In his speech at the National Press Club, Washington, DC on February 3, 2011 the Federal Reserve Board Chairman Ben Bernanke repeated that the loose monetary policy of the US central bank is aimed at stimulating domestic growth. Also last week the Fed Chairman reiterated that the economy still needs help, hence this is why the US central bank must continue with its monetary pumping.

According to Bernanke monetary pumping through the lowering of the interest rate structure contributes to an easing in broader financial conditions. This in turn bolsters household and business spending thus lifting economic growth.

If what Bernanke says is correct then world poverty should have been eliminated a long time ago. After all, every central bank in the world knows how to pump money and lower interest rates. Neither monetary pumping nor the artificial lowering of interest rates can set in motion an expansion in real economic growth – an expansion in real wealth.

All that such policy can do is to set in motion a process of diversion of real savings from wealth generating activities to useless non-productive activities. Such policies can appear to be successful in terms of monetary expenditure and misleading price deflators that generate a misleading measurement of the state of the economy labelled as real gross domestic product. (Note that most so-called key economic indicators are derived from the monetary expenditure data).

However, an artificial lowering of interest rates cannot make the pool of real savings larger than what it is. Hence without the expansion in the pool of real savings it is not possible to have a general increase in real economic growth.

Observe that as the pool of real wealth expands, individuals tend to allocate a larger portion of their wealth towards the buildup of the infrastructure – individuals raise their preference towards future goods versus present goods. This increase in time preference towards future goods versus present goods is reflected in the lowering of the interest rate structure. As one can see, interest rates are just an indicator – they are just a manifestation of individuals’ time preferences.

As monetary pumping falsifies the interest rate structure, it sends a misleading signal regarding the true state of real savings thereby leading to a waste of real wealth. Monetary pumping leads to a diversion of real savings from wealth generating activities to non-productive wealth consuming activities.

Now, it needs to be emphasized that as long as the pool of real savings is expanding, the loose monetary policy will appear to be “working”. However, once the pool of real savings stagnates – or worse, declines – the illusion that the central bank can grow the economy is shattered.

We are not entirely sure whether we have currently reached this stage. All that we can suggest is that the longer Bernanke continues with his loose monetary stance the greater are the chances that he will succeed in severely damaging the process of real wealth formation.

In the same speech Bernanke also argued that it is unfair to attribute the strong increase in commodity prices on US monetary policy. He suggests that the main reason for higher prices is the improvement in living standards in emerging economies.

As a result, argues Bernanke, people’s diets are becoming more sophisticated and consequently their demand for food and energy rise.

We suggest that world commodity prices in US dollar terms had to go up in response to the massive monetary pumping of the US central bank. After all, a price of a good is the amount of dollars paid for the good.

Hence, all other things being equal, the more dollars being pumped, the more dollars spent on goods and services, i.e. a general increase in the amount of dollars per unit of a good.

To suggest then that US loose monetary policy has nothing to do with strong increases in commodity prices is extraordinary.

Now, Bernanke is correct in holding that if the central banks of emerging economies would have pursued conservative monetary policies, the domestic price rises in these economies wouldn’t have been as sharp as currently is the case. (Remember, prices in every economy are set by the amount of domestic money spend on goods and services). We have to appreciate that most emerging economies are pegging their currency to the US$, so in this respect they are following the monetary pumping of the US central bank.

Bernanke also argued that,

We pay very close attention to oil prices and other commodity prices because they do present clearly two kinds of risks. The first is that higher oil prices are kind of a tax. We are trying to stimulate the economy. We are trying to get consumers to become more confident, be able to spend more, and to help put people back to work. To the extent that part of their income gains are drained away by higher gas prices, for example, that’s going to be negative, that will slow the recovery. So as international factors lead to higher oil and commodity prices, that is definitely a negative from the perspective of consumers and household budgets and economic growth.

Again we suggest that the increase in commodity prices in US$ terms is on account of massive monetary pumping by the Fed and not on account of some international factors.

