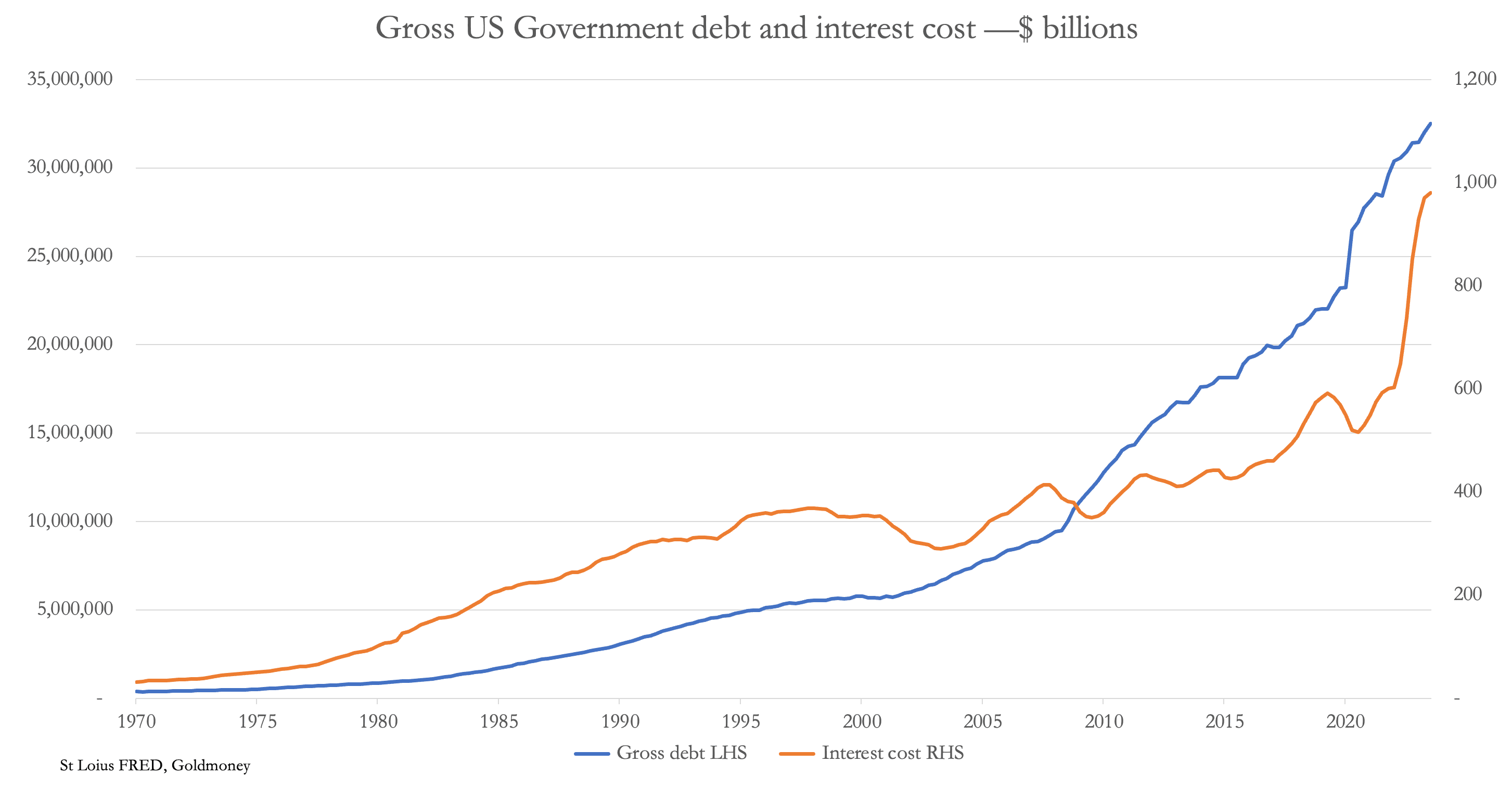

The chart above confirms that US Government debt is growing exponentially. More alarmingly, the interest cost is soaring. The average interest cost is lagging at roughly 3%, but with the outlook for bond yields and interest rates even higher than they are today, the day when interest cost exceeds $2 trillion cannot be far away. Runaway funding requirements and interest costs are the elements that make up the classic debt trap, inevitably leading to a collapse of a fiat currency.

