This has been a busy 10 days for Mr Schiff and he has had a lot to say about all of the crazy Keynesian things that have happened.

In the first video (25th Oct), Schiff speaks about the dispensing of economic advice to the G20 by Timothy Geithner, the US Secretary of the Treasury, who told the rest of the G20 heads of state to stop manipulating their currencies to prevent “excessive volatility”:

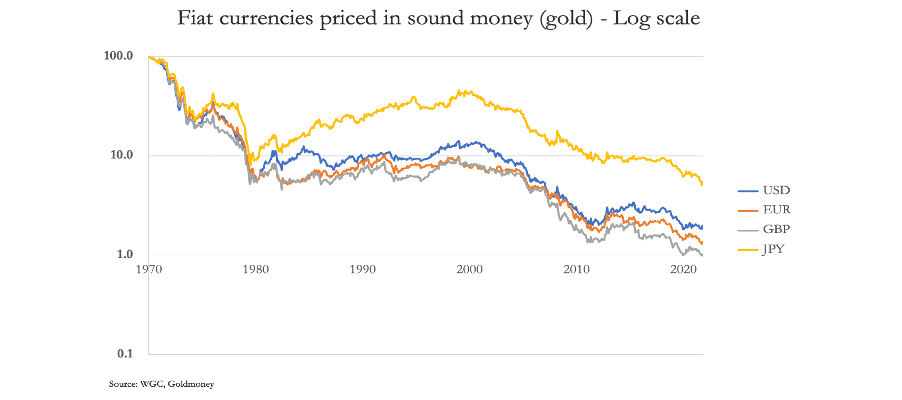

In the second video (29th Oct), Schiff speaks from New Orleans about the dollar index and the rise in the price of silver, especially the rise in institutional demand for this industrial precious metal. In this video, without explicitly mentioning Austrian Business Cycle Theory, he describes how the Fed’s stimulus plans are just a way in which they borrow from the future to pay for things today, thereby exacerbating the problems in the future. He also predicts that QE2 will be followed by QE3, QE4, and whatever else it takes to destroy the dollar. [The column on quantitative easing that he mentions can be found at the end of this post.] Schiff also points out that he thinks the real reason for quantitative easing is nothing to do with ‘policy’, but simply a backs-against-the-wall move to help the US Treasury move its bond securities, because without quantitative easing there would be an immediate funding crisis for these securities:

In the third video (1st Nov), Mr Schiff discusses the reported rise in US consumer spending and why this is going in the wrong direction and why this should be increased saving instead. He then gets round to a favourite subject, the thoughts of Chairman Paul Krugman, and why the Chairman is so spectacularly wrong about everything. For instance, if Krugman was right, indicates Schiff, then the 30% savings rates of Singapore and China would imply they were in a long economic slump rather than having record years of growth behind them.

Schiff finishes (3rd Nov) with his comments on the US mid-term elections and Uncle Ben Bernanke’s desperate QE2 injection of $600 billion dollars of ‘stimulus’ money printed from out of thin air, ostensibly to deliberately increase US price inflation, whereas Schiff thinks that the real reason is to allow the US Treasury to keep spending, with the money it spends funded from bond sales propped up via quantitative easing:

Here is the economic commentary on QE that Schiff mentions in his videos above:

By: Peter Schiff

Friday, October 29, 2010There has been so much discussion recently about “QE 2” that you would think the entire financial sector were about to embark on a transatlantic cruise. Unfortunately, they, and we, are not so lucky. In the year 2010, “QE 2” doesn’t refer to a sumptuous ocean liner, but a second, more extravagant round of “quantitative easing” – stimulus. In the past, this technique was simply called “printing money.” As if the nation has not already suffered enough from the first round, Captain Ben Bernanke and the Fed are determined to compound the damage by hitting us with another monetary juggernaut. Their stated goal is to boost the economy and create jobs. However, since economic growth cannot be achieved by printing money, their QE 2 will sink just as surely as the Titanic.

The intent of QE 2 is to lower interest rates to promote job growth and avoid the apparently growing threat of deflation. But the very idea that the economy is weak because interest rates are too high is laughable. Deflation is the market’s cure for the asset bubbles that have recently burst, so any attempt to avert it will only weaken the economy further.

In fact, one of the reasons the US economy is in such bad shape is that interest rates are already too low. Low rates have encouraged excess borrowing, by both individuals and governments, and discouraged saving, fueling new asset bubbles at the expense of legitimate investment. As a result, the dead weight of debt has simply overloaded our economy, and our creditors are getting nervous. What we need now is to make hard choices, not engage in more easing – to deleverage, not borrow more.

Worse still, by keeping rates too low, the Fed has enabled the US government to grow significantly larger than it otherwise could had its borrowing been restrained by higher rates. Absent these low rates, Washington likely wouldn’t have passed expensive new healthcare and financial regulation reforms; they would be too busy trying to keep the lights on in the Capitol.

For this and other reasons, the bogeyman of deflation is really not a concern at all. It’s not a threat because falling consumer prices could serve as a relief for many suffering from layoffs and pay cuts in the recession. Even if it were a threat, it’s not even likely because so much liquidity has already been created and an infinite amount could still be created at will by the Fed. Consumer prices are already rising across the board, despite a contracting economy, so what’s all this talk about deflation?

The Fed is quick to point to falling real estate prices. But a drop in real estate will no more cause consumer prices to fall than the real estate boom caused them to rise. Real estate prices are too high, and the economy will never truly recover unless they are allowed to fall. It is interesting that when real estate prices were rising, the Fed did not raise rates to bring them down, but now that they are falling, the central bank feels compelled to lower rates to prop them up. If falling real estate prices threaten deflation, why did the Fed not perceive an inflation threat when real estate prices were rising?

My thinking is that, at the end of the day, all this deflation talk is a red herring. The true purpose of QE 2 is to disguise the decreasing ability of the Treasury to finance its debts. As global demand for dollar-denominated debt falls, the Fed is looking for an excuse to pick up the slack. By announcing QE 2, it can monetize government debt without the markets perceiving a funding problem. If the truth were known, a real panic would ensue. So, the Fed pretends buying treasuries is simply part of its master plan to boost the economy, even though, in reality, it is simply acting as the buyer of last resort.

If the Fed really wanted to help the economy, it would raise rates quite dramatically. Instead of preparing for QE 2, it should be unloading the debt it purchased during QE 1. Of course, that is not so easy to do – which is precisely why I was against QE 1 from the beginning. However, even though the exit will be painful, going down with the ship will be even more unpleasant.

Higher interest rates and a commitment from the Fed to refrain from purchasing Treasury debt would force the government to dramatically reduce spending. If we combine less government spending with fewer regulations, reform our tax code in a way that stops punishing savings and investment, stop all government subsidies for real estate so that prices can fall to affordable levels, and allow all insolvent entities to fail, then a real recovery will take hold.

If the Fed refuses to set sail on QE 2, then her loyal passengers might complain, but at least the US will be on solid monetary ground as it tried to rebuild a viable economy. If instead we board QE 2 (and QE 3 and QE 4 thereafter), then we are headed to a sea full of icebergs called interest rate spikes, and all on board will surely drown in a sea of worthless Federal Reserve Notes.