It is monetary pumping that impoverishes US consumers – pushing more money to make consumers to boost their spending amounts to the strengthening of the process of impoverishment through the diversion of real savings from wealth generating activities to non-productive useless activities. Note again that such activities emerge on the back of loose monetary policy, i.e. monetary pumping and the artificial lowering of interest rates.

In comparison to previous speeches, in the February 3 speech the Fed Chairman appears to be more optimistic on the prospects for economic growth.

Overall, improving household and business confidence, accommodative monetary policy, and more supportive financial conditions, including an apparent increase in the willingness of banks to make loans, seems likely to lead to a more rapid pace of economic recovery in 2011 than we saw last year.

All these factors cannot grow the economy. On the contrary accommodative monetary policy, as we have seen, only weakens the process of wealth formation. Loose monetary policy provides support to various non-productive activities that sprang up on the back of monetary pumping. Note again that once there is very little left of wealth generating activities the illusion of loose monetary policy is shattered.

So why are Bernanke and most mainstream economists of the view that monetary pumping can somehow grow the economy? The main reason for that type of thinking is the belief that somehow an increase in general demand for goods and services on account of monetary pumping could set in motion the process of real wealth formation, i.e. an increase in real economic growth.

We maintain that an increase in demand by itself cannot activate the process of real wealth generation. Without the increase in the pool of real savings that funds the production of tools and machinery the key for the production of real wealth, no economic growth can emerge. All that boosting consumption by artificial means will achieve is a diversion of real funding from wealth generating activities to non-productive activities.

Note that we are not against an increase in consumption as such, after all the goal of every act of production is consumption. All that we are saying that every increase in consumption must be funded by a corresponding increase in real funding. In this sense it is not possible to replace real funding by pieces of paper money. If it could have been done, then scarcity would have been erased a long time ago. In this sense, fully backed or productive consumption is always good thing. Observe, however, that this is not what Bernanke and mainstream economists are saying. They imply that something can be generated out of nothing – out of “thin air”.

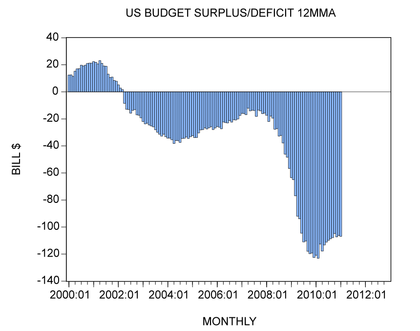

From this perspective we find it extraordinary when Bernanke last Wednesday warned against sharp cuts in US federal government outlays. Bernanke is of the view that such cuts whilst the economic recovery is still fragile could severely undermine real economic growth. We suggest that on the contrary wealth generators will find it much easier to operate with fewer government burdens on them. In similarity to the effect of monetary pumping, loose fiscal policy leads to the diversion of real savings from wealth generating activities to non-productive government sponsored activities. In the meantime, the January budget deficit widened to $49.8 billion from a deficit of $42.63 billion in January last year, the second-largest deficit on record for the month. The 12-month moving average of the budget stood at a deficit of $107 billion in January against $106 billion in the month before.

Bernanke seems to live in is own little world that exists of groups of economists dreaming up ways of sustaining the economy and is entirely oblivious of the real economy with factories and trucks and things.

He believes that increasing the volume of paper in the system will compensate for the decline in volatility and get people doing things again. He fails to see that the decline in volatility was because people decided not to spend at the same rate and no matter how much paper he lets loose people will not spend.

All that happens is that the surplus money in the system finds a safe home. This time it is commodities, priced in dollars and correctly perceived to move in the opposite direction to a falling dollar.

This spare cash will not create wealth but it can certainly cause poverty and starvation.