According to the Congressional Budget Office, funding for next fiscal year to end-September will have to cover a budget deficit of $1.571 trillion, and $1.761 for the following year. For the debt trap to be surmounted will require these deficits to be eliminated and replaced with sufficient surpluses to negate interest costs. Almost certainly, in the current environment cuts in expenditure of the required magnitude are politically impossible, particularly with 2024 being a presidential election year. And triggered by higher bond yields and dollar weakness, the US Treasury’s funding headwinds will face selling of dollars and bonds by foreigners and domestic residents alike.

These are similar to the conditions faced by the British government in 1976, which led to a $3.9bn IMF bailout that September, conditional on substantial cuts in public spending. Earlier, sterling had fallen substantially from $2.60 to the US dollar in 1973 to $1.60 in June 1976. Believing that sterling had fallen too far, the US Treasury made a temporary loan to the UK government, on condition that it was repaid by the following December. It was to refinance this debt that the IMF bailout was required.[i] Gilts with coupons as high as 15 ½% had to be issued to fund the budget deficit. Undoubtedly, the conditions imposed by the IMF helped turn the situation round, and the fact that the British government had no choice in the matter took the politics out of its hands.

Arguably, this time the outlook facing the US Government is deteriorating to become at as least as bad and probably worse. Nor can the politicians make the excuse to the electorate that the matter is taken out of their hands, as the left-wing Labour government under Harold Wilson was able to do.

At least British citizens were spared collapsing property prices in the 1970s because mortgage finance had previously been rationed and difficult to obtain. Consequently, house prices were stable through the crisis, with rising interest rates balancing their inflation-hedging characteristics. This is not true today, so residential property prices in the US and elsewhere can be expected to fall further, reflecting rising mortgage costs for marginal demand. Instead, Britain had a commercial property crisis in late 1973, which bankrupted a number of banks specialising in that market. But even though shopping malls and office property in America have already suffered from online retailing and administrators working from home, another hit from rising interest rates is in the pipeline.

It seems inevitable that recessionary forces are mounting with stagnating economic conditions at the least. Higher interest rates and bond yields are bound to lead to lower tax revenues and greater mandated costs. The assumptions behind the Congressional Budget office’s forecasts will be blown apart, and at the worst possible time budget deficits will soar.

Banking systems are wrongfooted for the Great Unwind

The West’s global banking system fundamentally changed in the mid-eighties from financing Main Street to financing an asset boom on Wall Street. Europe followed, facilitated by Big-Bang in London. Large-scale manufacturing emigrated to Asia, where labour was cheap, available, intelligent, and lacked attitude. Factories could be up and running in very little time, compared with the planning and other regulations which led to long lead times in America and Europe. Instead of providing liquidity to businesses which had migrated overseas, the big banks invested heavily in financial activities. It is that trend which is now unwinding.

The expansion into financial activities was the origin of the London bullion market massive expansion, which grew rapidly on the back of a carry trade, borrowing and selling leased gold to invest in higher-yielding Treasuries. Regulated derivative markets rapidly expanded from their agricultural roots, and over-the-counter derivatives mushroomed. According to the Bank for International Settlements, the notional value of OTC derivatives currently is $618 trillion and open interest in regulated derivatives are a further $38 trillion. The large majority are dollar contracts, so the dollar is bound to be in the firing line of the Great Unwind. Furthermore, many of these derivatives are credit obligations for notional amounts not reflected on bank balance sheets, which only record their mark-to-market value. The exposure of banks is considerably worse than their balance sheets suggest.

