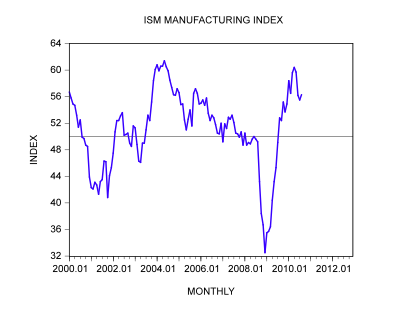

Despite the massive fiscal stimulus package of nearly $800 billion approved by the Congress early last year, and trillions of dollars pumped by the Fed, the rally in various key economic data seems to be coming to an end. After falling to 32.5 in December 2008 the ISM manufacturing index peaked at 60.4 in April this year. In August the index stood at 56.3. Also the unemployment rate remains stubbornly high at 9.6% with almost 15 million Americans out of work.

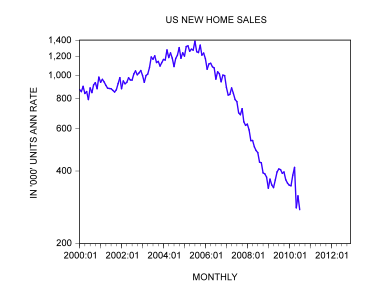

Also the housing market remains depressed despite the stimulus policies and record low interest rates. In July the yearly rate of growth of existing home sales plunged by 25.5% while new home sales fell by 32.4%. Furthermore, according to the Fed’s August report, known as the Beige Book, the US economy has shown widespread signs of slowing with an ample supply of qualified applicants for open positions.

Against this background some economic commentators and the US President Barack Obama are of the view that there is a need for another stimulus program to lift the economy out of the black hole. In fact on September 8 the US President proposed $50 billion more in infrastructure spending and a $100 billion extension to a tax credit on research and development.

But why should another stimulus program be effective given that the previous program appears to have failed?

Some commentators hold that the last year’s stimulus package wasn’t big enough to revive the economy. It is argued that given a $15 trillion US economy in terms of GDP, the $800 billion was far too small to make a meaningful impact – a much larger stimulus is required.

For some commentators such as Paul Krugman only a very large stimulus program is likely to produce the needed result.

According to Krugman the main focus of any stimulus program should be to generate as much employment as possible in a short period of time. With improved employment consumer demand will follow suit and this will lift the economy, so it is held.

This way of thinking is based on the view that initial increases in consumer outlays tend to set in motion a reinforcing process which supposedly strengthens the total output in the economy by a multiple of an initial increases in consumer spending.

The popularizer of the magical power of the multiplier, John Maynard Keynes, wrote,

If the Treasury were to fill old bottles with banknotes, bury them at suitable depths in disused coal mines which are then filled up to the surface with town rubbish, and leave it to private enterprise on well-tried principles of laissez-faire to dig the notes up again (the right to do so being obtained, of course by tendering for leases of the note-bearing territory), there need be no more unemployment and with the help of the repercussions, the real income of the community, and its capital wealth also, would probably become a good deal greater than it actually is.[1]

For Krugman and other Keynes followers the key here is monetary expenditure. The larger the expenditure the larger the income and real economic growth is going to be, so it is held.

Is funding about money?

It is also argued by the proponents of a larger economic stimulus package that in the present economic slump boosting employment by means of various stimulus programs is not going to be at the expense of other activities. This means that employing more Americans is going to be costless. Accordingly to the proponent of this view, Paul Krugman,

The point is right now we have mass unemployment. If you put 100,000 Americans to work right now digging ditches, it is not as if you are taking those 100,000 workers away from other good things they might be doing. You are putting them to work when they would have been doing nothing.[2]

But how is the increase in employment going to be funded? Who is going to pay for this? It seems that Krugman and most commentators hold that funding can be easily generated by the central bank by means of printing presses.

Contrary to Krugman and other commentators funding is not about money as such but about real savings – final consumer goods. It is the flow of final consumer goods and services that maintains people’s life and well being.

When baker trades his saved loaves of bread for potatoes he in fact provides a means of sustenance to the potato farmer. Equally the potato farmer provides a means of sustenance i.e. his saved potatoes, to the baker. Note that the real savings sustain producers in the various stages of production. (Real savings support the producers of intermediary goods and the producers of final consumer goods and services).

