I am pleased to promote this monograph by James Turk, founder of GoldMoney:

I am no fan of Keynesian economics. I find most Keynesian economic theories to be just plain wrong. But for the sake of truth and accuracy, I would like to correct a terrible injustice levied upon Keynes and, at the same time, also correct an equally terrible injustice that time and again is inflicted upon gold.

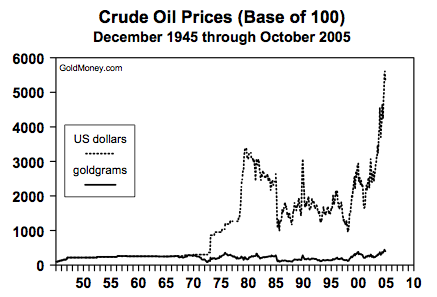

How many times have you heard gold described as the “barbarous relic”? It is a favorite phrase of gold-bashers everywhere who are trying to make gold the object of derision. I cringe every time I hear it, which is all too frequently, because gold is neither barbarous nor a relic, as can be explained easily by the following chart.

This chart presents a base 100 analysis of crude oil prices in terms of dollars and grams of gold (goldgrams). In other words, to establish the comparison depicted above, it is assumed in this analysis that one barrel of crude oil equals $100 and 100 goldgrams as of December 1945. The month-end price is calculated afterward based on the actual dollar price of crude oil and the prevailing dollar-to-goldgram rate of exchange.

The price of crude oil in goldgrams essentially is unchanged throughout the period measured. It is clear, then, that gold communicates the economic value of oil very effectively, and the communication of economic value is the primary feature of money. Because money is the tool upon which economic activity is based, which is a reality that makes money central to society, money is not barbaric. Consequently, gold cannot possibly be barbaric because gold is money.

Download the whole paper (PDF).