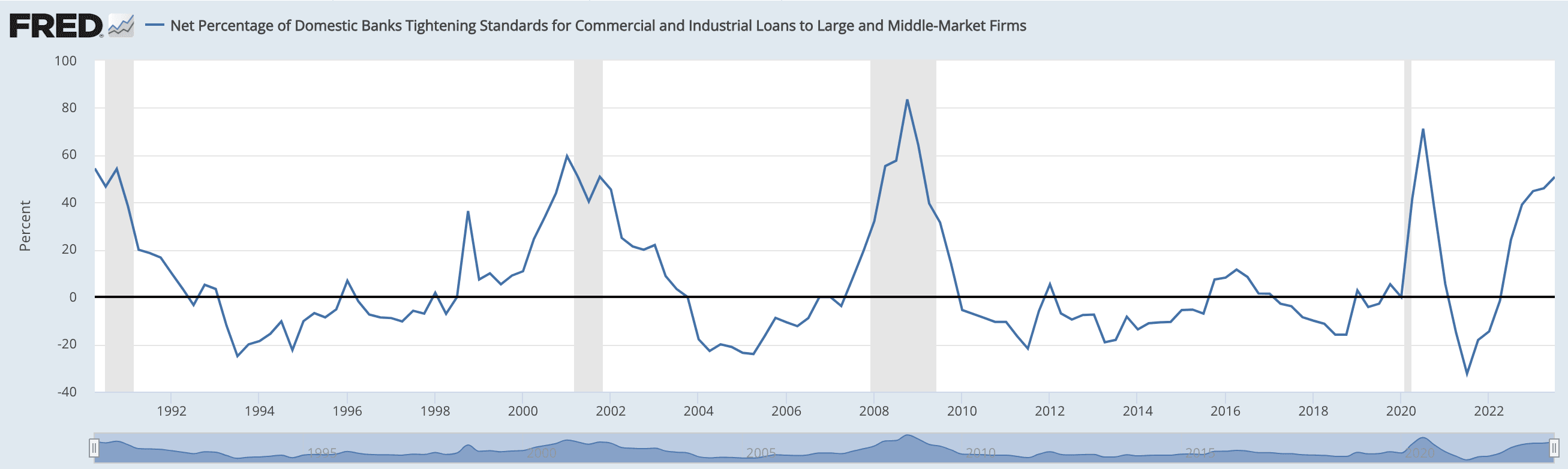

It seems inevitable that a combination of a declining dollar and higher interest rates will lead to a substantial reduction in the size of these markets, and financial accidents in the form of counterparty failures are likely to become a feature. It comes at a time when bank balance sheets are highly leveraged and are at the top of the bank credit cycle. Recognising the dangers, bankers in North America and Europe as a cohort are increasingly cautious, seeking every opportunity to reduce their risk exposure. Already, bank lending in major jurisdictions is contracting. But perhaps the best indication of banker’s sentiment in the US is found in loan officer surveys, and the chart below illustrates the current position.

Tightening loan standards appear to have further to go, which in this instance is not yet a response to an officially designated recession (the shaded bands). And we can be certain that higher bond yields and therefore interest rates will drive loan officers into even greater caution.

Higher interest rates are caused by the tightening of bank credit because credit demand tends to increase at the same time. The conditions that lead to bankers’ caution are rising input prices and slowing sales, which for most businesses lead to them requiring greater overdraft facilities. Banks are reluctant to provide them, but when they do, they demand a higher rate of interest to compensate for the increased risk. A general shortage of credit arises, which threatens to plunge the entire economy into a slump.

Not only is control over interest rates being wrested away from the central bank, but higher lending rates undermine financial asset values as well.

Economists’ understanding that it is a cycle of bank credit which leads to booms and busts was fatally undermined by a misreading of the causes behind the Great Depression. In the good times, banks suppress borrowing costs by competing to obtain business. The ratio of balance sheet assets to equity expands, and so long as this extra leverage more than compensates for the suppression of lending margins, profits for shareholders increase significantly. Instead of an average of seven or eight times, the leverage ratio increases to ten times or even more. It is this process which leads to balance sheet expansion, reflected in the general level of bank credit.

