Industrial policy is back in fashion. Our new coalition government claims that the financial industry is too big. They promise to “rebalance the economy”, mainly in favour of high tech and green industries. These excellent but mysteriously under-funded industries will be encouraged with subsidies.

Industrial subsidies are a bad idea. They replace the judgement of investors risking their own money with the judgement of politicians playing with other people’s money. Not only does this reduce the chance of wise investment, it distracts entrepreneurs from their proper business. They devote themselves to winning the sympathy of the subsidy dispensers rather than producing things that consumers will pay for voluntarily. A planned economy is an economy of political favours.

But these perverse effects of subsidies are not my concern here. An even simpler point about subsidies suffices to show where our politicians have gone wrong in their analysis of the financial crisis and our inflated banking sector. And that point is this. If a subsidy is offered, it will be accepted.

Whatever doubts Messers Cameron, Osborne and Cable may harbour about their industrial policies, it has surely never crossed their minds that they will be defeated by techies and greenies refusing to take taxpayers’ money. Perhaps a fiercely independent farmer once refused an agricultural subsidy, but I doubt it.

If our politicians could only remember that subsidies are always accepted, they would see that it was their own policies, not the peculiar greed of bankers, that caused the financial crisis and that they will almost certainly cause another. For they offer a subsidy that bankers can cash-in on only by taking the excessive risks that lead to financial crises.

The subsidy I have in mind is the government’s guarantee of loans to banks. Before the financial crisis the government explicitly stood behind loans to banks of less than £35,000 (retail deposits). If the bank failed to repay the depositor, the government would. Where larger, “wholesale” loans were concerned, the government did not explicitly promise to repay bank creditors. But it was widely and rightly assumed that they would.

Such a guarantee makes lending to a bank as safe as lending to the government, no matter how risky the bank is. Which means that banks need not pay their creditors a “risk premium”: that is, the higher rate of interest that creditors demand in return for lending to riskier borrowers.

If a bank took very little risk, making itself as unlikely to default as the government, then the guarantee would be worthless. Even without it, the bank would be able to borrow at the same low rate of interest. Only by increasing its risk – for example, by increasing its ratio of debt to equity – can a bank cash in on the guarantee.

Consider, for example, a bank with £500 billion of debt. If it takes risks that would normally carry a 1 percentage point risk premium, then the government guarantee is worth £5 billion a year. And the more risk the bank takes, and hence the higher the risk premium it would normally have had to pay, the greater the value of the guarantee. The government guarantee means banks can pursue the revenue that comes from risk-taking without having to pay the price that would normally constrain them.

In the run up to the financial crisis, government subsidies of bank risk-taking ran into the hundreds of billions of dollars. So it is unsurprising that banks took so much risk. It is just another example of the immutable law of economics that if a subsidy is offered, it will be accepted.

The politicians who arranged the subsidy now like to complain about the greed and irresponsibility of the bankers who accepted it. This is like a man who has had his wife murdered protesting in court that he never imagined the hitman would be so wicked as to do what he was paid for.

When it comes to absurdity, however, our politicians’ rhetorical response to the crisis is nothing compared to their policy response. They have not removed the risk subsidy by eliminating the guarantees – perhaps by making it a criminal offence to administer a bailout of bank creditors. On the contrary, they have made the formerly implicit guarantee to wholesale bank creditors explicit.

But do not fear. This time, things will be different. This time the laws of economics will be suspended and the subsidy will not be taken. Financial regulators will come up with rules that prevent bankers from taking excessive risks, even as politicians increase the subsidy for bank risk-taking.

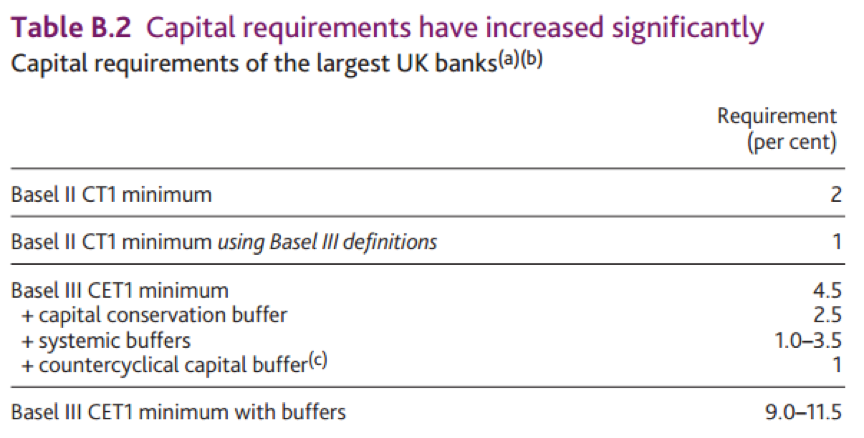

The most comprehensive attempt to ensure bank solvency through regulation, the second Basel Accord, came into force shortly before the financial crisis. All the banks that collapsed complied with its new rules. Yet this fiasco has not dimmed our politicians’ faith in the wizardry of financial regulators. They persist in telling us that a handful of bureaucrats can prevent the Masters of the Universe from getting their hands on hundreds of billions of pounds worth of subsidies.

Such tenacious wishful thinking might be endearing in children. In policy-makers it is catastrophic.