Observe that in order to maintain their life and well being what people require is final goods and services and not money as such, which is just a medium of exchange. Money only helps to facilitate trade among producers— it doesn’t generate any real stuff. Paraphrasing Jean Baptiste Say, Mises wrote,

Commodities, says Say, are ultimately paid for not by money, but by other commodities. Money is merely the commonly used medium of exchange; it plays only an intermediary role. What the seller wants ultimately to receive in exchange for the commodities sold is other commodities.[3]

Various tools and machinery or the infrastructure that people have established is for only one purpose and it is to be able to produce the final consumer goods that are required to maintain and promote people’s life and well being.

The greater the production of consumer goods for a given consumption of the producers of these goods, the larger the pool of real savings or funding is going to be. A larger pool of real savings can now sustain more individuals to be employed to enhance and expand the infrastructure.

This of course means that through the increase in real savings a better infrastructure can be built and this in turn sets the platform for a higher economic growth.

Higher economic growth means a larger quantity of consumer goods, which in turn permits more savings and also more consumption. With more savings a more advanced infrastructure can be created and this in turn sets the platform for a further strengthening in economic growth.

Note that the savers here are wealth generators. It is wealth generators that save and employ their real savings in the buildup of the infrastructure.

The savings of wealth generators are employed to fund various individuals that specialize in the making and the maintenance of the infrastructure. (Real savings also fund individuals that are engaged in the production of final consumer goods).

Contrary to Krugman and other commentators, the artificial creation of employment such as digging ditches is not going to be cost free. The unemployed individuals that will be employed in useless projects must be funded. Since government doesn’t produce any real wealth the funding will have to be diverted from wealth generating activities. This however, is going to undermine wealth generators and is going to weaken the real wealth generation process.

The following simple example encapsulates the situation:

In an economy, which is comprised of a baker, a shoemaker and a tomato grower, another individual enters the scene. This individual is an enforcer who is exercising his demand for goods by means of force. Can such demand give rise to more output as the popular thinking has it? On the contrary, it will impoverish the producers. The baker, the shoemaker, and the farmer will be forced to part with their product in an exchange for nothing and this in turn will weaken the flow of production of final consumer goods.

Since government doesn’t produce any real wealth obviously it cannot save and therefore it cannot fund any activity. Hence for the government to engage in various activities it must divert funding i.e. real savings from wealth generators.

Can something be generated out nothing?

Can an increase in the demand for consumer goods lead to an increase in the overall output by the multiple of the increase in demand as suggested by Keynes and Krugman? If this can be achieved then one could conclude that something useful can be generated out of nothing.

To be able to accommodate the increase in his demand for goods a baker must have the means of payment i.e. bread to pay for goods and services that he desires. For instance, the baker secures five tomatoes by paying for them with the eight saved loaves of bread. Likewise the shoemaker supports his demand for ten tomatoes with a saved pair of shoes. The tomato farmer supports his demand for bread and shoes with his saved fifteen tomatoes.

Whenever the supply of final goods increases this permits an increase in demand for goods. Thus the baker’s increase in the production of bread permits him to increase demand for other goods. In this sense the increase in the production of goods gives rise to demand for goods. Please note again that people are engaged in production in order to be able to exercise demand for goods to maintain their life and well being.

Note again that what enables the expansion in the supply of final consumer goods is the increase in capital goods or tools and machinery. What in turn permits the increase in tools and machinery is real savings. We can thus infer that the increase in consumption must be in line with the increase in production. From this we can deduce that an increase in consumption cannot cause production to increase by the multiple of the increase in consumption. The increase in production is in accordance with what the pool of real savings permits.

Production cannot expand without support from the pool of real savings i.e. something cannot emerge out of nothing. This of course means that only wealth generators can set in motion an expansion in real wealth.

Why data by itself cannot produce facts

How then are we to reconcile the so called facts that are supposedly presented by various studies, e.g. the ‘fact’ that stimulus programs can grow the economy? For instance, in his New York Times article from September 5 2010, Paul Krugman suggests that it is the massive government borrowing during the war in 1940 to 1945 that laid the foundation for long-run prosperity. Thus in 1943 the budget deficit as % of GDP stood at almost 28%. The rate of growth in real GDP after falling to minus 11% in 1946 jumped to almost 8% by 1951.

Note that the so-called economic growth here is assessed in terms of real GDP, which depicts monetary expenditure. Hence we suggest that an important force behind the strong increase in real GDP must be the monetary factor. Indeed we had strong increase in the money supply rate of growth from minus 11% in January 1947 to 6% in May 1951.

Now, even if we were to accept that notwithstanding all the shortcomings of real GDP and grant that the US economy had prosperity after 1946, it doesn’t necessarily follow that this occurred on account of large budget deficits as suggested by Paul Krugman and other commentators.

Contrary to the popular way of thinking, data cannot talk by itself and present so called facts. The data must be assessed by means of a framework that can withstand some basic scrutiny such as whether the government whilst not being a wealth generator can grow the economy.

