As we head into what will, in all probability, turn out to be just another tax-payer soaking, fatuous gab-fest, the G20 meeting has begun to generate headlines relating to the possibility – or otherwise – of concocting a new ‘Plaza Accord’.

In a broad sense, there are indeed some parallels – though perhaps not the ones the market is trying to draw. Back in the mid-1980s, the crude American political response to its growing lack of competitiveness was also to insist that others pay the price for its mistakes. Indeed, that latter-day secular saint, Paul Volcker, makes it clear in his 1992 book ‘Changing Fortunes’ how that archetypal fixer, James Baker, effectively bounced the Reagan White House into the agreement by informing the president directly of negotiations, that had been taking shape for some months past, only on the very eve of the fatal meeting.

In a BIS conference on central bank co-ordination held in the rather less fraught circumstances of 2005, Volcker’s verdict of hindsight was that: “In my view, Plaza was never very necessary because the exchange rate was going south anyway so far as the dollar was concerned.”

At that same gathering, former BOJ Deputy Governor Yutaka Yamaguchi was rather more forthright in his judgement, telling his audience bluntly that:

To me and many of my former colleagues of the Bank of Japan, monetary policy under the Plaza-Louvre process represents a failed model of international cooperation. The coordination process, particularly when translated into a domestic context, effectively constrained the flexibility of monetary policy…I believe it would be too simplistic to paint the Japanese bubbles as having originated solely in the easy money policy of the time. Nonetheless, one always wonders if monetary policy couldn’t have been different. … the external pressure on Japan to ease monetary policy was real. But why was it accepted by the Japanese side?

First, the Bank of Japan was asked, to put it mildly, to serve the national priority of the time. Historically, this priority for the central bank was typically war-financing. For Japan in the 1980s, the national concern was the trade war or how to moderate trade tensions

Given that Baker’s persistent bullying of his G-5 peers also led – via the concerted interest rate cuts which were supposed to help the subsequent Louvre agreement to put a halt to the dollar’s precipitous fall – to the stock market, junk bond, and Western property bubbles of the late ‘80s, the portents for some kind of repeat showing are hardly auspicious.

What could not be more evident is that the recent resurrection of the phrase, ‘Plaza Accord’ – and its breathless elevation to a near-ubiquitous buzzword – is nothing more than a crude propaganda tool to justify a further depreciation of the US dollar, paying scant regard to the possibly disastrous reserve currency impacts this might have on others.

What is rather cleverer – in that amoral, Bernaysian way of the spin doctor – is that the present focus has very much been upon the Chinese yuan, by analogy to the 1980s Japanese yen, as a currency crying out for upward revaluation when the truth is that the concerns of a quarter-century ago were almost exactly the converse of those now being expressed – viz., how to engineer a devaluation of a ‘Superdollar’ whose nominal exchange rate had soared beyond all bounds of normality, not one which, as today, was bumping along at its lowest parity of the modern era.

So, when the Chinese display a little reluctance to play sacrificial goat to the needs of the American electoral cycle, we can see their point, not just in relation to the appalling experience of the previous attempt at realignment, but also in its singular lack of applicability to the circumstances of today.

Mixed up in all this building acrimony is, of course, the looming threat of another grotesque piece of academic hubris from the Bernanke Fed – possibly to be backed up by its admirers in the Bank of England. These latter are not only being egged on by an uncertain coalition government in the hope it will mollify its recently announced programme of spending cuts, but they found a seeming endorsement in the Nelsonian blind-eye turned to the actual numbers by Governor King when he jaw-droppingly asserted this week that some ‘gauges of inflation are extremely subdued’ (sic).

In that perverse Wonderland where the laws of nature have been replaced by the fevered imagination of Keynes and his disciples, it is assumed (though often, with characteristic, General Theory inconsistency, it is sometimes not) that investment equals savings – an ex post truism which, in the real world, can yet hide a great deal of non-trivial, ex ante discoordination. Since savings are also rigidly governed by income through the operation of the iron, psychological law of the ‘propensity to consume’ (NB we Austrians are supposed to be the masters of unsubstantiated apriorism!), and since, further, Keynes has no place for a banking system in his convoluted imaginings, this leaves rather a conundrum about how the rate of interest can possibly be determined.

The deus ex machina which extricates our hero from this blind alley of his own construction is that yields are therefore set by a straight decision between holdings of bonds and cash – by consumers’ supposed expression of their ‘liquidity preference.’

The fabulous inference of this whole, sorry concatenation of false assumptions, dubious extrapolations, and pseudo-mathematical inevitability, is that, if ‘liquidity preference’ reaches high enough levels as ‘animal spirits’ wane, even a zero nominal rate of interest can do nothing to dissuade people from withholding their spending power in a fashion that does not link it to some form of investment elsewhere in the system. Note, here, that, being committed to this particular line of reasoning, Keynes cannot conceive of there being any justifiable reason why it may be that investment is rather being deterred by all-too rational fears of suffering intervention-driven losses, no matter how low the interest rate.