Likewise, as you say, interest rates should be a matter between borrower and saver with the optimum rate being reached at the point where supply and demand reach equalibrium, not guessed at by a bunch of economists who will always get it wrong. This present policy of keeping rates low will severely unbalance the banks’ liabilities and historic profiles that have allowed the banks to take short liabilities and lend long will no longer be as anticipated due to depositors of stable funds looking elsewhere for a return on their money.

The damage being wrought by these stupid policies will come to haunt us whilst Bernanke will be looking forward to a comfortable retirement at our expense.

The greatest irony of all is that he still thinks his policies are 100 percent correct

Shostak’s article and the above comment by waramess are politically a bit naïve. Both assume that Bernanke is 100% enthusiastic about the policies he is pursuing.

The political reality is the Congress is ideologically opposed to stimulus, whereas Bernanke favours stimulus, but has a limited number of (and defective) tools at his disposal. But he cannot say in public that the tools are defective.

Thus I suspect that Bernanke’s response in private to Shostak and waramess would be to yawn and tell them not to teach grandmothers to suck eggs.

Now for the economics. While I agree with Shostack that artificially low interest rates result in a misallocation of resources, it is not true to claim that low interest rates bring about a “diversion of real savings from wealth generating activities to non-productive wealth consuming activities.”

The effect of artificially low interest rates is to induce BOTH the investment of too much in producer type capital goods AND in consumer capital goods (primarily housing).

Shostak also claims that “an artificial lowering of interest rates cannot make the pool of real savings larger than what it is.” Quite the contrary: the WHOLE PROBLEM with artificially low interest rates is that they DO result in an excessive volume of “real savings” (e.g. the above mentioned producer and consumer capital goods).

I do read some critical articles about Ben Bernanke, Paul Krugman here, on mises.org and on other libertarian websites. Austrians always are willing to reveal truth about economy and stand for correct understanding of market phenomenon. However, I would put some arguments in favor of FED’s chairman and highly appreciated economist. They may express real democratic spirit (I hope it does not sound too ironic).

You see: freedom means not only the right to say the correct things, but also the right to say the wrong things (see L. von Mises remark about Lenin and Comte in Theory and History. In a chapter: The Historical Significance of the Quest for Absolute Values), because, as J.S.Mills pointed out in On Liberty: “[..] in an imperfect state of the human mind, the interests of truth require a diversity of opinions.” And observing Hegelian dialectics opponents try to make some efforts for a better society. They may simply try to contribute to the democratic tendencies in their country. Of course, it might be argued that true democracy means even the worst man in an office won’t be able to cause significant harm, as K.R.Popper pointed out. But it would require to analyze constitutionalism, legal restraints, limits of the state power, which is not any more only a topic of above-published article and economics in general.

Ralph, to cast Bernanke as the grandmother who knows all about sucking eggs is to presuppose that Bernanke would have seen the recession on the horizon, well before it happened, which he did not. This was a car crash of some magnitude for which Bernanke must accept blame and now in true Keynesian fashion he tells us that the car can be repaired with string and bubble gum.

I have an interest in economics but only so far as it can tell me what is happening around me and how the problems can be fixed. I am frankly at a loss to understand how your observation that low interest rates can induce “both the investment of too much in producer type capital goods AND in consumer capital goods” shines a light on the dark abyss of economic failure that we are facing; or is it just a matter of academics fiddling whilst Rome burns?

I am drawn towards Austrian economics because it is easily understood like: if you leave the kitchen door open in the winter the room will get cold.

The Austrians did see the recession well in advance and nobody took notice. Their advice to the owner of the crashed car is not string and bubble gum but to get it down to the garage fast where they will tear a few more bits off it but will provide a proper repair.

Bernanke is wrong but like all Keynesians he has and will have a lot of excuses at the ready: the stimulus was not big enough; we need to give it more time to work; I did not possess all the necessary tools, and all the while more people are being made redundant because Bernanke is now obsessed with printing money and unwilling to acknowledge it will not work.

I may be both politically and academically naive but I can see the real world for what it is and I can see the car was crashed and needs to go to a garage.