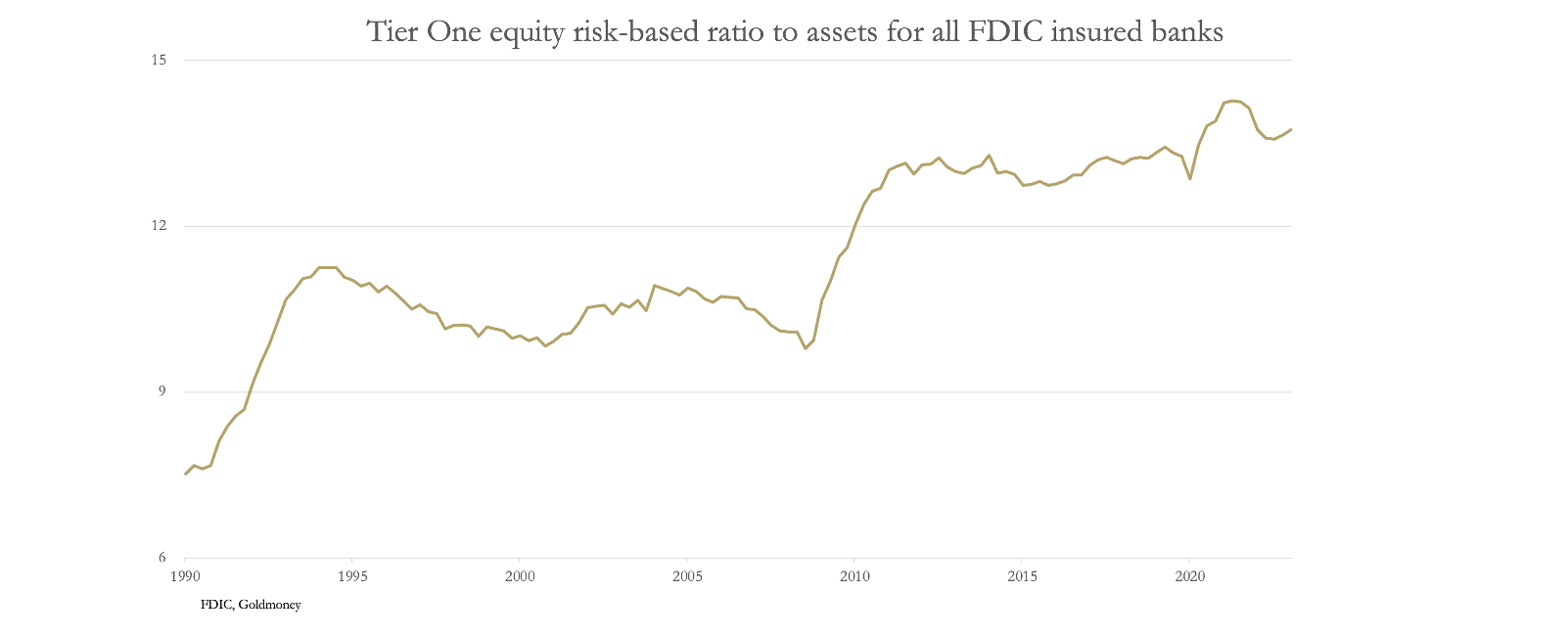

The chart below shows how this leverage ratio in the US banking system has evolved since 1990, from 7.5 times to almost doubling at 13.8 times today.

Though it has been a rising trend long term, the underlying cycle of bank lending is visible between 1990—2000, 2000—2009, and 2009—2020.

In the space of only one month, from 18th February 2020 at the orthodox top of the bank credit cycle, to 20 March the S&P500 Index fell fully one-third. It was due to a general credit tightening instigated by the Fed’s reduction of reserve balances (the consequence of its own balance sheet reduction), leading to a slight fall in balance sheet leverage for the commercial banks. Since then, there has been the distortion of Covid, zero Fed funds rates, and massive QE, which mechanically boosted the level of reserve assets on bank balance sheets.

Since the 1980s, with the odd hiccup interest rates have been in a declining trend. This suppressed lending margins over time, and in the absence of consumer price inflation, officially at least, banks have tended to increase their balance sheet leverage in order to maintain profits. Furthermore, the “Greenspan put” over the dot-com boom, subsequently continued by Ben Bernanke led to complacency over balance sheet leverage. This complacency has been compounded by Basel regulations in iterations I, II, and III. By giving preference to the regulators, directors have given less attention to leverage risk.

On any historic basis, US banks are now horribly overexposed to a business downturn. Thanks to the sharp rise in interest rates, the factors which are now driving bankers’ attempts to address leverage risk are greater than in previous downturns. The conditions driving balance sheet reduction, in other words bank lending, will become more vicious as interest rates and bond yields are driven higher.

These credit downturns are associated with bank failures, most notoriously during and following the Wall Street Crash of 1929—1932. Those conditions exist again today, the principal difference being the gold standard which was blamed for the depression, and the current fiat currency regime. Instead of specific bank credit risks arising from individual bank failures following the Roaring Twenties, the entire credit system is at risk today.

Mistaken monetary policies, and the foreign dimension

Central bankers believe that interest rates represent the cost of money, and that by raising or lowering them they can regulate demand and consumption. And it is almost certainly true to say that this is the way investors look at interest rates as well.

This is not the way a foreign holder of a currency will look at it. As well as time preference, which is the compensation for parting with immediate possession of credit in return for a debt to be settled at a future time, there is counterparty risk, and most important of all the expectation of what the currency’s purchasing power will be when the debt is repaid, or a bond matures compared with its value today. If the compensation is insufficient, then the currency is overvalued.

