By Dr Frank Shostak

Most financial commentators are of the view that increases in the stock market strengthens economic growth. The reason being because the increase in stock prices lifts consumer and business optimism, which in turn boosts the consumers and businesses demand for goods and services, which in turn strengthens the economy. But is it valid to hold that what drives the economy is the demand for goods and services?

Production and consumption

If an individual in a market economy wants to secure consumer goods and services that are going to sustain his life and wellbeing, he must produce something useful that can be exchanged for these goods and services. In a market economy every individual must be a producer first before he can exercise a demand. Producers pay by means of goods and services that they have produced for goods and services they are require. This also means that an increase in the production of goods and services sets in motion an increase in the demand.

According to David Ricardo,

No man produces but with a view to consume or sell, and he never sells but with an intention to purchase some other commodity, which may be immediately useful to him, or which may contribute to future production. By producing, then, he necessarily becomes either the consumer of his own goods, or the purchaser and consumer of the goods of some other person.

Note that an individuals’ demand is constrained by his ability to produce goods and services. The more goods and services an individual can produce the more he can acquire.

At any point in time, it is the stock of available consumer goods that funds and sets in motion the process of wealth generation. The given stock of consumer goods at any point in time is the subsistence fund. On this, Richard von Strigl wrote:

Let us assume that in some country production must be completely rebuilt. The only factors of production available to the population besides labourers are those factors of production provided by nature. Now, if production is to be carried out by a roundabout method, let us assume of one year’s duration, then it is self-evident that production can only begin if, in addition to these originary factors of production, a subsistence fund is available to the population which will secure their nourishment and any other needs for a period of one year……..The greater this fund, the longer is the roundabout factor of production that can be undertaken, and the greater the output will be. It is clear that under these conditions the “correct” length of the roundabout method of production is determined by the size of the subsistence fund or the period of time for which this fund suffices.

Note that the enhancement and the expansion of the infrastructure is what sets in motion the economic growth. The enhancement and the expansion of the infrastructure in turn is possible as a result of the increase in the subsistence fund.

The key driver of the subsistence fund is savings. It is saved or unconsumed consumer goods that support various wealth generating projects. For instance, a baker produces 10 loaves of bread. He consumes two loaves and saves 8 loaves. The saved 8 loaves are baker’s subsistence fund. By exchanging these 8 loaves for a special tool the baker can now enhance his infrastructure and lift the production of bread. This is what an economic growth is all about.

Stock market and economic growth

When commentators suggest that a particular factor is an important driving force in lifting economic growth one requires to examine that factor’s relation to the subsistence fund. Does this factor strengthen the subsistence fund? Following this reasoning, does a rising stock market set the platform for a strengthening in the subsistence fund? If it does then a strengthening in the stock market is causing an economic growth.

Again, by popular thinking a strengthening in the stock market makes people more optimistic about the future. This in turn, it is alleged, boosts their demand for goods and services thereby strengthening the economic growth.

We suggest that it is not a psychological disposition that determines whether an individual’s demand can be exercised but the increase in the production of goods. This however, requires an increase in the subsistence fund, all other things being equal. An improved psychology as such can do very little to lift the economy if the subsistence fund is not expanding.

Again, without the increase in production, it is not possible to accommodate the increase in the demand. The increase in the stock market however, does not cause the increase in the subsistence fund. Hence, the stock market can’t set the platform for economic growth. Also note, the prices of stocks reflect the individuals’ evaluations of the facts of reality. However, evaluations, without the increase in the subsistence fund cannot cause an economic growth.

Central bank policies cause investors to commit erroneous decisions

In the framework of the expanding subsistence fund and the market selected money such as gold and in the absence of the central bank the stock prices are likely to follow a rising trend. The increase in the stock market is going to reflect the economic growth brought about by the expanding subsistence fund.

Note that the strengthening in economic growth is not because of the increase in the stock market but because of the increase in the subsistence fund. The increase in the subsistence fund that strengthens economic growth also results in the strengthening of the stock market.

Note again, that in the framework of the market chosen money and without the central bank, the increase in the subsistence fund is going to be mirrored by the strengthening in the stock market.

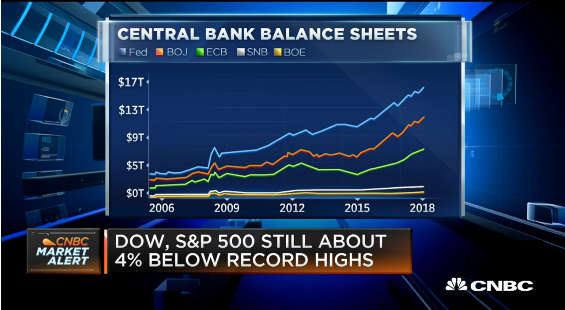

We suggest that the central bank’s policies of tampering with the financial markets that causes boom-bust cycles is the key factor behind the bull bear markets. As a result of the central bank policies, investor’s ability to distinguish wealth generating activities from non-wealth generating activities i.e., bubble activities are curtailed. By not being able to identify wealth generators investors are becoming gamblers with the stock market seen as a casino.

Various theories such as the Efficient Market Hypothesis (EMH) that emerged because of the central bank policies that disrupt financial markets, hold that it is futile for investors to attempt to identify wealth generators versus non-wealth generators. In fact, one of the pioneers of the EMH Burton Malkiel has even suggested that,

A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by the expert.

We suggest that a theory such as the EMH doesn’t explain but only describes hence, it is not of much help to an investor. By the EMH investors should give up sound thinking in favor of a haphazard conduct.

Conclusion

The heart of economic growth is the subsistence fund. Given that a strengthening in the stock market cannot strengthen this fund it follows that a strengthening in the stock prices cannot strengthen economic growth, all other things being equal. Note that without the improvement in the infrastructure irrespective of the state of the stock market it is not possible to strengthen the economy’s growth rate. We hold that the disruptive fluctuations of the stock market labelled as the bull-bear markets are the result of the monetary policies of the central bank. These policies undermine the subsistence fund and set in motion an economic impoverishment.