Once they decide to keep the proceeds sitting in ‘sterile’ money hoards in this manner, people become guilty of reducing everyone’s income stream, including their own. So, by depressing the price of both assets and goods, the dreaded deflationary squeeze of the ‘liquidity trap’ appears – a grim spectre variously made manifest of late to the usual rag-tag of permabear economic pundits and – rather more worryingly – to a number of policy-setting central bankers and their advisors.

Here, we must pass by the more profound, classical insight that, even were this situation to arise, it would be self-correcting if only sufficient price flexibility were encouraged for buyers’ and sellers’ real receipts to stabilise, stopping only to make the simple observation that money is only a medium of exchange, and that the pool of its nominal availability is therefore as irrelevant to the scale of the transfer of economic goods as is the size of the typeface employed in a letter, or the dimension of the enclosing envelope, to the transmission of a given quantum of information by mail.

But the principal practical objection we must raise is that this overlooks the fact that few people modern day Ebenezers actually do hoard cash: rather, they place any surplus, at the very least, on deposit at their local bank. There, it perforce remains at the disposal of the bank’s loan customers. Should enough of these not be found willing, or able, to borrow the monies, the bank will simply invest in existing or newly-issued securities instead, thus removing the original ‘blockage’ (albeit at one remove from its source) and effectively helping many a would-be hoarder swap his previous bond holding for a monetary claim on the bank.

Here, it is next objected that, were it truly concerned about the economic outlook, the bank could simply devote the new deposits to increasing its own pile of reserve assets and so, once again, choke off the circulation of money, with all the dire consequences supposed to be attendant thereon. But, all too few stop to ask how this is meant to be effected. By swelling its holdings of vault cash to a mountain? By buying up all the precious metals it can lay its hands on? Or buy placing the funds, in turn, with the central bank?

If this latter case – obviously the one which applies today – then, by the inexorable arithmetic of banking, the central bank must also add to its assets dollar-for-dollar with its increase in reserve liabilities. To do so, it buys up the stock of securities that the initial cash hoarder wishes to liquidate and which the original bank does not wish to hold in his place.

So, if Scrooge wants to turn his mortgage bonds, for example, into ready money while he waits out the crisis, he sells them to Chicken Little Bancorp which sells them to the Fed and $1 trillion dollars or so later, everyone should be happy, fractional-reserve free-bankers and late-era Hayekian, nominal-spending stabilizers included; hard money men less so.

Of course, things will not quite work out in such a neat, aggregative fashion in the real world because while borrowers and lenders, buyers and sellers, assets and liabilities may balance out in the round, the populations of the former and the composition of the latter may undergo profound alteration and with it the economic landscape may become greatly altered from that of the Boom. In fact, it is deep in the nooks and crannies of the multitude of specific mismatches, dashed expectations, and faulty speculations which this shift in activity entails where sizeable frictional losses can occur on the road to an unavoidable adjustment whose progression it should be our primary aim to facilitate by removing all the entrepreneurial uncertainty we can.

Ironically, these are changes of exactly that fine, micro-structural kind which the Keynesians generally ignore in both their analysis and their policy prescriptions, making the first facile and misconstrued and the latter all too often detrimental to that very adjustment whose lack they later blame on the malfunctioning of the ‘free’ market.

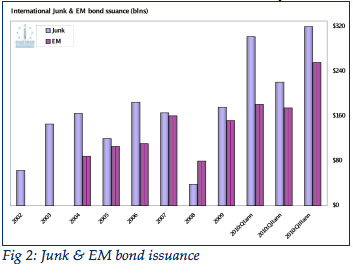

Theoretical considerations aside, we do have to wonder just what sort of ‘liquidity trap’ we are in – a state of paralysis where only cash will do, remember – when US (indeed, global) high yield issuance hits its highest on record, as it did this past quarter, and when this effusion is conducted at the lowest yields since before the crisis broke, and at close to the lowest recorded in the last 45-years.

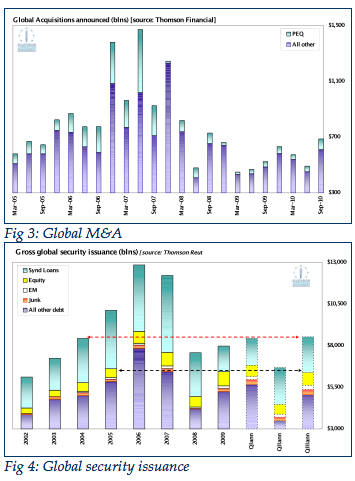

We also wonder just what sort of ‘liquidity trap’ we are in when equity IPOs increase 55% in value and 215% in number from the same period in 2009.