The future exchange rate of a fiat currency is a movable feast, driven by foreign assessments of current monetary policies. But these are relative assessments between competing currencies. Similar issues are faced by all major fiat currencies, and their central banks are group-thinking the same way as the Fed.

For the investment management cohort, it is an encouragement to simply regard the dollar as the risk-free standard for all currencies, to be bought at the expense of others in times of economic or financial crisis. The basis of this argument is a belief that the dollar is money and has replaced gold. This is the propaganda line pushed by successive US administrations since the abandonment of the Bretton Woods Agreement.

This propaganda conflicts with legal fact and ignores the difference between possession of gold which has no counterparty risk, and possession of dollar notes for which the counterparty risk is the “full faith and credit” in the US Government. As the Great Unwind of the post-Bretton Woods system accelerates, the flight will be less between the dollar into other currencies, and more between fiat currencies and legal money, which is gold, or credit which credibly takes its value from gold.

The fiat currency regime which has lasted since 1971 is now coming to an end. Replacing it will be currencies exchangeable for real values, be they energy or commodity based. And always correlating with a basket of these commodities is gold. Besides its long-standing legal status as money, gold is the practical embodiment of real values, as the currency planners in Russia, headed by Sergei Glazyev has concluded.

The end of full faith and credit and the return to gold

For decades, China and Russia between them have looked forward to trade between members, dialog partners and associates of the Shanghai Cooperation Organisation being settled in a currency medium other than the dollar. They fully recognised the unwelcome control that the dollar, its organisations (World Bank, IMF etc.), and America’s banking system exercises over their own spheres of influence in Asia and beyond. Getting rid of the dollar had been an evolutionary process until the western alliance implemented sanctions against Russia, when the US defaulted on its debts to Russia in March last year.

For Russia, this action led by the US changed the evolutionary approach into one of necessary aggression. At the St Petersburg International Economic Forum in 2022, 14,000 delegates from 130 countries, with 81 nations sending official representatives were told by Putin that the dollar was now fully weaponised, and that nations should reduce their exposure to the dollar and the euro as much as possible. They should also remove any gold stored in the “unfriendlies’” financial centres and take it into their own possession. These delegates had been alerted and warned, so are perfectly aware of the dangers of depending on the dollar.

Putin also prepared the ground for a new settlement currency, bringing in any nation seeking to protect themselves from dollar hegemony. Originally billed as a settlement currency for cross-border trade and commodity purchases between members of the Eurasian Economic Union, it also appears to be the basis for a new trade settlement medium for the BRICS members, other nations applying and interested in joining, and the entire SCO organisation, all attending the summit in Johannesburg later this month.