Once we reach the conclusion (based on logical analysis) that the government cannot grow the economy we can emphatically reject various studies and assertions that tell us the exact opposite.

This means that the long-term prosperity in the US took place on account of the expanding pool of real savings and in spite of aggressive government spending during the war. (We have seen that without the expansion in the pool of real savings no economic growth is possible).

It must be realized that the data out of which various so called “facts” are produced appear to be supportive of various empirical research conclusions as long as the private sector of the economy generates enough real savings to support productive and non productive activities. As long as this is the case various so-called empirical studies can produce “support” for any pie in the sky theory such as that the government can grow an economy and that something can be created out of nothing.

Whenever the ability of wealth generators to produce real savings is curtailed, economic growth follows suit, and no amount of money that a government pushes into an economy can make it grow. (Again the government cannot create real savings, it can only divert the existing real savings from wealth generators).

Once the process of wealth generation is damaged and loose policies become ineffective in “reviving” the economy various commentators such as Krugman are quick to suggest that the laws of economics must have changed. For them this means forgetting logical analysis based on the essential laws of economics and going for massive spending. Now if the laws of economics have changed, on what grounds can Krugman and others employ the 1940’s events to make their policy recommendations? If everything is in a state of flux, why should laws that were valid in 1940 be applicable today?

According to Krugman,

We are at unusual times where usual intuition doesn’t apply here, getting this economy moving is the best thing we can do, not just for the present, but for the future and for our children.[4]

What we can suggest here that if the pool of real savings is in trouble, adopting Krugman’s advice — i.e. introducing a massive fiscal stimulus package — will only make things much worse, and plunge the US economy into a much more severe economic slump. If the pool of real savings is still holding then there is no need for stimulus programs — the growing pool of real savings will revive the economy.

Conclusion

Despite the massive $800 billion fiscal stimulus package introduced last year the US economy is struggling to recover. Various economic indicators, after having a short rebound, are starting to display visible weakening. Many experts, including the US President Barack Obama, are of the view that a larger fiscal stimulus package might do the trick. Our analysis indicates that not only can fiscal stimulus not revive the economy, but on the contrary, it can make things much worse. The key factor for a sustained economic recovery is the build-up of real savings. This build-up can only be secured by wealth generators and not by government spending, which weakens the process of wealth formation.

[1] J.M. Keynes. The General Theory of Employment, Interest and Money, Macmillan & Co. LTD 1964, p. 129.

[2] Paul Krugman CNBC interview 31 August 2010.

[3] Ludwig von Mises, Lord Keynes and Say’s Law, The Critics of Keynesian Economics, edited by Henry Hazlitt, University Press of America 1983, p. 316.

[4] Paul Krugman CNBC interview August 31 2010.

Krugman wrote a peice for the NYT in 2002, in the midst of the post Nasdaq recession. He suggested that the correct course of action for the US govt and Fed was to inflate a housing bubble (he actually said this, yes….) so that consumers could borrow against the rising value of their houses and once again go out and spend, getting the economy out of recession.

Well, that turned out just wonderfully, didn’t it?

Whilst these actions did reinflate the US economy, much of the impetus was effectively exported (to producer countries like China, Germany), and the underlying problems of the (Nasdaq) bubble economy weren’t solved. Instead, these issues were kicked down the road a few years, and allowed an even larger bubble to grow and has led to an even larger crash.

Krugman really is nothing more than a left wing politician; his economics is ideological and his data cherry picked.

We strongly suspect that neither party really knows what they’re doing, nor does any group of experts know what to do.

This is an area of uncharted waters, and everyone has theories, including the President. He’s placing his untested theories into action, and people are uncomfortable. Even if the executed policies are the “right” ones, that is something which we will not know for several years down the road, even if then.

This economic problem is simply too large, complex, and interconnected with the economies of other nations, over which the US has no control. To fix most things in the universe, you have to get them to sit still at least for a short period of time. This is a dynamic situation.

If we as a society actually knew what worked, and could establish a direct cause and effect relationship with any certainty, we would have done it by now. Don’t you think?

If the solutions were that clear cut, wouldn’t you think that the governments of some other large world economics would have placed those solutions into action already? Any self-respecting, honest person would not claim WITH CERTAINTY that what they did at point X led directly to condition Y. Who really knows that? Let’s get real folks.

Quite frankly, we don’t think that any leader or legislative body ever KNOWS that what they do will have a specific, desired effect. Like any business person, they simply just give it their best shot and hope and pray that things will turn out OK. At least business people have more control over their smaller entities.