We further wonder just what sort of ‘liquidity trap’ we are in when US-based M&A rises 22% YOY, with private equity involvement up 117% to a 2 ½ year high and, as such, responsible for more than 10% of all deals.

We wonder, too, just what sort of ‘liquidity trap’ we are in when the number of ETFs grows 22%, their assets rise 14%, and trading volumes jump 15% in the first nine months of the year.

Finally, we wonder what sort of ‘liquidity trap’ we are in when an experienced CRE professional can tell an interviewer that: “…there’s a very active market… with all kinds of money entering and paying ridiculously high prices for assets … as if the crisis never happened… this is mostly institutional money using other people’s money to chase product…”

We are not alone in our scepticism: Dallas Fed president Richard Fisher noted the other day that:

“In my darkest moments, I have begun to wonder if the monetary accommodation we have already engineered might even be working in the wrong places. The …TIC… data show that foreign interest in buying Treasuries remains robust. Yet, far too many of the large corporations I survey that are committing to fixed investment report that the most effective way to deploy cheap money raised in the current bond markets or in the form of loans from banks, beyond buying in stock or expanding dividends, is to invest it abroad where taxes are lower and governments are more eager to please.”

For his part, John Hussman put it much more succinctly, saying:

“Throwing a trillion U.S. dollars against the wall to see what sticks is not sound monetary policy. By pursuing a policy that relaxes constraints that are not even binding, [this] depresses the U.S. dollar, threatens to destabilize international economic activity, encourages a “boom-bust” cycle, provokes commodity hoarding, and pops off the Fed’s last round of ammunition absent an immediate crisis, the Fed threatens to damage not only the U.S. economy, but its own credibility.”

Quite. Not that this will stop anyone in the US – and probably the UK – from trying, of course.

Nor has anyone convincingly mapped out just what will happen, come that fine sunny morning when Chicken Little Bancorp does decide to go back into the banking business; or when Ebenezer finishes his nightly sojourns with the Ghosts of Christmas Past, Present, and Future and decides to order goose and gewgaws all round for the Cratchits and that newly swollen cashpile gets put back to work buying things – scarce, hard-of-reproduction things – in place of ephemeral, instantly-created financial assets.

Reading this piece, I’ve felt a strange feeling: to agree (as usual) with your conclusions while disagreeing with one of your assumptions. It looks like you do not consider all savings to be investments. If it is so, then I’d like that you provided also the reason why you think they are (logically, not in practice) different. That’s because their logical identity is one of the most firm pillar of my economic thought, but if you differ, as I consider you one of the best economic mind in the world today, I feel the urge to reappraise my position.

It’s not a problem to agree with Keynes or not, because that sycophant has said everything and its contrary. We need a premise too. The reasoning does not apply to the contemporary economic world, ruled by money-confetti and by the Economic School of Surrealism, with their nefarious train of lies, damned lies and statistics (also known as “data”). Logic has long lost its place in such a world. It does apply in a world where Money is a good, produced through an economic process, forced out from Earth at heavy cost, while today it is just another piece of debt, only it has not to be discounted, and it’s able just to transfer the obligation, never to pay it.

Well, in this world not devastated by the Great Parasites every saving is ipso facto an investment, as I think. Every postponed consumption, every wealth produced or earned by the economic agent which is not consumed by him is an investment, made to consume (hopefully) more and better in the future. The practical form of the investment is not relevant, nor is its outcome.

The usual objection is that holding Money you are not producing anything, but I think it rests on a misunderstanding. I’ve tried to address it also in this essay: http://houseofmaedhros.wordpress.com/2008/08/07/graduation-thesis-homage-to-the-master/

I tried to get it published by the Mises Institute, but they declined with the bizarre motive that Rothbars said differently.

That objection assumes that every investment other than Money produce something economically useful. It is clearly not so! If you invest in a factory and produce goods that nobody needs or wants, you are not producing anything, you are wasting capital. The examples of malinvestments I could do, which will not only add nothing to the economic wealth but in fact will diminish it, would last for hours.

On the other side, investing in the good (also used as) Money could very well result in more goods availables in future for the same quantity of Money (at last you’re investing in economic progress here), could result in securing a stream of additional income if you lend it, could result in preserving wealth for future better ideas of production (preserving wealth has its own economic merits), and so on. It’s anyway an investment, which can result or less in accumulation of wealth, just as any other form of investment.

That’s my thinking in short, you can refer to the essay linked for a more extensive explanation. I hope you’ll have time to address the issue.

My compliments for the good work.