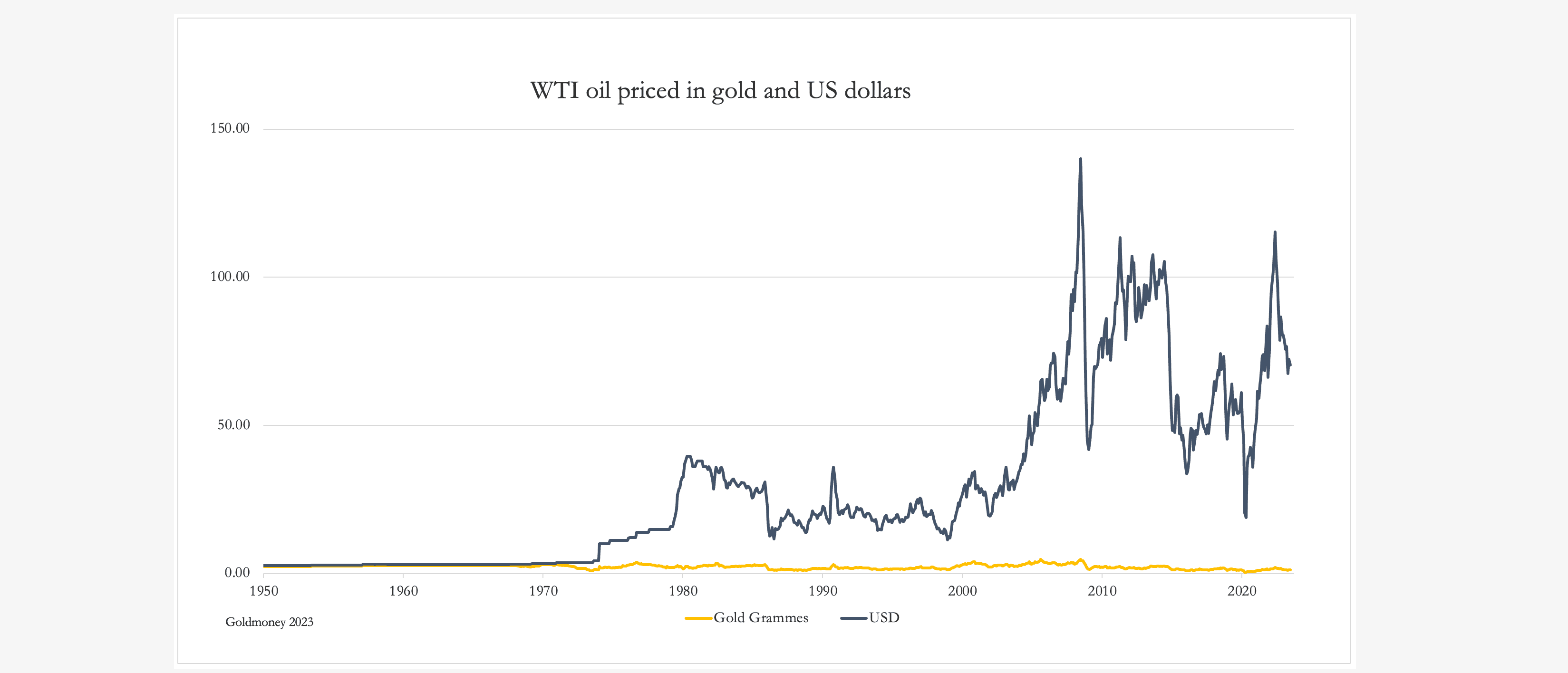

There is considerable confusion in Western commentary ahead of the summit as to what will be announced if anything. But Russia has made it clear that the new currency will be backed by gold, likely to be an expression of gold weight. Some are saying that it requires unanimous agreement from BRICS members, with officials in India saying they would not support it. But the reality is that the oil and energy suppliers — Russia, Saudi Arabia, and Iran — set the payment terms. We do not know the details yet, but it will almost certainly be credit denominated in gold by weight, freeing it entirely from the dollar and national currency exchange rates. The chart below says it all. Priced in gold, the price of a barrel of oil is remarkably stable, the volatility being in the dollar and other fiat currencies.

The fiat dollar has been a destabilising influence, suppressing the price of oil in gold grammes to the point where it has halved since 1950 to 1.14 grammes per barrel currently. In 1950, the Bretton Woods Agreement ensured currency stability backed by America’s huge gold reserves (20,279 tonnes, being two-fifths of global above-ground stocks). But, since the Bretton Woods Agreement was abandoned in 1971, the dollar has lost over 98% of its value measured in gold.

To the major oil producers in Asia, gold is money, and dollars are paper credit they would rather not have. From their point of view, the price of oil should return to the 2.28 gramme level of the 1950s, which implies a US dollar price of about $150 today. And what applies to oil equally applies to all other commodity values.

Nations exporting commodities and raw materials are therefore bound to prefer settlement in credit expressed in gold grammes instead of a weaponised fiat dollar. Led by the Saudis, for the first time a plethora of undeveloped commodity exporting nations are finding there is safety in numbers, and can turn their backs on the dollar.

The consequences for the dollar and the other major fiat currencies cannot be ignored. With its selective default on Russia, the US fired the starting gun on its own collapse, and the Russians were forced to take the offensive. By bringing gold back as central to trade for the majority of the world’s population and GDP on a PPP basis, the credibility of fiat credit has almost certainly been dealt a fatal blow, not just for the dollar but for the entire fiat currency system. It suits Russia and China which have hidden gold reserves, and even Iran which is suspected of having secretly hoarded bullion as well. It also suits the Saudis and Gulf states, who have always understood that gold is money and dollars are just foreign paper.

But some other SCO/BRICS nations may have to protect their currencies as well from these developments. It seems reasonable to assume that in devising this new currency, Russia will have incorporated plans to offer protection for these nations from the consequences of a return to gold. Given that nearly all these nations don’t have heavy welfare programmes, it would be relatively easy for them to introduce a sound money discipline, perhaps on a currency board basis linked to a new BRICS gold substitute currency. Alternatively, we can be sure that there are contingency plans in place for the rouble to adopt a gold standard and also for China’s renminbi — the latter would be a particularly suitable currency for currency board relationships with its trading partners if China introduced a gold standard for the renminbi.

