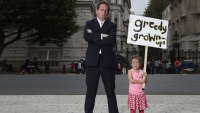

Britain’s Trillion Pound Horror Story will be transmitted on Channel 4, tonight Thursday, 11 Nov at 9pm:

Britain’s Trillion Pound Horror Story will be transmitted on Channel 4, tonight Thursday, 11 Nov at 9pm:

Film maker Martin Durkin explains the full extent of the financial mess we are in: an estimated £4.8 trillion of national debt and counting. It’s so big that even if every home in the UK was sold it wouldn’t raise enough cash to pay it off.

Durkin argues that to put Britain back on track we need to radically rethink the role of the state, stop politicians spending money in our name and introduce, among other measures, flat taxes to make Britain’s economy boom again.

This is a polemical film presented by Martin Durkin. The film brings economic theory to life and makes it hit home. It includes interviews with academics, economic experts, entrepreneurs and four ex-Chancellors of the Exchequer.

A number of members of the team gave interviews and we look forward to seeing the final result.

Steven

Thank you for the tip: I shall certainly watch.

Durkin has an element of adherence to marxist tenets in his past, so if he really has concluded that the remedies to our present predicament lie in a dramatically diminished role for the state and flat taxes, that is potentially very significant.

Given, though, the odium heaped on him after making “The Great Global Warming Swindle”, an earlier challenge to a then prevailing consensus, I suspect that he will attract equal criticism for this latest effort – and from much the same ideological sources.

Just finished watching the first part, and was suitably impressed by simplicity of delivery of some basic economic truth.

Unfortunately, I am now watching a sales patter for privatisation of health care and education. So the country that has delivered cheapest outcomes for greatest amount of people in terms of healthcare, should go for more expensive option of what is, by definition, non manufacturing, non income generating service industry?

Obviously, some private corporations, probably American, will make money of sick British people, delivering healthcare to those with deep pockets in gleaming surroundings.

Why are we being sold privatisation dogma in the middle of this scare story? Is this what this whole unprecedented 1.5 hours program is all about?

And this gleaming Hong Kong is also home to urban poor who live in poverty unheard of in Britain. Guess us poor are not quiet human enough to include in the story.

Can someone give me the correct spelling of John Camputhwaite? i have googled without success.

I haven’t had a chance to watch this yet but I am popping over to the channel 4 website right now to watch it on line. Family members have said it is a mist watch.

Eva,

Yes, of course that was what the program was about. The program abley and clearly demonstrated that we are burdened with a public sector we cannot possibly afford. That plainly entails that the only solution is that government does much, much less than it presently does; that we have a lot less of a public sector. Now, either that means that much of what the public sector now does does not get done at all, or it means that it is done privately, through free enterprise or voluntary co-operation between people in their communities. What did you think the solution to a far too large public sector was? Just as much public sector?!

I’m also not sure where you get your claim that the NHS “has delivered cheapest outcomes for greatest amount of people in terms of healthcare” and that privatisation entails going “for more expensive option of what is, by definition, non manufacturing, non income generating service industry”. First off, why would a private health care system be non-income generating?

Beyond this, it is true that the NHS is cheaper in terms of spending as a proportion of GDP than France or Germany (8.2% as opposed to 11.2% and 10.7% in Germany, in 2005), but price is not everything. The WHO ranked France’s healthcare system as number one in the world, and Britain’s as the 18th (higher than Germany’s though!). The NHS ranks worse than both France and Germany in terms of preventable deaths, with France having 65 preventable deaths per 100,000 population in 2002-3, Germany having 90, and the UK having 103. Healthy life expectancy is better in France than the UK, at 73 years compared to 71.7.

However, I would have prefered the program to look at Singapore’s healthcare system as an alternative to that of the UK. Eva, I suggest you look there if you want to make judgements about value for money. The WHO ranked it (in 2000) as the sixth best healthcare system, far above the NHS. And they get this outcome from a system that costs only 3.5% of GDP as opposed to the UK’s 8.2%!

The WHO’s overall health performance ranking places Singapore at 14 on level of health, with the UK at 24 and France at 4. Life expectancy in Singapore is 80.

But here is the shock for you: Whilst Singapore’s system costs only 3.5% of GDP, 66% of that funding comes from private sources, which is substantially more than the typically cited model of the US (about 52% of US healthcare funding is private). Singapore has far more private funding of healthcare, costs less and achieves as good, if not then better results than the NHS.