Why the Tories should abolish the Bank of England, and why they will politically benefit from doing so

The Conservative Party, since forming their coalition government have seemed to suggest, both from the actions they have taken and the announcements they have made, that they are ready to make radical reforms. Recent statements by Francis Maude would seem to suggest that this government is quite ready to continue in the direction of radical reform. Indeed an excellent article that recently appeared in The Spectator provided some hints as to direction the Conservatives, and in particular George Osborne, seem to be taking in order to wrest this country from its relentless state dependency. From this, a few things are clear.

The idea behind public sector cuts, devolution of schooling authorities tax breaks in particularly state employed areas, as well as removing the £545 child benefit tax cuts for families earning £50k a year seems to have been to cut the bloc of voters relying on state handouts to survive, and to begin to produce, in a Thatcherite fashion, a bloc of economically independent voters with what Shirley Letwin called “vigorous virtues.” Central to much of this is to reverse the tactics Labour had previously used against the conservatives, any further attempts to reintroduce state benefits and subsidies will have to face the burden of justifying where their funds will come from, in much the same way that Labour used to chide the Tories in opposition, whenever any hints of cuts or movement toward a balanced budget were made, as cruelly proposing the cutting of “critical services.”

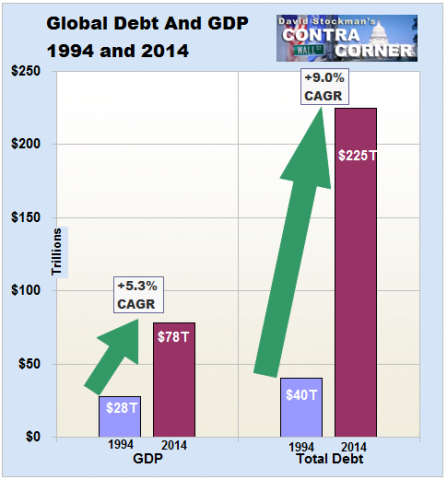

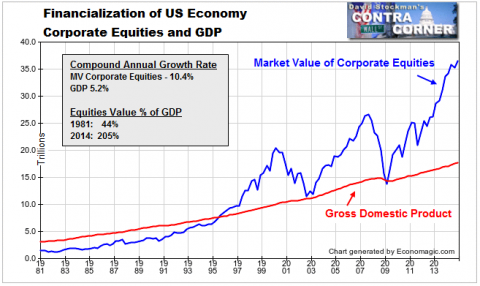

Taking this as a given, it seems puzzling at least to this writer, why money has not entered the debate. This is since the inflationary phoney boom created through credit expansion, was the primary means of smoke and mirrors the former government used to so effectively mask the disastrous consequences of its unsustainable spending policies. One could compare the modern economic boom as a tool of statecraft comparable in character to the bread and circuses of the Roman Empire. It is time for this nation to cast the wool from its eyes.

A printing press, can be a terribly convenient tool of conducting “monetary policy”, if you own one. Statists and their apparatchiks have long been fond of it, and it provides a great vehicle for the growth of the state, since it allows them to gorge the wealth of the people they rule over, without encountering direct resistance. Why is this, you might ask? As Adam Smith pointed out a long time ago, money is not wealth.

Printing money, or producing electronic credit, or rather “inflation”, as it used to be understood, never can and never does produce neutral effects. Quite obviously, those that receive the new money first can enrich themselves at the expense of others since they can spend this new money first. By doing so they increase demand for certain goods, causing their prices to get bid up relative to what they would have been, while others must cope with paying these increased prices whose income has not been raised have thereby been robbed of their wealth and had the purchasing power of their money destroyed. What is most sickening about this process is that it hurts the poor, the ones who have the least money to begin with, the most; while the same sycophants and interventionists who espouse these destructive policies nowadays are the very ones who claim to have their interests at heart.

Even more insidiously, while dumping newly created money to buy government and “high quality” private bonds, the Bank of England through its irresponsible quantitative easing policy is keeping interest rates at 0.5%. In much the way these easy money policies created this crisis, they will continue to exacerbate it. The manipulation of interest rates causes capital to appear less scarce than it otherwise would have been, causing submarginal long term investments to appear more profitable, producing an inevitable cluster of errors down the road, once the interest rates correct and the real scarcity of capital is revealed. This occurs since the consumer savings to needed to make such projects have any hope of being sustainable were never made.

Yet economic booms are a political tool, and really the most insidious among them. If the Tories continue to allow the Bank of England to operate as it does, they are preventing a real correction, and are fermenting a crisis that will surely punish them in 4 years time. Yet if they truly are wanting to be radical this time around, there is no better way of consolidating their political position than allowing the privatisation of money, allowing people to use non-monopolised currencies like gold and silver not controlled by mercantilist bigwigs who seek to actively destroy the savings of the citizenry.

This would “shut the door”, preventing any future Labour government of allowing itself to engage in profligate and damaging spending; removing their ability to hide the robbery of the citizenry through inflation, since they would now have to account for any spending increases through taxation. Predictably, people would resist this much more vehemently. What better way to create Shirley Letwin’s kind of people!

Repeal of the legal tender laws would be a place to start, with the ultimate goal being to abolish the demonic institution that has been at the heart of our troubles: the Bank of England. Alternatively, any of one of the excellent plans for monetary reform that have already been suggested on this website can begin to be considered.

Furthermore, as already noted such a reform, when clearly stated as above would shame any opposition from either Labour or the Lib Dems if they even once tried to state they were doing so in favour of the poor. By advocating inflation they are and have been destroying both the poor and the middle class! Therefore, I must ask the Tories out there, what are you waiting for? Privatise money!

Lovely idea. The tories I voted for might even have considered it but the Thatcher days are long over. This will not happen merely because it is a good idea. It needs a lot of grass roots support similar to that created with Ron Paul’s book “End the Fed”.

We have a population mostly uneducated in any kind of economics let alone the Austrian variety. It is far too easy to keep that wool over the eyes.

But I’m all up for joining and contributing to a grass roots effort on this. I believe it to be an issue well worth pushing.

Bernie, when I was born in 1969 if you said the private sector should produce cars and the steel that went in them, you would have been considered mad. Stranger things have happened. You have to hope and try your hardest. Welcome aboard.

I wonder how many of even the Tory MPs understand Austrian economics. Perhaps 10?

Unfortunately, even after living through our recent banking crisis, this is still the case. Another debt-induced problem would doubtless result in the same money printing.

I remain convinced that the only thing that is likely to result in a wholesale re-wiring of the banking system is an inflationary wipeout.

I say this for two reasons:

Firstly, it would de-bunk the current consensus that central banks know what they’re doing and folks would be forced to look for other answers to the problems.

Secondly, all debt would be wiped out such that there would be no vested interest in maintaining inflation/artificially low interest rates.

Unfortunately, even if this were to unfold, and a re-wiring of the system become a given, it is far from certain that the governments of the day would reach for the Austrian handbook – it might just as easily decide on something else.

Tim, that it might well do. We must be bold and brave and mention our solutions at all points in time and at least we might get listened to.