For now, this is speculation. We shall see how events are likely to progress following the Johannesburg summit. But on one thing we can be certain: foreign selling of the dollar and dollar denominated debt could easily turn into an avalanche, because of the bear market in financial values due to rising bond yields. Americans have only about $700 billion in foreign currency to offset this selling. The rest of US portfolio investments abroad are in ADR form, priced in dollars. And selling ADRs does not lead to selling of foreign currencies, and therefore demand for dollars.

The escalating funding requirements of the US Treasury will conflict with this foreign selling, probably in too great a quantity for commercial banks to offset by taking this debt onto their over-leveraged balance sheets, as they will undoubtedly be pressured to do. But they are desperately trying to reduce their balance sheets, and the only debt they are likely to entertain is in short term maturities such as T-bills. The US Government’s debt trap is set to ensure that funding its deficit can only be achieved at far higher bond yields, or alternatively by accelerating the pace of monetary inflation.

But aren’t rising interest rates bad for gold?

The myth that rising interest rates for fiat currencies is detrimental for the gold price has its origin in the carry trade of the 1980s, when it was possible to lease gold from a central bank at less than one per cent, sell it into the market and invest in US Treasury bills yielding six per cent. Returns were even greater when this carry trade was leveraged up. Ever since then, traders have automatically assumed that higher dollar interest rates would lead to selling gold and buying dollars.

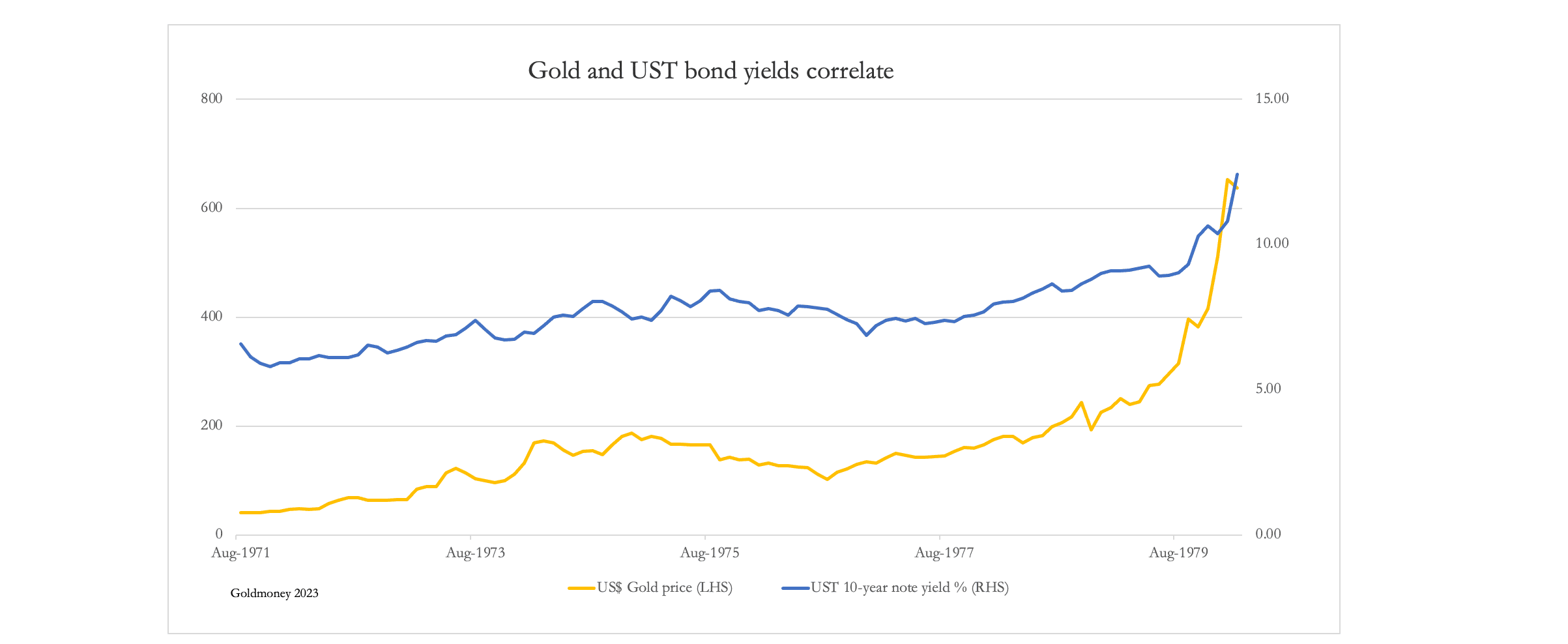

The long-term decline in interest rates between the 1980s and 2020 without resurgent price inflation appeared to confirm it. But the 1970s experience, when the general level of prices rose in similar conditions to today and bond yields with it was different, as our last chart illustrates.

The chart runs from August 1971, when President Nixon suspended the Bretton Woods Agreement to February 1980, to Paul Volcker was forced to jack up interest rates to stop the dollar from sliding, a policy which he continued into 1981. Clearly, after the dollar lost its anchor to gold, the factors which drove US bond yields up also drove the dollar price of gold higher as well. It was a time of runaway price inflation; or put more correctly a falling purchasing power for the dollar. And the correlation was only broken by Volcker raising overnight interest rates to 20%.

The error in modern thinking is not to understand that interest rates are compensation for parting with money, currency, or the right to instant access to credit. As pointed out earlier in this article, interest rates represent the market assessment of the future discounted value of a medium of exchange, to which foreigners are particularly sensitive. Since gold retains its purchasing power over time, the discounted future value only reflects time preference and counterparty risk. The discounted future value for fiat currencies includes their anticipated loss of purchasing power, which is not only more material today than it was two years ago but increasingly so. There is therefore, no connection in monetary or economic theory between the yield on gold and a fiat currency.

Using the US Treasury 10-year note puts the chart at the beginning of this article into the context of an inflationary fiat currency. In early 1980, its yield was over three times as high as it is today. Arguably, the unwinding of all the accumulated distortions of the fiat regime could have a far greater negative effect on the dollar and other fiat currencies than experienced in the 1970s. If so, it will be the bear market of all bear markets for financial assets. But the real collapse, as John Law discovered in similar circumstances in 1720 France, was in the currency.

[i] See the Cabinet Papers in the National Archives at https://www.nationalarchives.gov.uk/cabinetpapers/themes/sterling-devalued-imf-loan.htm

The dollar is going down in flames, yes. But so is Fiat and gold already failed us.

Gold is only money in hand, otherwise is just credit. Not your vault keys, not your gold coins.

You cannot send gold over the Internet, and the fraction exchanges happening in person today is minuscule.

Once we started moving ships far and fast, gold tend to be stored by 3rd parties and instead IOUs of gold were exchanged.

With the advent of Telecommunications, gold demise was assured. Money needed to travel at near the speed of light, but it could not. So instead credit did.

But credit is NOT money, whether is IOUs of gold or something else. Credit has its uses, but things fall apart when it tries to replace the money’s use case: final instant settlement without counter party risk.

Free banking worked, for a while, but the unverifiability of the fractional reserve system was too good an opportunity for state nations to pass on.

So in the “golden era of the gold standard” things kind of worked because you had to trust a bunch of commercial banks that were NOT going bail out by anyone. They were strongly incentivised to give loans for productive uses and “do not over print” bank notes and deposits. Still, some banks did go bust.

Soon after governments enter the scene with central banks and, after some Bretton Woods transition period, gave birth to a full Fiat system that today replaced gold backing completely for most common mortals.

Fiat is designed to go bust, and it is on its way to do so.

Governments had enjoyed the Fiat toy, allowing them to spend without remorse, never to balance budgets. The country that has enjoyed this game the most is the US, of course. It had the global reserve currency.

But the underlying problem is still unsolved: We do not have a credible trust-less money, something we can use in most transactions peer to peer, verifiable, providing settlement and moving close to the speed of light.

Yes, the US dollar does not inspire the confidence it used to. Yes, more and more countries will flee from it. Maybe individual users, but there is less talk of that, because the dollar in the street usually falls slower than the fiat currency next to it, ask Argentinians, Venezuelans or Zimbabweans.

But the real question that remains is:

Are you going to replace trust in the crooks at the US governments with trust in the crooks of the China or Russia or Brasil, or you name it governments?

No sir, not even the BRICS trust each other.

Trust is key in a world where nobody is trustworthy.

Tungsten gold painted reserves or any kind of pretend backing must be trusted, how would a crook trust another crook with that?

The abuse of credit ends with a tsunami of accumulated debt. This screams you need a way to transact with as little trust as possible.

Maybe trust in something not political, like math would be best?